The good, the bad, and the how-to for budget variance calculations and analysis. With examples!

What is budget variance?

Put plainly, budget variances are any difference between an actual amount and a planned or budgeted amount. This could refer to material or labor cost variance, or alternatively any sales price variance or any other budgeted line item variance. Variance analysis helps to uncover reasons behind any failure and to identify trends for success.

Common causes of budget variances:

- Inaccurate budgeting: If this is a recurring issue you might want to revise your budget, and get help with your budgeting process and forecasting as included in our outsourced CFO services.

- Changes in the market economy: Make plans to monitor and adjust your business plan. Maybe you simply missed a sale. Is it time to use a new sales channel? Perhaps you could improve your customer service?

- Client/Customer Acquisition: Related to market economy, increased competition often comes into play. To stay on budget, read more about how to lower customer acquisition costs (CAC) and learn about allowable CAC.

- Employee fraud: Unfortunately, it happens. And it goes without saying that employee or expense-related fraud is something you want to identify and prevent. Having the right workflows and policies will help mitigate your risk.

Related read: One way to reduce fraud is to clean up your AP process using three-way matching.

- Changes in costs: This might be expected if suppliers implement price hikes after you’ve set your budget. We’ve seen some of our most innovative clients tackle cost-cutting by going to their existing suppliers and competitors to negotiate a better price. Swapping fixed costs for variable costs can also be a strategic move to offset other expenses and cut costs as you grow. Learn more about how to cut business expenses. This is one of the reasons to ensure you understand your landed cost calculation.

- Improved operations: Maybe employee turnover has been at an all-time low. Or perhaps, your team has new, more efficient procedures. Whatever the reason for improved operations they’re as important to note and build on as inefficient operations. Whether good or bad, the reasons behind a variance are essential to your business operations.

Favorable vs. unfavorable budget variances.

Favorable Budget Variance

A favorable budget variance or positive variance is any actual amount differing from the budgeted amount that is good for the company. Meaning actual revenue that was more than expected, or actual expenses or costs that were less than expected.

Unfavorable Budget Variance

An unfavorable budget variance is, well, the opposite. Unfavorable budget variances are deviations from the budgeted amounts that have a negative effect on your company. Jump ahead to our budget vs actual example.

You might assume that a favorable variance deserves only a quick nod before moving on. But it’s important to understand what’s causing the variance(s) no matter whether they’re good or bad for your company. Budget variance analysis helps you uncover the drivers behind operations. And, if you’re noting unfavorable budget variances you want to determine the source ASAP.

Key Takeaways

- Budget variance is a difference between your planned spend and your actual spend.

- These variances could be favorable or unfavorable.

- There are may causes to budget variance like inaccurate budgeting, changes in market economy, or changes in cost.

- Because of this, it’s important to run budget variance analysis.

Budget variance analysis

You should perform actual vs. budget variance analysis on a quarterly basis at the very least. And in more tumultuous climates, more often than that. For example, in the wake of COVID-19 restrictions in Q2 of 2020, we increased our forecasting and analysis to a weekly basis. So, you have to find the right cadence for your company’s needs in response to the industry and market environment.

Example: In 2022, we switched one of our clients to weekly meetings with their outsourced CFO to track financial reporting like budget variances and customer channel profitability. Their revenue has jumped by 120%.

How to perform budget variance analysis

The most important thing most business owners want to know is whether they’re going to hit, miss or exceed the budgeted targets. So, how do you monitor these unexpected up and down swings?

First, determine what program or method you will use to track your budget variances. Our favorite approach for calculating accurate variance calculations is to use either dashboards or dynamic spreadsheets customized for your company.

Next, we’ll help you understand your budget variances using this formula: Actual Amount – Budgeted Amount

How to calculate budget variances

On a monthly or at least quarterly basis you should be asking yourself: “what did I think would happen when I pulled on these levers?” And, “what actually happened when I pulled on those levers?

Your budget vs. actual report is a great place to look for the answers.

