Working Capital Ratio vs. Cash Conversion Cycle

Your working capital ratio (also referred to as your current ratio) and cash conversion cycle are important measures of your company’s liquidity.

Your working capital ratio (also referred to as your current ratio) and cash conversion cycle are important measures of your company’s liquidity.

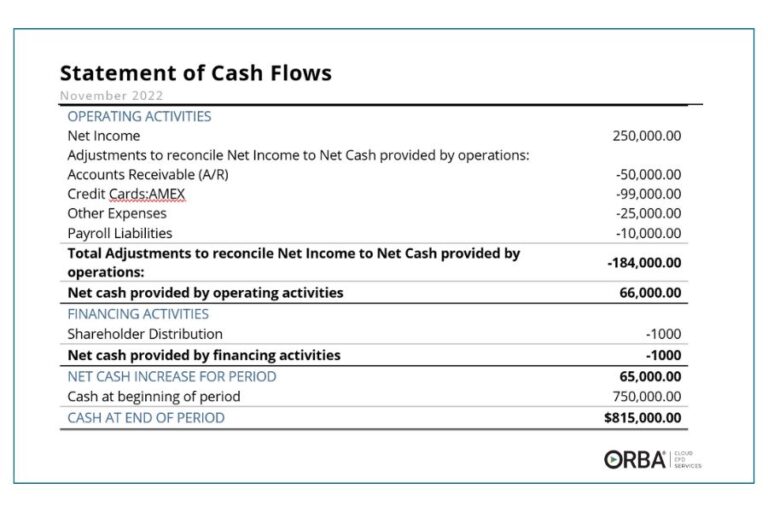

A comprehensive guide to understanding cash flow. What is cash flow, how do you report it, and why does it matter?

The secret to cash flow awesomeness? Cash flow analysis. Imagine walking into a store without really knowing whether your card

When you’re trying to improve cash flow or working capital a great place to begin is by improving your accounts receivable (AR) cycle. Six ways to improve your accounts receivable are…

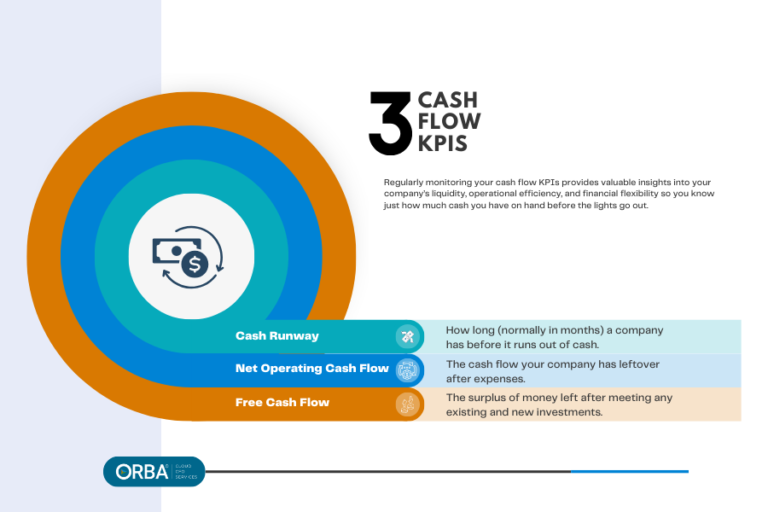

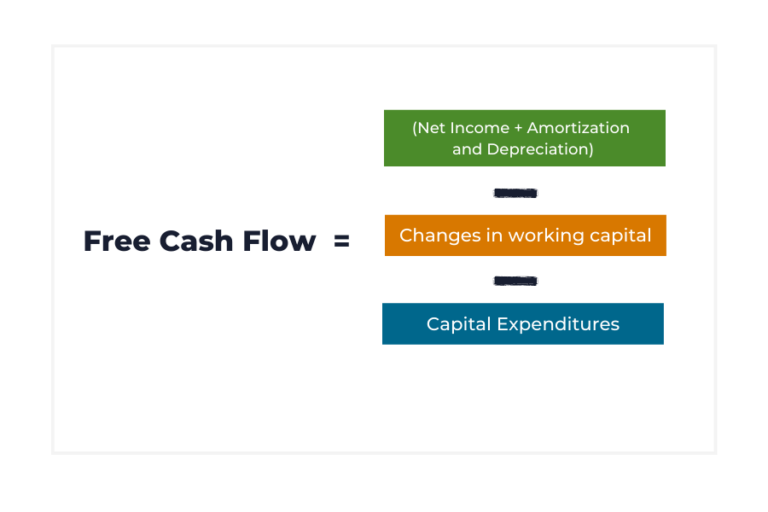

Why is Free Cash Flow (FCF) important for scaling companies? Simple. FCF enhances shareholder value and is an attractive metric for investors compared to price-earnings. Discover how you can easily calculate and build your company’s FCF.

With all warning signs pointing to recession, many companies are looking at ways to reduce costs. For those in the consumer products or ecommerce sector they might specifically be searching for ways to reduce inventory costs: 1). Leverage your data to optimize your inventory management, 2). Forecast your true demand and, 3). Bundle dead stock to sell.

It’s not uncommon. Because of inventory needs, we often see entrepreneurs struggling to increase cash flow for ecommerce businesses. Here are 6 ways to start:

In a crisis, restricted cash flow can be a double-edged sword. To stay afloat, a business must improve liquidity for fluctuating priorities. Many will focus solely on cutting costs, but there are a few other ways to get creative with cash flow in a crisis.

© 2025 | All rights reserved. Ostrow Reisin Berk & Abrams, Ltd.

Are you ready for forward-thinking financials? Book your free consultation today.