What is the working capital ratio?

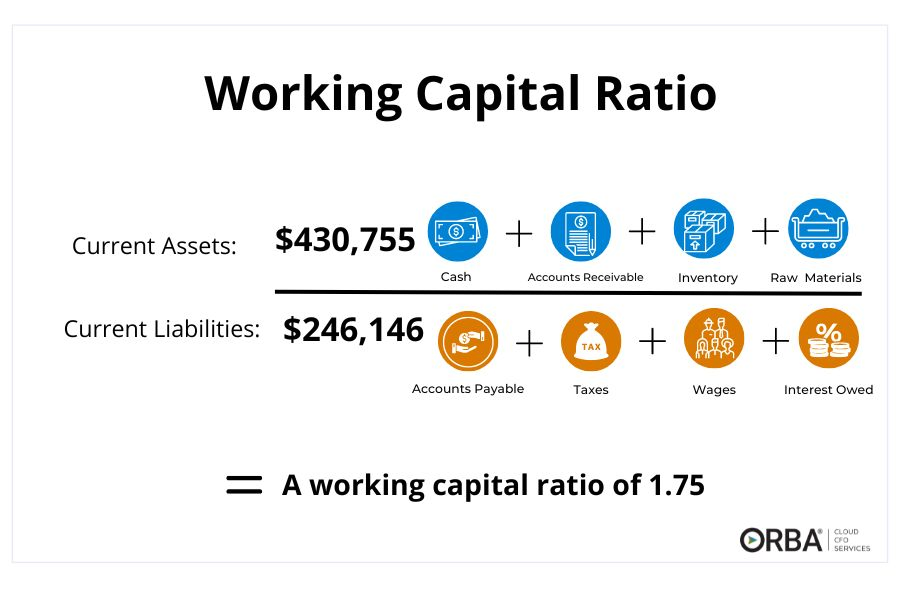

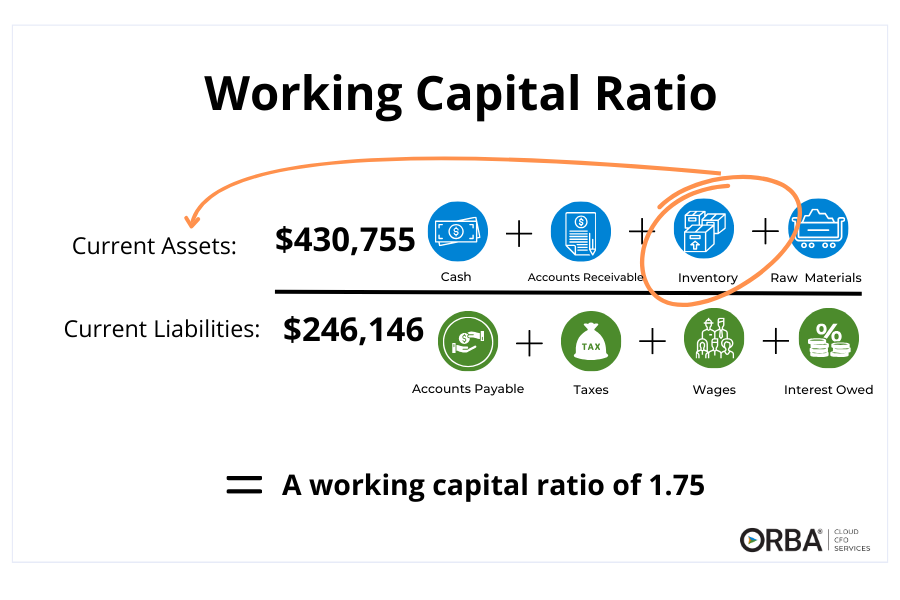

Your working capital ratio (also referred to as your current ratio) is a measure of your company’s liquidity. It measures if you have enough assets to cover short-term expenses like payroll and your accounts payable. The working capital ratio is calculated by dividing your current assets by your current liabilities.

Working capital ratio = current assets / current liabilities

Current assets include:

- cash

- accounts receivable

- raw materials

- inventory

Current liabilities include:

- accounts payable

- taxes

- wages

- interest owed

Generally, to maintain a healthy liquidity you would aim for a working capital ratio of 1.5 to 2.0. If you have a higher working capital ratio it may suggest you aren’t maximizing your return on assets and revenue. A lower working capital ratio is a warning sign that the business may not be able to easily pay all of its short term bills and payroll.

