A new year, a fresh start. Isn’t that right? Not always, but it does serve as a nice reminder to check in with a few must-do items as a business owner or entrepreneur. This 10-point business checklist will help you kick off 2025 right.

A Quick Small Business Checklist:

1). Look for ways to streamline operations and workflows

If we’ve learned anything in the last three years, it’s that the most successful businesses are those that can act nimbly when things (like the market) suddenly change. Cloud tools can help automate and streamline reporting and many other business operations. More than ever, business owners can access all kinds of operational data in real-time. And there’s nothing more nimble than that. A couple of the cloud tools we lean on:

For team communication time-tracking and workflow processes:

- Microsoft Teams

- Know Your Team

- Teamwork

For client accounting:

- QuickBooks

- Xero

- NetSuite

- BILL

Related Read: NetSuite vs QuickBooks: A side-by-side comparison

For CRM and Marketing:

- HubSpot

- Canva

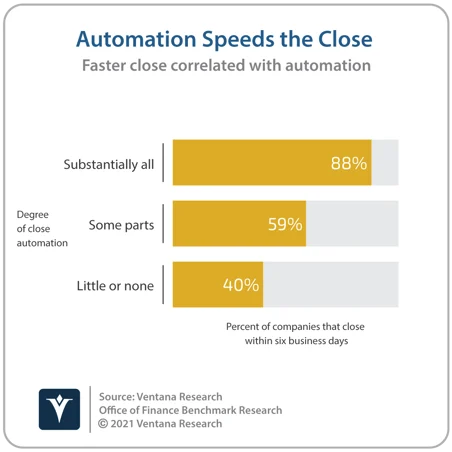

Automation helps in three big ways: it minimizes manual entry-errors, saves time and offers more visibility into important data that can drive your decision-making. Ventana research even found that the more a company automated their month-end close, the faster the turnaround.

2). Update your business plan

The new year is normally a great time to sit down with your business plan and reassess. If you’ve introduced new products or services, had changes in structure or leadership or changed your target market, these are all signs it’s time to update your business plan.

Cloud CFO Tip: We have redefined our target market a few times over the course of 13 years. Segment your customers with the highest churn and compare them to those with the greatest lifetime value (LTV). Say sayonara to the segment churning quickly and adjust your market to target the customers with the best LTV.

Take the time to think strategically and look into changes since the last time you updated it.

A business plan should include:

- A company or brand narrative

- Your goals and their metrics to measure your success

- Products or services and be sure to define your value proposition

- Financial projections (be sure to avoid these common mistakes with financial projections)

- A buyer persona and your market position

First time drafting a business plan? If you’re willing to give up your name and email, Hubspot has an easy-to-use ecommerce business plan template that can simplify the process for you.

3). Check in with your budget regularly

This is something I say often. Your budget is your stake in the ground. The reason you want to check in with your budget regularly is not because there won’t be budget variances, it is to drive regular strategic discussion with your team. There are so many reasons to create a budget and yet I often see small businesses operating without one.