Budget vs. actuals example

To calculate budget variances, use this simple formula: Actual Amount – Budgeted Amount

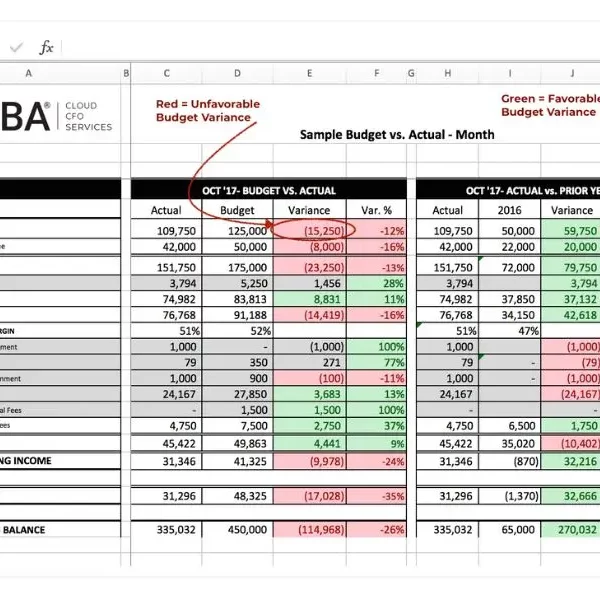

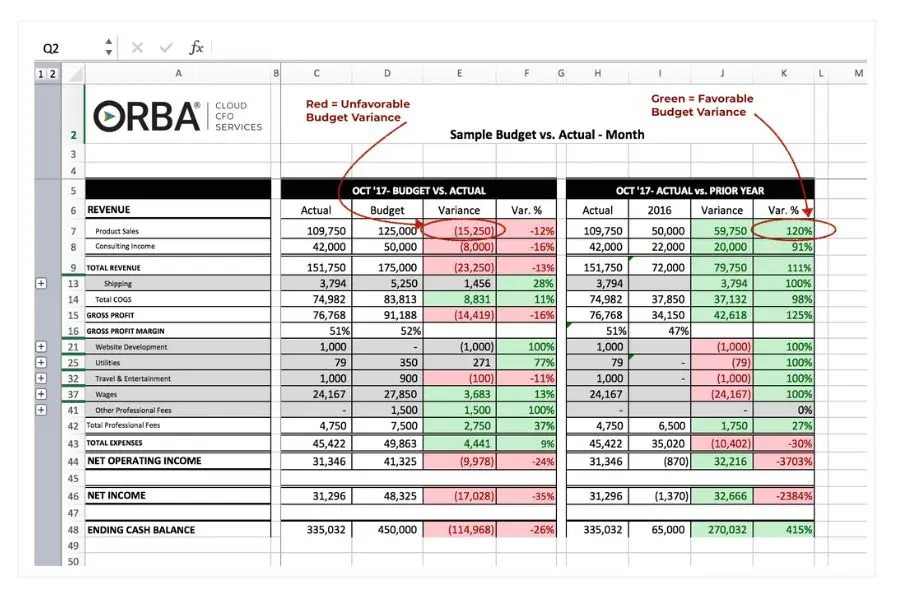

So, in the sample budget vs. actual below, under revenue, for product sales you would subtract the actual from budget, $109,750 – $125,000 = $ -15,250 or a negative variance compared to the predicted (or budgeted) sales.

Many entrepreneurs will be familiar with your classic budget to actual in monthly reporting. It helps to add some conditional formatting to quickly hone in on the most important areas to dissect.

In the example below, we’ve used red for unfavorable variances and green for favorable ones. We’ve built in formulas that show all unfavorable variances as negative numbers in both revenue, COGS and expenses.

To calculate the percentage budget variance, divide by the budgeted amount and multiply by 100.

The percentage variance formula in this example would be $15,250/$125,000 = 0.122 x 100 = 12.2% negative variance.

You can also easily set this up as a dynamic spreadsheet template or as a dashboard depending on your tech stack to automatically calculate your variances each month.

Cloud CFO Tip: Pay attention to sizeable budget variances in both percentage and dollar amounts.

Pay attention to sizeable variances in both dollar amounts and percentage. Say you spend $200 in office supplies compared to $100 budgeted. The variance percentage will be 100% off, but who cares? It’s a mere $100, compared to salaries which may be only 5% off but could mean tens of thousands of dollars over or under budget.

What’s more important, expense or revenue variances?

Especially in high-growth companies, executives tend to spend a lot of time budgeting and looking at expense variances. A good rule of thumb is to consider anything over 10% as unusually volatile for expenses.

Cloud CFO Tip: A good rule of thumb is to consider anything over 10% as unusually high for expenses.

Business owners are inclined to focus on expenses because you can control them. However, when you are halfway through the year, your revenue is always the most volatile number. You could be off by 50% because revenue is so choppy. While you can’t fully control revenue, you gain valuable insight by pinpointing the root cause of the revenue variance.

7 steps to build a budget

- Set Clear Objectives: Start by determining your business goals for the upcoming period, whether it’s growth, sustainability or profitability. Align your budget with these goals to ensure your financial resources are being used effectively.

- Choose the type:

- Surplus

- balanced if you’re a non-profit

- zero-based

- value proposition based

- Forecast revenue: Estimate sales, forecasting revenue and totaling up your income. Be sure to build in any related advertising and marketing costs you will need to help achieve these sales goals. Take into account seasonal trends and market conditions that could affect these figures.

- Cloud CFO Tip: avoid making these mistakes with your financial projections.

- List out your fixed costs: (e.g. rent), and semi-fixed costs of salaries. Most of your operating expenses will likely be in these two categories.

- Include variable expenses: (e.g. cost of goods sold). Also connect your expenses to your revenue using your growth ratios. For example, if you know you need to hire a new customer support person for every 10 customers you sign, then make sure your payroll costs increase along with any projected revenue increases.

- Plan for big spends and cash flow: Look ahead to any capital or one-time expenditures you need to make in the upcoming year. Don’t forget about the ever-important balance sheet, to help budget for future CapEx and inventory that dramatically affect your cash flow.

- Prepare for Contingencies: Always allocate some funds for unexpected costs or emergencies. This buffer will provide financial protection against those unforeseen budget variances and help maintain business stability.

Related Read: Follow along these budget process steps for small businesses. (With free budget template)

Budgeting revenue

Ideally when you are budgeting and forecasting revenue, you’re not just picking a number based on last year’s revenue. It’s important to be budgeting revenue based on a key driver. Don’t make the mistake with financial projections of picking some arbitrary percentage to grow your revenue by. Instead, consider how you acquire a customer, the conversion percentage and the length of your sales cycle. If you have recurring revenue you might consider your CAC into your projections and budget.

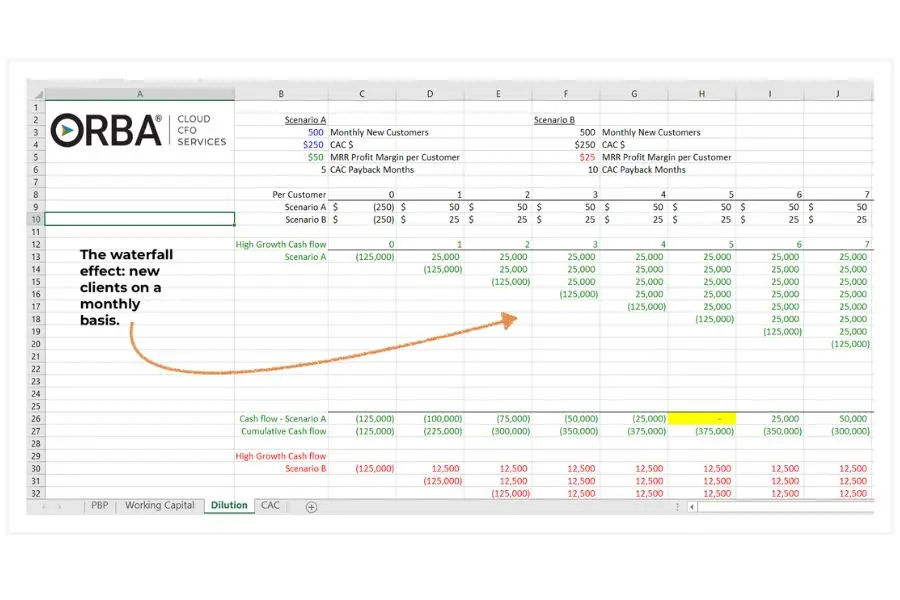

For example, say you offer a subscription service with a flat monthly fee. Budget in your monthly revenue estimates according to customer acquisition rates and your new monthly recurring revenue (MRR). Breaking down recurring revenue into its components helps to explain the factors that contribute to its change from one period to another.

Next, add in any anticipated new clients and the additional income each month in a sort of waterfall effect.

Reviewing revenue variance:

Your waterfall revenue should provide a month-by-month recap of your budget. Then you can quickly see any red flags or signs of revenue leakage. Did you have negative customer churn? Didn’t sign up as many new customers as anticipated? Or maybe the expected number of customers was correct but they were generating less income per month than forecasted. This budget variance analysis can provide useful insight into places you might need to dig in further like your customer lifetime value (LTV) for example. Follow these four steps to increase LTV.

For other clients, they can quickly see when the cost of one sales channel has inflated and whether they should focus their efforts on more economical channels instead to drive more revenue and ultimately profit.

A budget variance checklist:

| ✓ Review budget vs. actuals monthly |

| ✓ Identify significant variances (e.g., >10%) |

| ✓ Determine if variances are favorable or unfavorable |

| ✓ Investigate root causes of variances |

| ✓ Consult relevant departments for context |

| ✓ Assess impact on cash flow and operations |

| ✓ Document findings for each variance |

| ✓ Update forecasts based on variance trends |

| ✓ Adjust budgets if consistent patterns emerge |

| ✓ Report findings to leadership or stakeholders |

| ✓ Consider engaging CFO services for ongoing support |

Budget variances and forecasting

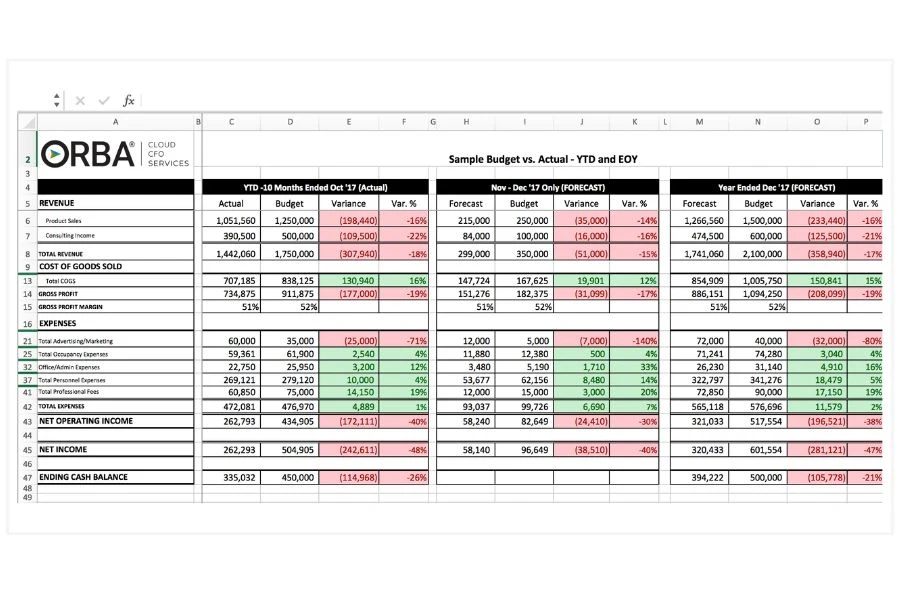

Budget variance analysis can create a more accurate forecast for year to date (YTD) and end of year (EOY). Your summary YTD shows how you have performed. It also shows how you will perform compared to budget for the remainder of the year. This becomes especially important in Q3 and Q4 as you prepare your budget for the following year.

For example, in the sample YTD budget vs. actual below, you can see that sales were overpredicted by 16%, and ultimately net income by 48%. That is a drastic difference and highlights exactly why it helps to monitor budget variance throughout the year to tighten up both the budget for next year and issues with sales.

The Bottom Line

The methodology behind budget variance analysis is not to make you feel like you are doing something wrong. Which, as an entrepreneur, it can sometimes feel like. (Speaking from experience here!)

Variance analysis provides insight into your operations but it also builds accountability. Understanding budget variances helps you know whether it’s time to scale your company or scale back.

Need help understanding your budget variances or the difference between a balance sheet vs P&L or cash flow forecasts? Hire an outsourced financial controller that is dedicated to helping businesses do just that. Contact us for help.