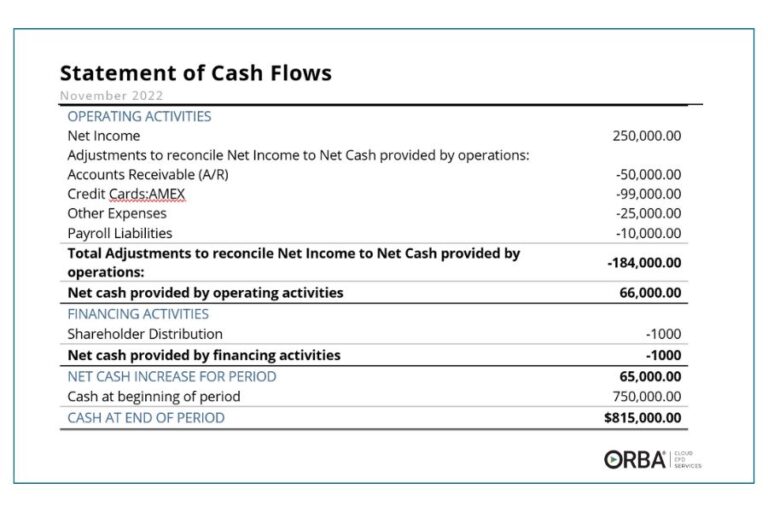

It’s not uncommon, because of inventory needs, we often see entrepreneurs hoping to increase cash flow for their ecommerce businesses. Cash flow is the root of every business. You need to have a steady stream of capital to keep the door open (or, in the case of an ecommerce business, to keep the site running). A positive cash flow means you have enough money to cover your overhead costs and invest back into the business.

Monitoring your cash flow regularly highlights any issues, and can help you correct any unexpected negative cash flow as soon as it rears its ugly head. So, how do you increase cash for your ecommerce business?

How to Increase Cash Flow for eCommerce Businesses

1. Keep your bookkeeping up to date

Having accurate and reliable bookkeeping records is step one to increase cash flow for an eCommerce business. Using a proactive outsourced bookkeeping service can mean the difference between knowing your cash runway and running through cash. In other words, can you cover your expenses each month? Or is it an ongoing concern?

2. Optimize your bill payments

Have your finance team streamline your AP process and organize your expenses to optimize your cash flow. Pay close attention to the payment terms your suppliers offer. Since most suppliers expect payment within a set term, you don’t always have to pay them right away.

Cloud CFO Tip: Choose periods of increased revenue to pay your most significant expenses. Then, take advantage of early payment discounts in times when revenue is high.

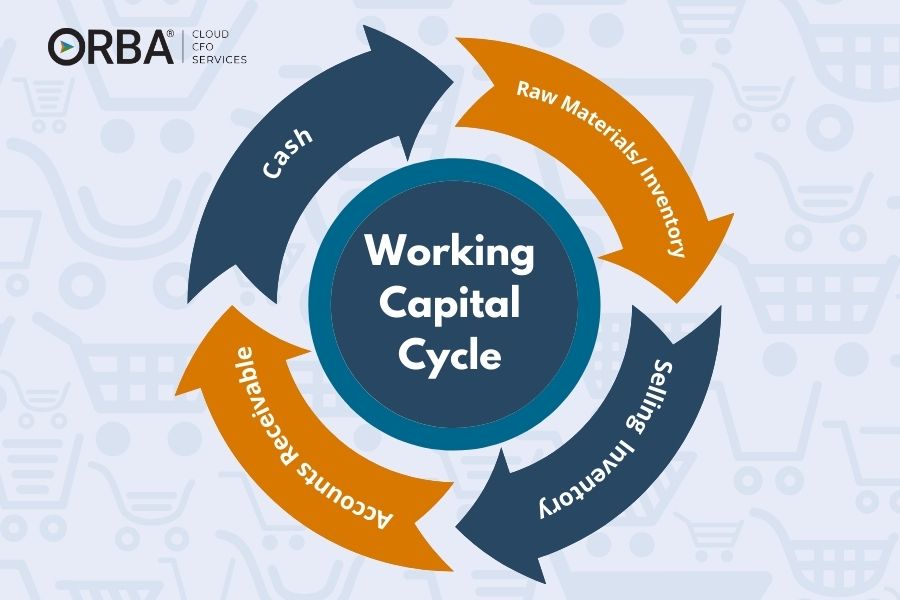

3. Shorten your working capital cycle

The less time that there is between paying for an expense and receiving money from a customer, the better your cash flow.

