Are you wondering why your small business is losing money? It’s not very often that a company or business isn’t trying to turn a profit at some point (nonprofits excluded, of course). Here are the top five reasons why your small business is losing money:

Why is my small business losing money?

Reason #1: You don’t understand your financial position

You can’t fix something you don’t know is broken. This may seem obvious, yet it’s a common problem we see with new clients. They are operating financial review with an incomplete picture. Or, alternatively, they are way behind on financial reporting.

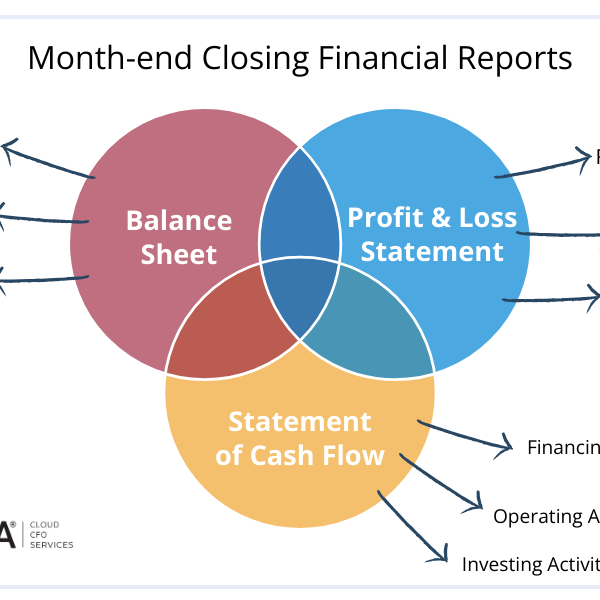

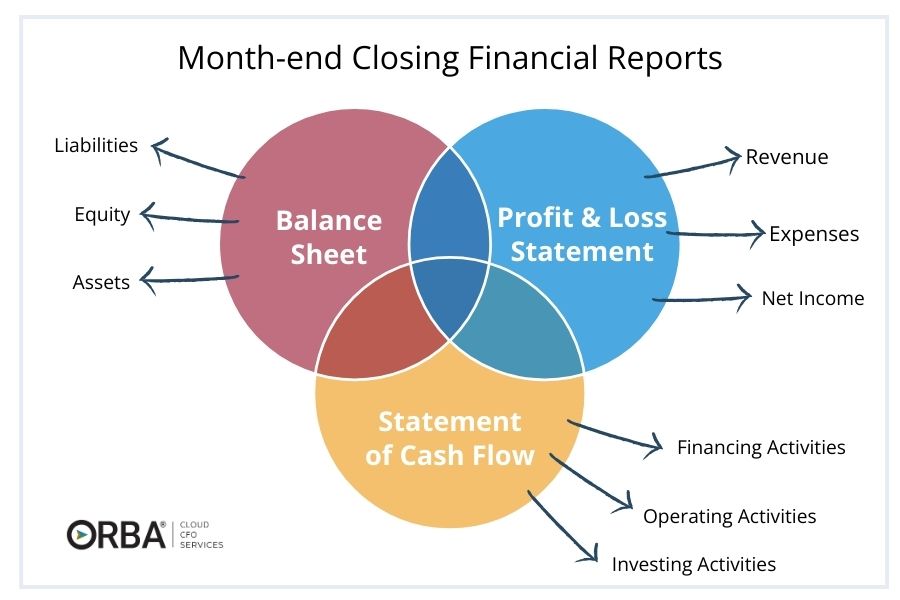

Analyzing your cash flow statement, balance sheet and profit and loss (P&L) will tell you a great deal about your financial position and why you are not turning a profit.

