A comprehensive guide to understanding cash flow. What is cash flow, how do you report it, and why does it matter?

What is cash flow?

Cash flow is the money coming in and out of your business. Cash received = cash inflows, and cash spent = cash outflows.

Cash flow is the root of every business. You need to have a steady stream of capital to keep the door open (or, in the case of an ecommerce business, to keep the site running).

Get better cash flow forecasting with fractional CFO services

While many companies focus on their income statement (also known as the profit & loss or P&L), the income statement does not measure and report your cash inflows and outflows. For example, the income statement does not report the following:

Cash inflows:

- Cash collected from sales. (eg. cash Collected from customers 45 days after the sale.)

- Cash received from the sale of long-term assets

- Cash received from bank loans

Cash outflows:

- Cash payments to reduce a loan’s principal balance

- Cash paid for buildings and equipment Chat will be expensed over the next 5+ years

- Cash paid for goods sold. (eg. Payment may have been made many months prior to sale.)

- Cash withdrawn by owners or cash dividends paid to stockholders

A company’s understanding of its cash flow is critical for meeting its short-term and long-term obligations. And for attracting potential new lenders. This is why reviewing your monthly cash flow statement (or statement of cash flows) and running regular cash flow forecasts is so important.

Cash Flow vs Profit

It’s important to note the difference between cash flow vs profit. Cash flow and profit are both important in understanding your company financial health. Without good cash flow you will undoubtedly suffer lower profits eventually.

Profit is what your business has left over after deducting expenses from revenue. Like cash flow, you might have positive net profit or a negative profit (A.K.A. a loss) and it is one of the main indicators of how successfully you are running your business. Cash flow, on the other hand, indicates how successful you are at managing money.

Cash flow is the net amount of cash you are moving in and out of your company and you might have positive or negative cash flow.

Positive vs Negative Cash Flow

A company has a positive cash flow when it brings in more cash than it spends. A positive cash flow means you have enough money to cover your overhead costs and meet your short-term cash obligations.

You have a negative cash flow when you have less cash than expenses within a set period of time. Some businesses may have a negative cash flow when they have:

- Hired new staff to meet increase in demand

- Invested in increased quantities of inventory

- Purchased capital equipment

Most often, companies run into cash flow issues when they’re not able to pay debts when they’re due. That said, it can be the case where a company may intentionally owe more money than they’re earning. If you have plans to scale up and grow your business this may be a good thing, as long as it’s short-term and you have a plan to have positive cash flow again in the future.

That said, having consistently negative cash flow is a sure indicator of business failure. Therefore, using and analyzing your cash flow statements can help prevent the cash flow problems before they begin.

How do you calculate cash flow?

Two cash flow formulas you might consider are the operating cash flow formula:

Operating Cash Flow = (Net income + non-cash expenses) – Change in Working Capital

Your operating cash flow includes unplanned expenses, earnings, and investments that affect daily business activities. Or you may opt for the commonly used net cash flow formula:

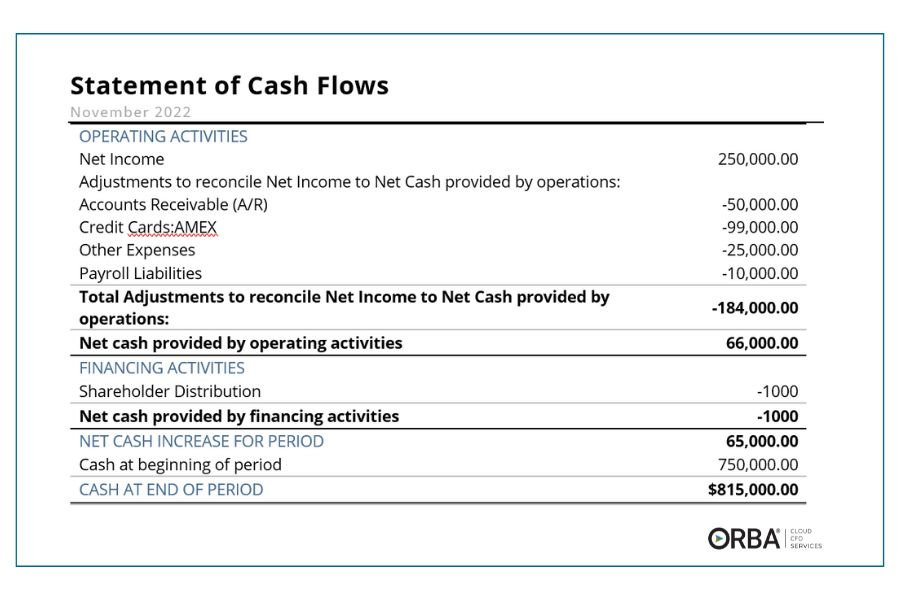

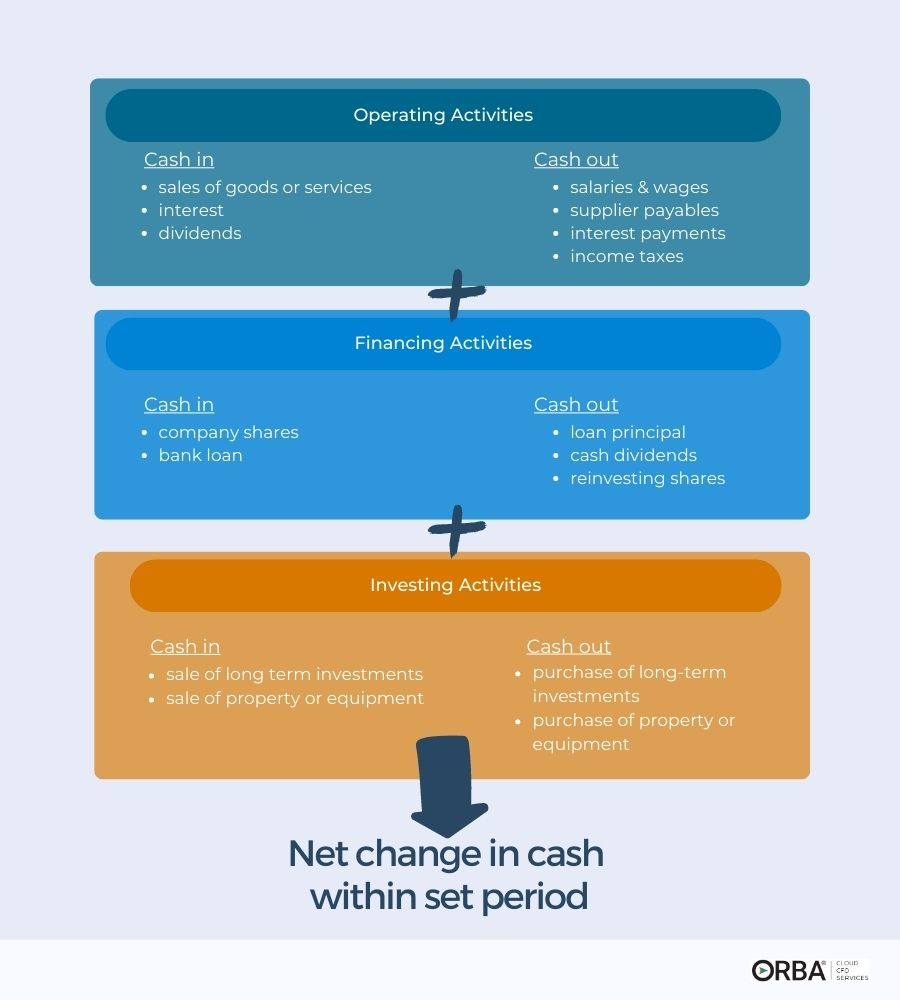

Net Cash Flow = Operating activities + financing activities + investing activities

The net cash flow statement is created using the net cash flow formula, by adding up the cash transactions within a set period from your: operations, investment and financing activities.

What are the different types of cash flow?

