Your accountant should be an integral part of your strategic plan to scale. In fact, I think it’s a glaring sign to switch accountants if they’re not a tactical partner in most aspects of growth.

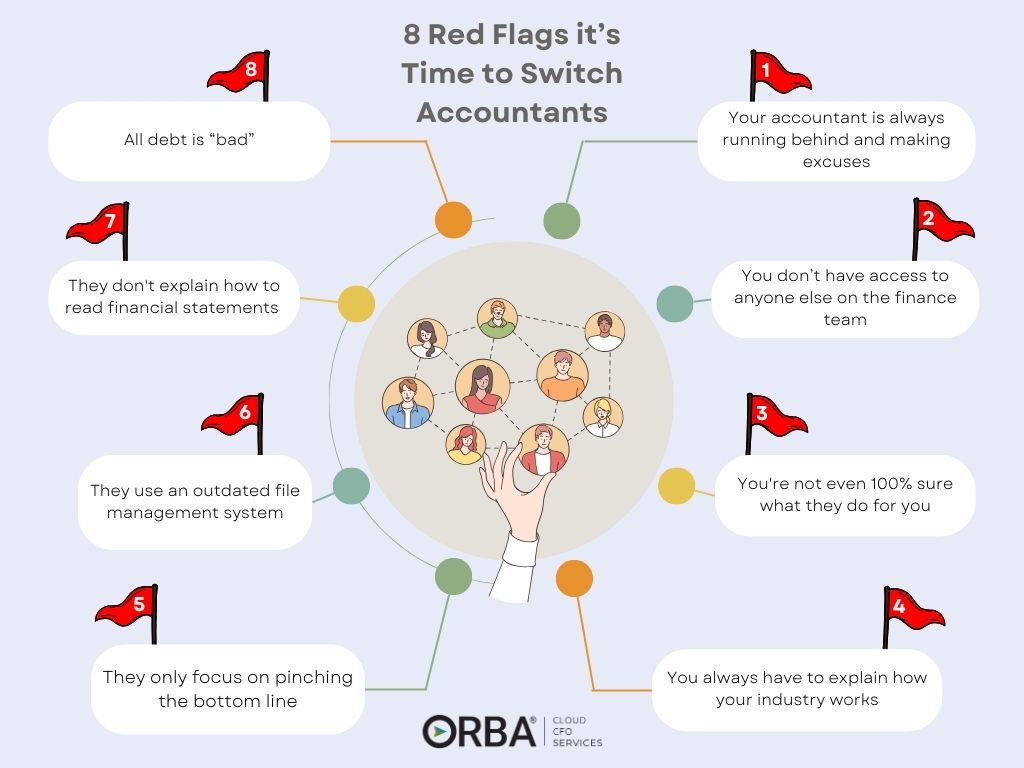

When small problems affecting your business growth begin to seem anything but small, it may be time to examine whether your finance team is helping you scale or stunting your growth. Here are eight signs your accountant is holding your business back.

8 Signs it’s Time to Switch Accountants

It’s often around Q4 that we see a lot of leads coming to us with complaints of their financial standing or back-office needs. Is it time to break up with your accountant? Here are 8 red flags it’s time to switch accountants:

1). Your accountant is always running behind and making excuses

Here’s the truth: Your accountant should be a strategic financial partner who is as proactive as you are about your business success. Or nearly, anyways. If your accountant is often making excuses and falling behind, they aren’t in a position to help you grow. Operating with old financials is a huge hurdle to setting up your business to scale. Find out why requests and/or closing the books is taking longer than it should. Look for an accountant or service that keeps you in the loop before you even knew you had fallen out of it.

2). You don’t know anyone on your accounting team besides your controller

If you’re not allowed to speak to anyone else on the accounting team because your controller is a control freak (excuse the pun), that is hurting your company’s ability to scale. Here’s what I have noticed about accounting teams bottlenecked by a controller or accountant who cannot delegate: They end up with high turnover because anybody good doesn’t stick around long.

Related Read: CFO vs. Controller: Which one should I hire?

3). You’re not even 100% sure what they do for you

A sad but true reality of the relationship between business owners and accountants is this: They hand off the monthly and yearly financial work and then remain in the dark about what their accountant is doing behind the scenes. If your goal is to scale, you should be a regular part of conversations about your finances. Even if the majority of the work has been delegated to an accountant, there’s no one who knows your industry better than you. Questions a controller should be able to answer:

- What’s my break-even sales point?

- Which one of my sales channels/customers is most profitable?

- How can I improve my cash conversion cycle?

- Why is my business losing money?

Related Read: The Most Important Questions to Ask Your Controller

If they can’t answer those questions, they’re not doing what you need an accountant to do.

4). You’re always having to explain how your industry works

Speaking of, while you’ll inevitably be the expert on your business, a true financial partner should get to know your industry and market environment in order to best advise you on strategic decision making. Switch to an accountant who, from the outset, can prove they at least understand the high-level operations of your business and where you should be headed.

5). They only focus on pinching the bottom line

Controllers and accountants generally tend to hang in the backward-looking financial safe zone, focusing on shortcuts instead of strategies. Accountants are traditionally seen as pinching the bottom line (e.g., “This is how to save 10% more by cutting salaries”). That isn’t helping anyone scale. You want to grow by paying the best people to do the best job.

- What are your goals?

- Do you know which key drivers will get you there?

If you don’t, your finance team should. If they are getting defensive when you ask these questions, consider it a red flag: It’s time to switch accountants.

They should be able to help identify those metrics and clearly tie those KPIs to budget items. We firmly believe that well-thought out, budgeted drivers lead to revenue growth.