The 3 financial reports to understand why your small business is losing money:

Balance Sheet

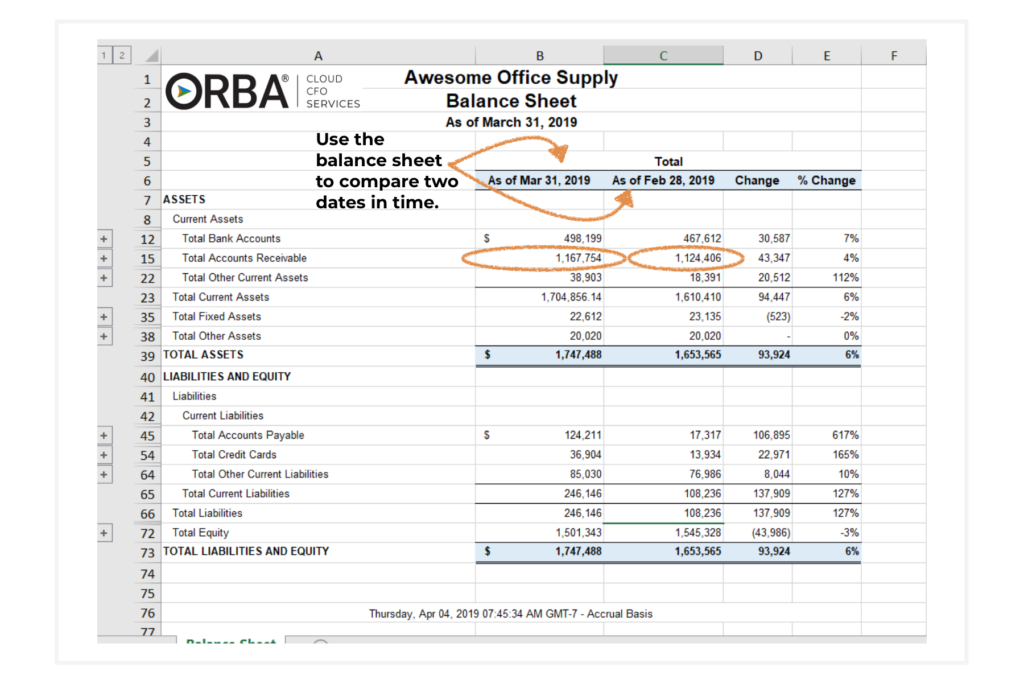

The balance sheet reports on your assets, liabilities and equity within a snapshot of time. It provides a useful comparison for understanding company value and identifying trends.

Profit and Loss Statement

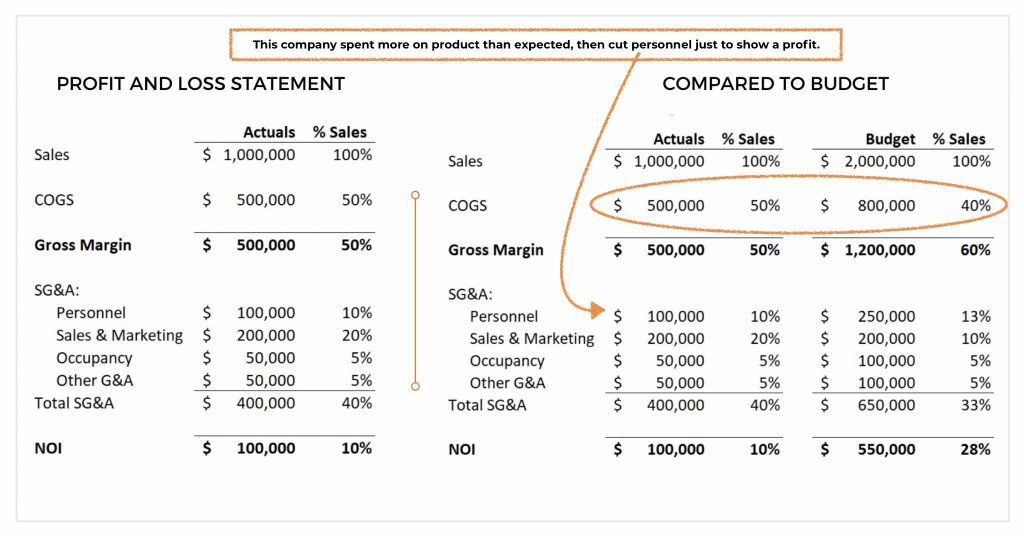

The P&L, or income statement, reports on revenue, cost of goods sold (COGS), expenses and profits, summarizing operations during a period of time. Your P&L is useful for reviewing a certain interval of time. As a standalone report, it only tells part of your financial narrative. But, when compared to your budget, your P&L can uncover trends from one period to another.