Looking at the three aspects of net cash flow in more detail:

Operating Activities

Cash flow from operating activities includes cash inflows from the sales of your goods or services, and interest or dividends. Cash outflows from operating activities might include wages and salaries, interest payments and income taxes.

Investing Activities

Cash flow from investing activities includes any cash you receive from the sale of long-term investments, like real estate or capital equipment; as well as any cash you pay out to purchase long-term investments, property or equipment.

Financing Activities

Financing activities can affect cash flow as it relates to debts, loans and dividends. For example, if you’re receiving cash from a loan or company shares or if you’re paying down your loan principal.

Cash flow statement vs. balance sheet

The balance sheet reports on:

- Assets ( items of value like: accounts receivable, cash, inventory, property)

- Liabilities (money owed like expenses and debt: rent, loans & long-term debt, taxes, wages)

- Equity (shareholders equity, retained earnings or net assets)

- The balance sheet formula is assets = liabilities + equity.

- The balance sheet depicts a snapshot in time.

The balance sheet does not report on revenue or expenses, or any of the business’s other cash activities. Those are recorded on your cash flow statement.

Cash flow statement vs. income statement

A P&L statement or income statement reports on:

- Revenue

- Cost of Goods Sold

- Expenses

- Profits

It does not report on any cash inflows or outflows. Using only an income statement, or P&L, to track your cash flow can lead to cash management problems:

If you use accrual basis accounting, income and expenses are recorded when they are earned or incurred—not when the money actually leaves or enters your bank accounts.

So, even if you see income reported on your income statement, you may not have the cash from that income on hand. The cash flow statement takes that into account so you can see your net cash flow—the precise amount of cash you have on hand.

For example, say you have a piece of equipment depreciating—it’s recorded as a monthly expense. Yet, you’ve already paid cash for that asset (but it’s not cash leaving your account each month).

The cash flow statement takes that monthly expense and reverses it—so you see how much cash you actually have on hand.

What are the most common cash flow problems?

Ideally, the net net cash flow from operating activities will be greater than the net income. If not you might be experiencing some of these cash flow problems:

Operating at a Loss

If your income is really not profitable (i.e., if your P&L is negative), it means your small business is losing money. Look to see where you might be spending too much or if sales are down, dig into those drivers and the reason why.

A Growing AR Balance

Neglecting your AR aging reports can spell trouble for your cash inflow.

Increasing Inventory

This negatively affects your cash flow if you are buying more inventory than you are selling, or if you are buying inventory too fast.

Client case example: a consumer goods company has a high volume of inventory. It is reporting a poor cash flow balance. Working backwards, the balance sheet illustrates an increase in current assets from the investment it made in inventory—every entry on the balance sheet is a placeholder for something that has not turned into cash yet. It is clear that the company’s closing cash balance is small due to the business’ investing and operating activities.

Too Many Fixed Assets

Cash used toward investing on fixed assets can leave you cash poor. A recurring expense can also sometimes be hidden as a fixed asset.

Debt Repayment

Paying off debt is a great example of when a company might actually be financially healthy but have a low cash flow. f your company continues to pay off debt over time, your debt-to-equity ratio will be decreasing, which is a good thing. Keep in mind that it is important to also consider the drain on cash flow from higher interest rates on short-term debt compared to interest on long-term debt.

It is possible to have limited cash flow but still be in a financially stable position.

Client case example continued: The company’s SCF reports a small cash flow balance but the organization is growing assets in inventory. If the company made $3 million YTD compared to $800,000 last year and is using the revenue gain to pay off debt while investing in inventory, it may have a smaller amount of cash-on-hand but is, in reality, improving its financial health.

Need tips on how to troubleshoot these cash flow issues? Head over to our guide to troubleshooting common cash flow problems to know where to find the related KPIs and how to fix them.

How can you increase cash flow?

