Preparing for year end finances shouldn’t only be about taxes. It’s a perfect time to prepare your business for the holiday rush and begin business planning to meet your financial goals. Follow our 8 tips to prepare your business for the holidays and then use our year end checklist to start off the new year with clean books.

How to Prepare for the 2023 Holiday Rush

You can expect shoppers will be feeling the pinch of inflation. As a result, you can expect to face similar challenges seen in the last two holiday seasons. Here are 7 tips to prepare your business for the 2023 holiday rush and what Tik Tok calls Q5:

1). Run holiday inventory demand planning reports

Run a historical report of September through November sales for your most popular holiday items. The year-over-year comparison will offer a good indicator of existing customers’ normal buying behavior. Expect customers to be shopping early and going after sales. Check in with all your most important supply chain KPIs to get your inventory management dashboards dialed now.

Related Read: 7 tips to get a better inventory forecast

2). Get in front of your cash conversion cycle.

Talk to your suppliers to know exactly what your DPO will be ahead of time.

Cloud CFO Tip: Check in with sellers like Amazon to understand any Q4 increases on things like FBA fees.

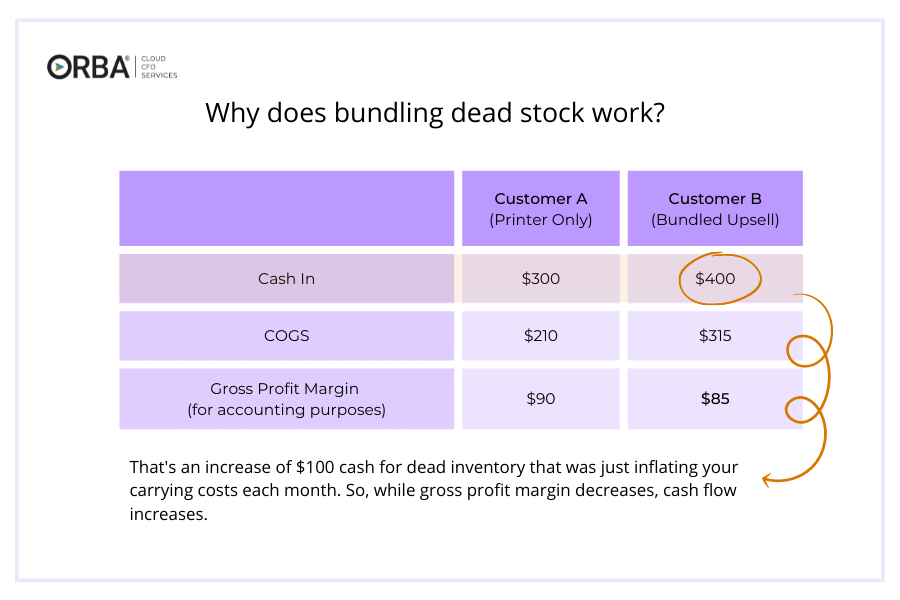

3). Do boost revenue by bundling slower sellers

Bundle slower selling items with some of your top sellers to get inventory moving and to increase sales. This can reduce carrying costs, and increase your average order value.

4). But don’t go too big with the discounts

Worried about recession? Raise your prices, and ditch the discounts. Okay, from a marketing perspective you may still wish to run certain holiday promos to drive revenue (see #3). And while it may seem counter-intuitive to increase your prices, last year you had both inflation and supply-chain issues to combat. This year, you’ve got recession knocking on your door. It makes sense to try to increase your cash flow as we head into continued market uncertainty in 2023.

5). Run specific promos to grow customer-base

If you sell consumables for example, this is a great time to offer promos in order to build your customer base. Even if you retain a third of them it’s likely grown your revenue MoM and covered any lost income from the discounted price. Plus it can take care of bundling dead stock mentioned in #3.

6). Call on 3PL providers

Consider having a 3PL provider on-call in case a warehouse becomes unusable, or just try it out and you might find it takes some of the weight off your warehouse operations.

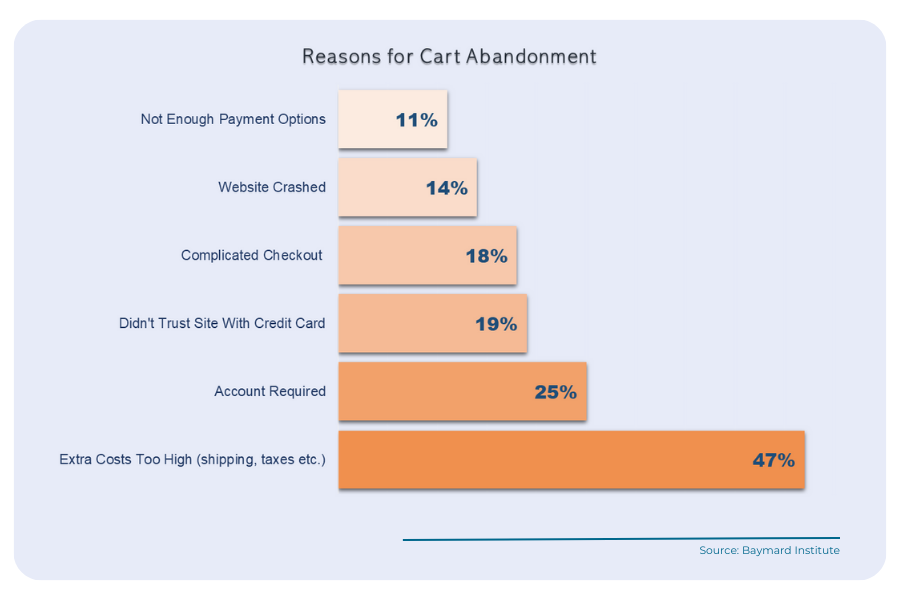

7). Reduce cart abandonment

Make it easy for customers to pay you to ensure the shortest DSO. Baymard reported that the average cart abandonment rate is over 70%. That leaves a lot of potential customers missing out on your great product.

Preparing for Q4 (and Q5)

Let’s call it the metric of the month: days to perform a year-end close.

The more you prepare now, the more likely you’ll shorten that metric, which in this case means moving forward with all your goals for Q1of 2024. (and that pesky Q5 only Tik Tok wants to talk about).

Below is a refresher of our year end checklist. Following along with this financial checklist will have your books squeaky clean for whatever business resolutions you’ve made for 2024.

A Business Owner’s Year End Checklist

Reporting

Every company should have a few key reports that they run for year-end:

- Run a profit and loss (P&L) report by business line to know exactly where you stand before the holiday season/year end;

- Use your balance sheet to get a snapshot of your assets and liabilities and compare to the prior year, looking for major or unexpected differences in account balances;

- Run aging reports for both accounts receivable and payable to know what will be booked for the prior year that might only show up the following month; and

- Review your financials in conjunction with any bank loan covenants to ensure you won’t violate any terms of your loan agreement.

Personnel

Don’t wait until the last minute to look after staff, payroll and personnel year-end loose ends:

- Decide if, and how much, employees will receive for year-end bonuses;

- Plan ahead for the payroll schedule over the holidays and for the first few weeks of the New Year;

- Tie up any expense reimbursement loose ends; and

- Make sure you know how much 401(k) match or safe harbor will be owed after year end.

Loose Ends and Review

Look after all the loose ends ahead of time so you are not scrambling at the last minute:

- Ensure your inventory is up to date ahead of the busy holiday season; for example, to know if you should offer a bundled sale like we mentioned above in order to reduce inventory costs or if you have sold-out items;

- Have your accounting team review your expenses to confirm everything is appropriately allocated. If you have any big expenses to pay for before the year end, it’s important your accountant knows. It can affect your taxes if you use a cash-basis accounting approach.

- Review your reconciliations and be sure they are up to date before the holiday crunch time;

- Ensure you have all the W-9 and contractor information you need so you or your accounting team are ready for processing 1099s; and

- Decide if the current year should be locked in your accounting system after December close to prevent changes to the prior year’s finances.

Budgeting and Goal-Setting

If you haven’t already, begin planning your budget for the following year:

- Perform your company health check and set your financial goals for the upcoming year

- Follow these essential budget process steps

- Take into account any budget variances you saw in the current year.

Tax Preparation

Check with your tax advisor to see what needs to be done to maximize savings and minimize your tax burden:

- Ask your tax advisor which additional reports you should have prepared ahead of time to make your tax season seamless;

- Donate money: It provides tax savings, and it will leave you feeling great;

- Learn which tax law changes might affect you; and

- Use up your end-of-the-year budgets; this can help maximize your deductions for the current tax year.

Don’t forget to prepare for next year too

Whenever you are preparing for year end, don’t forget to also prepare for the year ahead. Set up all the accounts, files and folders you will need for the new year, ahead of your first month end close. January is a busy month regardless so the more prepared you can be, the better.

Cloud CFO Tip: Last but not least, if you don’t have one already, start a “Questions/Year End List” that you can refer back to at this time every year.

Sounds like a lot to look after? Get in touch for more help preparing your business for year end.