“The cash forecast is dead. Planning cycles have shifted from long-term to short-term and the financial operations we’ve run our companies on have dramatically changed.”

This was my recent conversation with Raman Chadha of the Junto Institute, which led us to this webinar topic. Watch the webinar here or read the summarized notes below to see the five different business models and how our clients are able to survive and thrive using a dynamic cash forecast.

Webinar Summary: The Cash Forecast Dead, Long Live the Cash Forecast

Hosted by the Junto Institute

- Cash is King

- What Business Model are You?

- How are Clients are Surviving and Thriving

• SaaS example

• Multi-Channel example

• Service Based example

• Marketplace example

• Real Estate and Investment example - The Cash Forecast is Dead

- The Dynamic Cash Forecast: Best Practices

Cash is King

First, cash is king. Every business needs cash. It doesn’t matter if you are a very small startup or a large company. Every business model, every industry, every size business needs cash.

Right now, everyone is feeling that cash pinch. Similarly to ten years ago, we are seeing businesses that were deemed too big to fail. Yet, they are receiving massive bailouts and are on the verge of shutting their doors permanently. J Crew and Virgin Australia have recently filed for bankruptcy. On the other end, main street businesses like dry cleaners, restaurants, travel agencies, etc. are closed or doing a very small percentage of the revenue they normally do. Mass layoffs are an inevitable reality due to lack of cash. It has never been more apparent that understanding cash flow is critical for your business.

It has also never been more apparent that having a dynamic cash forecast allows you to adjust quickly is essential to respond to crazy times like we are now experiencing. Even in normal times, if you are a high-growth business, you need something dynamic because your business is changing month-to-month. Cash is king and creating a battle plan (i.e., a forecast) to protect it is essential.

What Business Model are You?

There are five common business models. Many companies do not fit into just one model and are often a combination of two of the models. To clarify, when I say business model, I’m not meaning industry. If you are in the restaurant industry, for example, you will likely have a service-based model component and a product-based component. We are going a layer below industry to really think about the drivers of the business.

The five most common business models we see today:

This table shows one large, well-known example of each business model. We will be talking about more small to medium-size businesses and how they are managing in the current times. A few notes about the different models:

- SaaS (Subscription as a Service): Some service-based business models might also offer a flat monthly rate that would mirror something closer to a SaaS.

- Multi-Channel Product: Few consumer products companies these days are only using a single sales channel. Essentially, if you have inventory you are looking to move, you fall into this model.

- Service-Based: Like ORBA or the Junto Institute, a business that is offering services for a fee.

- Marketplace: A business bringing two sides together and taking a fee for facilitating that exchange.

- Real Estate and Investment: A model focused on sourcing capital and then redeploying it to get a return on that money, and then repaying its investor.

Most businesses fit into one of these models, but don’t get hung up if your company does not exactly fit into these buckets. You may have a foot in more than one business model.

Client Case Examples of Dynamic Cash Flow Forecast

Let’s take a look at a few examples of how some of our clients within each model are adjusting their focus to survive, thrive and manage their cash flow in the middle of this pandemic.

Situation

- Annual and longer contracts (one year+) with a long sales cycle and slower impact

- One of our clients in particular has a number of clients up for renewals for Q2

- Q2 renewals = high churn

- Uncertainty for future quarters

- Customers making downgrades

- Sales pipeline is frozen

Current Focus

- Giving more value with any Q2 renewals or allowing customers to defer the renewals and extending their clients’ terms to generate goodwill. The aim here is to avoid increasing customer acquisition cost (CAC) and the long sales cycle to re-sign them or acquire a new customer later.

- Offering moderate (15-20%) discount for full annual payments. This is appealing to any business that does have some cash on hand right now and is looking to secure savings wherever possible. They have cash and you need it. Offer larger discounts to small and medium-size business (SMB’s).

- Consider offering more value on the free tier if it prevents possible churn.

- For clients working with the C2FO platform, bid for an early-pay discount.

Key Takeaways: Avoid customer churn and a long sales cycle to acquire or re-sign customers later by offering more value, discounts or even a short-term free tier. By making it clear that this is a special offer only during these difficult financial times, it prevents you from harming your premium brand or value proposition.

Situation

- Wholesale channel has either been cut in half or frozen. No retailers are open; therefore, no wholesale channel sales.

- E-commerce direct-to-consumer (D2C) has exploded in many industries. One client has experienced a 600% increase in e-commerce sales.

Current Focus

- Decrease reliance on wholesale partners, and instead, build a brand with an end-buyer via social media. Building an online presence creates future leverage with wholesalers and allows for robust direct-to-customer approach.

- Discount stale inventory.

Key Takeaways: Build online brand presence for both D2C sales and to build future leverage with wholesalers. Selling inventory below cost can free up much needed cash. Cash is more important than profit right now.

Situation

- Painful financial climate can lead businesses and individuals to change their service providers.

- Many non-profit organizations can fit into this model as well. One of our clients is currently seeing delays in funding from regular donors.

Current Focus

- Utilize retained team to: Improve your internal processes, surprise and delight your current clients, and invest in learning initiatives.

- Our non-profit example above created a special interest fund given the COVID-19 situation and has raised $500,000 from other donors for that fund to serve the same demographic that they would normally serve.

Key Takeaways: Focus on what you can control to improve and strengthen your team and relationships for the post-pandemic recovery. Gain market share by focusing on content for inbound leads.

Situation

- A client that functions as an online health exchange (connecting hospitals with needed equipment) has seen very high growth due to a massive uptake in users. They pivoted to help provide PPE during this critical time.

Current Focus

- First focus is on helping as many people as possible.

- Lowered exchange fees to help those in need and generate cash.

