Why is a cash flow statement important?

Cash flow is the root of every business. You need to have a steady stream of capital to keep the door open (or, in the case of an ecommerce business, to keep the site running). A positive cash flow means you have enough money to cover your overhead costs and meet your short-term cash obligations.

Why is it important to understand your cash flow statement?

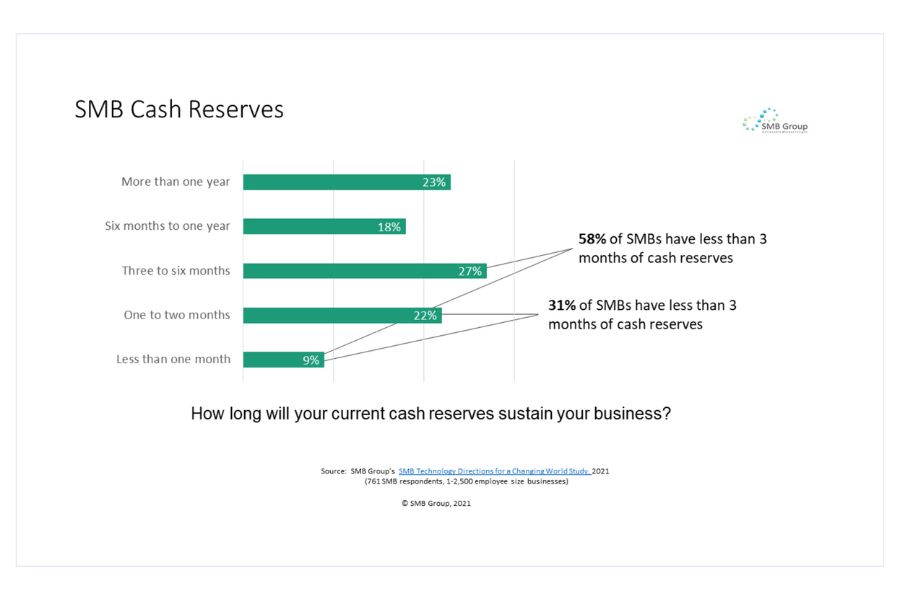

SMB Group found that 58% of small businesses have less than three months of working capital. And that’s the minimum we suggest having on reserve. If you’re hit with an unexpected cash crunch you want to feel confident you can pay employees, vendors, lenders and investors on time. Plus, if you’re always worried about having the cash reserves to meet those basic obligations, it becomes hard to focus on drumming up new business.

Cash flow indicates whether your company can generate and use cash in a sustainable way. A successful business needs cash to:

- Pay employees

- Purchase raw materials, goods and supplies

- Meet overhead costs

- Cover debt-related payments (loans, business line of credit, credit cards etc.)

A company has a positive cash flow when it brings in more cash than it spends. Most often, companies run into cash flow issues when they’re not able to pay debts when they’re due. That said, it can be the case where a company may intentionally owe more money than they earn. If you have plans to scale up and grow your business this may be a good thing, as long as it’s short-term and there is a plan to have positive cash flow again in the future.

Some businesses may experience a negative cash flow when they have:

- Hired new staff to meet increase in demand

- Invested in increased quantities of inventory

- Purchased capital equipment

However, having consistently negative cash flow is a sure indicator of business failure. Therefore, using and analyzing your cash flow statements can help prevent the cash flow problems before they begin.

What is a cash flow statement?

A cash flow statement (also referred to as a statement of cash flows) is a financial report that we include in our three-pronged approach to financial reporting:

- Income statement or Profit and Loss (P&L)

- Balance sheet

- Statement of cash flows

Your cash flow statement shows the business cash inflow and outflow over a specific period of time. If you employ an outsourced controller, your cash flow should be reported on at least monthly.

Related Read: The difference between your P&L and your balance sheet.

Your cash flow statement depicts:

- Your company’s liquidity and working capital

- Changes to cash in your assets, liabilities and equity

- Numbers that can be used for cash flow forecasts

- Reconciles the numbers on your P&L with your balance sheet

The difference between a cash flow statement and a cash flow forecast: a cash flow statement is a historical report looking at your cash flow from a certain period of time, say a month for example. A cash flow forecast is a projection that may help you identify when you will run out of cash.

Two cash flow formulas you might consider are:

Operating Cash Flow = (Net income + non-cash expenses) – Change in Working Capital

or the commonly used net cash flow:

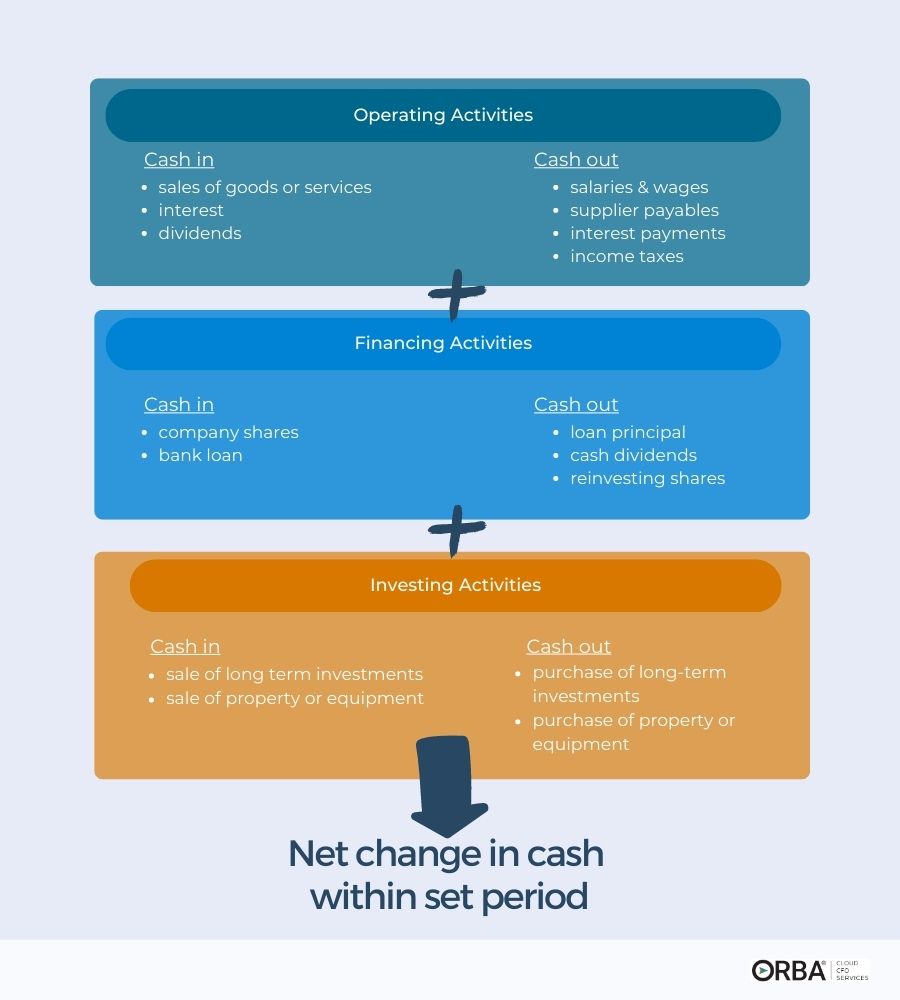

Net Cash Flow = Operating activities + financing activities + investing activities

The net cash flow statement is created by adding up the cash transactions within a set period from your: operations, investment and financing activities.

Looking at the three aspects of net cash flow in more detail:

Operating Activities

Cash flow from operating activities includes cash inflows from the sales of your goods or services, and interest or dividends. Cash outflows from operating activities might include wages and salaries, interest payments and income taxes.

