Get to know the basic accounting terms. Don’t be that business owner that says gross profit when what you really mean is gross margin.

If you’re mixing up accounting terms like gross profit with gross margin it makes communication with your outsourced accounting services more difficult and more importantly, it makes you look bad to potential investors. In fact, in this article, Entrepreneur explains why having a solid grasp on the basic accounting terms is indispensable for: business success, working with your accounting team and financial planning and analysis.

Familiarize yourself with these basic accounting terms so you can talk the finance talk.

What are the basic accounting terms?

Accounting terms to know:

Accounts Payable

Money owed by your company.

Accounts Receivable

Money due to your company.

Accrual-Basis Accounting

Expenses you account for when the expense occurs not when the cash is paid, and accounts receivable accounted for as assets before the cash is received. Accrual-basis accounting allows for a better measure of the profitability during a specific window of time.

Assets

Assets are items of value owned by your business which can include: cash, accounts receivable, inventory, investments, ownership of land or buildings, equipment.

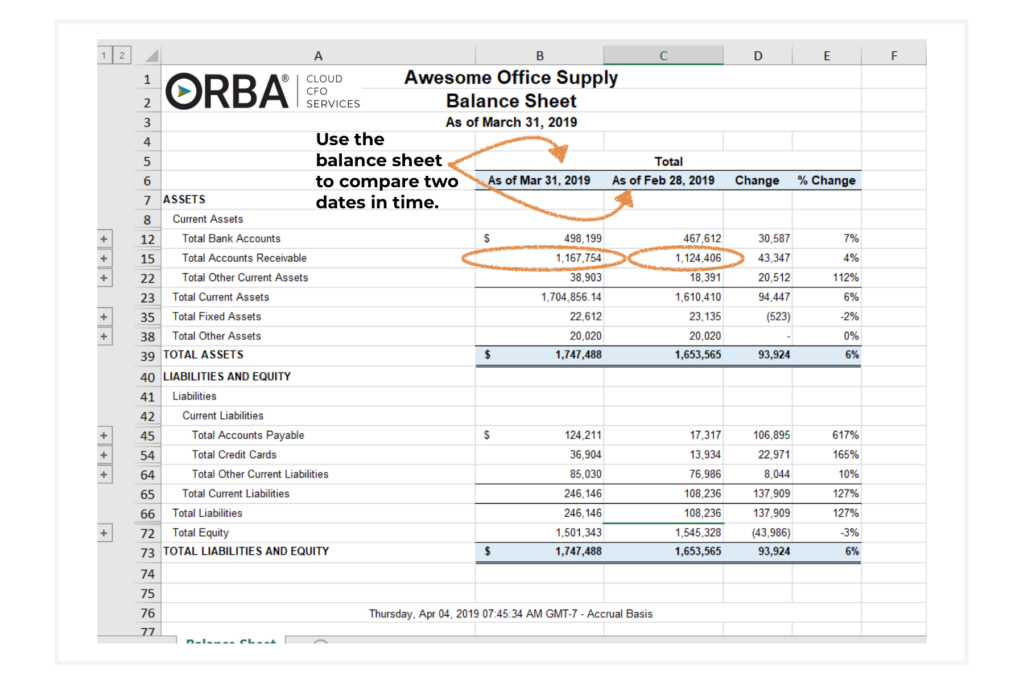

Balance Sheet

The balance sheet is a financial statement that should reflect your company’s assets, liabilities, and capital at a specific time while listing the income and expenditure before that time. This statement is important for potential investors to determine the liquidity of your business. The formula for your balance sheet is assets = liabilities + stockholder equity / capital at a certain point in time. The balance sheet is typically reported on a monthly, quarterly or annually basis.