- High volume to offset discounts.

- Acquiring new users to drive future, sustained growth.

Key Takeaways: Build top of mind awareness for normal market needs. Offering discounts can serve two purposes: increase the volume of sales and can generate goodwill for a post-pandemic market.

Situation

- One client, a student housing developer and property manager, has seen massive vacancies and delayed rents.

Current Focus

- The client was well capitalized, so they are searching for investment deals.

- They have a good track record and can now use that to find deals (not predatory; they are simply buying up investments from people that need the cash.)

Key Takeaways: Use the current environment to double-down and increase market share. Work with lenders on loan deferrals to conserve cash.

The Cash Forecast is Dead

Okay, so maybe it’s not actually dead. But, the old way of forecasting certainly is. The traditional approach is an annual exercise full of guesses, often developed by executives based on high-level goals and summarized data. Typically, it is static and rigid, and not very useful in the current climate.

Best Practices: The Dynamic Cash Forecast

Best practices for a cash forecast and, more specifically, a dynamic approach:

How often should I prepare a cash forecast?

- Traditional approach: Annually

- Dynamic approach: Monthly, weekly, daily

- Monthly is our default, but in current circumstances, we have moved to weekly.

- We have seen other clients adjust from forecasting quarterly and monthly to weekly and daily.

- Check-in with your accounts payable and receivable, looking at today and tomorrow.

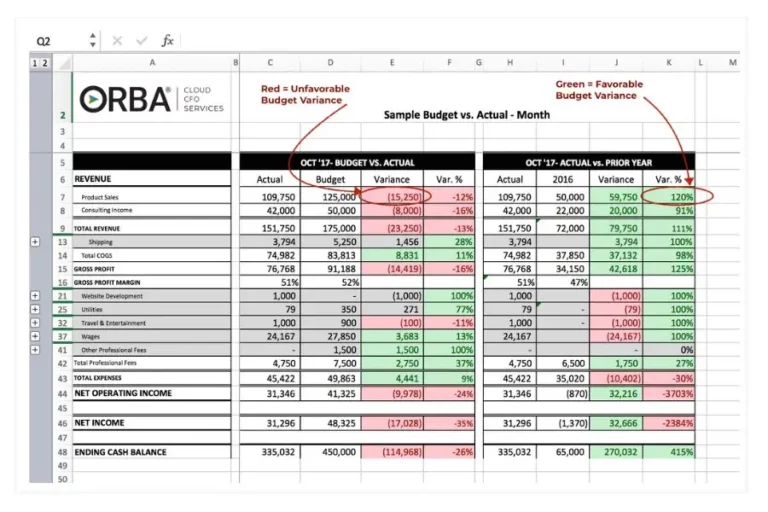

- Ignore the P&L and instead, focus on the balance sheet. The P&L, as per GAAP, can be a very complicated report that does not follow your cash flow.

Who should create the cash forecast?

- Traditional approach: Executives using summarized data

- Dynamic approach: Tactical managers, including the controller, using transactional details

- In these circumstances, you need to be checking in with your accounts receivable for a better understanding how each item is affected to really understand your cash flow. Your data from last year is irrelevant.

How do you keep a cash forecast useful and current?

- Traditional approach: Create with unlinked data using one scenario

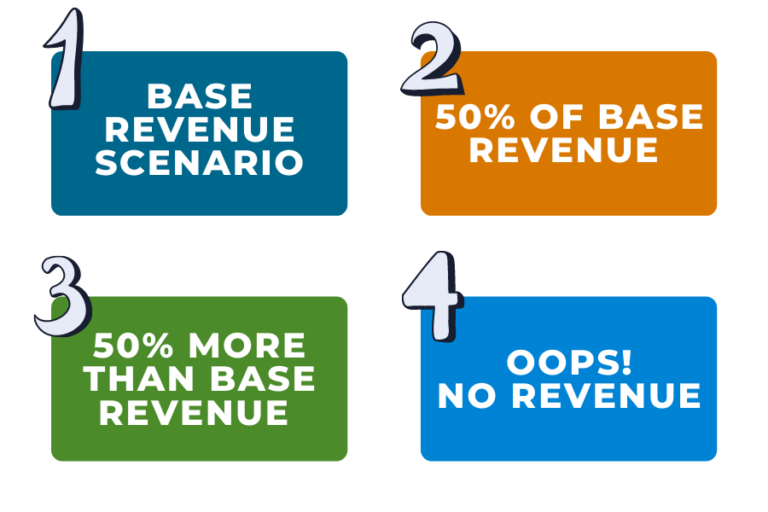

- Dynamic approach:

- Link timing of in/out flows.

- Planning for the three A’s scenarios: Average, anemic (your worst case) and awesome (your best case).

- Know your revenue/expense ratios.

In our health exchange example, they understood their ratios and knew that for every 20 new clients, they needed to hire one more customer service rep. So, knowing your ratios can help you prepare for both worst and best case scenarios without waiting on historic financials.

Are There Programs that Can Automate Cash Forecasts?

Yes, there are applications that output a pretty chart after entering a few quick inputs. But what you get out of that chart is outweighed by an opportunity to dig in and analyze your cash and forecasts. This is an invaluable part of the process to learn more about how your business is operating. We still choose to use Excel because it can be customized to each clients’ needs and gives us an opportunity to talk with our clients and garner a better understanding of the story that the numbers are telling us about their business.

For now, in the fast-moving COVID-19 landscape, the traditional cash forecast is dead. Essentially useless. Opt for dynamic, short-term cash forecasts made with transactional detail so that your business too can survive and thrive.

Need help with cash flow forecasts? Contact us to get started with our outsourced accountants today!