The break-even point sales formula is a useful calculation that tells you how much sales revenue your business will need to, well, break even. In other words, how many products or services you will need to sell to cover all of the business expenses and to stop losing money.

Jump to the break-even calculator

This metric is an essential number to know for most business owners and your accounting services should be able to help you get the numbers to report on it.

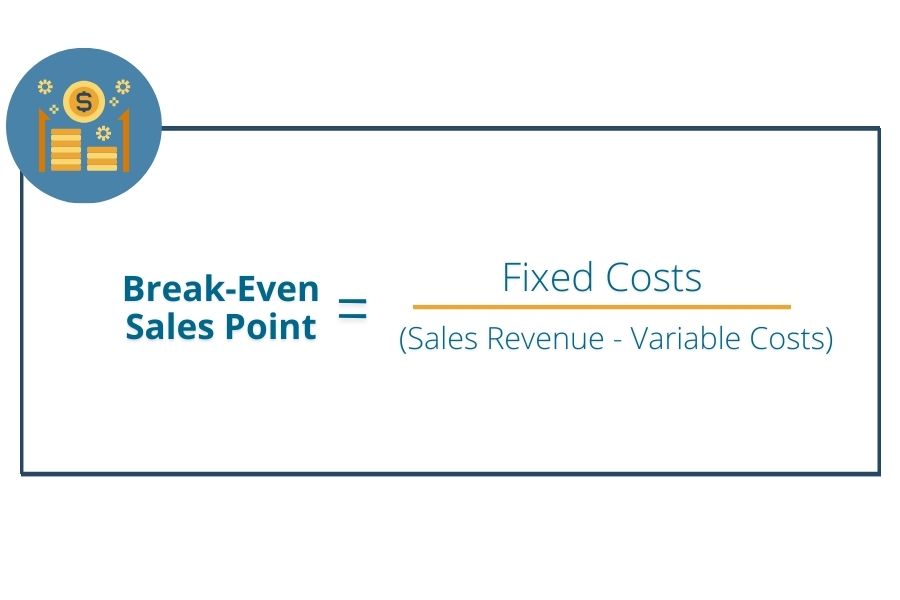

The break-even point formula

The break-even sales point formula is:

Break-Even Sales Point = Fixed Costs / (Sales Price per Unit – Variable Costs per Unit)

So to find your break-even sales point you take your fixed costs and divide them by the contributing margin or the sales price per unit minus your variable costs per unit.

Similarly, the break even point in units tells you how many units you will need to sell in order to reach your break-even quantity.

The break even point in units is:

Break even point (units) = (Fixed Costs)/ (sales price per unit) – (variable costs per unit)

Want to try it out? Use our break-even sales formula in this useful break-even point calculator:

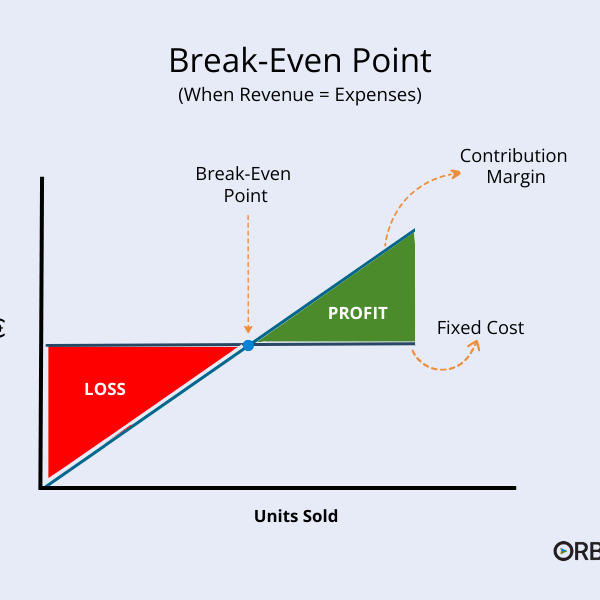

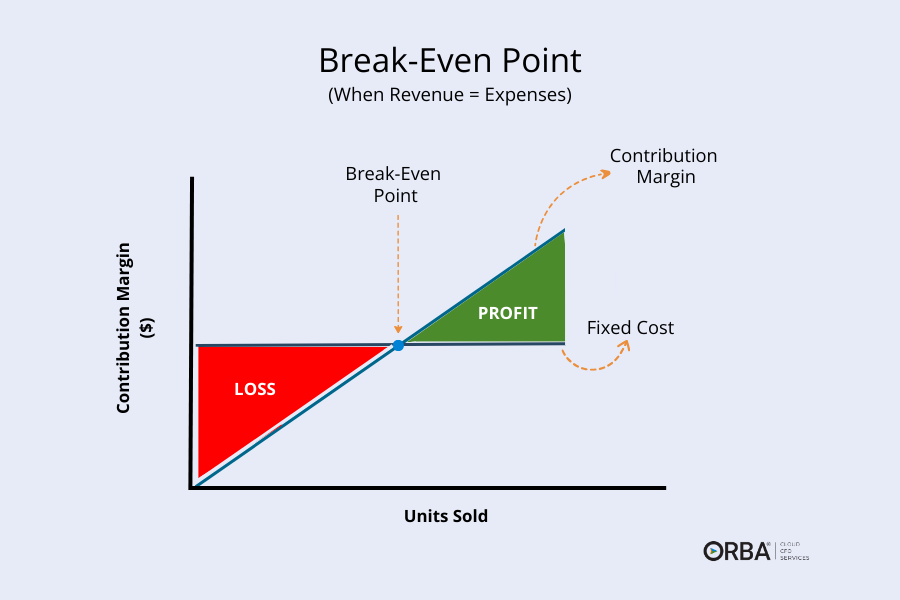

What is the break-even point?

So what is the break-even point? In the simplest terms, it’s the sales revenue needed for your business to break even. If you’re selling more units or services than your break-even point, congratulations, you’re making a profit! On the flip side, if you’re selling less than the break-even point, it may be time to tighten those purse strings because you’re facing some losses.

Putting the break-even sales formula to work can help you budget, price your products and make strategic sales decisions. Planning a holiday sale in Q4? Run some break-even point analysis first.

30-Second Video: How to find your break even point

Check out more detailed examples of how to calculate your break even point below:

How the break even point impacts decision making

The break-even point formula comes into play for business owners in four major cases:

1). Make strategic financial decisions

Wondering whether or not to invest in a new machine or launch a new product line? It can be tempting to jump into new projects, products, or investments, thinking they will bring in more revenue. However, it’s important to consider the relationship between total costs and expected revenue. Without knowing this, it’s difficult to determine if it’s truly a good idea. That’s where the break-even point comes in. It helps companies understand how much revenue they need to break even, allowing them to make decisions based on solid numbers rather than just intuition.

2). Set revenue targets

Once you’ve grasped the concept of the break-even point, take a moment to reassess your company’s revenue targets and ensure they’re generating a healthy profit. This valuable metric will enable you to establish sales targets that safeguard your business from any financial losses to instead focus on increasing revenue.

Cloud CFO Tip: Regularly perform product analysis to Identify which products or services have the highest profit margins and focus on promoting and upselling these.

3). Finetune pricing strategies

One of the most impactful applications of the break-even point is in shaping pricing strategies. For small businesses, setting the right price is a delicate balance between competitiveness and profitability. Armed with BEP insights, entrepreneurs can make pricing decisions that drive both sales and profits.

By understanding the interplay between pricing and costs, small business owners can experiment with different pricing models. For example, increasing the price per unit may raise the break-even point but could lead to higher margins. Conversely, lowering prices might boost sales volumes, helping to achieve break-even faster.

Related read: Use this price increase letter template if you do need to raise your prices to break-even

Furthermore, break-even analysis enables businesses to explore promotional strategies confidently. Discounts and limited-time offers can be assessed through the lens of their impact on reaching break-even. This empowers businesses to engage customers without compromising financial stability.

Using the break-even sales formula, you can determine if your business’s pricing strategy is effective or if you need to raise prices in order to maintain profitability. By conducting a break-even analysis, you might also discover that your company has the potential to lower prices, thus becoming more competitive while also increasing sales volume and revenue.

4). Secure funding

Whether trying to get funding for a new product line or planning an exit, the break-even point is a telltale metric potential investors and lenders will consider. In my experience, it’s helpful to tell a narrative about your financial performance when you’re trying to secure funding and a business’s break-even sales point tells an important part of that story.

Cloud CFO Tip: Just because a business has a high volume of sales, does not mean they’re profitable. Remember, in 2022, even Amazon was not profitable for the first time in 6 years.