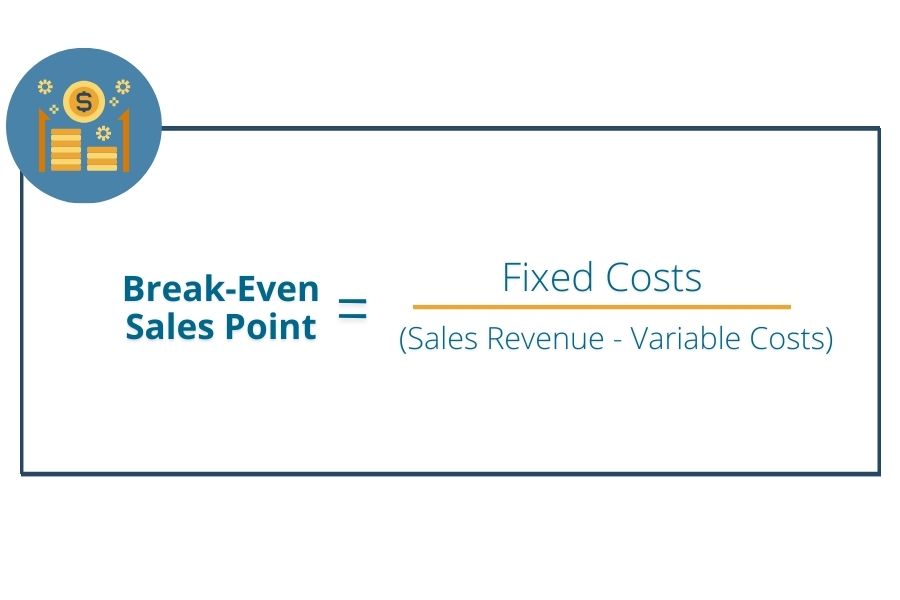

Break-Even Point

The sales revenue needed for your business to break even.

Cash Disbursements

Any outgoing cash payments made for things related to your business’ operating expenses, capital expenditures or interest on loans for example.

Cash Flow

Cash flow is the money coming in and out of your business. Cash received = cash inflows, and cash spent = cash outflows. May refer to operating or net cash flow.

Cash-Basis Accounting

As opposed to accrual-based accounting (see number 3), cash-basis accounts for revenue and expenses when the cash is physically received or paid.

Churn Rate

In simple terms, the rate at which customers stop supporting your business. Often seen as an important Key Performance Indicator (KPI) for Service as a Software (SaaS) business models, it is especially useful for looking at the rate at which customers end their subscriptions within a certain time. Generally, you want your growth rate to exceed your churn rate in order to scale.

Cost of Goods Sold (COGS)

The total direct cost to produce and sell your goods. This total should include all direct labor, materials and supplies and any overhead you incur. You want to know and understand your COGS as it is directly related to knowing your gross margin (see number 13). If you can lower your COGS, you increase your gross margin, and increasing your gross margin = awesome!