To increase cash flow for ecommerce businesses, it’s extremely advisable to shorten your working capital cycle. This refers to the cycle your cash makes. Spend cash > Buy Inventory > Sell Inventory > Get cash back from customer. While ecommerce businesses don’t have invoicing or the accounts receivable you might find in professional services, they do likely have a delay between buying product and selling it. Although the length of your cycle can vary depending on what you sell, the most efficient companies would have a cash-to-cash cycle of less than one month,

How to shorten your working capital cycle

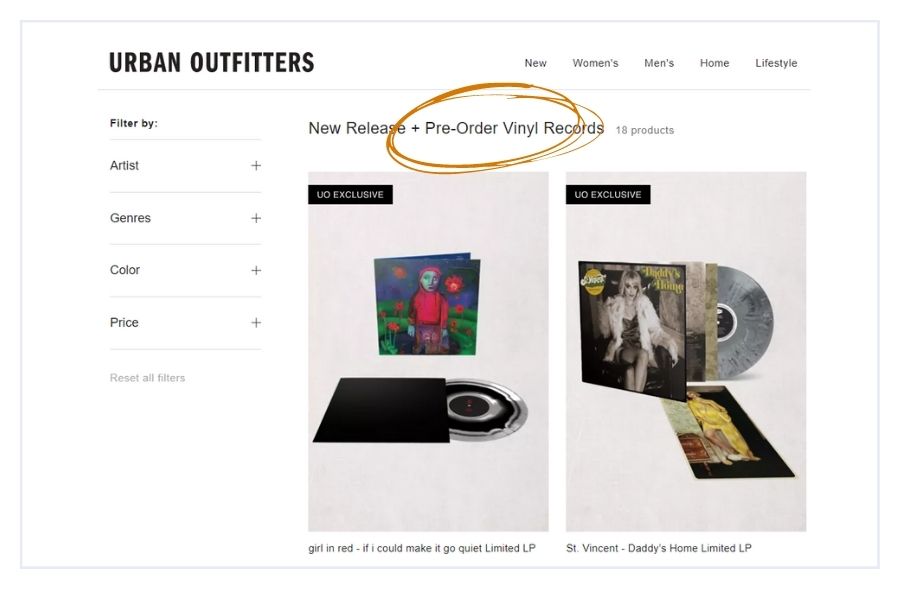

Ecommerce businesses should try to reduce inventory costs by minimizing carrying costs and by building a better inventory forecast. Stock only those items that you are confident will sell quickly or use sales strategies that will shorten your working capital cycle. One way to do this is using presales and pre-orders.

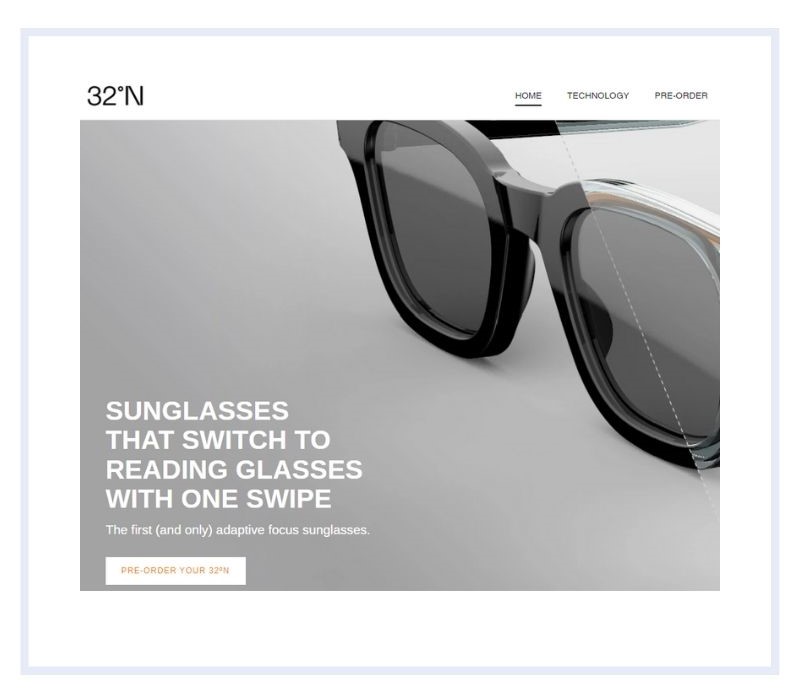

For example, you might consider creating pre-orders for a new product at a good discount. The customers pay for it up front, so even before you pay your supplier, you’re collecting cash from your customer. While you may be selling it for a lower profit margin, you don’t have to worry about the sales and marketing costs to get the product into your customers’ hands. As a result, you still make a good margin overall plus you get cash up front. And bonus, it’s a targeted way to introduce a new product or product line into your customer-base. Some benefits using the pre-order system:

- You get a closer look at customer interests

- You avoid overproduction

- It increases your overall value proposition

This strategy has been used on a grander scale for NFTs but it’s a very effective way to increase cash flow for everyone from the small boutique to the more-established ecommerce shops.

Additionally, using the presales strategy above, you actually have what is called a negative working capital cycle which is awesome from a financial perspective. A negative working capital cycle means the faster you grow, the more cash business generates.

4. Make it easy for your customers to pay you

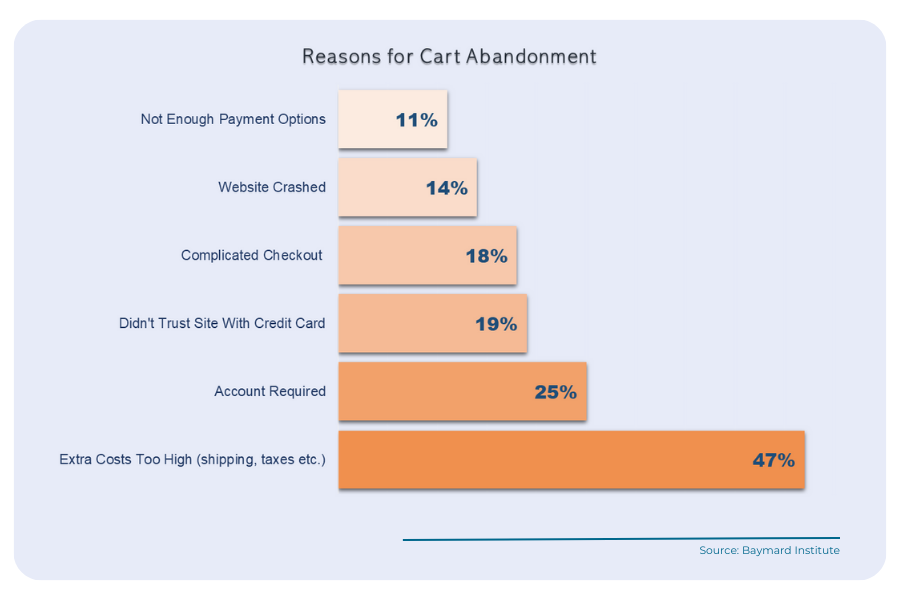

This probably sounds obvious, but so many businesses unknowingly make this mistake. If the payment process isn’t easy for your customers, chances are they will take their business elsewhere. Plan to accept all types of payment methods and credit cards; the more options a customer has, the better your chances of making a sale. Include additional ways to pay like Apple Pay or PayPal will further increase sales and cash flow for ecommerce businesses.

Don’t forget that for the holiday season, buy now, pay later options can be very attractive to your consumer. Big Cartel points out that the fewer clicks, the more likely your customer is to complete the purchase.

You can also automate the billing process. If you have a B2C ecommerce platform, make sure that your customers can easily checkout on your website and pay online. If you are seeing a high cart abandonment rate, take a closer look at the payment platform you’re using.

5. Increase your average order value

Finding ways to increase your order value will ultimately increase your sales and improve your cash flow. For example, you could try offering free shipping over a certain purchase amount. Other strategies include upselling using recommended purchases “you may like” sidebars or “others also purchased…” widgets.

Besides improving cash flow, increasing average order value is also a good way to increase LTV.

6. Create a cash flow forecast and refer to it often

Using a dynamic cash flow forecast like those included in our outsourced controller services, is important to plan ahead. You can identify potential shortages in cash balances ahead of time. Then you’re able to set aside surpluses to cushion slower months and prepare for seasonality changes.

Increasing cash flow for your eCommerce business can mean the difference between success and failure. The better your cash flow and forecasting the better able you will be to deal with any fluctuations in sales that may come your way. One of the best ways to increase cash flow visibility is to have reliable and accurate bookkeeping records at all times.

Is it time for you to hire ecommerce accounting services? We can help. Get in touch to learn more.