How do you know your company is financially fit? We all talk it to death: profit, profit, profit. And for good reason—your profitability, and therefore your profit margin, is the single best measure of company health. However, it’s a mistake to think that’s all there is to it. There are other metrics you should be using to perform your business financial health check.

Both short-term metrics and long-term metrics matter.

Your company’s financial fitness should include revenue growth, size growth and client growth. And, the metrics you use should be industry-specific based on thorough analytics. Don’t know where to start? That is where we come in with our outsourced CFO services. But, in the meantime, you can begin your company financial health check by looking at the following measures.

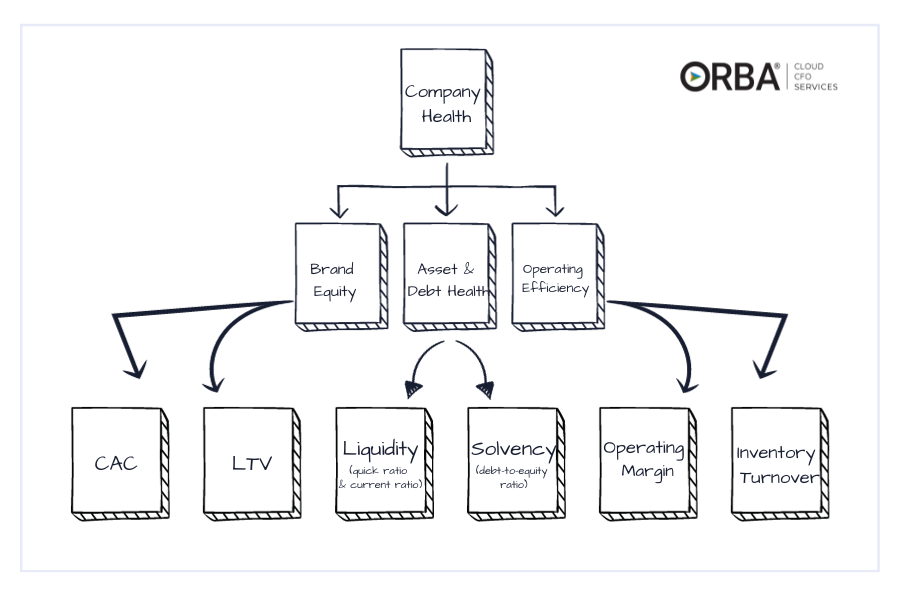

The Best Measures of Company Health

Brand Equity

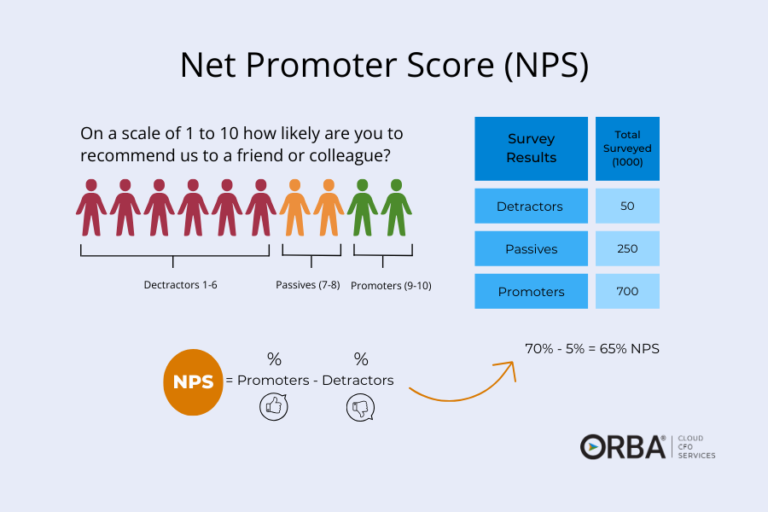

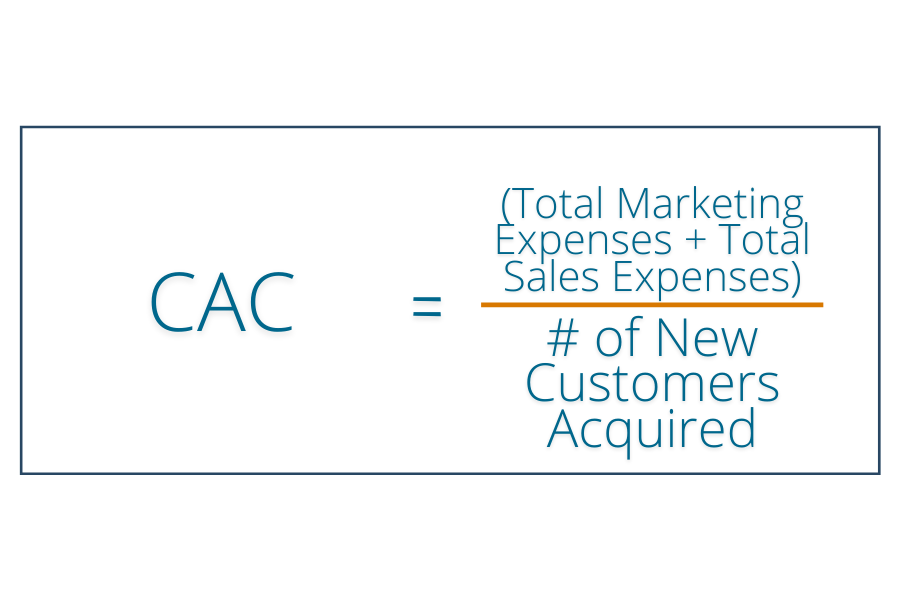

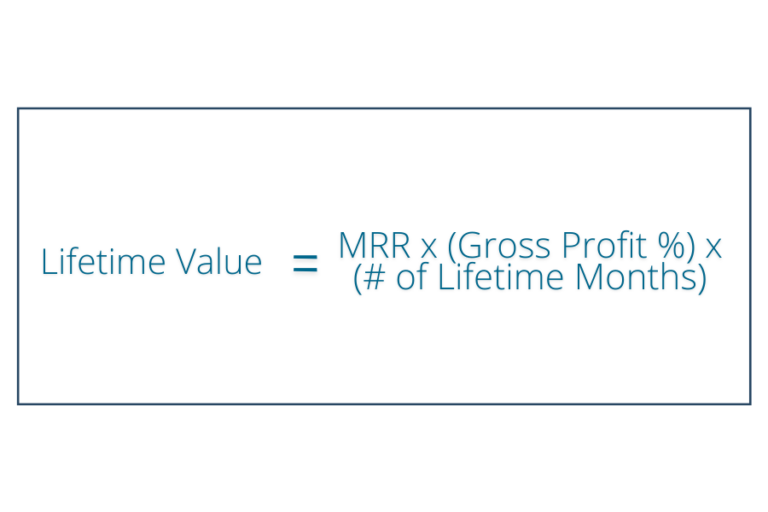

Innovation matters for certain businesses more than others. Know the consumer trends. Is this a fad or is your brand here to stay? Customer acquisition may play a greater role in measuring the ability for long-term growth in industries like Subscription-as-a-Service (SaaS). That is why you see so many SaaS companies offering discounts for referrals. The referral is saving them more on customer acquisition cost than the cost of the discount.

Lifetime value tells an important financial narrative about

Measures: customer acquisition cost (CAC) & lifetime value (LTV)

Liquidity (Asset Health) & Solvency (Debt Health)

Liquidity is the short-term ability to cover your debts. A greater liquidity in your cash and convertible assets plays into your financial health in the overall value of your company.

Measures: current ratio & quick ratio

Solvency is the ability to pay debt and long-term expenses on an ongoing basis. In other words, do your assets cover your debts? Having more equity than debt with a downward ratio trend is a good thing. You want your shareholders financing the operations more than your creditors (that said, increasing your debt to take advantage of an awesome new opportunity can be worth it if properly vetted first, but don’t rely on debt for normal operating expenses).

Measures: debt-to-equity ratio

Related Read: Use our convenient debt to equity ratio calculator to quickly determine your company’s solvency.

