Create your own month-end closing checklist to close your books faster each month.

Closing your Books Faster

One of the first things a client wants to know when they sign on with our outsourced accounting services is how to close their books faster. The first step is to create a month-end close checklist. Use this step-by-step month-end closing checklist to review and reconcile your financial records, ensuring accuracy and providing valuable insights into your business’s financial health.

Month-End Closing Checklist

In this 10-point checklist, we will guide you through the essential steps of month-end closing to help you manage your finances effectively.

1. Verify all transactions have been posted

Take the time to check for any missing or duplicate entries in your financial records. Make sure that all expenses and income are properly accounted for to maintain accurate financial reporting. By ensuring the completeness and accuracy of your financial transactions, outsourced bookkeeping can give you a clear picture of your business’s financial performance.

Cloud CFO Tip: Outsource your bookkeeping. That’s it. That’s the tip. Why take up in-house time for a task that is easily outsourced?

Removing tasks that can easily be automated off of clerical staff is a great way to reduce labor costs. We rarely suggest laying off staff, instead unlock more potential from those people and retool to other tasks that need human oversight or input.

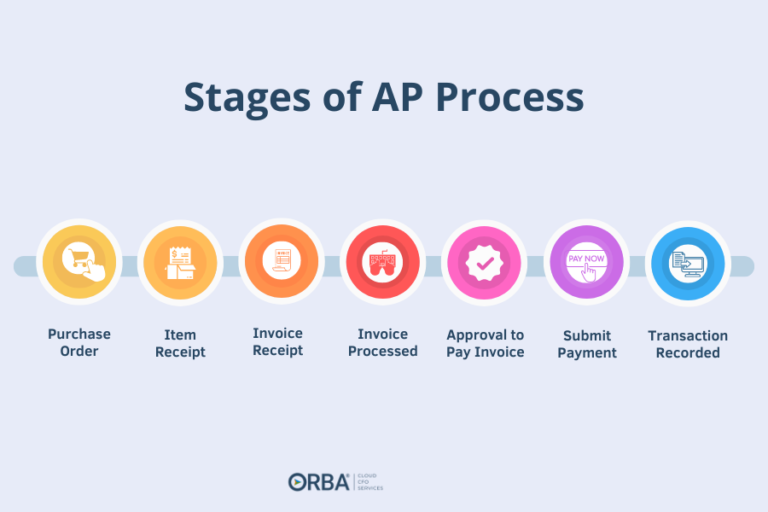

2. Update all accounts payable and receivable

To start, review your outstanding invoices and payments. Follow up on any late payments to ensure timely collections. By staying on top of your accounts payable and receivable, you can minimize financial discrepancies and optimize your business’s cash management. Improving your accounts receivable = a healthy cash flow.

Client case example: Logical Media group uses our outsourced controller services. Their service delivery team helped them understand how to use QuickBooks to automate and schedule their accounts receivables. This improved their processes, reduced workload and ultimately increased cash flow.

3. Reconcile bank accounts

Comparing your bank statements with your accounting records is vital to identify any discrepancies. Resolve any issues to ensure your financial records align with your actual bank balances. Reconciling your bank accounts helps you identify any errors, detect fraudulent activities, and maintain the integrity of your financial data.

“I wish people paid more attention to is the legitimacy of uncashed checks. My recommendation is to review the transactions that are left over in the register after you’ve completed the reconciliation. This is the easiest way to identify if you have a duplicate transaction that needs to be removed.”

Carolyn Koonce, Accounting Manager

Legitimate unreconciled items are things that have been posted to your bank ledger but haven’t hit your bank account yet. Most often those are uncashed checks. If you have significant uncashed check liability, you have less money available to you than what you see in your bank account. The balance shown in your bank register after accounting for these unreconciled items, is what is referred to as your book balance.

This comes full circle with #2, update all accounts payable and receivable. Following up with your vendors about uncashed checks can:

- Reduce bank balance surprises– the faster they cash their check, the closer your book balance is to your actual bank balance.

- Ensure the check went to the right person– the faster you can report issues like checks going to the wrong person to your bank, the more likely you are to recoup losses in the case of mail fraud.

4. Review and close income and expense accounts

Thoroughly review your income and expense accounts to ensure proper classification. Make any necessary adjustments to accurately reflect your financial performance. By carefully reviewing your income and expense accounts, you can identify cost-saving opportunities, evaluate revenue streams, and make informed budgeting decisions.

Cloud CFO Tip: Find your revenue and expenses on your profit & loss statement (P&L). I recommend reviewing your current month in comparison to a few prior months to get a sense of your historical trends. Examining your income and expenses in the context of other months can shed light on inconsistencies with your accounting that you wouldn’t notice looking at the one month by itself. If your current month looks significantly different from your previous months (and it shouldn’t), it may be the case that you’ve forgotten to record something or recorded it to the wrong place.