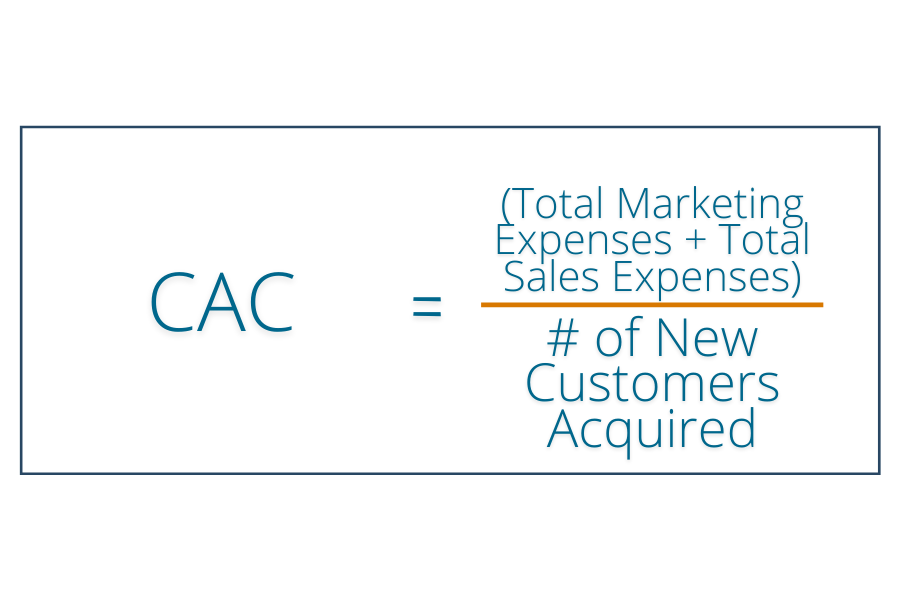

Customer Acquisition Costs

A KPI measuring the cost to your company for acquiring one customer called your CAC for short.. Although we are happy to crunch these numbers for you, you can learn more about how to lower customer acquisition cost here. The formula for CAC is:

EBITDA

To calculate your profit margin, one measure that is commonly used as a benchmark is earnings before interest, taxes, depreciation and amortization – or EBITDA:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Equity

The excess value of your business assets above the value of the business liabilities. If you have more liabilities than assets, then you have negative equity. Use our convenient debt-to-equity ratio calculator to determine your solvency.

Financial Statements

Typically the combination of the business income statement, balance sheet and statement of cash flows.

Gross Margin

A percentage value found from the difference between your revenue and COGS.

Gross Profit

Not to be confused with your gross margin, gross profit is a dollar amount found from your net sales minus your COGS.