Financing Activities

Financing activities can affect cash flow as it relates to debts, loans and dividends. For example, if you’re receiving cash from a loan or company shares or if you’re paying down your loan principal.

Investing Activities

Cash flow from investing activities includes any cash you receive from the sale of long-term investments, like real estate or capital equipment; as well as any cash you pay out to purchase long-term investments, property or equipment.

How to prepare a cash flow statement

There are two ways to prepare a cash flow statement: direct or indirect.

Using the direct method, you record every cash transaction entering or leaving your business as it happens.

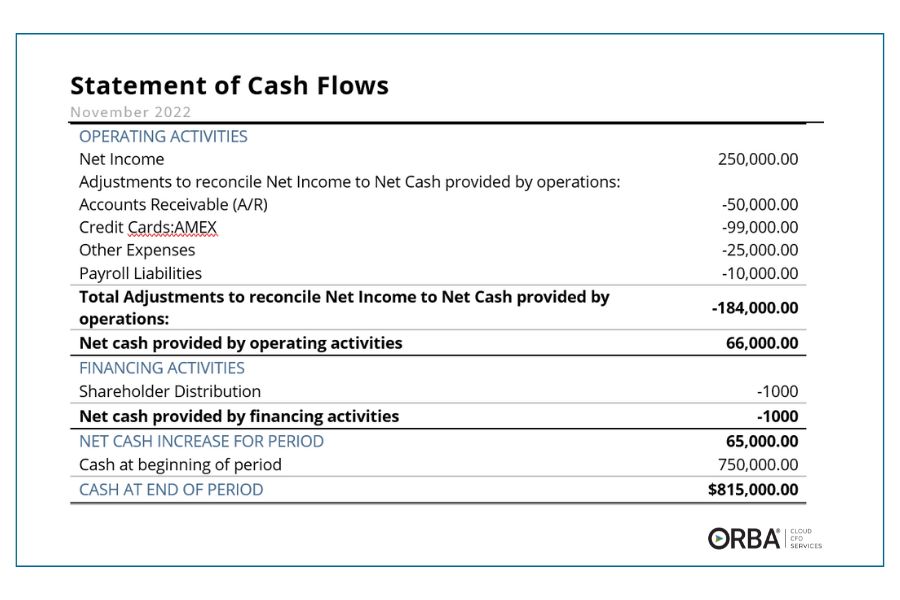

Example: if your cash balance at the end of last month was $750,000 and you recorded gross cash receipts of $250,000 and gross payments of $185,000, your cash flow statement would show ($750,000+$250,000 – $185,000 = $815,000) $815,000 in positive cash on hand or a net cash increase of $65,000.

Using the indirect method, you work backwards from your net income to calculate cash flow and the ending cash balance for the period.

Example: if your income statement shows $750,000, you would adjust that amount to reflect depreciation and amortization, and to incorporate cash activities from operating, financing and investing.

The direct method suits businesses with fewer income sources and non-cash assets. Most businesses use the indirect method because it’s easier to track and provides more financial insight than simple cash flow from operating activities.

How to analyze your cash flow statement

Analyzing your cash flow statement regularly makes it easier to spot cash flow issues and plan for growth. Some key areas you should review include:

- Net cash flow trends: it may not be positive month-over-month but you want to see an overall trend upwards

- Outstanding accounts receivable (AR): one of the easiest ways to improve your cash flow is to catch any lagging accounts receivable

- Investments and capital expenditures (CapEx): unexpected CapEx can have a large impact on cash flow

- Timing of cash inflow and outflow: you can improve cash flow by optimizing your payment terms with suppliers along with the timing of your AR

Finally, by regularly analyzing your cash flow statement you will have the financial data you need to create more accurate financial projections to plan for the future.

Need help building your cash flow statements month-to-month? Learn more about our outsourced controller services and how we make your financial data work for you.