There are many ways to improve your cash flow. It will depend on each unique business where it makes the most sense to focus your efforts. Here are some of the best ways to increase cash flow:

- Keep your bookkeeping up to date

- Optimize bill payments

- Stay on top of accounts receivable process

- Consider AR automation

- Sell off stale inventory

- Offer recurring services or subscriptions

- Shorten your working capital cycle

- Shorten your cash conversion cycle

- Reduce cart abandonment

- Increase average order value

- Monitor your cash flow forecasts regularly

We elaborate more on how to increase cash flow with these tips for increasing cash flow in a crisis, or if you are in ecommerce, check out our ways to increase cash flow for ecommerce businesses.

Cash flow FAQs

How do you analyze cash flow?

To understand your cash inflows and outflows you should be reviewing your monthly statement of cash flows and regularly perform cash flow analysis. To plan ahead for cash flow, consider hiring a fractional CFO to set up a dynamic cash flow forecast that you can check in with regularly.

How do I keep tabs on cash flow?

Effective cash flow management includes four areas:

Working Capital

- Accounts Receivable (DSO), inventory turnover

- Accounts Payable (DPO)

- Inventory (forecast vs actual by SKU)

CapEX

- CapEx Spend (% of revenue)

- Capital productivity

OpEx

- Salaries and Wages (budget vs. actual)

- Procurement (COGS and % of revenue over time)

Balance Sheet

- EBITDA

- Debt-to-equity

- divest in underperforming assets (liquidity ratios)

- consider external funding and its effect on cash flow

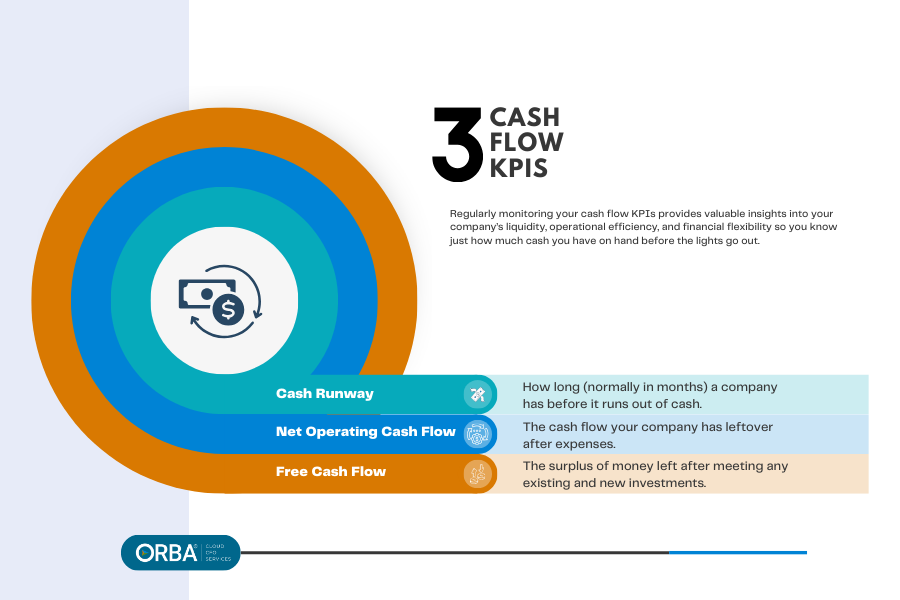

While all of these aren’t always directly considered cash flow KPIs, they do affect cash flow performance and should be measured in some degree by your CFO dashboard. Additionally, we recommend that business owners track certain high-level cash flow KPIs like: cash runway, net operating cash flow, free cash flow along with your cash conversion cycle.

Who needs to report cash flow?

Generally your controller or accountant will provide a monthly statement of cash flow. This is a backward looking document that reviews your cash flow within a set period of time (most often a month). A CFO or sometimes a controller can offer a rolling cash forecast to plan ahead for future months.

Who can help manage cash flow?

Consider outsourcing transactional tasks using bookkeeping services or hiring outsourced controller services to manage your monthly reporting and cash flow statements.

That said, to truly optimize your cash flow culture, we’ve seen the best results in companies that assign employees to each process that affects cash flow to increase accountability. For example, a team assigned to AR overdue invoice collections or on the other side of the cycle, procure-to-pay should have clear steps known to improve cash flow performance.