When you’re examining customer profitability, there are two key methods where you can focus your efforts on growing: Increase the number of customers or, alternatively, increase the customer lifetime value (LTV).

Customer LTV is an often over-looked metric that tells an important story about the value you offer your customers and how valuable they are to your company.

What’s covered in this blog:

- How to calculate customer LTV

- The magic ratio for customer LTV

- WATCH: Increase LTV and Supercharge your growth webinar

- The best 4 ways to increase customer lifetime value

- 5 Approaches to Referral Programs (with examples)

How to Calculate Customer LTV

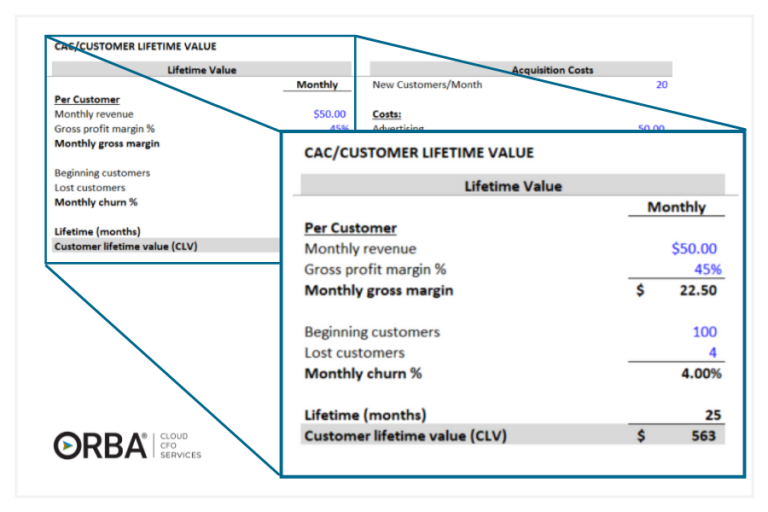

The customer LTV is the net profit your customer brings to your company over a set amount of time. The formula for customer LTV is:

LTV = MRR (Monthly Recurring Revenue) x (Gross Profit %) x (# of lifetime months)

Many marketers know that your focus is better spent on extending the lifetime of your current customer base, and yet many companies still spend a significant amount on acquiring new customers (which also does have an important role when you are trying to scale up).

The Magic Ratio for Customer LTV

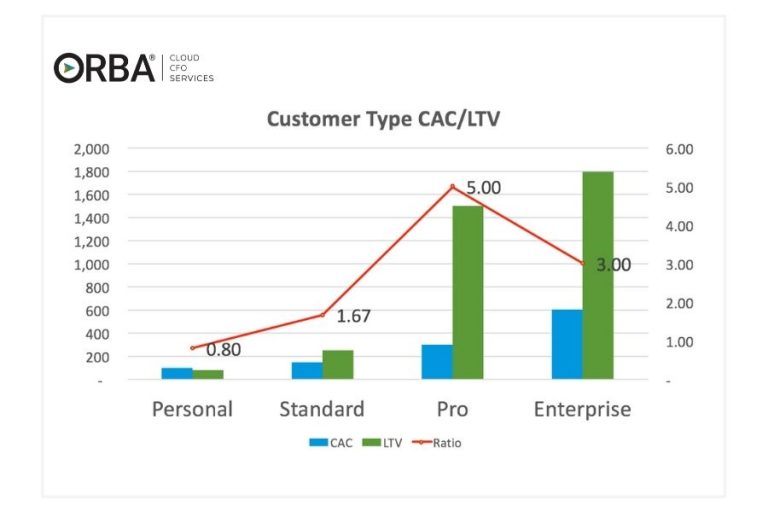

Generally speaking, you want to aim for a ratio of 3:1 for LTV to CAC. In other words, you want the lifetime value of your customer to be three times the value to acquire them. If it’s less, you are spending too much; if it’s more, say 6:1, you are spending too little.

*Remember Your Allowable CAC

If you do have more than the 3:1 LTV to CAC ratio, it is time to optimize your sales channels to acquire more customers.

Watch: Increase LTV and Supercharge your growth

The Best Four Ways to Increase Customer Lifetime Value

If you’re trying to reduce churn, here are a few places to start in order to increase LTV:

Step 1. Profile your best customers.

Calculate a more accurate LTV by segmenting your customers by channel, customer type or location. This allows you to see which channels have the highest LTV and which are struggling. For instance, say your average CAC is $150 and your average LTV is $400. Your magic ratio is 2.67. Great, yes? But how do you know what customer to target? The overall average is simply a vanity metric and not all that helpful. If you take the same numbers and plot them by customer tier, for example, you get a ton more insight.