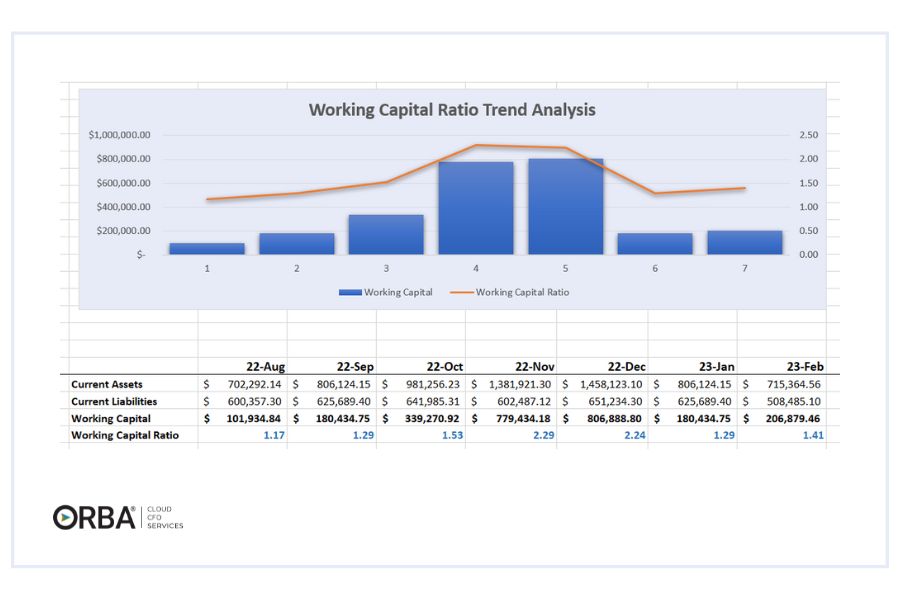

For most companies, working capital will fluctuate. Many factors can influence your working capital, including large bill or debt payments and seasonal changes in sales. To perform working capital ratio analysis you may wish to track your working capital ratio and compare over time. A company that increases inventory leading up to the holiday sales might see a higher working capital if they’ve stockpiled inventory leading into the holiday rush, for example, which then may regulate after the busy season.

What are the limitations of the working capital ratio?

That said, the working capital ratio or current ratio has limitations depending on the context within which it is calculated. For example, if you operate a business with high seasonality, the current ratio might not offer the best picture of your liquidity; often why I might recommend using the cash conversion cycle or even the quick ratio (or acid test) instead. Your quick ratio excludes your inventory from the working capital ratio:

Quick Ratio = (current assets – inventory)/current liabilities

Remember to only include your most collectible AR in the quick ratio. Let’s assume anything over 90 days may not be collectible and could cause you to overestimate cash flow.

Another limitation of your working capital ratio is that it counts all inventory in the assets value. If your business holds a lot of inventory (maybe even too much inventory?) then that will inflate your asset value, which increases your ratio. But if most of your net working capital value is from dusty old inventory that you can’t really sell for cash, then you may not be able to pay your bills or cover payroll despite a positive working capital. This is why your cash conversion cycle may paint a more accurate picture for lenders or management.

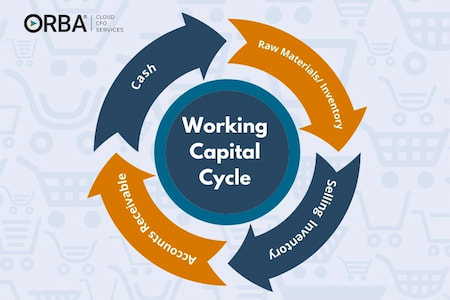

What is the working capital cycle?

Your working capital cycle differs from the working capital ratio in that it reflects the length of time it takes to convert your products or services into cash. This refers to the cycle your cash makes. Spend cash > Buy Inventory > Sell Inventory > Get cash back from customer. To increase cash flow, it’s extremely advisable to shorten your working capital cycle.

The less time that there is between paying for an expense and receiving money from a customer, the better your cash flow.

This can look different depending on what industry you operate in. For example, while ecommerce businesses don’t have invoicing or the accounts receivable you might find in professional services, they do likely have a delay between buying product and selling it. Although the length of your cycle can vary depending on what you sell, the most efficient companies would have a cash-to-cash cycle of less than one month.