Example: Break-even sales point profitability

Let’s take a fictional SaaS company, 2MuchSaaS as an example.

2Much makes $730,000 in revenue every month on their 3-tier SaaS: Standard, Pro and Enterprise plans. Sounds like a lot of sales right? But monthly costs include $300,000 on salaries, rent, business insurance, and some additional fixed overhead costs. Their variable costs range from $330,000 to $530,000 a month.

Right away, it’s evident that 2Much runs the risk of dipping into the red. Because sales revenues average $730,000 and fixed costs are $300,000, that leaves only $430,000 remaining to cover variable costs. When both fixed and variable costs equal total revenue ($300,000 + $430,000 = $730,000), then the business breaks even.

But when 2Much sees a more expensive month with fluctuating overhead expenses with and sees $530,000 on variable costs, it experiences a $100,000 loss. If the company spends less than $430,000 there is profit left over.

Instead of simply operating on a thin profit margin, the executive team should call on an outsourced CFO to implement new strategies to increase profits. These strategies might include any of the above four points:

- Cost-cutting strategies: Are there any expenses that could be cut to break-even? E.g., You could massively reduce your staff size like Elon Musk did with X (formerly Twitter) to turn around your break-even. Just kidding, don’t do that. Or at least try our fractional CFO services before you do. We can offer plenty of ways to reduce labor costs that don’t involve doling out pink slips.

- Sales and revenue targets: Using tangible metrics, the exec team can incentivize its sale team to drive new business to increase profits.

- Pricing strategies: 2Much could raise their prices on their enterprise packages to increase total revenue.

- Secure funding: They could look for an R&D opportunity in order to double-down and invest in order to grow.

In this case, with guidance from a CFO, 2Much realizes they need to lower their customer acquisition cost, because some of their enterprise sales leads are not yielding the best LTV:CAC ratio. Instead, by targeting pro-tier customers, their sales team can focus on increasing revenue. Using the break-even sales formula, 2Much has pinpointed a way to correct their break-even point.

Break-Even Point (BEP) Calculator

To use the break-even point calculator, make sure you know:

- Your business’s estimated fixed costs

- Your business’s selling price per product or unit

- Your business’s estimated variable cost per product or unit

Break even point analysis example

Back to planning for that holiday sale. Running a break even analysis tells you how many units you need to sell to cover costs. You want to aim for your break-even sales point or higher. Remember, once you find the minimum number of units sold or sales revenue that is needed to break even, then, every additional unit sold is profit for your business.

Let’s look at a break even analysis example: let’s say your consumer goods business wants to release a new product in time for the holiday rush. It plans on selling each unit for $30, but needs to know how many units they have to sell to break even by year end.

To perform the break-even sales analysis, start by calculating variable costs.

Let’s say the company expects to procure 500 units for the season at a cost of $10,000. (Need help understanding your landed cost? Get in touch to learn more about how our NetSuite accountants can help).

Dividing the total variable costs by the number of units, we can determine the per-unit variable cost: $10,000 / 500 = $20.

Now you can find your contribution margin: the difference between the sales price of the new product and its variable costs. So, if the new product per unit sells for $30, and the variable cost is $20, the contribution margin is $10.

Next, say the fixed costs for the season will be $8,000. Using the break-even sales formula, Number of Units to Break-Even = Fixed Costs / (Sales Price Per Unit – Variable Cost Per Unit), we can calculate that the business must sell 800 units this holiday season to break even.

$8,000 / ($30 – $20) = 800 units sold to break even

You see the problem right away. The business was only planning on producing 500 units. There are two options to break even. Increase the selling price by $6. At $36 per unit, it breaks even.

$8,000 / ($36 – $20) = 500 units sold to break even

Or the second option is to reduce costs. Either by producing more units without lowering production costs; or, by reducing fixed costs. As long as your total fixed and variable costs equal total sales revenue, your company will break even. Here’s a little chart that sums it up nicely:

Using the break-even point formula helps determine what pricing and spending decisions will help your small business avoid losing money and instead, turn a profit.

The Bottom Line

One of the pitfalls of break-even analysis is that it requires accurate data. Need help?

The break-even sales formula is just one calculation you can add to your toolbox to ensure your company makes a profit. There are many moving parts to any business financials. If you’re in need of an entrepreneur’s CFO, get in touch to learn more about how we can help you see the forest through the trees.