Does this sound familiar? You’ve got a sales team driven to get the job done no matter what it takes, but their customers never seem to pay on time; or it’s becoming increasingly harder to carve out the time to make sure your invoices have been paid within the set terms. You had an Accounts Receivable process created… (about five years ago) and have never really reviewed them since.

While many businesses may have accounts receivable (AR) processes in place, I’ve found it’s not uncommon to see them struggling to enforce them- especially if they are a company that places a heavy emphasis on sales.

When you’re trying to improve cash flow or working capital a great place to begin is by improving your accounts receivable (AR) cycle.

Accounts Receivable Process: 3 reasons to pay more attention

1️⃣

Your Accounts Receivable (AR) balance is an asset that can be converted to cash.

2️⃣

The higher your AR balance = the less cash you have.

3️⃣

The longer your balance remains unpaid, the greater the risk of unpaid debt.

Accounts Receivable vs Accounts Payable

The accounts receivable process should not be confused with the accounts payable process. Here are some of the basic differences between accounts receivable vs accounts payable:

Accounts Receivable

- Money owed to you, incoming funds

- Asset on the balance sheet

- Focus on accelerating cash inflows

Accounts Payable

- Money paid by you, outgoing funds

- Liability on the balance sheet

- Focus on optimizing payments for cash flow

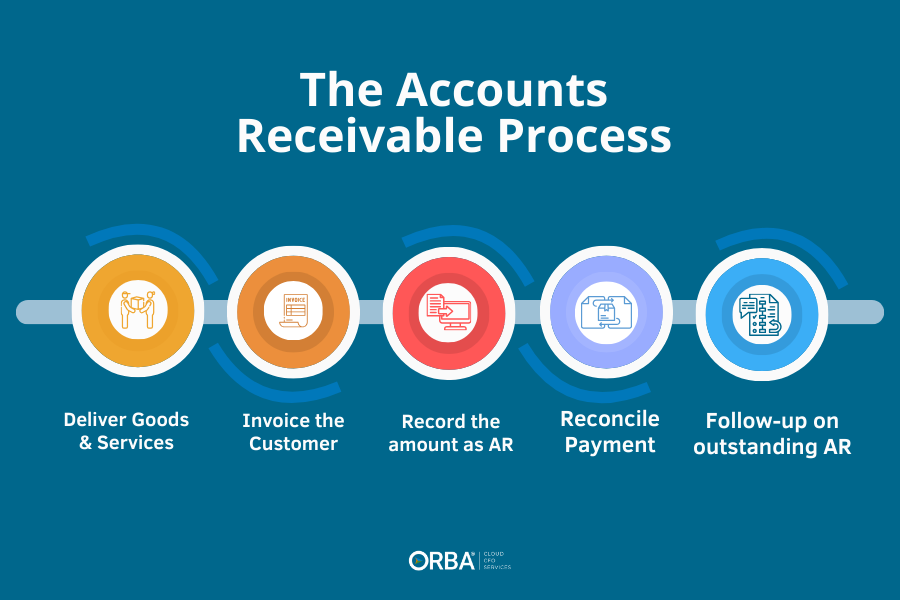

5-Step Accounts Receivable Process

- Deliver Goods or Services to Clients

- Ensure that products or services are provided to customers as agreed upon.

- Invoice the Customer

- Create and send accurate invoices with clear payment terms. (These are often due in Net 10, Net 15, Net 30, Net 60 for example).

- Include relevant details such as due dates and payment methods.

- Record the Invoiced Amount as an Account Receivable

- Log the outstanding amount owed by customers.

- This step is crucial for tracking and managing AR.

- Process and Reconcile Accounts Receivable Payments

- When clients pay as agreed, record the payment as a deposit.

- Timely payment processing is essential for maintaining cash flow.

- This step can be owned by your outsourced bookkeeping services.

- Follow Up on Outstanding Payments

- Issue reminders for overdue invoices.

- Implement a systematic approach to collections.

- Consider AR automation tools to streamline this process.