The 4 phases of the working capital cycle are:

- Cash: The goal is to have healthy cash balance by managing cash inflows and outflows of your business

- Payables: The payment terms for money owed for goods or services provided to you suppliers and/or vendors

- Inventory: How long it takes to sell your inventory (if applicable)

- Receivables: The payment terms for money owed for goods or services you sell

Cloud CFO Tip: We suggest having a minimum of 3 months working capital on reserve. If you’re hit with an unexpected cash crunch you want to feel confident you can pay employees, vendors, lenders and investors on time. Plus, if you’re always worried about having the cash reserves to meet those basic obligations, it becomes hard to focus on growing new business.

4 ways to improve your working capital

Here are a few tips to improve your ratio at each stage of the working capital cycle:

1). Optimize bill payments:

On the other side of your cycle, if you have suppliers that offer early-pay discounts, choose periods with increased revenue to pay your biggest expenses and to take advantage of early-payment discounts.

Cloud CFO Tip: Get creative with presales. By collecting cash before you pay for raw materials or inventory, you are shortening your working capital cycle and have a better chance of maintaining that optimal working capital ratio.

2). Run frequent inventory forecasts:

Monthly is ideal, while considering any seasonal fluctuations.

Cloud CFO Tip: Slice your date by SKU, sales channels, and locations to get more accurate forecasts. These give you better data to base decision-making on to optimize inventory.

3). Reduce inventory and carrying costs:

Stock only those items you are confident will sell quickly. Sell off stale inventory to reduce dead stock and raise cash.

Cloud CFO Tip: Bundle your dead stock with faster-selling inventories. Like all tactics to empty dead stock shelves, your profit margins will take a hit. To recover as much revenue as possible, bundle dead stock with highly popular items that are likely to sell anyway. Pairing a hot item with a stagnant product has the added bonus of upselling your other items.

4). Improve your accounts receivable

Cloud CFO Tip: One way to improve cash flow is to offer an early payment discount to clients or customers that pay before the terms set in your invoice. Even with the discount it’s better for cash flow to have it in-hand compared to waiting for late invoices. Think 2% savings if you pay before the term. A 2% discount is common if customers pay you within 10 days of invoice.

All these tips ultimately also will help improve your cash conversion cycle.

What is the cash conversion cycle?

If you operate in ecommerce, manufacturing or consumer goods, you may find the cash conversion cycle (CCC) is a more useful measure of liquidity than the working capital ratio. The cash conversion cycle measures how quickly your company turns inventory into cash and then back again. It calculates your inventory into cash within a set time period (normally days).

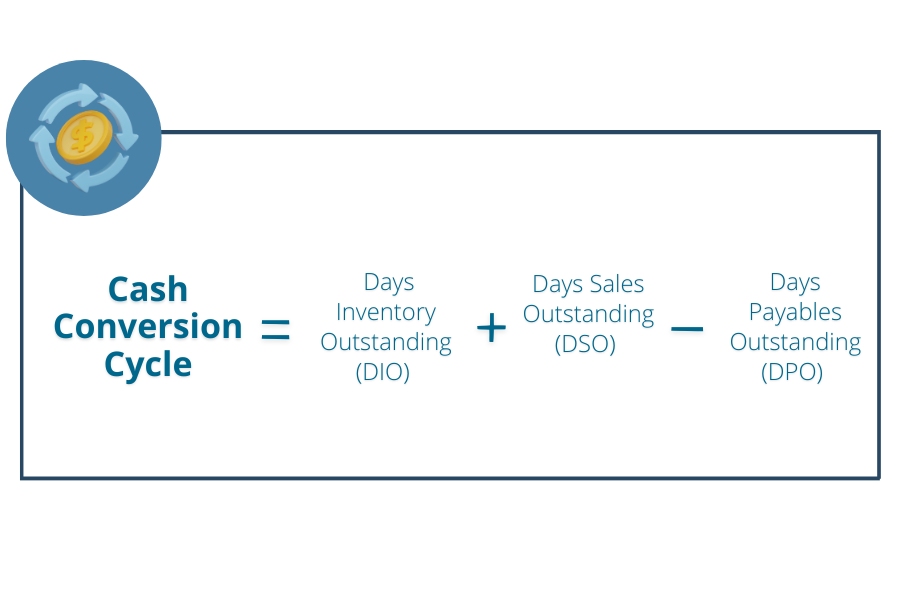

Cash Conversion Cycle (CCC) = DIO + DSO – DPO

An unsustainable CCC is a red flag that you may be seeing issues with liquidity and should signal a need for improvements to your working capital.

