A common question we get asked: what does a fractional CFO do?

So, you’re in need of some financial guidance but don’t want to break the bank? Cue the fractional CFO – the experienced financial expert who operates outside of your company structure to provide strategic, fiscal, and operational guidance. An outsourced CFO should be the full package – a strong financial background and leadership skills included. Whether you call them a Virtual CFO, Part-time CFO, or Outsourced CFO, they all offer the same solution – complete strategic guidance at a fraction of the cost of a full-time CFO.

Genius, right?

What does a fractional CFO do?

As the highest ranking financial professional in the organization, a fractional CFO’s responsibilities include:

Optimizing Cash Flow

- Tracking revenue from sales, investments, interest along with cash flow analysis.

- Determining how to maximize liquidity (think working capital and cash conversion)

- Monitoring profitability while ensuring it doesn’t have a negative effect on customer service

“To have a full-time CFO, we didn’t think that we could attract the right caliber of talent to be able to do that, being that we’re a small business. So this is the absolutely right fit for us right now. [Kim]’s helping us really understand our cash flow. We’ve set a big revenue goal this year, and we want to make sure that we are on track to meet that.

I feel like we have an additional member of the team that has given me back my focus so I can help grow the business, I can help service the clients,” Wilson says. “If we’re working with these big clients, we need to also be just as big and fortified. So by partnering with ORBA, that’s one more way to fortify our services and our offerings.”

Lindsay Wilson, Ink Factory

Short and Long-term Financial Planning

- Preparing for expansion or an exit is a common reason why fast-growing companies seek to gain financial insight with our fractional CFO services

- Helping prepare for fundraising

Financial Modelling & Financial Analysis

- Scenario planning and forecasting

- Searching for areas of financial strength and weakness in the company.

- Analyzing what investments had the best and worst ROI

- Offering modelling for both stakeholders and lenders

Regulatory Compliance

- Managing the relationship between day-to-day financials and your tax accountant or auditor

Why choose a fractional CFO?

The #1 benefit of a fractional CFO, according to our clients, is that they gain a strategic partner who both allows them to focus on core operations and offers insight into profitability. Here is what a fractional CFO can do for your business:

A fractional CFO can make data-backed decisions

An outsourced CFO or fractional CFO services can offer your business data-backed advice using financial reports and forecasting tools. And they can offer it without the bias that may come along with entrepreneurs that are emotionally-tied to their business investment.

What financial data can a fractional CFO offer?

Ideally, a fractional CFO can report on the following:

- Operations and inventory management

- Supply chain KPIs

- Cash on hand and cash forecasting

- Accounts receivable

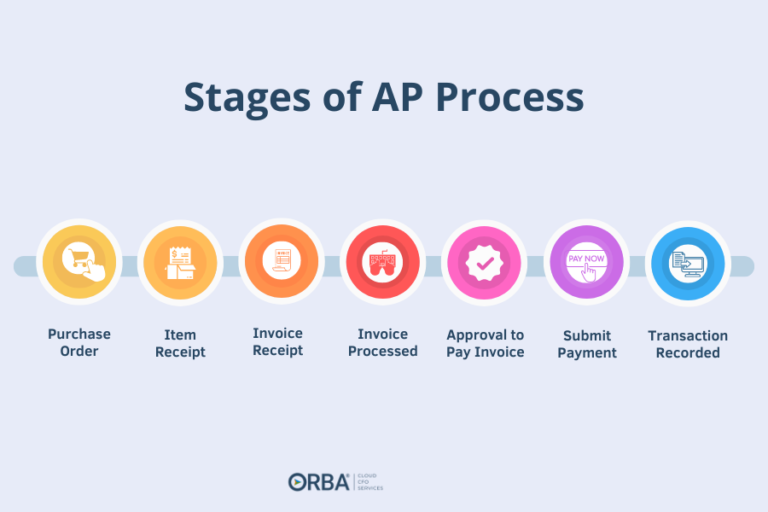

- Accounts payable

- And more

Fractional CFOs usually come armed with cross-industry experience and can offer insight that you might not otherwise gain from an in-house hire.