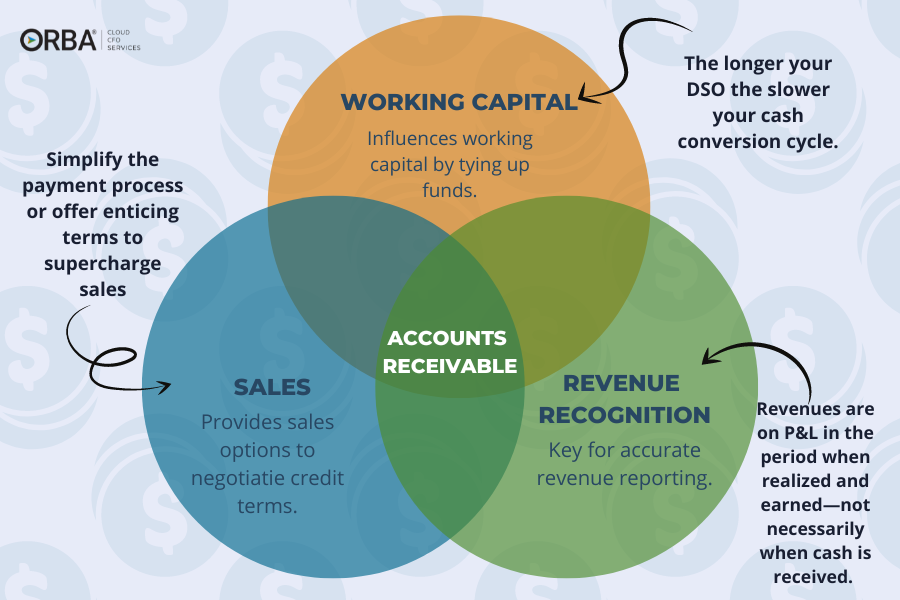

AR affects your operations and financial health:

- Working Capital Impact: Influences working capital by tying up funds.

- Revenue Recognition: Key for accurate revenue reporting under GAAP principles.

- Sales Facilitation: Promotes sales opportunities by offering credit terms options.

By extending credit terms through AR, you can supercharge sales by simplifying the purchasing process for customers. This not only fosters loyalty but also encourages repeat business.

Common accounts receivable mistakes

- Failing or forgetting to follow up with late customers in a timely manner.

- Neglecting to train staff (specifically sales staff) on the effects of late payments and how to follow up appropriately with late-paying customers.

- Failure to adopt best practices in invoicing.

- Ignoring the issue altogether.

So how do you improve your accounts receivable process?

6 Tips to Improve Accounts Receivable Process:

So given we now know the importance of optimizing your AR, how exactly can you improve your accounts receivable process? It takes some digging in, but these are tangible changes you can make that will have an affect on your bottom line:

#1. Begin with your accounts receivable metrics.

Review your accounts receivable reports often: balances past due, customers owing, or DSO (days sales outstanding). Aim for a smaller DSO to reduce your cash flow needs. Determine which accounts receivable KPIS are most relevant to your business. Next, review these reports regularly (at least twice a month) to know where your AR efforts could be improved. If you don’t have a dashboard like the one offered by NetSuite, look for these on your balance sheet. These are reports offered by our outsourced controller services.

#2. Establish firm payment terms.

Create a formal credit process on any customers you will give terms to. Make them fill out credit applications and request existing trade references. Discounts should only be offered in instances that will directly benefit the company. For example, offering early-pay discounts will increase your cash flow.

#3. Offer multiple and instant payment options.

This may seem obvious but all too often we see people offering only one or a few ways to pay. With all the EFT and options available online, the best thing you can do is to offer multiple ways to pay even if it comes at a small fee. You want it to be EASY for your customers to pay you. Consider offering a few different structures for paying:

Discount for payment upfront.

As mentioned above, one way to improve cash flow is to offer an early payment discount to clients or customers that pay before the terms set in your invoice. Even with the discount it’s better for cash flow to have it in-hand compared to waiting for late invoices. Think 2% savings if you pay before the term.

Fixed-fee structure.

Another way to tackle outstanding AR balances is to offer a fixed-fee structure. This can prevent higher-than-expected invoices and the resulting late payment issues that follow.

#4. Automate wherever possible.

Look to cloud accounting solutions to automate parts of your accounts receivable process. This eliminates manual entry errors and reduces transaction processing time. Using the right system for your business can: optimize many aspects of the AR cycle; ensure addresses are up to date; offer electronic billing for faster delivery, set automated terms by customer etc. Plus, as seen above, real-time dashboards are especially useful for arming your sales or collections teams with the information they need.

#5. Be proactive about your collections.

To begin with, send email reminders at regular intervals. Move fast on past-due AR. If you think your any of your outstanding invoices are over 30 days past due you’re already in catch-up mode. Worse, if you’re unsure how many days past due than you should circle back to #2. Train your staff to know how to deal with late-paying customers and how to employ collection efforts in line with your best practices. Align your team to your financial goals to get buy-in on your collection efforts.

#6. Get rid of accounts receivable.

The best method for managing accounts receivable problems is by saying goodbye to them entirely! Of course by asking for all your payment upfront you avoid all AR woes and this cash flow problem altogether.

One sure way to tank your business is by ignoring common cash flow problems like a growing accounts receivable (AR) balance. By reviewing the six steps above you can be sure you’ve optimized your accounts receivable process to meet your business needs.