Cash Flow Statement

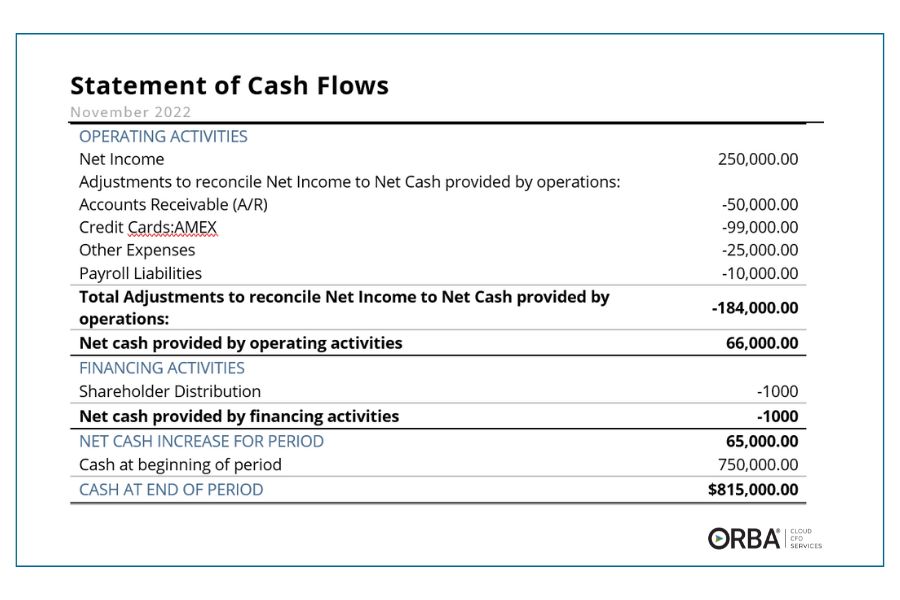

Your cash flow statement (also referred to as the statement of cash flows) depicts the inflow and outflow of cash within a certain period of time. This should be a dynamic and detailed report to reconcile the core operations, investing and financial activities found on your balance sheet and P&L.

By reviewing your financial statements on (ideally) a monthly basis, you can spot areas of concern, identify opportunities for growth then use them to secure investors or financing like a business line of credit. An outsourced controller should easily be able to offer these on a monthly basis.

Together, this three-pronged approach to financial reporting can ensure you know your financial position from month-to-month.

Reason #2: Poor unit economics

When was the last time you analyzed your unit economics? Also known as the economics of one.

If you boil down any business, at the end of the day your financials are the sum of transactions within a period of time. You’re selling something to somebody. Not quite as complex as it sounds, unit economics is the concept of selling one thing. Or, the value each item generates for your business. It is directly tied to gross profit margin. You can measure and define “units” like this:

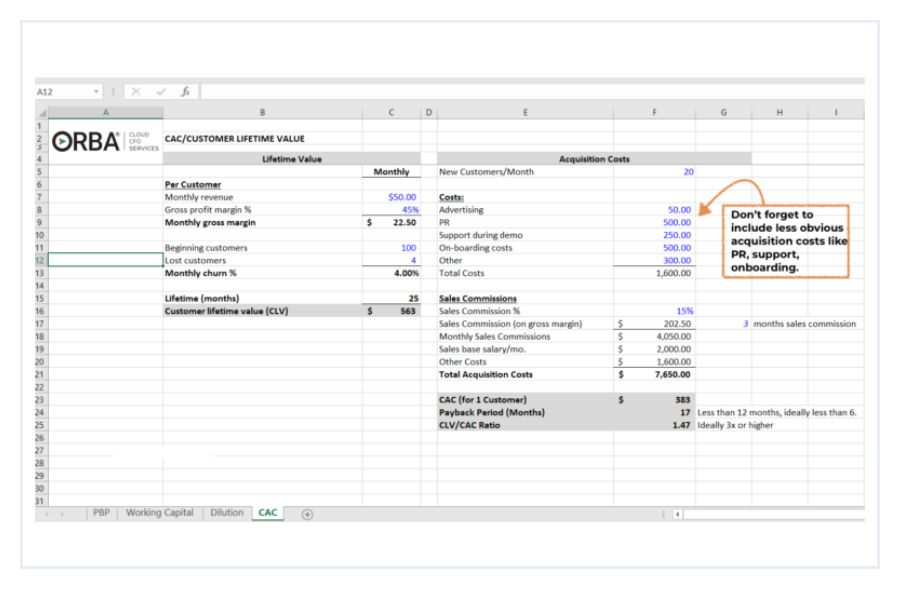

- One unit = one customer: Measured using the LTV/CAC ratio

- One unit = one item sold: Measured using your contribution margin

Contribution margin = (Price per unit – variable cost per unit) / price per unit x 100%

