We Cover what is a supply chain KPI, why they are important, key supply chain metrics to track & how to measure performance.

KPIs (Key Performance Indicators) are not unique to the supply chain, they are used across all industries to gauge performance over time. A KPI in marketing, for example, may be the cost per acquisition, in business development a KPI might be the cost per lead, in finance, the debt to equity ratio & in supply chain, the inventory sales ratio. Point being, every industry has dozens of ever expanding KPIs to more accurately measure and predict performance.

With the increasing frequency of supply chain disruptions, our clients have more questions about their supply chain KPIs.

Why are supply chain KPIs important?

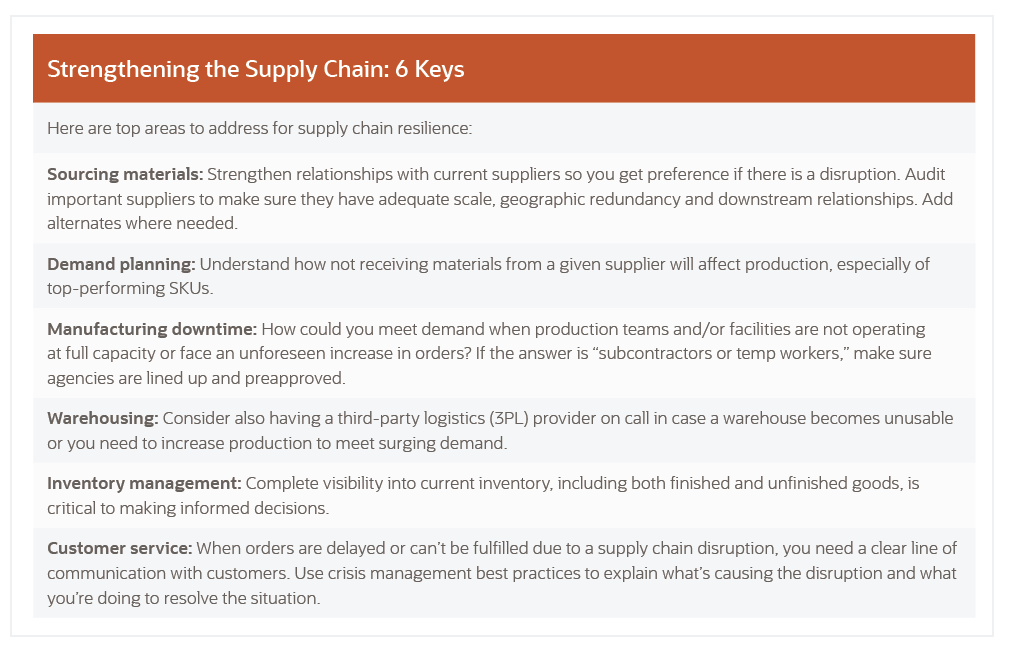

In the current economic climate, there is a growing importance to leverage supply chain KPIs in order to improve your bottom line. Yes, crisis followed by inflation would call for this. But supply chain resilience should be considered a long-term strategy beyond the last two years. According to McKinsey, on average, companies can expect to lose 42% of one year’s profits to supply chain disruptions over the course of a decade. NetSuite offers these 6 suggestions to strengthen your supply chain.

In order to mitigate these disruptions, supply chain performance, aka supply chain KPIs, need to be measured regularly. In fact, certain business models, like those with ecommerce accounting needs, should be tracking their supply chain metrics continuously. Tracking the right supply chain metrics allows you to achieve two things: spot inefficiencies to improve customer experience and increase revenue. So, how do you assess supply chain performance?

What supply chain KPIs should you be tracking?

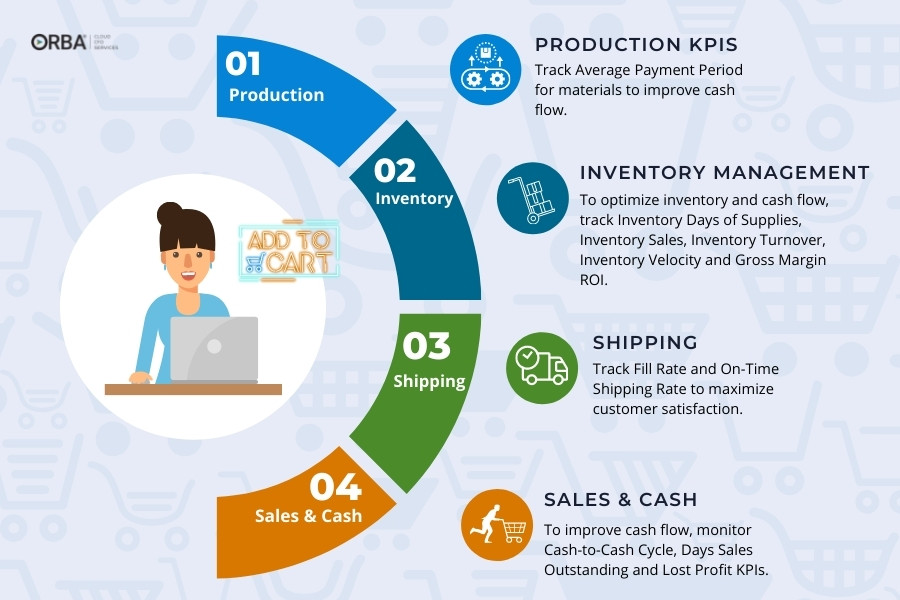

To assess supply chain performance, begin by tracking drivers and KPIs related to production, warehouse and inventory management, shipping, and finally, sales forecasts.

12 supply chain KPIs you should be tracking

Production KPIs

Average Payment Period for Materials = (materials payables / total cost of materials) x days in period

To improve cash flow, track your average payment period KPI for production materials to find suppliers that have favorable billing terms.

Warehouse & Inventory Management KPIs

Inventory days of supply formula is:

Inventory Days of Supply = (average inventory in a month, in dollars / monthly product demand, in dollars) x 30

This supply chain KPI is the number of days to run out of inventory if you weren’t to restock. The sweet spot you’re aiming for is referred to as the “par level”. Or, when your warehouse has enough inventory to satisfy customer demand without tying up too much cash. This is one of the KPIs you want to track to reduce inventory costs.

Inventory sales formula is:

Inventory Sales Ratio = inventory dollar amount / sales dollar amount

Your inventory turnover ratio formula is:

Inventory Turnover Ratio = cost of goods sold in period / average inventory in a period

You don’t want to be sitting on unsold inventory for too long. The higher the turnover rate, the healthier the company should be, provided you’re hitting the proper margins. Put another way, the higher the turnover the better your cash flow. This is one of the top supply chain KPIs we suggest monitoring to increase your cash flow.

Inventory velocity ratio is found using the following formula:

Inventory Velocity = opening stock / upcoming period’s sales forecast

Use inventory velocity to optimize inventory levels so you don’t carry too much inventory at one time. Aim for an inventory velocity of 60% to 70%, with up to 80% for fast-moving inventory items.

Gross margin ROI formula aka the GMROI formula is:

Gross Margin ROI = gross profit / [(opening inventory in the period – closing inventory in the period) / 2] x 100

Also known as GMROI, track gross margin ROI for insight into which inventory are your best performers. Or which ones should be bundled with top-sellers in those holiday rush sales. GMROI is my favorite supply chain KPI for better inventory forecasting.

Shipping KPIs

Your fill rate formula is:

Fill rate = (1 – [(total items – shipped items) / total items]) x 100

Directly related to customer satisfaction. A customer that gets their order is a happy customer. With our NetSuite accounting services you can get more specific fill rates related to orders, units or lines as needed. Another supply chain metric relating to customer satisfaction:

On-time shipping rate formula is:

On-time shipping rate = (number of items delivered on time in a period / total items shipped in the period) x 100

The landed cost formula is:

Landed cost = unit cost of product + shipping/freight costs + customs + risk + overhead

Understanding landed cost is important for procurement, pricing and most notable, your profitability. Higher landed costs cuts into savings you might expect from a low per-unit price. It reflects direct costs only to move the product from the factory floor to your customer. Sounds simple? There are many external factors that can affect landed cost. We break down the landed cost further in this article.

Sales & Cash Forecasts KPIs

We go into more detail in this post about why business owners need to know how to forecast, but, a business that runs out of cash is more likely to fail. Regardless, whether your business is growing or sustaining, increasing cash flow is good for business.

Cash-to-cash cycle formula is:

Cash-to-cash cycle = receivable days + inventory days – payable days

This measures how long it takes you to get cash from customers once you’ve paid your suppliers. You want to aim for the shortest cash-to-cash cycle you can.

Days sales outstanding (DSO) formula is:

Days Sales Outstanding = (receivables / sales) x number of days in a period

DSO measures how quickly you receive revenue from your customers. A lower DSO = better cash flow.

How to calculate lost sales due to stockout?

To find your lost profit due to supply chain issues use the following formula:

Lost Profit = (days out of stock x daily sales of item) x gross profit margin %

Perhaps one of the most common obstacles we’re seeing with our ecommerce clients is stockout lost sales because of supply chain disruptions. To track the lost profit you might see, use the formula above. This will truly tell you how your supply chain is performing.

What’s the best way to measure supply chain performance?

Sounds like a lot? It is. One way to track supply chain performance more easily is by digitizing it. Using ERPs like NetSuite coupled with NetSuite accounting services can offer dashboards that allow you to spot supply chain vulnerabilities more easily through the entire inventory management cycle. Production > Inventory Management > Shipping > Sales & Cash.

Set your business up for long-term success by regularly tracking supply chain KPIs and metrics to meet your customer demand and improve margins. Your bottom line will love you for it.

Looking for customized ecommerce accounting services or NetSuite bookkeeping? We’ve got you covered. Contact us to learn more.