In this EBITDA guide, we’ll unravel what EBITDA is, why it’s a useful measure of business performance, how it compares to net income, free cash flow and the EBITDA pitfalls to avoid. Plus, we’ve included an EBITDA calculator to jumpstart your financial analysis today.

Understanding the financial health of your business is critical, whether you’re at the helm of an e-commerce company, a manufacturing firm, or any inventory-heavy enterprise. EBITDA is a KPI that can provide a clearer view of your company’s operational profitability without the distortion of accounting and financial decisions.

Jump to EBITDA Calculator

What is EBITDA

To calculate your profit margin, a frequently used measure is earnings before interest, taxes, depreciation and amortization – or EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It measures a company’s operating performance by focusing on the profitability from ongoing operations.

It’s most commonly used to compare businesses within the same industry. For example, a small business might earn $1,000,000 in annual revenue and have an EBITDA margin of 12%, while a larger company might earn $15,000,000 in annual revenue but have an EBITDA margin of 5%.

How to Calculate EBITDA

Start measuring your EBITDA using this formula:

EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization

Tips when using the EBITDA Calculator:

- Net Income: Found at the bottom of your income statement (P&L)

- Interest Expense: Make sure to only include your interest expense not your interest income. The idea is that you’re trying to understand the profits of your business if you don’t have any loans outstanding.

- Taxes: This is income taxes paid or accrued, but not sales taxes as the latter shouldn’t hit your income statement at all.

- Depreciation: Since depreciation is based on prior fixed assets you’ve purchased, it helps to add this back to understand how profitable your business is now without adding in this non-cash expense.

- Amortization: Amortization is similar to depreciation. It’s a non-cash expense that’s based on prior investments so it’s helpful to add this back to determine the current period profitability of the business.

Client onboarder, Vanessa Evanson points out that “when you calculate EBITDA it’s important to remember that not all tax is actually excluded. Sales tax paid on purchases and sales tax paid above what was collected from customers and payroll taxes would be considered. Really only income tax is excluded from EBITDA.”

Pros and Cons of EBITDA

EBITDA is a common benchmark, but it’s not without its pitfalls. As a non-GAAP KPI, it has its limitations and some important financial measures aren’t captured. Here are some of the pros and cons of EBITDA:

Pros of EBITDA

- Clarity: EBITDA is an easy measure of company health and profits, removing effects of financing, tax and accounting decisions.

- Benchmark KPI: Because, it’s used by so many, EBITDA is a good operational KPI to compare to earnings to industry peers.

- Important for lenders/investors: It’s often used in loan agreements as a measure of cash available to pay off debt. It’s also often used by investors to make investment decisions.

Cons of EBITDA

- Ignores cash flow: Because it does not include working capital and CapEx it only paints part of your financial picture.

- Partial measure: Related to the above, a good EBITDA can mask underlying company health issues, by painting an optimistic picture of profitability and cash flow.

- Non-GAAP: In the U.S., GAAP prohibits EBITDA on your income statement, therefore there is no standardized set of rules on how to calculate EBITDA.

You might be thinking, “Hold up! I see more pros than cons above.” BUT (and it’s a big but), by ignoring CapEx spends that depreciate to zero and income taxes, EBITDA should only be used in certain instances. Let’s break down some of the EBITDA pitfalls.

EBITDA vs Free Cash Flow

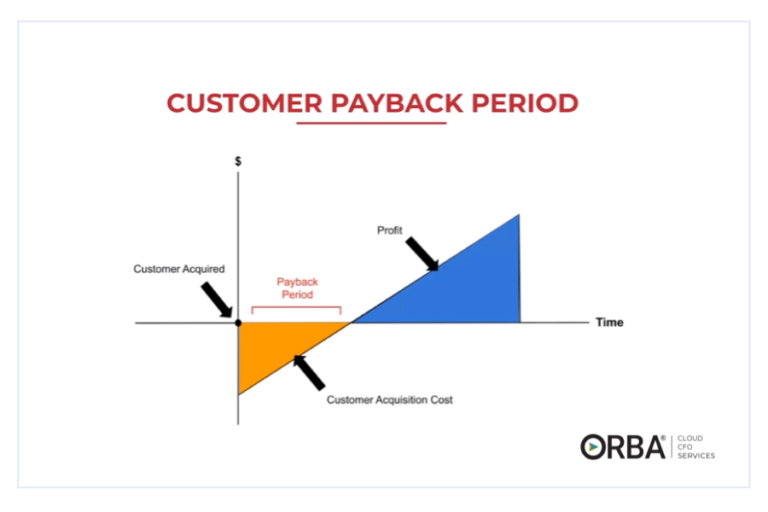

EBITDA should be avoided as a defining benchmark KPI for CapEx-intensive industries.