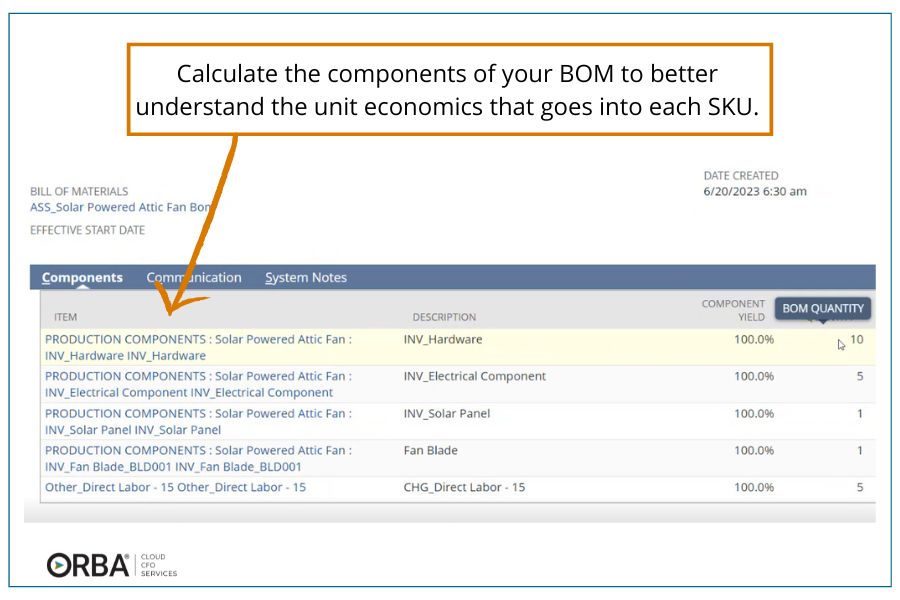

Contribution margin is important to understand to your break even sales point. The easiest thing to calculate in unit economics is the direct materials cost. It becomes more complex, if you have a lot of materials that go into one widget or item that you are manufacturing. Then, you need to also find your bill of materials (BOM). Your BOM is essentially a recipe of raw materials required to build your end-product.

Related Read: What is landed cost?

While BOM is more specific to manufacturing, all businesses have unit economics. For example, in our business of outsourced accounting there are no raw materials or products. So, we determine margins by calculating how many hours a manager and associate spend on each client.

If you’re a business that manufactures product, the staffing costs to manufacture is direct labor. I know what you’re thinking. How can I know exactly how much time it takes to make something? Start by taking an hour of your staff’s time, then determine how many items they can make in that time. This gives you an average direct labor cost per unit.

Unit economics example:

For example, let’s look at a very simple transaction:

Say you sell a widget for $100 and it costs you $40 to make it. You then make $60 of profit on every transaction. You have a pretty solid 60% gross profit margin.

Now to examine your unit economics for profitability.

If you sell your widget for $100 but it is costing you $110 to make it, the more you sell, the more money you lose. Less obvious though, is when it costs $80 to make your widget. Theoretically you make $20 every time you sell one widget. But that’s only a 20% profit margin, which is normally not enough to cover overhead expenses or fixed costs like rent, management salaries, etc.

Examining your gross profit margin percentage compared to industry benchmarks will let you know if you have poor unit economics. If you are lower than the benchmark, there is probably an issue that you need to look into.

Ways to improve unit economics:

There are a few levers you can pull to improve unit economics:

- pricing

- work on CX to reduce churn and increase LTV

- focus on highest ROI sales & customer channels

- product line expansion

- standardize parts of your sales funnel to shorten sales cycle

- cross-sell & upsell

- prepaid services & subscriptions

Cloud CFO Tip: Don’t make the mistake of across-the-board adjustments like reducing total production or spreading capital equally. Not all products and services deserve the same treatment.