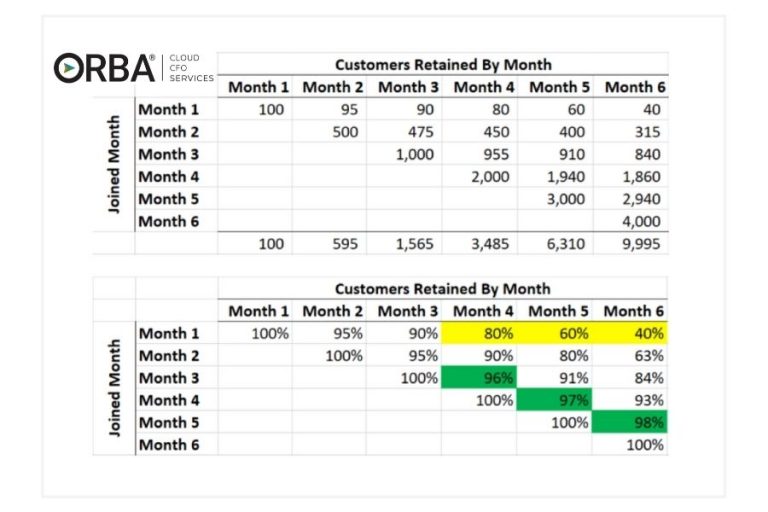

Run a cohort analysis over time to understand your churn. This will help you identify trends and get more bang for your buck.

Cloud CFO Tip: Target customers that will also do some of the selling for you. Using the profiling you did earlier can help identify the customers that could be brand ambassadors and help with cross-promotion.

Step 2. Cross-sell, upsell.

If you are in the ecommerce industry, one way to upsell is by product line expansion. Remember, it is always easier to sell more to current customers than it is to acquire new ones. Our ecommerce accounting services can help identify your best sellers.

If you have a SaaS company, offering different pricing tiers is a smart approach for increasing customer LTV. Aim to move existing customers up a tier once your product/service becomes valuable or, better yet, invaluable to them.

And of course, recurring revenue is essential to customer LTV. If you can offer products or services in a subscription format, each customer’s LTV is exponentially increased.

Step 3. Surprise and delight customers to reduce churn.

In B2B for example, this might mean increasing touch-points in account management to build better relationships. Check-in with questions or surveys. Face-to-face, Zoom or a phone call are always going to feel more personal than a quick email. But sometimes a survey allows people to feel like they can provide more anonymous feedback. “Are we meeting your needs? Is there an area we could do better?” or “What could we change so you can do your job better?”

In B2C industries, the possibilities are endless: Surprise discounts, presales, flash sales, samples or gifts. Reward with an experience. Offer birthday gifts or birthday discounts. A handwritten note can make a shipment/gift feel personal.

And, in either B2B of B2C business models, the more you can solve your customers’ problems the better. If there is anything you can do to make your customer’s life easier, do it. BILL offers a list of a number of ways to increase customer retention, including what we’ve noted. Here are a few highlights that we believe can help you increase LTV:

- Have an exceptional return policy

- Self-serve support for your customers

- Be transparent

- Share what causes you stand for: social responsibility is becoming a bigger factor, especially for millennials (aka those with a lot of purchasing power)

- Showcase customer stories.

Step 4. Build out referral programs.

Referral programs are not to be ignored. Companies like AirBnB and Uber were built on them. Customers that were referred are statistically more likely to stick around longer. Plus, according to Andrew Roth, a McKinsey partner in digital ventures, 20-30% of all new customers are driven by referral programs. He says that “it becomes a massive channel, because you’re relying on your own first-party data to drive growth, and you’re not doing anything complicated. I guess it’s like an Uber type of referral program, where both sides get some kind of benefit.” This doesn’t have to be as simple as refer a friend, get a 10% discount. There are plenty of ways you can get creative with referral programs to keep customers from churning that will not hurt your bottom line. Here are a few referral program ideas you may want to try:

Cash Credits Referral Program

Cash credits: Uber offered referral credits for any riders that referred a friend. Then Uber needed to meet demand with supply, so they also offered drivers large rewards to refer drivers. We’re talking up to $1,750.

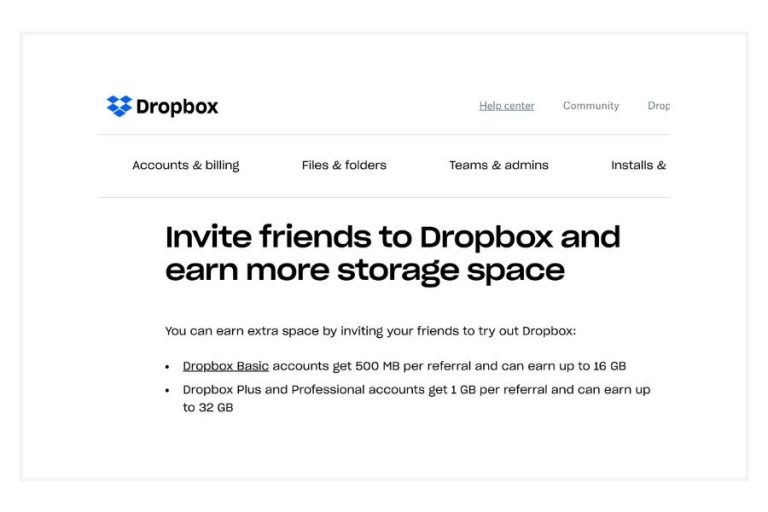

Product-based Perks

Product-based perks: Dropbox offered 500MB of free storage to a customer who makes a referral. The result: Membership grew by 60%.

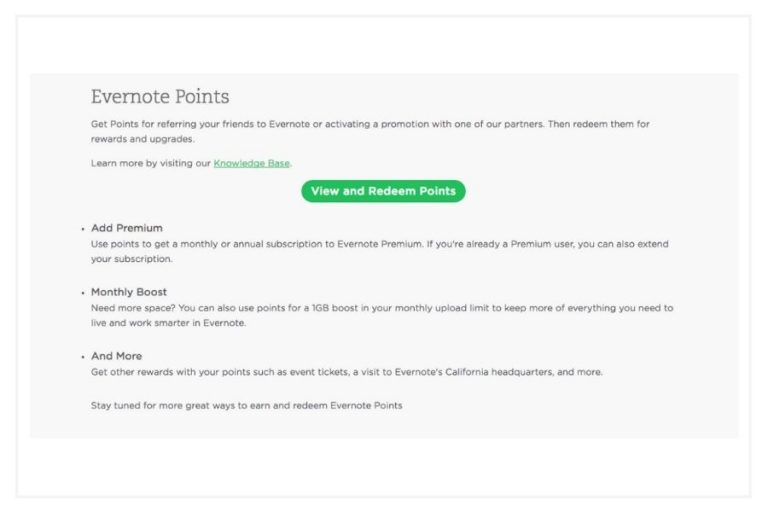

Point-based Referral Program

Points-based rewards: Customers that make referrals to Evernote get points that can be redeemed for premium features within Evernote. This has been integral to their growth engine. Co-founder, Phil Libin is quoted as saying, “we don’t care if you pay, we just want you to stay around and keep using it and get all your friends to use it.” They care more about referrals than they do about users paying for it initially. This is because they know that 25% of users will eventually pay once they realize Evernote’s value (see step 2 above).

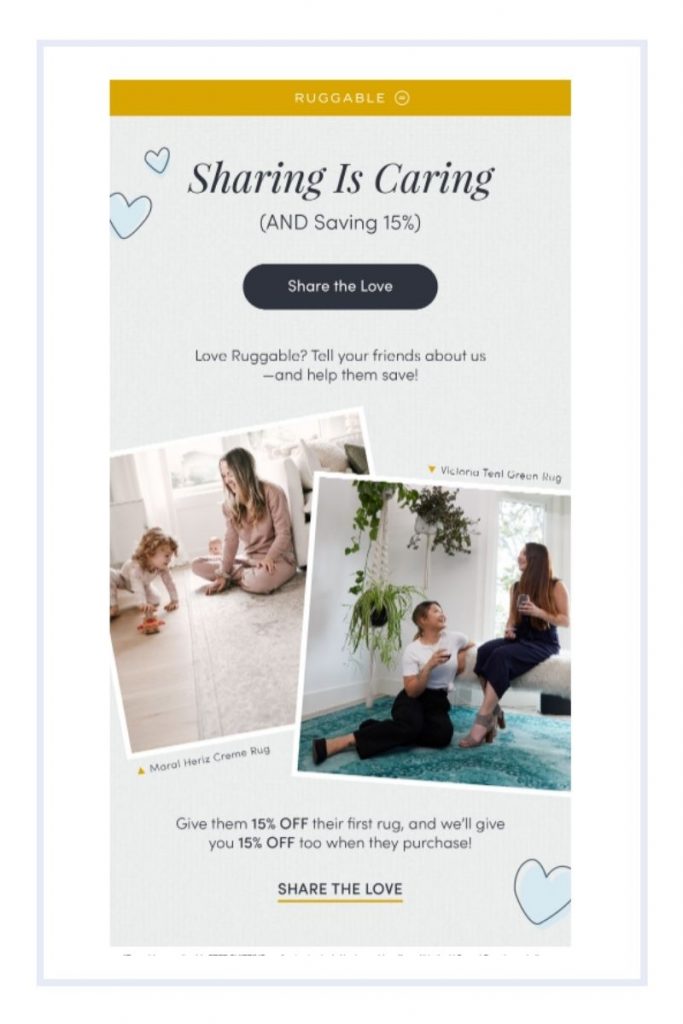

Two-Way Rewards Program

Two-way rewards: Think “sharing is caring”. That’s what Ruggable did anyways. They give a referred customer 15% off their first rug and if you referred a friend you get 15% off the next rug. So both parties save, plus it encourages you to make another purchase, or at least think about it.

Join-links Referral Programs

Join-links reward program: Provide readers with a personalized referral link, then reward them with points or prizes. Cross-promotion from business partners works especially well in these cases.

The bottom line? Increase LTV by combining customer data with creative referral programs. This will simultaneously reduce churn, increase your number of customers and grow customer profitability.

Need help running cohort analysis? Learn more about our outsourced CFO services and how we can help you discover your growth engine.