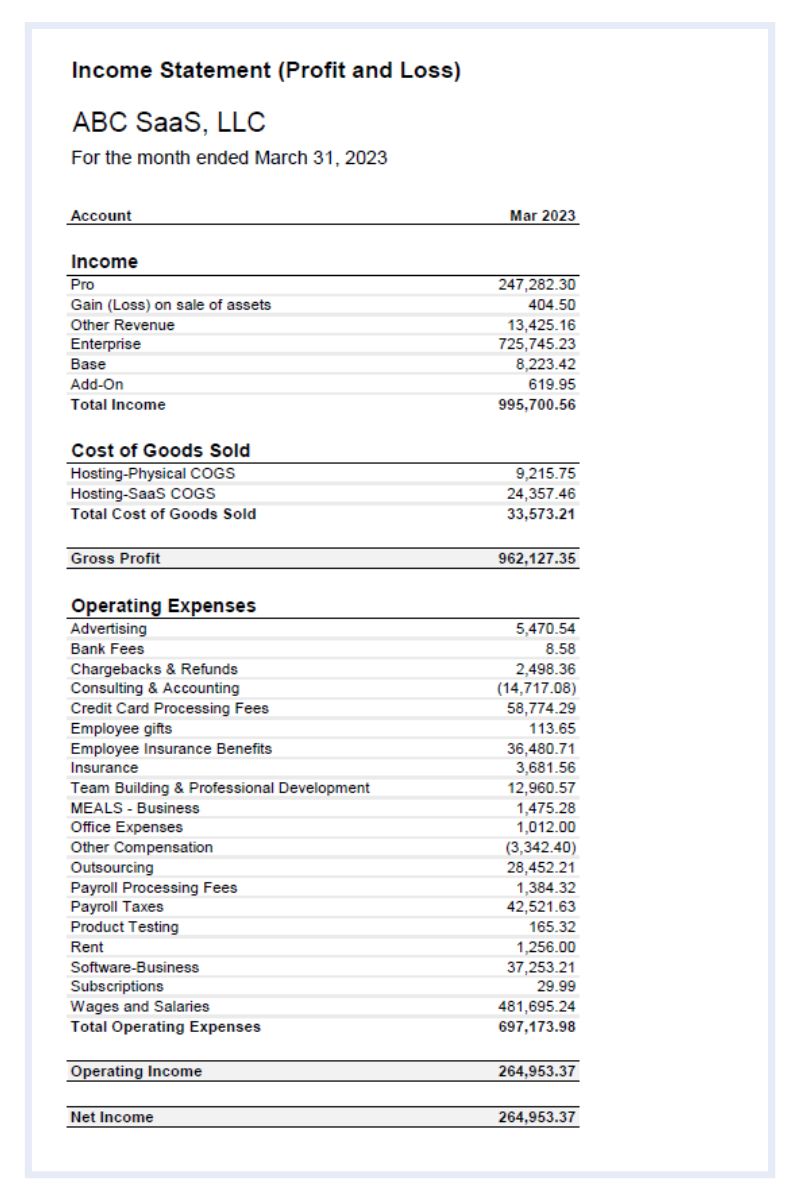

Income Statement

Sometimes referred to as the Profit & Loss (P&L) statement, your income statement reflects your financial performance over a certain period of time. It includes all revenue and expenses and any net profit or net loss over the same period of time.

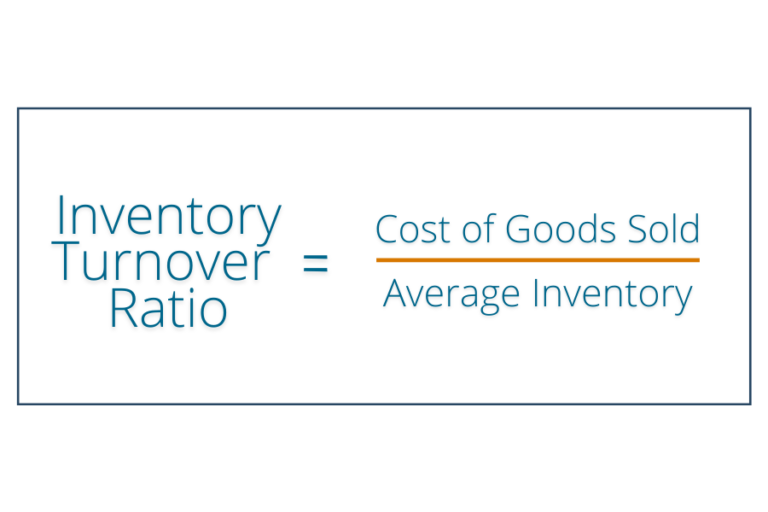

Inventory Turnover

The number of times inventory is sold within a specific time period. It is found from your COGS divided by the average inventory.

Liabilities

Any financial debt or obligation your company has. For example, accounts payable, mortgage or accrued expenses. We often see liabilities overlooked in startups and small- to medium-sized businesses that have yet to hire an outsourced CFO to look after their books! And, a reminder that if you are not correctly accounting for your liabilities, then your balance sheet is also incorrect. That spells a problem for investors or your stakeholders.

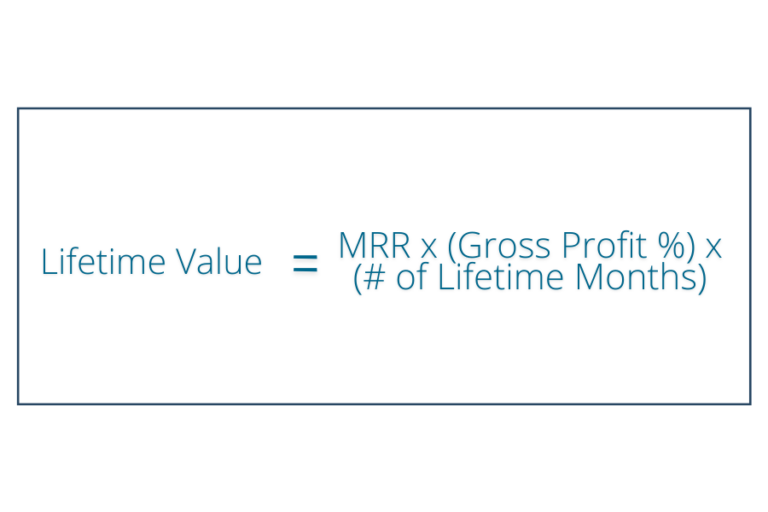

Lifetime Value

Lifetime Value (LTV) is the value given to the estimated profit gained from a customer during that same customer’s “lifetime” as your customer.