Related Read: Budgeting and Forecasting Guide for Business Owners

4). Review monthly reporting… monthly

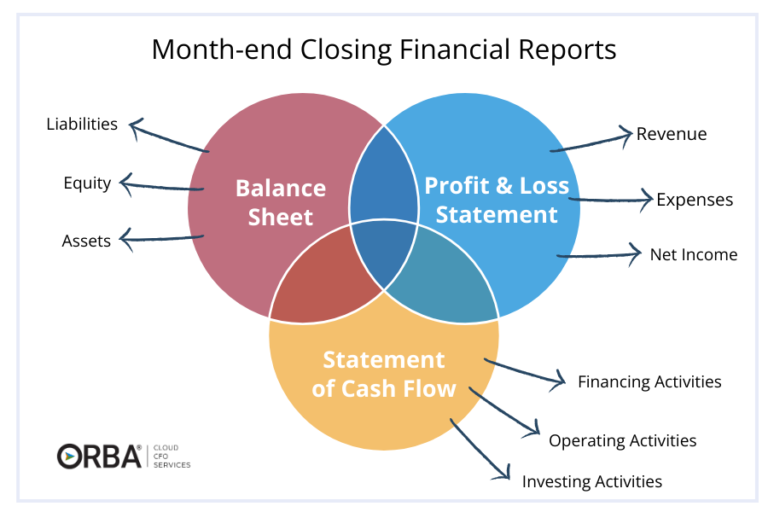

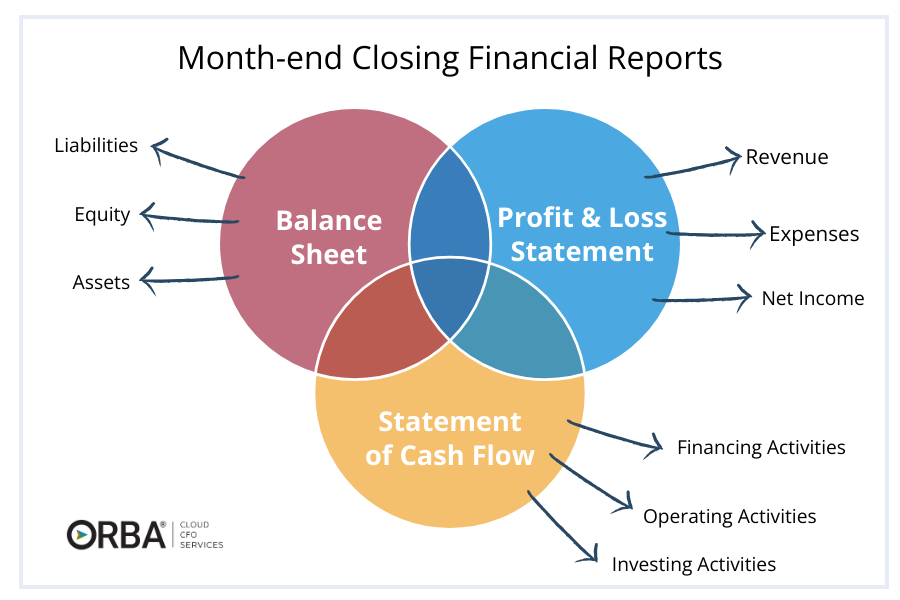

This coincides with number 3, review your monthly reporting…. monthly. Groundbreaking stuff, I know. The three financial reports: your P&L, balance sheet and cash flow statement are the pillars of your financial health. And so many of your most important financial health indicators are sourced from these three reports. It’s easy to fall behind if bookkeeping isn’t kept up to date. But if you’re only ever looking at financial reports from 6 months ago, it’s like driving a car only looking in the rearview mirror.

5). Find outsourcing opportunities

Spend less time on things like figuring out QuickBooks and more time on business development and leadership. Outsourced bookkeeping, marketing or IT are some of the easiest ways to step back from the in-office tasks to focus on growing your business instead.

Related Read: Benefits of outsourcing staff: Advice from 30 CXOs

6). Refresh your website

If we’ve learned anything by providing accounting services for a number of ecommerce companies, it’s that the clients who refresh their website regularly perform better.

Baymard is reporting an average cart abandonment rate of over 70%! Optimizing your website is one of our recommended ways to lower your customer acquisition cost. Things like easy-to-use, concise forms, having A/B landing pages and ensuring your site is mobile-friendly are all ways to increase conversions. Less abandoned carts = more converted customers and ultimately a better cash flow.

7). Lean on your network

In my experience one of the best ways to increase our leads is to tap into our network. This can look like a number of different things:

- writing a guest post for a partner service

- hosting a webinar with a thought leader from your network

- being a guest on a cross-industry podcast

- asking for testimonials

- being interviewed for content

- looking for referrals

8). Make customer service a priority

Focus on increasing your LTV by making your customer service a priority. Remember it’s always cheaper for your business to keep an existing customer than to acquire a new one. Get a handle on your net promoter score (NPS) and other customer success KPIs by running surveys to understand how you could do better.

Net Promoter Score (NPS) measures how likely customers are to recommend your business to a friend or colleague on a scale from 0 through 10.

- Those who rate a company a 9 or 10 are “promoters.”

- Those who give a rating of 7 or 8 are “passives.”

- Anyone who gives a rating of 0-6 is a “detractor.”

Net Promoter Score = % of surveyed customers who are “promoters” – % of surveyed customers who are “detractors”

Applying metrics that matter to your mission will almost always yield better customer service and better LTV in the long run. Another customer-centric metric to pay attention to is your churn rate. If it’s high, that’s a telltale sign you need to focus on your customer service.

Churn rate analyzes how often customers discontinue their usage of your product or service within a specific timeframe.

Are a quarter of your customers abandoning your service within a year, or do the majority continue to utilize it for an extended period of five years? It is important to assess whether this churn rate aligns with the expectations of your industry or business model. A high churn rate may indicate underlying issues that need to be addressed. Here’s a simplified version of the formula:

Churn Rate = Lost Customers/Starting Number of Customers x 100

For example, if your business had 1,500 customers at the start of the quarter and 1150 by the end, you’d apply the above formula as follows for a 23% churn rate:

350 (number of customers lost) / 1,500 (total customers at the start of the quarter) = 0.23

9). Remember that company culture is your foundation

Offering the best customer service becomes challenging if you’re experiencing high turnover. After years of competitive labor markets and the Great Resignation, company culture is as important as ever. So by beginning with your foundation, which really boils down to your culture, you can increase employee retention and ultimately that will carry through your customer journey.

Related Read: 4 Strategies to Increase Employee Retention

10). Find balance

Prevent burnout by focusing on your long-term goals. Promote work-life balance and flexibility throughout your organization and it will reflect back to you.

Need help dialing in the financial to-dos on this small business checklist? Get in touch to learn more about our outsourced accounting services.