6). Faxes, photocopies and accordion files are their go-to file management system

If your data is a prisoner of paper, it cannot be accessible for analysis. Perhaps it goes without saying, but if your accountant is still holding on to snail mail and paper filing, it is time to rethink your go-to money person.

Admittedly, the accounting industry has not always been on the forefront of technological advances. That said, that is rapidly shifting.

There are hundreds of cloud solutions that are specifically catered to finance departments. Your accountant should be investigating the best options to get you real-time data. Imagine fine tuning your marketing and sales strategy without current numbers behind customer acquisition cost or inventory turnover. Many companies operate this way, but it does not make it right. Having that accessibility is paramount to saving employee time and providing resources to other essential departments for scaling. Some of our best performing clients have seen how accessible financial data has allowed them to make better business decisions to improve profitability and cash flow.

For example, one client was able to identify that a big name distributor (rhymes with Shmole Moods) was actually eating into their profits and they pivoted their sales channels to focus on distributors like Target that were less work and more reward. The result: their revenue increased by 120%! Another client increased revenue by 29% while also increasing cash flow by running bundled sales and moving inventory. Both of these clients were able to gain this insight using our NetSuite accounting services.

7). They don’t explain how to read financial statements

If you’re in the dark, it could be a sign your accountant is too. If you ask your accountant to explain budget variance analysis, and they cannot easily and concisely explain it to you, that is a problem. For example, if you are looking at your year-to-date (YTD) marketing expense, and it’s double your budget and your accountant can’t tell you why, they are definitely holding your business back.

Additionally if you’re not regularly reviewing your balance sheet, you don’t really know how effectively your business is turning its profits into cash. The balance sheet report provides business financial health check ratios like the acid test and debt-to-equity ratio and tells an important story about your financials. More relevant than the compliance need, these metrics help identify trends so you can adjust operations as needed to “balance” your risk and return. This is one of the most important reports you will review month-over-month and many businesses don’t even look at it. If it’s not a report your accountant is referring to regularly then you might want to start asking why.

8). All debt is “bad”

It isn’t. It really is that simple. While you certainly want to show investors and other stakeholders that you’re in a good cash flow position, if you’re reinvesting in order to grow, that’s a perfectly acceptable reason to be short-term in the red. Your accountant should be fundamental in that decision-making process. They should be able to demonstrate to your stakeholders the financial projections to support that investment in growth. Debt used in a responsible way can be very beneficial to accelerate growth. In fact, in many instances, compared to equity, debt can be cheaper, providing tax savings to a company. In this blog we go into more details about the debt-to-equity ratio and how to use debt to your advantage.

When you are ready to scale, the last thing you need is someone on your team impeding your growth. Use the eight signs above to know if it’s time to switch accountants.

Some questions to ask before switching accountants:

Onboarding manager, Angelica Pierzchala highlights some of the questions to ask yourself before switching accountants:

- What kind of relationship suits my business and team?

- Where do I want to go with my business?

- Will my current accounting relationship help me grow to where I want to go?

- Where am I in my business and what are my future goals?

- What kind of support do I need? Do I need more specialized services, whether that’s a Bookkeeper, Controller or CFO services? Or one or more of the above? Do I need more specialized industry experience from my accounting team? How can I get all these services for a reasonable cost?

- My current accountant is great, but I would like to have more of a relationship with my finance team. I would like more communication and guidance for best practices. I think I may need more advisory or regular communication with my accountant team.

- My current systems are getting us through, but I would like to be more efficient and optimize our processes. I think it is a good time to review our current policies & implement stronger internal controls.

FAQ about switching accountants

Of course, if you are thinking it’s time to switch accountants, you likely have a few questions.

When do you need a controller for your business?

Outsourced accountants can really help small businesses if you and your staff are short on time and need more insight from your finances. Or, if you find yourself hoping to increase profitability or reduce debt. For example, if you struggle to understand exactly how your finances can leverage your operations, or vice versa, an outsourced controller can help.

Tips for hiring the right accountant:

- Your accountant should have a good handle on your industry and market position. The last thing you want is to feel like you’re having to always explain how your business works.

- Pay special attention to your accountant’s approach to problems. While a controller does typically focus on historical financials, if the candidate you are considering is only focused on pinching the bottom line, then by default, you can expect they will struggle to see the big picture.

- Ask the accounting candidate what kind of approach they take to debt. It says a lot about how they think about finances and whether they have the ability to think outside the box.

How much does an outsourced accountant cost?

We save our clients both time and money. Our outsourced accounting services can replace at least one full-time employee and we have seen savings of up to 30%. See our pricing tiers to learn more about our base packages.

Our Cloud CFO Services offer the best of both worlds: Our accounting managers cover all controller-level needs with the support of our bookkeepers and staff accountants for your day-to-day bookkeeping operations. Because our team works with a number of business models, we can offer industry-expertise that you will not normally find in a accountant.

Plus, you can gain access to our strategic CFO check-ups a few times a year. We believe this is just the right amount to fuel your growth. Our awesome CFO service add-on offers custom accounting at a price that fits within many budgets.

What happens after I switch accountants?

When you switch to outsourced accounting services with ORBA Cloud CFO we complete the onboarding in four phases:

Phase 1

Kickoff meeting, team introductions and system set up.

Phase 2

Transition of weekly accounting and bookkeeping items.

Phase 3

Month-end accounting: monthly reporting and Chart of Accounts.

Phase 4

Advanced services: key metric analysis and special projects.

Once you’ve completed onboarding and we’ve completed any accounting clean-up you requested, we kick off the ongoing outsourced accounting services. Typically, you can hand over the day-to-day accounting within week one.

Through weekly check-ins with a dedicated staff accountant, you will be gifted back time to focus on what you do best. Growing your business.

Get in touch to learn more about our outsourced accounting solutions.