Cash conversion cycle formula

The cash conversion cycle formula is: Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payables Outstanding (DPO) = Cash Conversion Cycle (CCC)

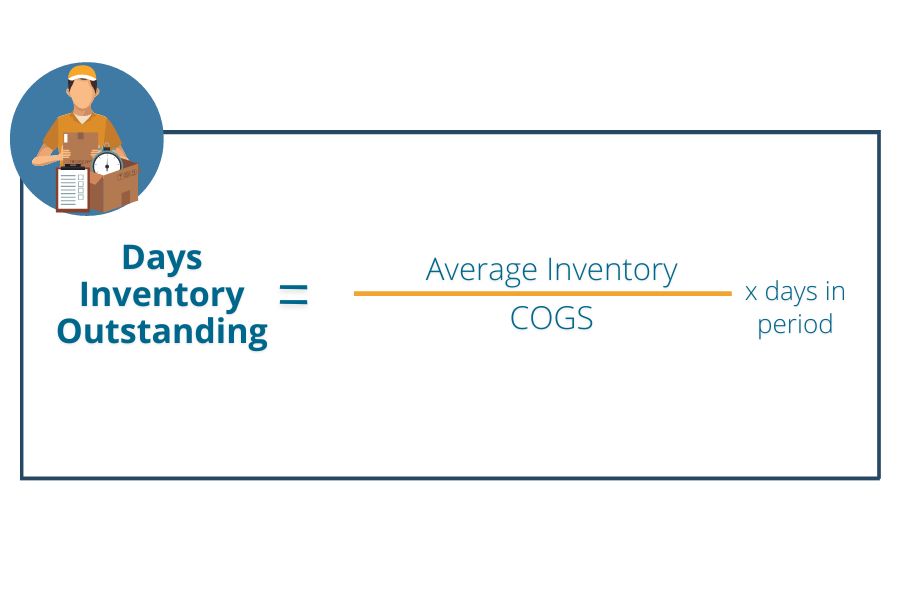

DIO refers to Days Inventory Outstanding = (Inventory/COGS) x Days in Period

The first stage of the cash conversion cycle is your days inventory outstanding (DIO). Your DIO tells you how long it takes to sell your inventory.

DSO refers to the average number of days it takes a company to collect payment from its customers after a sale has been made. DSO refers to Days Sales Outstanding = (Average Accounts Receivable/Revenue) x Days in Period

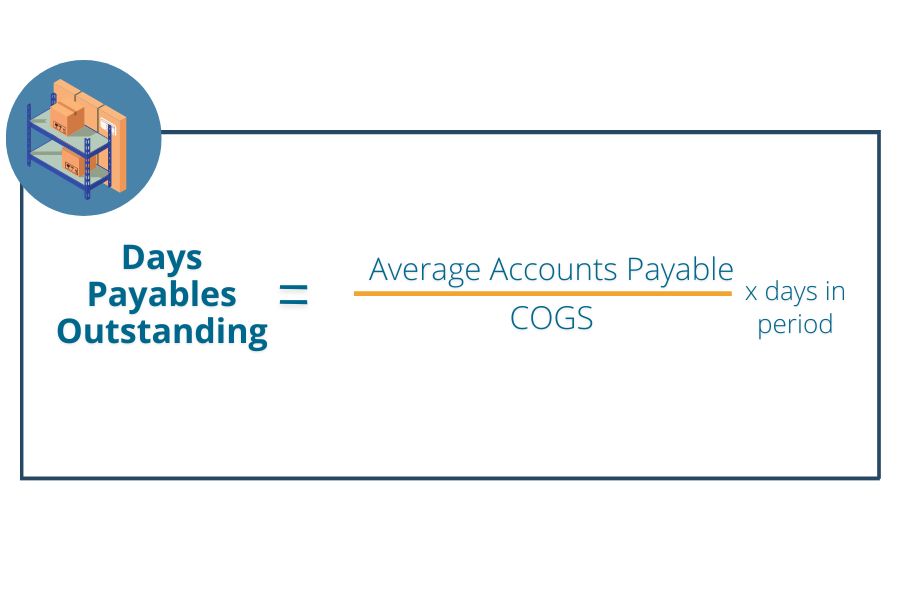

DPO refers to Days Payables Outstanding = Average Accounts Payable/COGS) x Days in Period

You can find this information on your income statement and balance sheet. Generally, the lower your CCC, the better. A lower cash conversion cycle is an indicator of a faster inventory-to-cash process. Meaning your working capital is tied up for a shorter amount of time and your business has greater liquidity, a.k.a, better cash flow.

3 ways to improve your cash conversion cycle

Let’s break down the ways you can lower your CCC by improving each of the three measures that make up the cash conversion cycle formula:

1). Lower Days Inventory Outstanding (DIO):

A lower DIO indicates a shorter time between buying inventory and selling products, which is beneficial for your company’s cash flow.