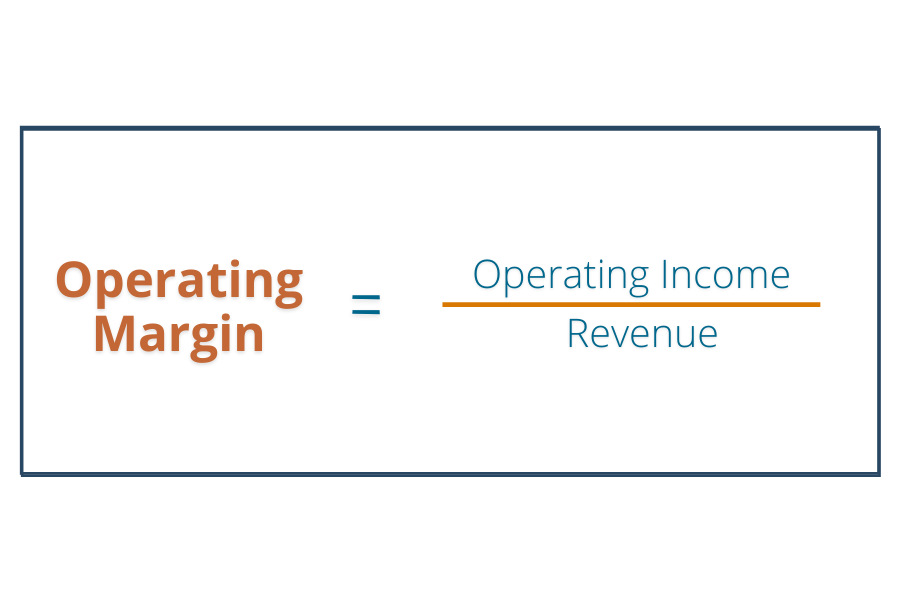

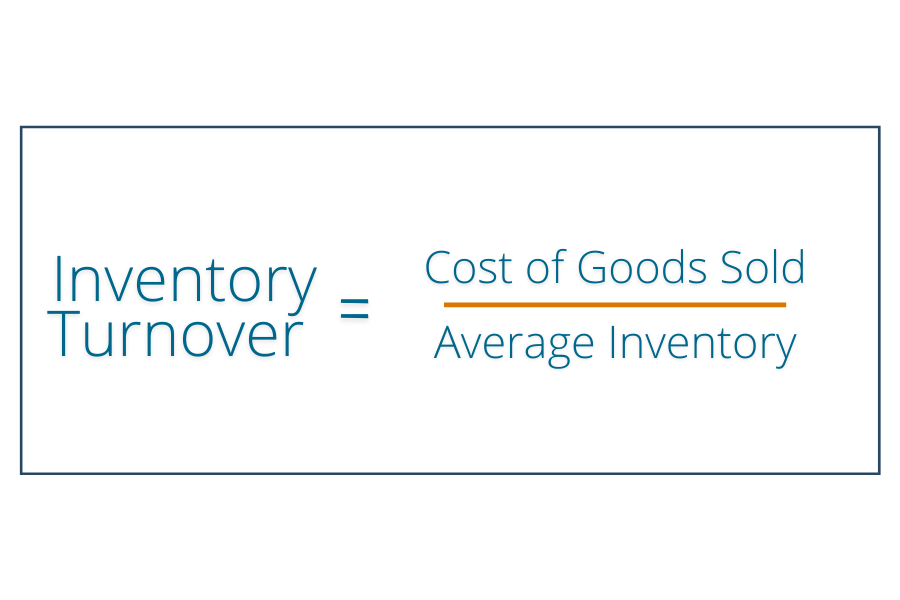

Operating Efficiency (Cost & Productivity Health)

Your inventory and working capital should be efficient, well-oiled machines. This reflects well on your company and proves it is being managed effectively while controlling costs. If the inventory and capital are not, perhaps it is time to rethink your current management. (Or your current accounting team!) We customize our outsourced accounting services to meet your business needs.

Measures: operating margin & inventory turnover

The Bottom Line

Profitability

Finally, the bottom line: is your company turning a profit?

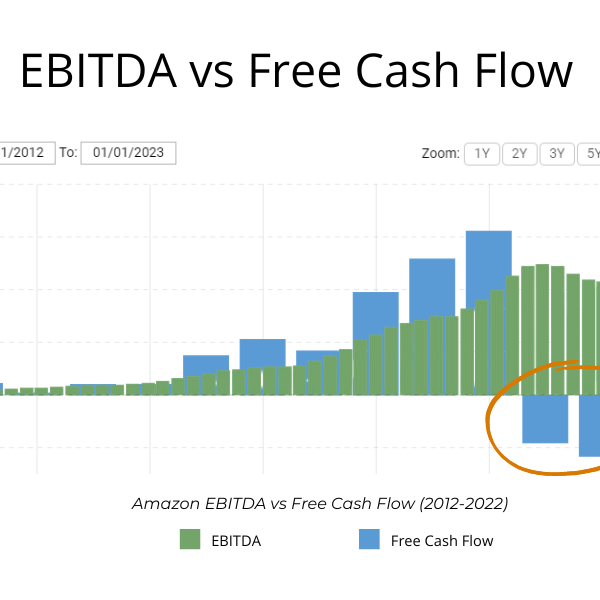

Measures: EBIDTA and net margin profits/revenue and Free Cash Flow

To calculate your profit margin, one commonly used KPI is earnings before interest, taxes, depreciation and amortization – or EBITDA:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

And while EBITDA is a quick snapshot, and can be useful to compare performance to industry peers, it’s not without its pitfalls which we cover in this EBITDA guide which includes an EBITDA calculator.

Free Cash Flow offers a more holistic measure of your company profitability as it takes into consideration depreciation & amortization, working capital and income taxes.

Free Cash Flow = Net Income + Depreciation & Amortization +/- Non-Cash Income And Expenses +/- Changes In Net Working Capital – Capital Expenditures

There are a number of factors that can affect your net margin, here are 5 reasons why your small business is losing money (and how to fix it). Taking into account your industry peers in your market, a business with a larger net margin typically indicates your company’s health is in the black. And a healthy company is ready to grow! What’s more awesome than that?!

Finally net profit may be in the millions but if your net margin is only 0.5% it’s not a financially “healthy” business.

Questions that might have you looking for better financial advice:

- How is your current operating efficiency

- What about your ability to pay debt over the long-term?

- Is your long-term return on invested capital (ROIC) accelerating or slowing, and how does it relate to your industry peers?

Get in touch to begin your company health check.