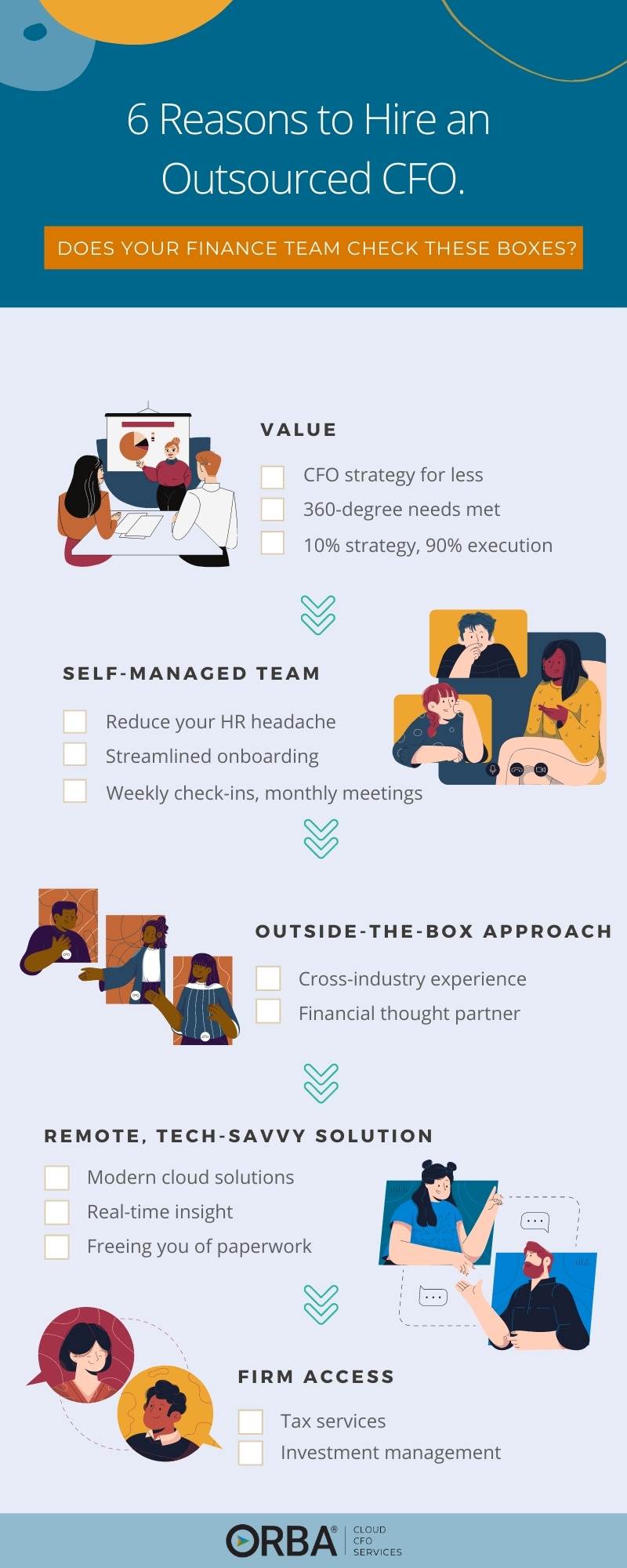

Here are 6 things to know when hiring an outsourced CFO

We frequently see these common misconceptions when entrepreneurs realize they need more strategic insight and it’s time to hire an outsourced CFO. Below, we bust 6 myths about choosing an outsourced CFO vs. hiring an in-house CFO:

Myth #1: If you hire an outsourced CFO, your overhead will increase.

Fractional CFO services can provide just the right amount of knowledge without the price tag of a CFO: which can run upwards of $300K per year.

Price meets strategy: The option of outsourcing a CFO offers low overhead. We replace the equivalent of one full-time employee (plus, we often see an additional 20-30% savings in the finance department). For example, we also work with in-house CFOs, but recently one of our client’s CFO left and we simply increased our scope of work with the client to absorb the CFO’s former responsibilities. This was a win for our clients considering the current economic climate.

The 360-degree approach: For those clients that opt in to our core services plus the CFO add-on, we offer a behind-the-scenes team to manage all things financial:

- Bookkeeping services are handled by an associate who is not afraid to roll up their sleeves for those day-to-day financial needs.