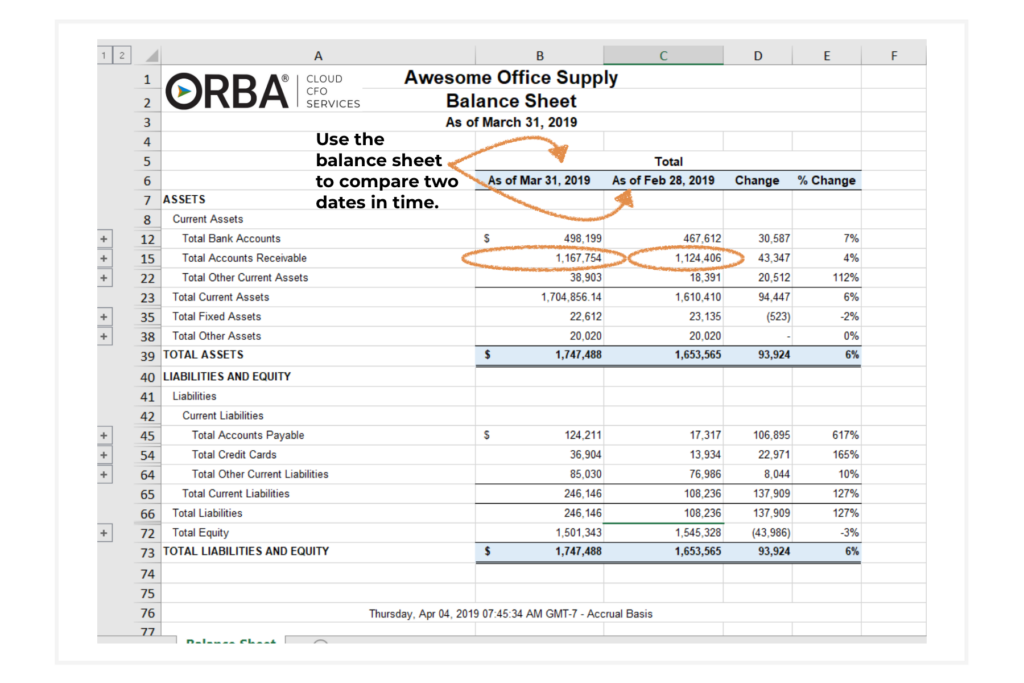

The same thing goes for reviewing assets and inventory (and all accounts on your balance sheet, really).

5. Review assets and inventory

Verify the accuracy of your asset records and conduct physical inventory counts if applicable. This step ensures that your books accurately represent your business’s assets and inventory levels. With accurate inventory accounting, you can optimize your supply chain management, minimize waste, and improve overall operational efficiency.

Cloud CFO Tip: Find your assets on your balance sheet. Again, comparing the current month to prior months to look for trends.

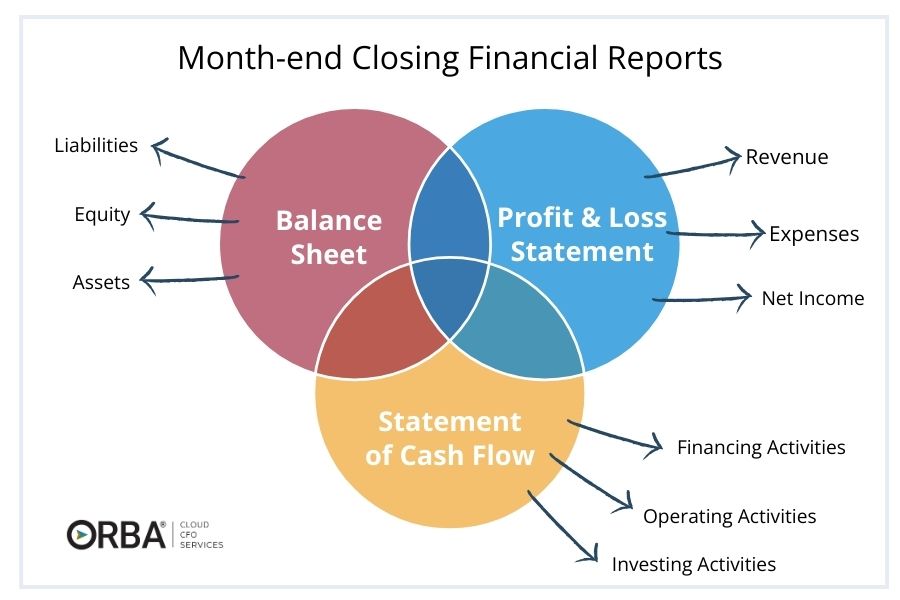

6. Prepare financial reports

Generate comprehensive month-end financial reports to provide a clear overview of your business’s financial standing. These reports should be shared with relevant stakeholders to keep them informed and involved. By preparing detailed financial reports, you can communicate financial performance, track progress towards goals, and facilitate data-driven decision-making. We recommend having a minimum of the three standard reports:

- The P&L or income statement

- Your balance sheet

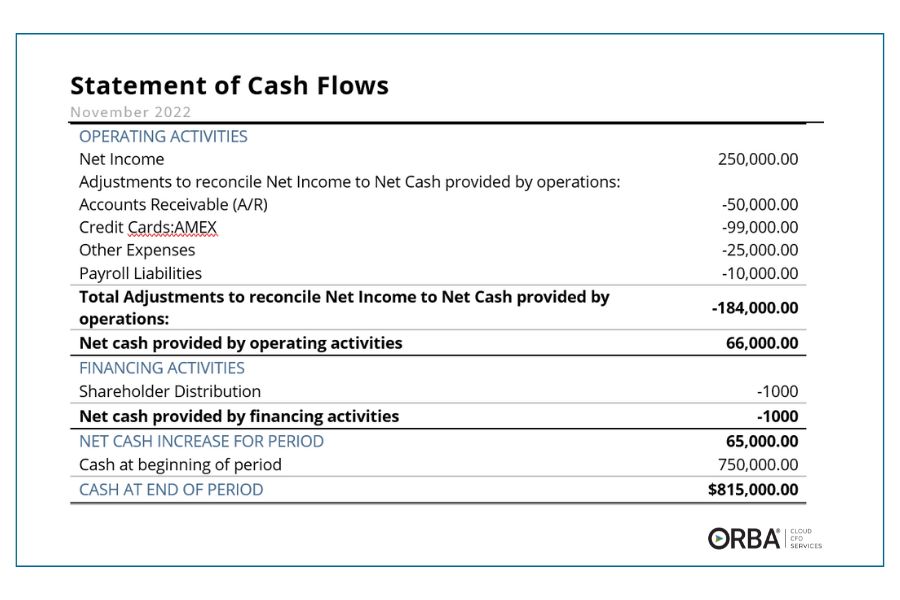

- Cash flow statement or statement of cash flows (SCF)

7. Evaluate cash flow

Assess your cash inflows and outflows to understand your business’s liquidity. Identifying areas for improvement can help you better manage your cash flow and make informed financial decisions. By evaluating your cash flow and liquidity ratios you can optimize working capital, plan for future expenses, and ensure a healthy financial position.

8. Review financial statements for accuracy

Analyze your profit and loss statement and balance sheet to gain insights into your business’s financial performance. Look for any anomalies or errors that need to be addressed. By reviewing your financial statements, you can identify trends, assess profitability, and evaluate the overall financial health of your business.

Cloud CFO Tip: Don’t forget your balance sheet! It’s a commonly neglected report. When we inherit clean-up projects, one of our first tasks it to verify all the balances on the balance sheet. An incorrect balance sheet often spells trouble for your income statements as well. There may be hidden expenses or income write-offs that significantly change your income once they are recognized properly.

9. Plan for the next month

Set financial goals and targets for the upcoming month. This goes hand-in-hand with checking in with your budget. Outline strategies to achieve these goals, whether it’s increasing sales, reducing expenses, or improving profitability. By setting clear financial goals, you can align your business activities, prioritize initiatives, and drive sustainable growth. These don’t always have to be lofty goals. Maybe increasing sales is as simple as having your sales team make 10 calls per week.

Client case example: For one CPG client, having reliable month-end closing meant they could track their customer sales channels month over month (MoM) to see that one distributor was costing them more than they were worth. The client was able to refocus their operations on a higher volume channel and as a result, they saw their profitability jump significantly.

10. Archive records

Organize and store all financial documents, ensuring compliance with record-keeping regulations. Properly archiving your records allows for easy access in the future and provides a solid foundation for audits or financial analysis. By maintaining well-organized financial records, you can demonstrate transparency, facilitate compliance, and mitigate potential risks.

Month-end Closing Challenges

- One of the biggest pain-points of month-end closing is the error-prone process of closing using spreadsheets.

- The other biggest challenge is likely turnaround time.

How to speed up month-end close?

Set a process and stick to it

Take the time to document your month-end closing checklist step-by-step. This clarifies who is responsible for which tasks and what items are dependent on another task being completed first.

Automate repeatable tasks

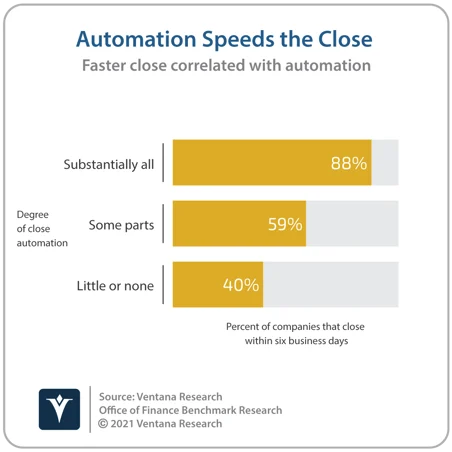

Ventana Research found that companies that automated a substantial part of their month-end could close their books within six days on average.

Once you’ve documented it, use it!

Share the checklist with all the parties involved in the process and use it as a working tool.But… don’t lose sight of the big picture. Don’t assume that your checklist is the law; your business will change, and the checklist needs to change with it.

The Bottom Line

By following this comprehensive 10-point month-end closing checklist, you can effectively manage your small business’s finances. Regular financial reviews and accurate reporting are essential for making informed decisions, identifying areas for improvement, and ensuring the long-term success of your business. Stay proactive, stay organized, and stay in control of your financial future. Remember, your dedication to financial management will lay a solid foundation for your business’s growth and prosperity.