Instead, maximize profitability, anticipate demand and prioritize getting the answers to these 6 questions:

- Which SKUs, services or clients have the highest profit margins?

- Which SKUs, services or clients have the largest sales volumes?

- Which products or services share components and raw materials?

- How do rising costs impact the margin for this product/service?

- Can any of these goods/services share labor costs?

- How much does this SKU/service contribute to the bottom line?

Now you’re armed with the information you need to direct and spend resources along with how much it will affect your bottom line.

Additionally, by automating processes related to creating, selling or fulfilling your product. You can do this will tools like Ramp and NetSuite.

Example: If you’re a manufacturer, you may want to consider investing in a barcode scanning system to automatically mark product as picked to fulfill orders more quickly.

Reason #3: Overhead costs are too high for current amount of sales

Now, if your unit economics are looking good and still you’re finding your small business is losing money, it could be that you are not selling enough of your product to cover overhead. Remember, anything that is not related to making the product that you sell is overhead cost.

Example: Again, say you sell a widget for $100, the cost is $40, so you make $60 on every sale. Let’s pretend that the only cost to your business outside the widget cost, is $6,000 a month for rent. So, if you are not selling at least 100 widgets per month, you’re not breaking even. You can’t pay rent.

And , of course, most businesses have other overhead costs. This is a scenario where you have a good profit margin, but a net loss for the business. There are two reasons you might see this:

- You spend too much for overhead (you’re renting out too nice of a place or your executive salaries are too high for the size of the business, etc.); and/or

- You simply need to sell more. Perhaps you need to spend more on marketing or sales because once you sell more, you can cover overhead costs.

Ways to lower overhead:

One of the easiest places to quickly optimize operations is to use a tool that can repeat processes on a schedule you set. For example, say you’ve identified a problem with your in-house accounting. Maybe the salaries are set too high or it’s lacking efficiency. You have a couple of options:

Streamline your online payments to increase revenue without increasing overhead. Tools like Bill.com or Botkeeper can automate payments that are recurring and do not change from month to month.

Hire an outsourced accounting team to take over the bookkeeping and financial reporting to lower salary costs. This gives you a chance to focus on core operations and business development.

Reason #4: Attracting the wrong kind of customers

Many first-time clients who choose outsourced CFO services learn their business is losing money because they’re not correctly calculating their customer acquisition costs or customer lifetime value (LTV).

Use data to analyze each touch-point a customer has with your company (e.g., customer service, fulfillment, returns, etc.), then identify and profile the best ones. Once you do that, build a pricing and referral strategy to attract the right customer, increase LTV and lower customer acquisition cost. Here are some questions to get you started:

- Do certain types of customers require more customer service or extra care? What are the costs involved? Don’t forget to include any costs related to customer service that fall under social media replies too.

- Are there customers that consistently require more labor costs? Can this be fixed through automation, or is there a bigger issue?

- If you are in the ecommerce sector, could you increase the minimum spend to qualify for free shipping to prevent certain customer segments from taking advantage of it? For example, customers outside a certain geographic location.

- If you offer a service, does your base rate need to increase in order to cover the costs of onboarding?

- Would a tiered service model allow you to offer premium service to premium customers?

- If you are a SaaS company, does a ‘freemium’ model make sense for your business? Check out our accounting for tech companies solutions!

Reason #5: Forgetting to involve your team.

Set goals and check back often. With the evolution of remote work, it’s imperative to include your staff in setting and tracking goals. We refer to this as operational metrics. Have team members own processes, then encourage them to improve those processes in departments like sales, procurement, bill-pay, overdue AR and inventory.

How to introduce operational metrics (with examples):

As opposed to strategic KPIs, operational metrics measure your business performance from a day-to-day point of view.

