What was employee turnover like at your business in 2021?

If you feel like it’s the year that everyone left their job you’re not alone. If you don’t, then kudos, your employee retention strategy is doing its job. A not-so humble brag: our Cloud CFO team saw very little turnover this year and instead went on a hiring spree to add to and grow our team. How did we do it?

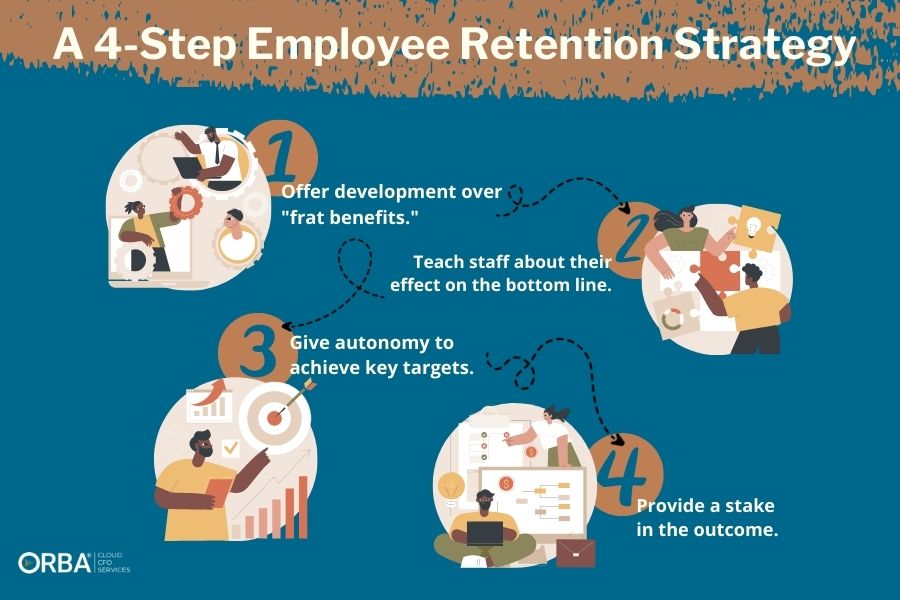

4 ways to improve employee retention strategy.

Throughout 2022 we’re hearing more from our clients about labor shortages. Here’s how to invest in your employee retention strategy to attract the best talent. And get them to stick around.

1). Create a company culture that no employee wants to leave.

In the midst of such marked labor shortages, nurture talent that wants to stick around long-term. By all means include the happy hours, foosball tables or rotating taps. But also create a culture beyond the “frat benefits.” Because just like a frat, employees are more likely to grow out of benefits that are geared towards the college crowd. Plus, these benefits are likely not enough to attract top talent anymore especially in our increasingly remote-work world.

Related Read: Is the Labor Market Finally Stabilizing? What Business Owners Need to Know

To build a culture to improve employee retention, invite and encourage employees to participate in next-level events. Meaning events that provide an opportunity for them to grow or network with those higher-level employees, clients or customers. Think events like webinars, seminars, networking, leadership opportunities, or tradeshows. These events are traditionally reserved for c-suite or managerial positions; however, by including staff before they are in management positions you are fostering a culture of both mentorship and inclusion. Set expectations or follow-ups regarding the outcomes of these events. Then, when your staff move into that managerial role, they will have already had experience attending these types of events. And what doesn’t build more confidence than experience?

Other examples of how ORBA Cloud CFO invests in employee retention:

- We take turns hosting Lunch and Learns;

- Our team members work across industries and rotate projects with multiple leaders to learn different skill sets;

- We support and acknowledge diversity through various committees and educational workshops. These don’t always have to include PowerPoints. For example, some of our committee events include cooking classes from different cultures!

- We support health (including mental health);

- The management team listens and supports people airing out concerns instead of suppressing them. We provide a safe forum for speaking up when something isn’t going well. Our Cloud CFO team knows they can speak up using open lines of communication.

2). Teach staff about their effect on the bottom line.

The most successful employee retention strategies create a growth culture. To do this, give your team the tools to understand how their work directly affects the bottom line. Provide concrete examples and teach them the difference the profit & loss statement and balance sheet. We’re not suggesting you need to pull out the complete monthly financial reports. Instead, plan ahead with an internal version of your financials and the line items that relate to them. (Or better yet, have your outsourced accounting services put these reports together). If your employees feel their work can make a difference they will be more “invested” in the company’s success.

Example: A warehouse manager who is shown how her warehouse employees affect direct labor costs will know that by increasing efficiency of, say, picking and packing orders, it will reduce labor costs.

3). Offer autonomy to achieve key targets.

Now that your employees understand the direct role they have on your income statement, step back and let them have the autonomy over their department, role or position to drive their own success. As long as there are tangible targets, line item goals should be something each team member can help set and achieve. Then, when discussing performance, you can focus on missed opportunities instead of threats.

Example: Let’s say a purchasing manager didn’t account properly for the lengthening lead time on raw materials. This led to stockout. By tracking the lost profit supply chain KPI they can avoid missing out on a personal bonus as a result.

4). Provide a stake in the outcome.

Simply put, an employee who receives earnings from success will be more invested in that success. Historically, the percentage of staff that are distracted by financial worries has been suggested to be between 30-80%,1,2 with over 60%3 suggesting their financial concerns have increased since the start of the pandemic. The same employees admitted to being distracted by financial stress at work and more likely to choose a company that cares about their financial well-being.

To address financial stress, begin by tutoring your employees in financial literacy: how to build and retain wealth. Then share the wealth. Instead of bonuses, offer financial compensation, like employee shared ownership programs (ESOPs). Does the idea of increasing salaries and benefits in the middle of the current inflationary market seems like a delicate balancing act?

Cloud CFO Tip: Communicate the equity numbers in dollar amount terms instead of percentages. For example, which of the below offers seems more tangible?

“We are granting you options equivalent to 0.5% of the company’s equity.”

Or alternatively:

“We are granting you options equivalent to $200,000 of the company’s equity.”

Profit sharing is proven to increase productivity in a two-fold manner3: staff are more motivated plus they are less distracted by financial burden.

How to improve your employee retention strategy:

To recap: foster a culture where employees feel valued over the long-term; educate your team on how they affect the bottom line; step back and let each department run themselves; and share the wealth. By implementing these four employee retention strategies you are investing in a culture of growth.

Does all this talk of awesome company culture have you interested in a career with ORBA Cloud CFO? Head to our careers page to see our current postings.

Sources: