Our complete guide to understanding, creating and analyzing corporate budgets and forecasts.

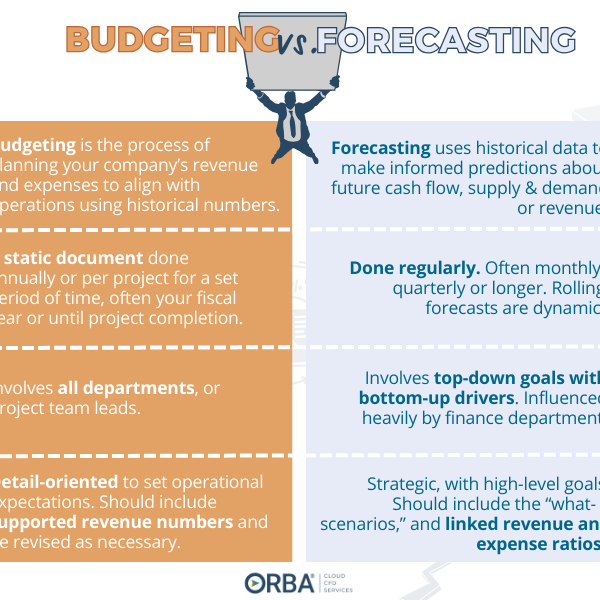

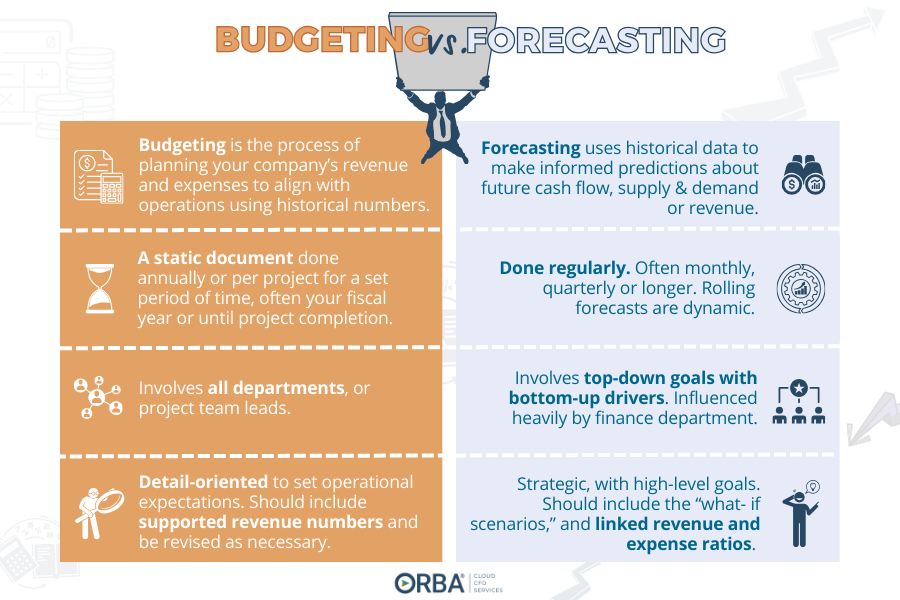

Budgeting vs. Forecasting: What is the difference?

Budgeting and forecasting are essential processes to maintain the financial health of your company. While they are inherently related, there is a difference between budgeting vs. forecasting.

What is budgeting?

Budgeting is the process of planning your company’s revenue and expenses for a period of time (normally your fiscal year) to align with operations. While all departments should be involved in budgeting and forecasting, your CFO should drive planning and discussion.

A typical corporate budget:

- Is normally an internal document used for strategic operations.

- Should take into consideration your financial reports including your P&L and balance sheet and cash flow statement.

- Identifies your key growth drivers and has the relevant team members assigned to them.

- Can take up to three months to complete (longer for some, though I wouldn’t advise it).

- Includes all departments with top-down goals, and bottom-up drivers

Types of Budgeting

There are different types of budgeting depending on your needs:

- Operating budget: includes expenses like rent, utilities and salaries and revenue like sales and interest

- Cash flow budget: Tracks cash inflows and outflows

- Project budget: Includes expenses for a specific project, like a product launch

- Capital budget: Plans for expenses related to a capital project like a new building or equipment. Read our step-by-step guide on how to create a CapEx budget.

- Zero-based budget: An intensive budgeting process from zero to explain all expenses (useful during cash flow risks like in the pandemic)

- Flexible budget: A budget that allows for on-the-go adjustments due to changes in sales or market for example

- Value proposition budget: A priority-based budget focused on creating what brings your customers the most value, and eliminating unrelated expenses.

Related Read: Pros of Zero-Based Budgeting

What is forecasting?

Forecasting involves using historical data to make informed predictions about cash flow, supply and demand or sales and revenue for example. It provides a deliberate time to strategize without getting sidetracked by your daily undertakings.

Goals are great, but only if you have a tangible strategy in place for how you plan to achieve them, e.g. “…here’s how we plan to hit x number of customers by this date.” You’re likely going to be wrong, but it’s not about having a perfect forecast, it’s about creating valuable conversation.

Begin by discussing your key assumptions based on the cash flow you expect then nail down your costs and drivers. Be clear about the purpose of the forecast and how it will be used.

Note, budgeting and forecasting for high growth companies should include three stages: creating, reviewing and revising.

Types of forecasting

There are a number of different types of forecasting you might undergo for your business:

- Cash flow forecasting

- Rolling forecasts

- Inventory forecasts

- Demand planning

Generally, most business owners, once they reach a certain size, will employ some version of cash flow forecast. Follow the steps we’ve outlined in this article for how to forecast your cash flow.

Benefits of Budgeting and Forecasting

Would you be surprised to learn that many small businesses still don’t have a budget? I know, right?! (If you’re one of them, it’s okay, our fractional CFO services are just the thing for you!)

Learn about our fractional CFO services

In fact, in 2020, Clutch reported that nearly half of of small business did not have a budget (mind you this was surveying only about 355 businesses). As the Entrepreneur’s CFO, I don’t find this shocking but it is concerning.

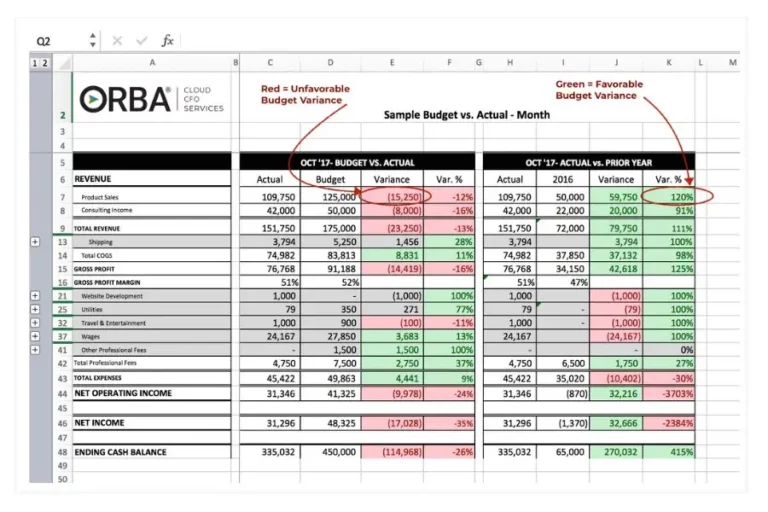

Of course, creating a budget is just the first step. Sticking to it is the real challenge. And while you want to avoid demoralizing your staff by introducing huge cost-cutting measures or constant expense review, tracking budget variances is a phenomenal way to highlight revenue gaps or unexpected cash burn.

So, this is why I always suggest SMBs that don’t have a budget, create one. And why I encourage regular analysis and forecasting.

It’s easy to draft a budget, walk away and ignore it until Q4; but, without review it’s hard to know if you’re on target. Better yet, it puts you at risk of overspending on growth and restricting cash flow. And we all know running out of cash spells death for most companies.

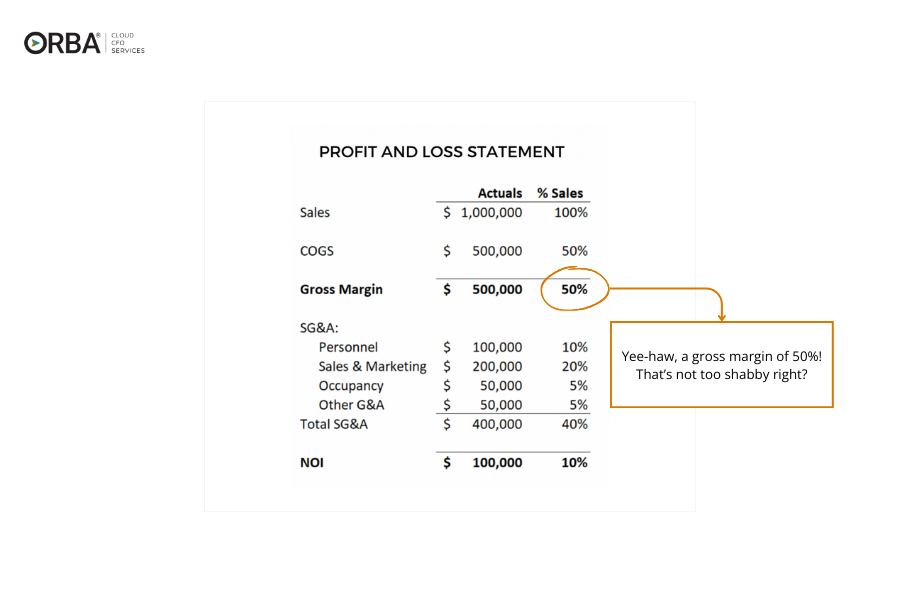

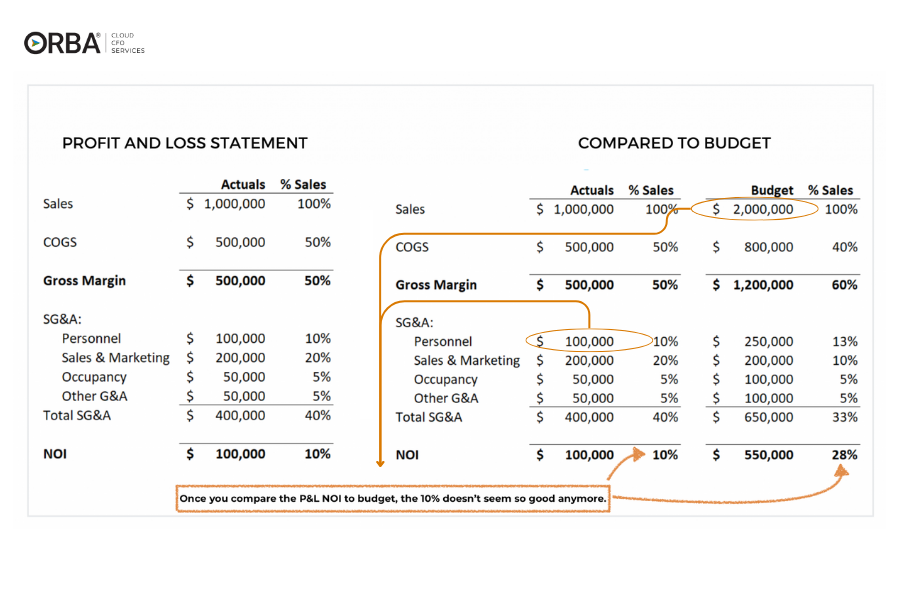

Let’s look at an example:

This P&L looks pretty good right? A gross margin of 50% and Net Operating Income (NOI) of 10%. Now what happens when we see it compared to budget?

Once we compare the P&L to their budget, we see that this company had 50% less revenue than they had budgeted for and then just cut personnel in order to show some net profit. Not cool bro. So you can see, that without checking in with your budget it’s easy to just motor along pretending everything is fine. But if your cash flow is causing you to make cuts along the way then that is the opposite of growth. Plus, without budgeting, you might never have realized that there’s some work to do in order to maintain your sales targets. More on this later..

Finally, regular budget review and forecasting gives your management team opportunity to sit down at regular intervals and strategize. And that is unquantifiable value.

The 6 most common benefits of regular budgeting and forecasting:

- Ensure that income aligns with expenses

- Prevent overspending

- Know how and when to allocate resources

- Reduce unnecessary costs

- Identify areas for improvement

- Plan ahead for emergencies

“Regular forecasting gives your management team opportunity to sit down at regular intervals and strategize. And that is unquantifiable value.”

7 Steps to Create a Budget

Check out our budget template and our 7 step-process to create a budget:

- Set realistic goals

- Choose the type of budget

- Project revenue

- Include fixed costs

- Estimate variable costs

- List CapEx spend plans

- Add in room for contingencies

3 Cloud CFO tips for budgeting:

Tip #1

Start with your statement of cash flows and work backwards through your P&L and balance sheet

Tip #2

Involve the relevant team members for more buy-in. Your sales team is more likely to hit the targets if they had a say in setting them.

(Remember those revenue gaps we caught above in that example? Here’s where a good budget can keep you on target).

Tip #3

Don’t be overwhelmed by details like office supplies, but do drilldown into your key growth drivers.

Best Practices for Financial Forecasting:

- Include all departments.

- Use top-down goals with bottom-up drivers.

- Be detailed about the line items that matter. Read this article on how detailed a business budget should be.

- Link your expenses to revenue and know your growth ratios, e.g. hire one person for every four new clients.

- Bridge your daily operations to your long-term financial goals, e.g. digital cost-per-action, daily prospect touches by your sales team, customer usage frequency etc.

- Aim for a dynamic approach to forecasting

Common Problems when Budgeting and Forecasting

3 common budgeting mistakes

- Too much detail.

- Not involving the team and relevant departments.

- Revenue plugs- or unsupported numbers used to build the budget that weren’t later revised.

3 common forecasting mistakes

- Picking an arbitrary percentage to grow revenue

- Failure to distinguish between fixed and variable costs

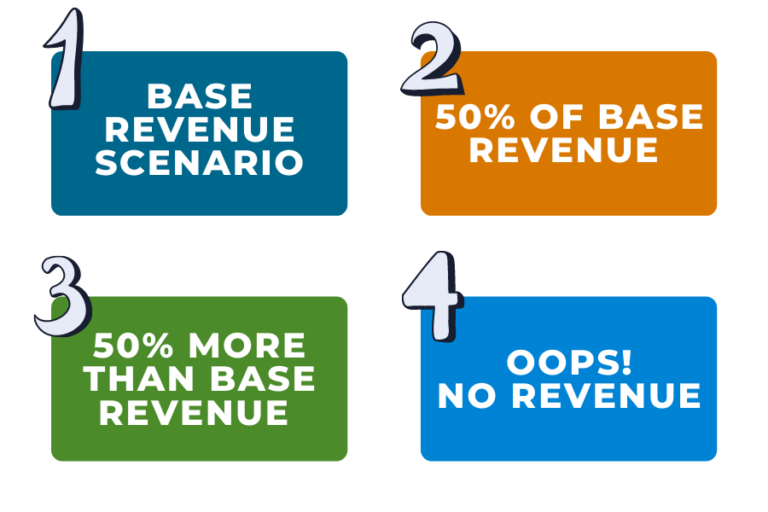

- You omit the “what-if” scenarios

Click over to our guide on troubleshooting common forecasting problems to get specific tips to troubleshoot each of these issues!

Controller, Nick Webb, says, “the biggest pitfall I see clients run into with budgeting is getting caught up with too much detail. Instead, focus on your biggest drivers like COGS. Avoid getting too much into the weeds of items likes office expenses. Even if you could do a better job of containing those expenses they aren’t going to make or break your business.

“Say you expect to spend 20% more on marketing, if it’s not the biggest driver of your expenses, don’t spend 6 hours budgeting every detail of the marketing department. Make an estimate and move on.”

Webb’s view on the importance of forecasting is equally practical:

“Clients want to know if they’re going to have a cash crunch to try to head it off and make sure they have the additional cash before payroll is due tomorrow. It comes down to cash flow. With better forecasting, clients can be more proactive and plan ahead instead of reacting and spending more cash than needed.”

For example, when we get new clients, there is often a need to dial in things like inventory forecasting thanks to arbitrary revenue plugs or inaccurate financial reporting. Here are some common problems you might experience with forecasting:

Flawed data that leads them expect a spike in demand when it isn’t necessarily there.

False assumptions based on broad guesswork with inventory numbers.

Lower profit margins due to needy resellers that take up more time than they’re worth.

How to improve inventory forecasting?

When it comes to inventory, forecasting becomes hugely important. Webb elaborates:

“Without accurate inventory forecasting clients are unable to order in advance, before they run out of product. If they forecast properly they can avoid paying for things like expedited shipping and have product when they need it.”

An accurate demand forecast means you know you will have enough product on hand. Additionally, you avoid wasting valuable warehouse space on products that move more slowly. Find your par level using the inventory forecasts offered in our ecommerce accounting services. Or, use the 7 tips below to build a better inventory forecast.

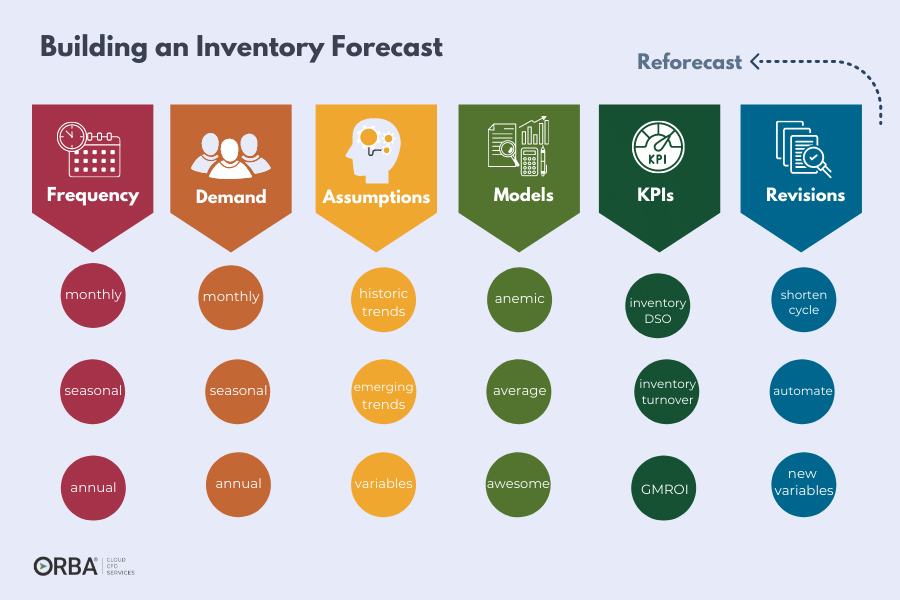

- Frequency: Set forecast period (monthly, seasonally or annually)

- Review Demand: Look at historical demand by period

- Assumptions: Include variables and emerging trends

- Models: Run multiple scenarios (the 3 A’s: anemic, average, awesome!)

- KPIs: track relevant inventory KPIs

- Revise: Do you need to shorten your cycle? Automate? Include new variables?

- Reforecast

Budgeting & Forecasting FAQs

Should I create a budget first, or should I forecast first?

This might be the chicken and egg question of accounting. Without some level of forecasting it’s hard to create a budget. And without a budget it’s hard to get a sense of how to forecast for the following year. Ultimately, beginning with a budget is a good foot forward when you’re just starting out.

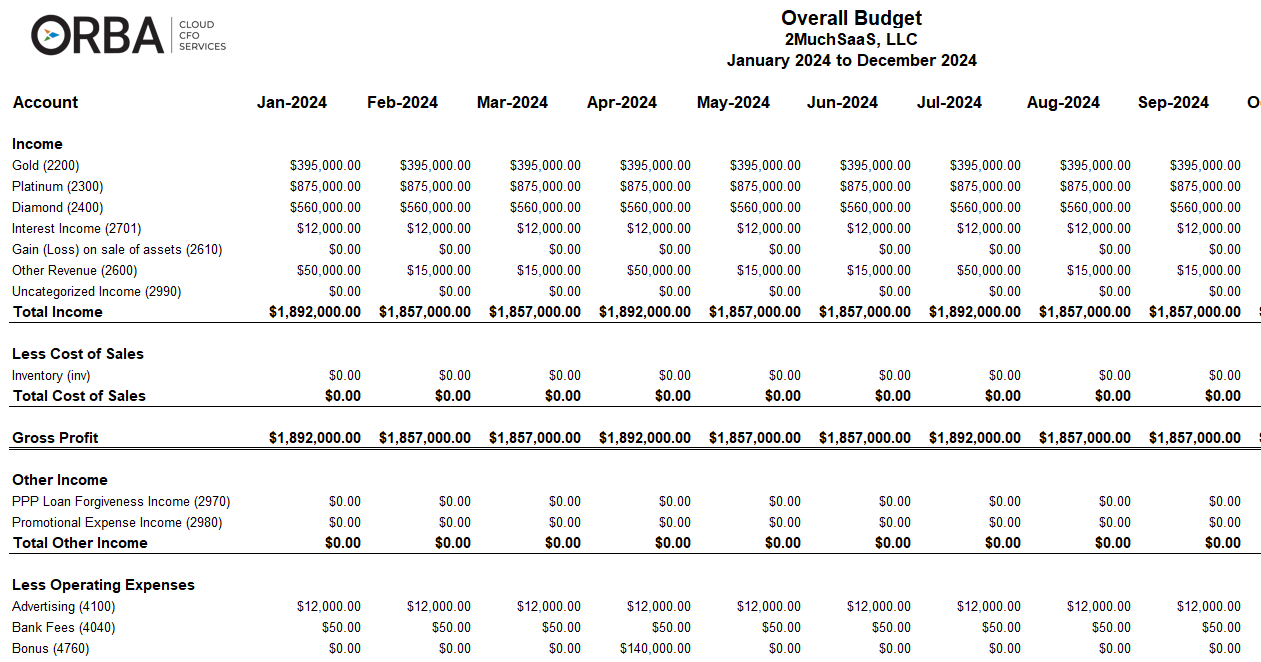

What is an example of a budget?

Check out our example budget here.

When should I start budgeting and forecasting?

Once your business is accruing regular revenue and expenses, we recommend creating a business budget. If you start small it will feel more manageable as you grow to add new line items. That said, it’s never too late to start. If you need help getting started our outsourced accounting services offer a comprehensive option to get you just the right amount of strategic insight without breaking the bank on a CXO salary.

My business is so small, why do I need a budget?

If you begin budgeting and forecasting when your business is still in its startup evolution, you stand a better chance of protecting your cash flow and getting the other benefits mentioned above. But more than anything, if you start small, it will be easier to add to, then starting when you’re already seeing unnecessary cash fly out the door. Plus, you will be in the habit of budget review and analysis, which becomes invaluable as you scale up.

How do I know when to adjust my budget and forecast?

We recommend creating a budget at least once per year. And as needed for smaller projects. As for forecasting, in our opinion the most successful companies employ rolling forecasts.

Disclaimer: You’re going to get things wrong, and miss your targets. That’s okay! It’s more important to plan and drive discussion about how to improve so you’re more likely to hit your targets next quarter.