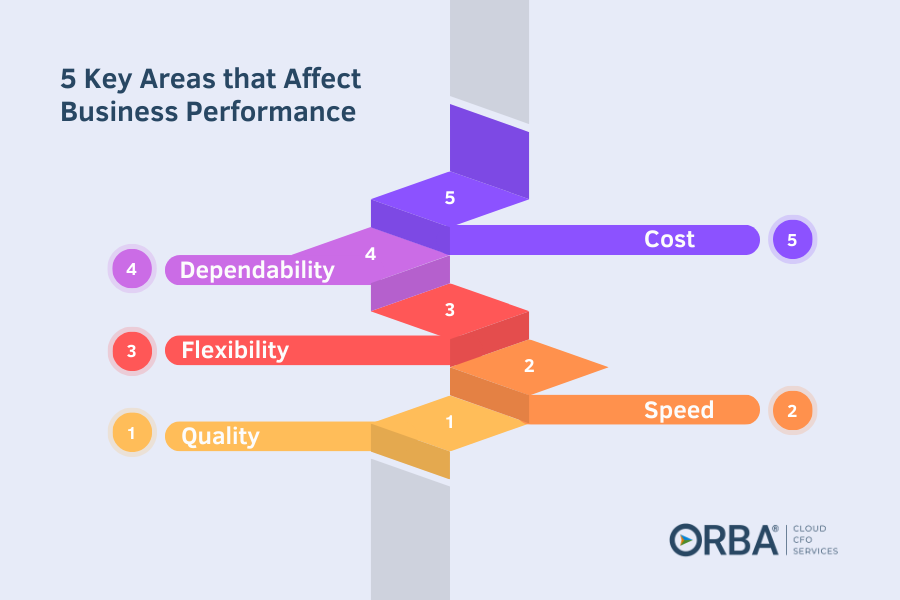

5 Key Areas that Can Affect Business Performance:

- Quality

- Speed

- Flexibility

- Dependability

- Cost

From there, begin to think about which measures to use for each. These may differ depending on which department you are introducing operational metrics to. For example, quality in manufacturing might be measured by defect rate but in customer support it might be measured using net promoter score.

Focus on which are your company weaknesses (e.g., gross profit margin and customer lifetime value). But don’t spread your resources thin trying to optimize every metric immediately. Start by giving your team financial transparency related to their department to establish a growth culture. Using simplified, internal versions of the financial reports mentioned in #1, focus on the line items directly affected by the work that they do.

Next, give them the ability to control those results. Set clear targets and write names next to those budget line items to build accountability.

Let’s look at a few examples by department:

Marketing

Your focus could be on how to lower customer acquisition costs, using the ROAS model or other customer success KPIs. This would improve your quality of leads and cost to improve business performance.

Example: Track CPA from ads by source. Operating with a ROAS model can give you a good idea of ad performance compared to budget.

Cloud CFO Tip: Make sure you have an existing budget and a handle on your profit margins beforehand to really understand whether you’re meeting your benchmark.

Sales

Track lead conversion rates to improve the speed and quality of your sales funnel or other business development KPIs.

Example: There are specific day-to-day items that the staff can perform each day. E.g., To improve lead conversion rates, task the sales team with making ten calls per day.

Logistics

To lower costs, improve quality and dependability you can reduce landed costs or check in with other supply chain KPIs, like inventory turnover.

Example: Remind staff in procurement that building lasting relationships can reduce landed costs and increase profitability. Educate your procurement team how an early-pay discount can increase your cash flow. Having a stronger relationship might mean getting offered an early-pay discount or preference when there are disruptions.

Cloud CFO Tip: Pay early if you have sufficient cash reserves to get the savings and increase cash flow.

Finance

Find ways to improve your accounts receivable

Example: Assign a team member to examine overdue accounts receivable in both dollars and percent of sales by the number of days outstanding. Each week, target the overdue accounts that are the most likely to pay.

Finally, to see better results, management should not be setting all of the goals. Instead, educate employees about how their specific work affects the financials and give them autonomy within their department. The focus then shifts from pestering employees to work harder to discussing missed opportunities.

Cloud CFO Tip: Proper incentives are key so remember to provide a stake in the outcome. This is one of the 4 ways we suggest you can improve employee retention strategy.

Are you missing visibility into any of these five reasons your small business is losing money? If so, we can help. We pride ourselves on bringing new insight into your business operations with our outsourced accounting services. Get in touch today to learn more.