An outsourced controller is an experienced financial expert, outside of your own company structure, who handles a range of time-consuming tasks such as: supervising daily bookkeeping, the bi-monthly grind of payroll, and advanced financial reporting .

The role has a variety of titles (Virtual controller, part-time controller & fractional controller) but each provide the same solution; complete financial reporting at a fraction of the full-time controller salary.

Get reliable financial reporting with our outsourced controller services

What does an outsourced controller do?

As a management-level financial representative for your organization, a fractional controller responsibilities include:

- Financial Operations:

- The outsourced controller approves day-to-day financial operations and ensures that they have been executed accurately.

- Provides custom financial reports;

- Reviews debt and equity ratios for debt planning;

- Financial Review:

- Creates and reviews recurring and monthly financial reports. For example, the statement of cash flows, balance sheet, and profit and loss statement.

- Assists in building budgets

- Performs monthly review of company profitability and performance

- Ultimately reviews all things include in this month-end closing checklist.

- Manages Compliance

- Liaises with tax accountant and/or auditor regarding day-to-day and monthly financials

- A controller develops and improves internal controls;

- Leadership:

- A controller supervises the accounting and bookkeeping team and reports directly to the CFO (if you have one).

Advantages of Outsourced Controller Services

The obvious answer is cost savings, but there are more benefits to hiring an outsourced controller service:

Better Financial Reporting

The proactive nature of an outsourced controller service versus an in-house one, brings a forward-thinking approach to your financial reporting. Because an outsourced team is used to relying on the cloud, by default they’re likely to think outside-the-box.

Client case example: When our client, Logical Media Group hired our outsourced controller services, their P&L needed serious help, reconciliations were 6+ months overdue, and payroll was being booked incorrectly, which made financial reporting very difficult to understand. Logical has some Monthly Recurring Revenue (MRR), but there is a reasonable amount that is not recurring. Plus, because they manage ad-buying for clients, they couldn’t use cash inflows as a reliable growth indicator. Director of Finance, Lauren O’Neill, explains, “with a lot of bank accounts for clients’ media money, we needed to know how things should be classified. The media revenue was inflating the P&L and balance sheet.” Enter ORBA Cloud CFO controller services.

The result: improved financial reporting and YoY gross profit margin.

Efficiency

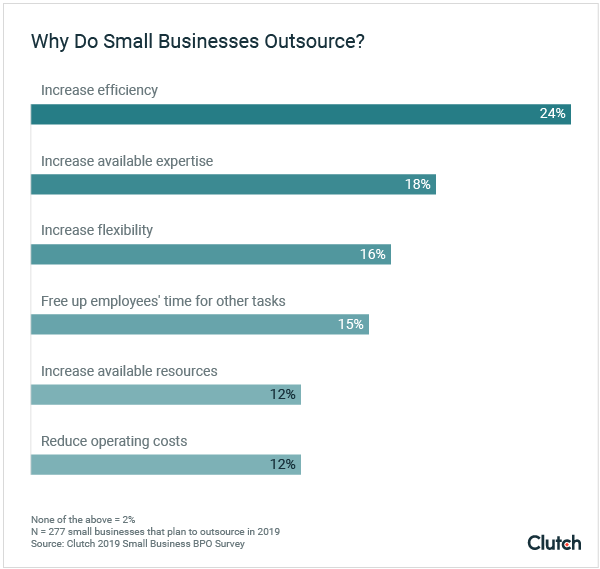

Hand off the monthly financial reporting requirements to a team of experts and you get to concentrate on core functions. Of over 500 small business owners surveyed by Clutch in 2019, the largest percentage (24%) that outsourced said they did so to increase efficiency, while 18% were seeking increased expertise.

Cross-Industry Expertise

Because outsourced controllers work with a number of clients at once, they bring cross-industry experience that offers a unique approach to your business.

Client case example: one client in the B2B ecommerce industry was experiencing tight cash flow. Our outsourced controller was able to confidently recommend tracking and reporting on their landed costs using NetSuite because of their experience with another ecommerce company that was operating in the medical sector. The outsourced controller knew they would be able to get insight into more accurate sales margins with the upgraded reporting because of their experience with another client with increasing freight costs.

Result: With improved reporting, the B2B client was able to tighten up payment schedules to increase cash flow.

Value

For many high-growth companies the option to outsource rather than build in-house teams offers huge value. And of course, for most business owners, the cost to outsource a financial controller compared to hiring in-house is notable:

The average salary of a full-time controller in the United States is $151,186. When you hire ORBA Cloud CFO’s fractional controller services the monthly fees start at $3,500 per month. That means you could see up to a 70% savings depending on how complex your financial requirements are.

Why is the difference so dramatic?