- Outsourced controller services are performed by a manager who completes all the monthly financial review.

- Our clients have quarterly CFO check-ups to identify and track the right KPIs for their business and its stage of growth.

We believe building a business is 10% strategy and 90% execution. Our outsourced accounting team offers both to our clients, which they love. Comparatively, a fractional CFO on their own may only offer the strategy piece, but is not willing to roll up their sleeves and do as much of the review or day-to-day bookkeeping. The flip side of this is an outsourced bookkeeping service that might cover the day-to-day, but cannot offer the strategic analysis. So, having just enough of each of those levels is something attractive and unique.

Myth #2: Contracting an outsourced CFO will require too much oversight.

You don’t need to manage us– we manage your financials. Our experienced team eliminates the need for additional HR management that comes with an in-house finance department.

We have an exclusive approach to onboarding new clients that we have streamlined to get you up and running with our team in a matter of weeks, without any interruption to your operations. Plus, we do clean up and documentation of processes as we go. For many of our new clients, it is the first time they have had their accounting and financial processes documented.

Myth #3: Outsourced accounting means offshored accounting.

Worried about outsourcing an accounting team because you need a likeminded financial partner? Our team is entirely U.S.-based. And because we work with an array of industries and fields this experience is something that no single CFO could ever replicate.

Our management team draws on this cross-industry experience, creating a unique lens with which we examine our clients’ businesses. Subsequently, we can then apply an outside-the-box approach. ORBA Cloud CFO has an operation-based but entrepreneurially-minded accounting team.

We take what we have learned from hundreds of clients to help your business scale. Want references? Just ask us and we will be happy to point you in the direction of some of our happy clients.

Myth #4: Accountants are not tech-savvy.

Not so. Our outsourced CFO team uses modern cloud solutions like Bill.com, Expensify, and NetSuite, to name a few. But if you are still using QBO or Xero we are pros at those too. As NetSuite accountants, we handle NetSuite implementation and clean-up, if required. This recently saw one of our clients, Young Nails achieve a sales growth of 29% in one year. Additionally, we offer automated accounting services to some of our smaller clients: Coined as an “outsourced CFO team powered by Botkeeper.”

You can officially ditch the accordion file: when our clients chose to hire an outsourced CFO, we freed them of paperwork. Additionally, with the adoption of these cloud tools comes real-time insight.

Myth #5: Hiring an outsourced CFO means an accounting service that lacks a personal touch.

Unfortunately, “proactive” isn’t a term often used by entrepreneurs when discussing their accountants. But, soft skills are just as important to us when we are hiring our outsourced CFO team. These are just some of the intangibles we look for in our awesome accountants:

- Interpersonal skills: The ability to create a high-touch and trusting environment for our clients is paramount to what we do.

- Communication: Our Cloud CFO candidates must excel at simplifying accounting concepts into layman’s terms. It’s important to us that even our non-finance-inclined entrepreneurs have a good handle on their financial health.

- Critical thinking: A willingness to both learn and identify what is essential to your business’ success. The CFO-level team are expected to harness their creativity and foster their team’s skills in order to bring the “awesomeness” to our clients’ finances.

Myth #6: Hiring an outsourced CFO means limited service offerings.

Need more than just accounting services? By choosing ORBA, a top-ranked accounting firm, you can be matched with the right professional for your tax or investment management needs. For example, having access to other arms of our firm recently helped one our clients be in compliance with new tax laws by completing a huge sales tax registration.

When is it time to hire an outsourced CFO?

When you start wondering about the differences between a CFO versus a controller and asking yourself these questions:

- Do you have time to handle all CFO responsibilities, including managing any financial software or ERP that you need?

- Can you or your HR team look after the hiring of your finance department?

- Are you competent enough with your books to understand and improve your company’s health?

If you answered no to any of the above questions, you may want to consider hiring a CFO. And, a great place to start is with an outsourced or fractional CFO.

How much does an outsourced CFO cost?

Our outsourced CFO team can replace at least one full-time employee with additional savings in the finance department of up to 30%. See our outsourced accounting pricing tiers to learn more about our monthly and CFO add-ons starting from $2,500 per month.

For many businesses a fractional CFO like those included in our outsourced CFO Services can offer just the right amount of forward-thinking analysis you need along with a team of professionals to tackle the necessary day-to-day bookkeeping tasks. All with a price that fits within your budget.