To improve DIO, you can implement strategies such as better inventory management, efficient supply chain management, and better inventory forecasting. Implementing a Just-in-Time (JIT) inventory system can also be beneficial. JIT involves maintaining minimal inventory levels and ordering supplies just when needed, reducing the duration that cash is tied up in inventory. Additionally, using the benefits of ERP systems to track and analyze inventory data can help identify slow-moving items and prevent overstocking. This step, when executed properly, can significantly reduce the cash conversion cycle and improve your company’s cash flow.

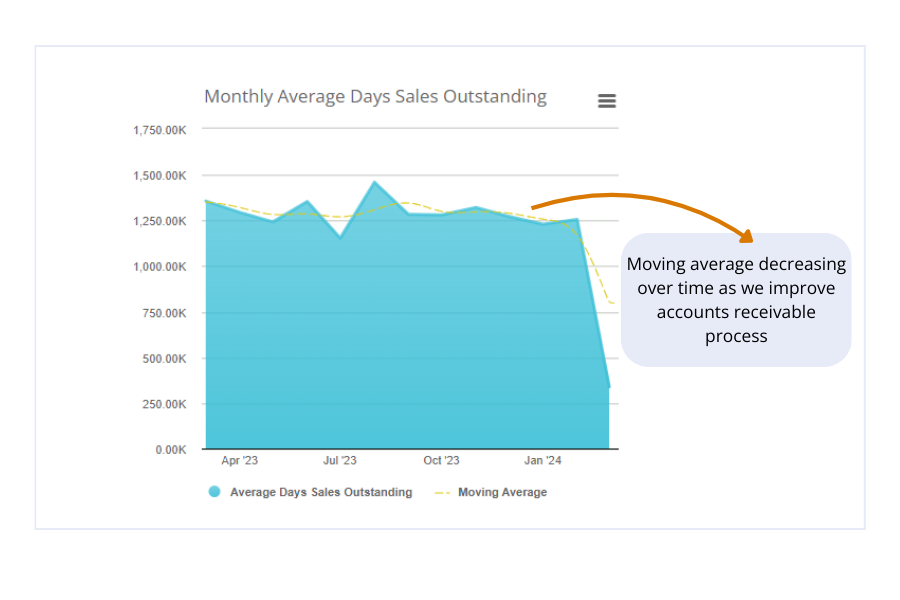

2). Reduce Days Sales Outstanding (DSO):

A lower DSO means that a company is collecting its receivables more quickly.

To improve DSO, you can implement strategies such as setting clear payment terms with customers, sending invoices immediately after sales are made, offering early payment incentives, and following up promptly on overdue payments. Many of these can be improved using AR automation. Additionally, implementing a robust credit management system can help prevent extending credit to your customers who have a history of late payments.

Sr. Staff Accountant, Connor Lucas says, “one of the bet ways to reduce your DSO is by invoicing more regularly and sending reminder emails when invoices are overdue to improve the collection process and cash flow.”

3). Improve Days Payable Outstanding (DPO):

DPO is the average number of days that a company takes to pay its suppliers.

To improve DPO, companies can negotiate longer payment terms with suppliers, take full advantage of payment terms offered, and use electronic payment systems to pay invoices on the last possible day. Lucas explains, ” almost all of my clients use BILL. Payments can be made so quickly and customers can sign up for their preferred payment, whether that’s by e-payment (ACH), credit card or check.”

However, while a longer DPO can improve cash flow in the short term, it’s essential for the company to manage its relationships with suppliers carefully, as late payments can strain these relationships and potentially put your supply chain at risk. Therefore, maintaining a balance between extending DPO to improve cash flow and maintaining healthy supplier relationships is key.

Financing and investing activities also play a crucial role in managing a company’s cash flow. By optimizing these activities, you can further stretch your DPO. For instance, by securing more favorable loan terms or attracting more equity investment, a company can maintain larger cash reserves. On the investing side, more prudent management of capital expenditures—like delaying non-essential equipment purchases—can also keep more cash at hand.

The CCC is particularly useful if you’re comparing it year over year (YoY) to improve business performance or if you’re comparing it to competitors. It can be used along with the working capital ratio to improve your company’s liquidity and overall financial health. But Lucas points out that “without accurate inventory numbers and reporting, it’s hard to improve your end-to-end cash conversion cycle.”

Need help calculating your working capital ratio or cash conversion cycle? Contact us to learn more about our NetSuite accounting services and fractional CFO services.