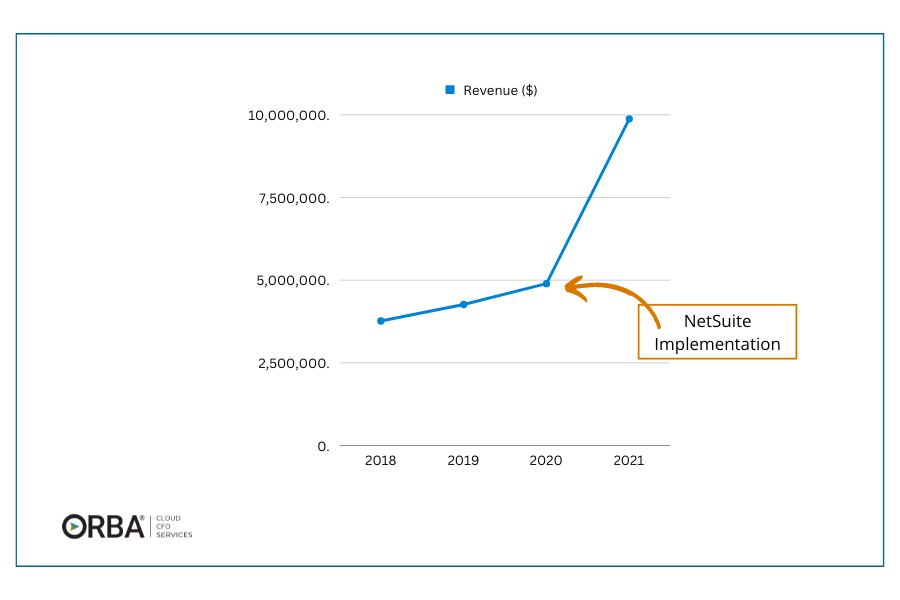

In addition, a solid fractional CFO will use sophisticated software tools to generate financial reports and explore “what if” scenarios.For example, when we introduced and implemented NetSuite to one of our clients, we were able to use it to better track customer channel profitability. The result? Their net profit jumped by a whopping 120%!

A fractional CFO helps make strategic business decisions

A fractional CFO is more than a high-level accountant or glorified controller. Every company makes important decisions on a daily basis. Some are straightforward and have only short-term consequences. Others are strategic and can make or break your profits for years to come. Unfortunately, these crucial decisions can be clouded by the biases and assumptions of individual executives. That’s when you need a rockstar fractional CFO to come to the rescue. Here are some business planning areas where a fractional CFO can be a valuable strategic player.

Corporate Expansion

Expanding your product lines or entering new markets may seem daunting and costly. From securing additional funding to navigating new regulations and tax laws, it can be a complex process. However, with the help of a fractional CFO, you can evaluate the costs and benefits of your expansion plan, and uncover hidden risks and considerations. Additionally, your outsourced CFO may also be able to uncover credits and benefits, such as grants and tax incentives, that you may have overlooked.

Initial public offering (IPO)

In the lead up to going public, it’s crucial to have a convincing investment thesis that makes investors eager to pour their funds into your company. With a fractional CFO’s guidance, you can pinpoint the right investors to target, provide the necessary financial information, and craft a message that resonates with them. Additionally, a CFO can offer up financial projections and oversee financial management during the IPO transition.

Construction, relocation or capital projects

A fractional CFO’s expertise can prove invaluable when it comes to deciphering the true expenses involved in capital projects like constructing new facilities or relocations. With their ability to forecast costs, including both construction and long-term maintenance, they can help identify the most cost-effective methods to sell or dispose of unnecessary facilities. Executives without a financial background may not anticipate hidden costs like employee turnover, but a CFO can take these factors into account and offer sound recommendations.

Acquisitions, mergers and exit strategies

The CFO’s involvement is paramount throughout the deal planning process. Should the plan progress, your fractional CFO plays a crucial role in conducting due diligence, financial modeling and forecasting, facilitating business transition, and much more. Ultimately, the CFO is best positioned to decide whether the proposal is feasible and advantageous.

What is a fractional CFO salary?

The average salary of a full-time CFO in the United States is $415,000. When you hire ORBA Cloud CFO’s fractional CFO services the pricing starts at $4,000 per month for $300 per hour on an ad-hoc basis. That means you could see up to a 90% savings depending on how complex your financial requirements are.

Why is the difference so dramatic? The reality for many businesses averaging $5-$50 million in revenue is that most need strategic financial insight 10% of the time. What they need the rest of time is someone to look after the weekly accounting needs and the financial reporting.

A fractional CFO on their own may only offer the strategy piece, but is not willing to roll up their sleeves and do as much of the review or day-to-day bookkeeping. The flip side of this is an outsourced bookkeeping service that might cover the day-to-day, but cannot offer the strategic analysis. So, having just enough of each of those levels is something attractive and unique.

The Bottom Line

If your needs aren’t overly complex and your finance plan is costing you more than 2% of your revenue, ask yourself why? Outsourcing a fractional CFO may be the answer.