Why?

EBITDA hides costs in these industries by excluding depreciation, and amortization (D&A). Assets that depreciate to zero need to be replaced, which means…? Cash. Warren Buffett is famously quoted saying, “does management think the tooth fairy pays for capital expenditures?”

After adding back D&A and by ignoring income taxes (another one of the largest company expenses) , EBITDA can paint a more optimistic picture of profitability than your Free Cash Flow (FCF) would suggest. Your FCF is the surplus of money left after meeting any existing and new investments. Looking at FCF along with your balance sheet gives you valuable insights into long-term potential for growth.

While Free Cash Flow is a more volatile measure due to changes in working capital and CapEx spending, it is hard to manipulate when compared to EBITDA or Net Income. Ultimately, metrics like FCF offer a more holistic measure that include D&A and balance these items against your CapEx.

Related Read: Don’t forget your free cash flow

To calculate your FCF, start with your net income and add back your amortization and depreciation. Subtract your working capital (to do this, subtract your current liabilities from current assets). Then subtract any capital expenditure.

Free Cash Flow = Net Income + Depreciation & Amortization +/- Non-Cash Income And Expenses +/- Changes In Net Working Capital – Capital Expenditures

EBITDA vs Net Income

Unlike EBITDA, your net income, (also known as net earnings) includes taxes and interest— elements not related to core operations. Found on your P&L, net income is the positive result of a company’s revenues and profits minus its expenses and losses. A negative result is called a net loss.

Net Income = Revenue – COGS – Operating Expenses – Interest – Income Taxes

Net income, as a result is a more conservative measure of your company health because it includes more expenses.

When to use EBITDA?

Simplified measure. When comparing your performance to industry peers.

Tip: Avoid relying on EBITDA as your only measure of profitability. Instead, use with balance sheet review.

When to use Free Cash Flow?

While more complex, use FCF when you need a true company valuation, have a lot of CapEx or when planning an expansion.

Tip: A simplified FCF can be calculated using your cash flow statement.

When to use Net Income?

To get a more conservative measure of your company health and when you have minimal CapEx.