The reality for many businesses in the $5-$50 million in revenue range is that when it comes to their accounting needs, most of them only need strategic financial reporting 10% of the time. What they need the other 90% of the time is someone to roll up their sleeves and look after the weekly accounting needs and the financial reporting. Many business owners get caught up in thinking strategically without establishing the monthly processes that are essential to getting that financial insight they’re striving for.

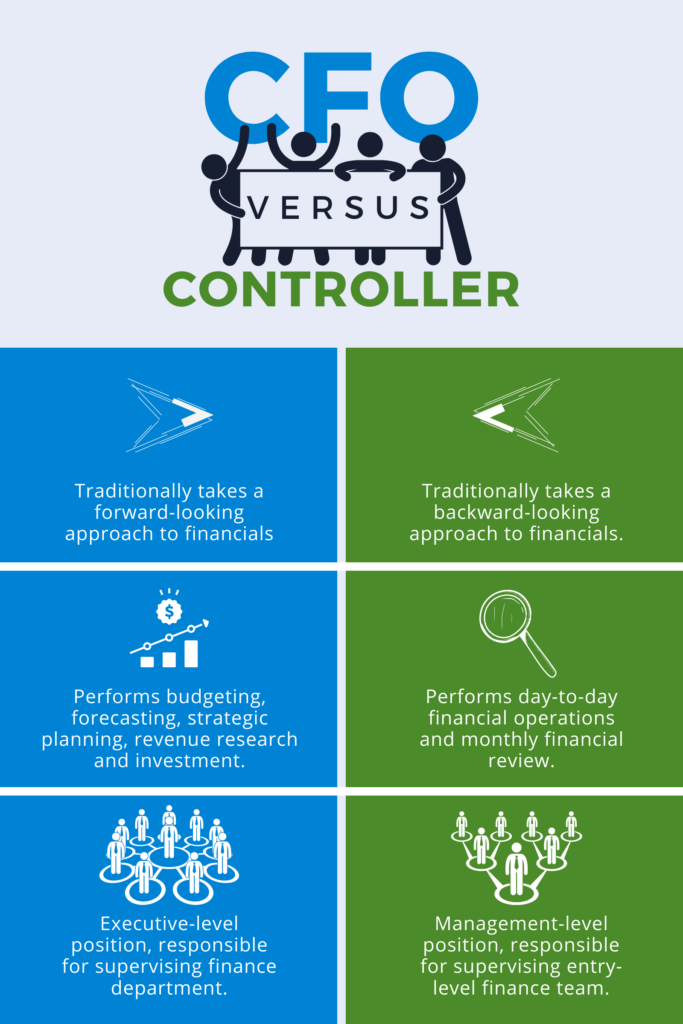

Related Read: CFO vs Controller: Which one to hire?

Client case example: one of our long-standing clients has an average revenue of over $25 million per year. Their outsourced accounting fees cost them over $150K per year. Sounds like a lot? But really it’s less than 1% of their annual revenue. And dramatically less than hiring an in-house finance team.

Result: I had never thought of our services as a money-saving operation, but when I ran those numbers I realized we were saving them about 20-30% compared to hiring in-house.

Faster onboarding and lower HR needs

It’s faster than the typical hiring process. For example, clients can move through the contract phase to be fully onboarded within two months. (With weekly and day-to-day accounting being handled within the first week the contract is signed).

This provides a more immediate solution than hiring internally, plus outsourced controllers are self-managed, and any HR needs are normally looked after by the outsourced accounting company taking the onus off you. Because of this, you can expect that pulling on outsourced controllers actually makes it easier to scale.

When is it time to hire an outsourced controller?

Here are some common situations that drive a company to hire an outsourced financial controller:

- Rapid Growth

- New product or services launch

- Influx of funding without financial direction

- Behind on financial reporting or inaccurate financial data

- Cash flow issues

- No budget! Happens more often than you might expect.

- Outdated accounting practices

- Compliance issues (nonprofit accounting services, cannabis accounting services)

Skills to look for in a fractional controller

- Your controller should have a good handle on your industry and market position. The last thing you want is to feel like you always have to explain how your business works.

- Pay special attention to your controller’s approach to problems. While a controller does typically focus on historical financials, if the candidate you are considering is only focused on pinching the bottom line, then by default, you can expect they will struggle to see the big picture. In fact, we often see companies choosing to switch accountants as a result.

- Ask the controller candidate what kind of approach they take to debt. It says a lot about how they think about finances and whether they have the ability to think outside the box.

The Bottom Line:

If your finance needs aren’t overly complex and your finance plan is still costing you more than 2% of your revenue, ask yourself why? Hiring an outsourced financial controller may be the answer.