Net Cash Flow

The actual amount of cash made or lost within a specific period of time. Cash flow is an important valuation component to investors because you cannot fake it, unlike other metrics like price to earnings ratio, which can be manipulated.

Net Profit

The actual profit after all expenses during a specific period of time.

Operating Expenses

Expenses that your business incurs from its main operating activities that are reported on your income statement including the production of your goods or services, salaries, insurance and rent.

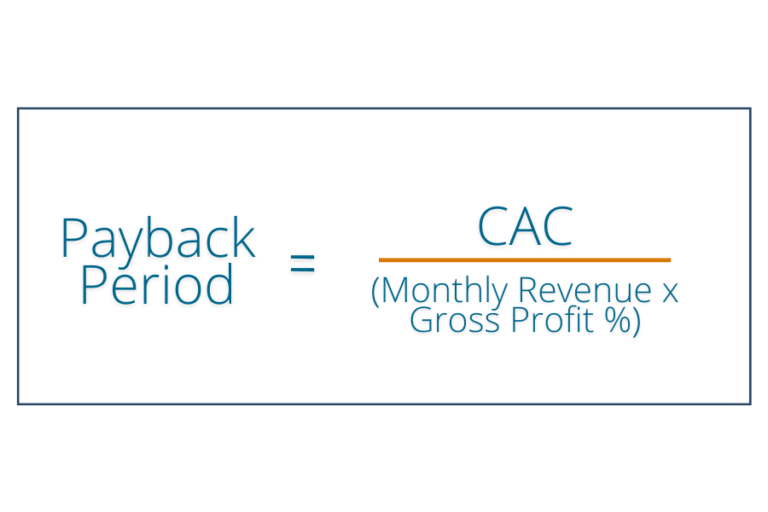

Payback Period

Your Payback Period (PBP) is the length of time required to earn back the cost of your investment. A shorter PBP means more profit cycles within a specific time period which means less capital needed to fund your growth!

Price to Earnings

Your price-to-earnings ratio is often (mistakenly) thought to be the most important ratio to focus on to impress your investors. While it is a ratio that determines your share price or stock relative to your earnings, remember that being profitable is not the same as being cash-flow positive.

Profit & Loss Statement (P&L)

Your income statement, commonly referred to as the P&L. Your profit and loss statement reflects your financial performance over a certain period of time. It includes all revenue and expenses and any net profit or net loss over the same period of time.

Recurring Revenue

Any portion of your revenue that is likely to continue or repeat. This is not relevant to all business models, of course, but it is good to be aware of it as it is the most predictable of models over time. So, even if all your revenue is not recurring, if you can find a way to have a portion of your earnings recur, then you are setting up your business in a very stable way. Recurring revenue is related to a few of our top customer success KPIs.

Return on Investment (ROI)

The benefit to a shareholder from investing in your business. A high ROI is good for your investors.

Revenue

Income from your business’ goods or services.

Statement of Cash Flow

Your statement of cash flow (SCF) or cash flow statement shows the business cash inflow and outflow over a specific period of time. It is typically reported on monthly.

Trial Balance

A statement or report that lists all income statement and balance sheet balances you hold (debits or credits), noting anything without a balance of zero. This should help catch any accounting errors if, for example, debits do not equal credits. (Which never happens right?!)

Working Capital

Your working capital ratio (also referred to as your current ratio) is a measure of your company’s liquidity. It measures if you have enough assets to cover short-term expenses like payroll and your accounts payable. Working Capital = Current Assets – Current Liabilities

This isn’t a complete list of accounting terms, of course; it simply includes the ones we deem the most important for high-growth entrepreneurs. We aren’t trying to write ourselves out of a job here, either, we just know that if you have a solid understanding of these basic accounting terms then we can do an even better job of getting your books ready to scale! Need help balancing your debits and credits? We’re here to help, check out our virtual accounting services to see what package might meet your needs today.