Remember: can be influenced by various accounting practices and non-cash items

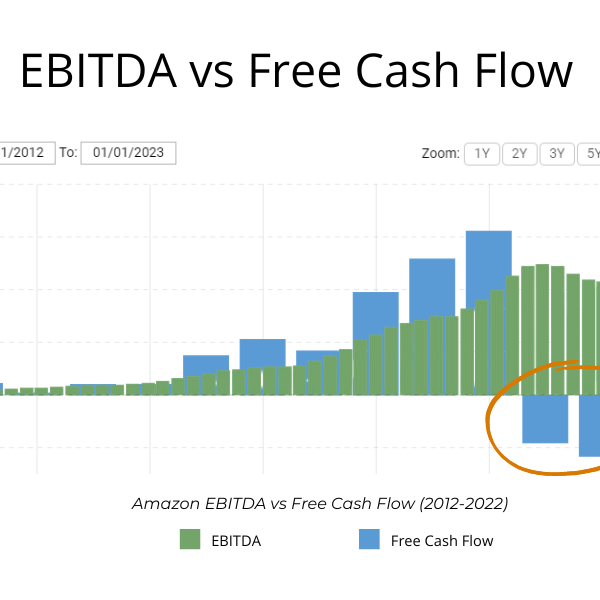

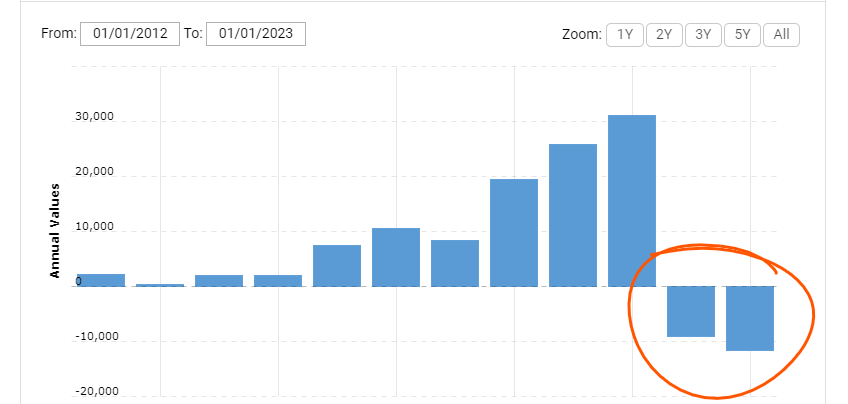

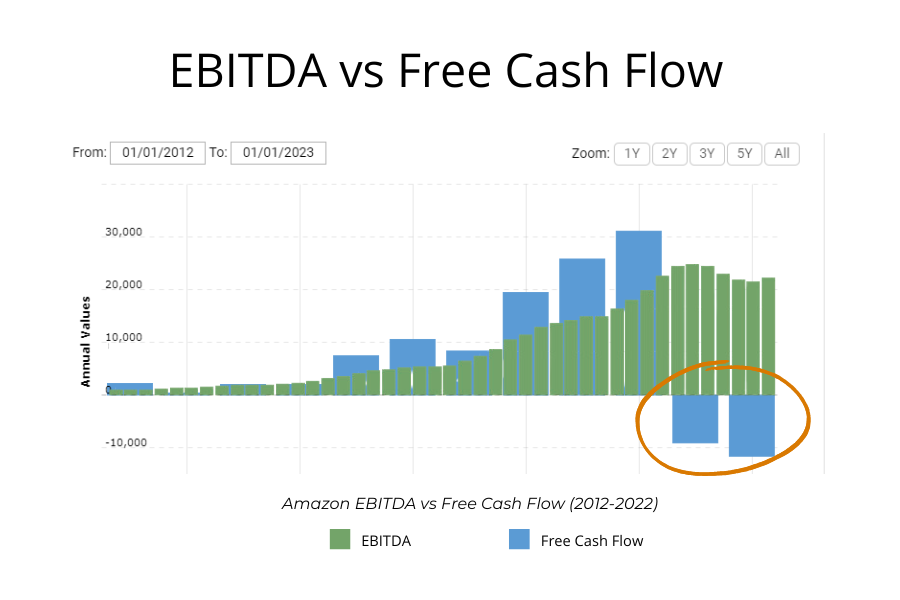

Here’s an example you might remember. In 2022, Amazon reported an annual EBITDA of $54.2B, which was a slight decrease from 2021 but still a 13% increase from 2020’s EBITDA. Impressive. And Amazon’s Free Cash Flow?

For the first time in almost a decade, Amazon reported a net loss of $-2.7 billion with an FCF of $-11.6B. So while their EBITDA looked positive, their FCF tells a different story.

Now, does that mean Amazon is going out of business? Uh, no. After paying down liabilities, big cost cuts, layoffs and their massive revenue growth in Q4 of 2023, that was all investors needed to see for stocks to bounce back. But the above does paint a more complete picture of their financial health in 2022 which some investors may heed as a warning. And ultimately serves as a good reminder of how EBITDA can hide other cash flow issues.

EBITDA problems with market demand

So what happens to EBITDA when market demand shifts?

If you’re in a position where you can’t control your COGS or other costs, you may not be able to meet demand and maintain your profit margins. And if you are able to lower prices you may see your EBITDA value decrease. Neither one is good for business.

This, is in part, why we recommend increasing prices strategically and monitoring your supply chain KPIs regularly. Through these audits you can flag the best places in your supply chain to negotiate contracts in order to maintain a strong EBITDA.

How to Improve EBITDA

Cloud CFO Benchmark: Because it’s used to compare earnings, your benchmark EBITDA will vary by industry, but a good rule of thumb is to aim for over 10.

So how can you do that? You can improve EBITDA by looking into these things:

- Operational Efficiency: Introduce methods for streamlining operations.

- Cost Reduction: Identify and control unnecessary expenditures.

- Revenue Growth Strategies: Aim for new product launch, expand into new markets.

There are some common mistakes we see business owners make when they’re trying to improve EBITDA:

EBITDA Mistakes

- Cutting costs by postponing new hires to keep profit margins looking better, thereby missing out on growth opportunities

- Holding on to inventory to try and maintain margins instead of selling it off

Cloud CFO Fix

- This is not sustainable. Nor is it helping you scale. Instead, reduce labor costs and hire in-house, train up, pay more and automate repeatable tasks

- Optimize with an inventory management system to reduce inventory costs. Remember, carrying costs are still cutting into your net income.

The Bottom Line

Remember, while EBITDA is one instrument gauging the operational health of a company, it doesn’t give the full financial picture. EBITDA has a specific case-use for comparing earnings for lenders or investors, but it’s important to remember that it ignores cash flow, D&A, and is not a GAAP measure.

It’s one tool of many in your financial toolbox, and we’re here to help you master it!