With all warning signs pointing to recession, many companies are looking at ways to reduce costs and conserve cash. For those in the consumer products or ecommerce sector they might specifically be searching for ways to reduce inventory costs: 1). Leverage your data to optimize your inventory management, 2). Forecast your true demand and, 3). Bundle dead stock to sell.

3 Steps to Reduce Inventory Cost

1). Leverage your data to optimize inventory

Optimizing inventory is more difficult since COVID-19 disrupted the “last-minute” supply chain. Companies can no longer operate with the “just-in-time” method to order goods and reduce inventory cost. Many carry more inventory as a buffer. This puts a crunch on cash flow and CFOs are faced with a rising need to have their finger on the pulse of their inventory data.

In order to effectively time your inventory purchases, (and to improve inventory forecasting) you need solid, accessible data. At the core of reducing inventory costs are issues that plague many growing businesses using manual or entry-level systems.

Common Issues with Inventory Management:

- Products can’t be tracked across multiple locations, like stores, warehouses and 3PL facilities. This results in trouble with your true landed cost calculation.

- Inventory levels don’t update in real-time and are instead refreshed at the end of each day, or worse, manually.

- Businesses rely on spreadsheets making it challenging to get the whole picture on their inventory.

This incomplete view of inventory without proper inventory accounting results in a predictable issue: too much or too little of certain products.

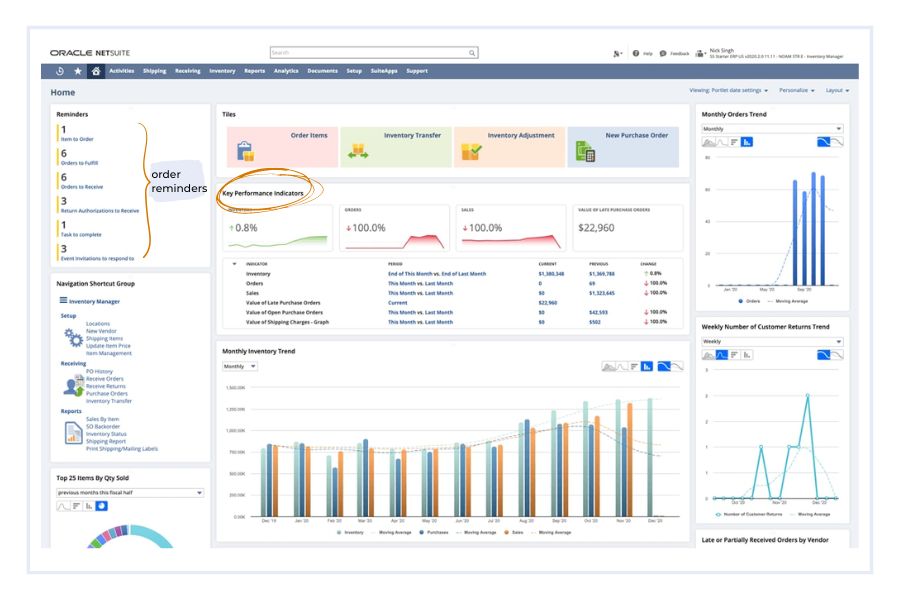

To increase cash flow, you need to optimize your inventory on hand. That’s why we recommend that our clients with heavy inventory needs switch to NetSuite. With ERP solutions like NetSuite Inventory Management, you can access real-time data to predict demand and avoid over-purchasing. Using machine learning, it can calculate the optimal time to replenish stock and even gives you order reminders.

With reliable reorder dates you reduce inventory cost and simultaneously ensure product availability across all channels. Plus, if you ship from multiple locations, you no longer have to worry about having excess inventory in one location while another is out of stock. Where do we come in? Once companies are actively using NetSuite Inventory Management, many require a NetSuite accountant to leverage the consolidated financial reporting and forecasting that is essential for large inventories. Learn more about how we tailor NetSuite pricing for you.

With NetSuite, data is accessible. Especially for our marketing efforts to drive growth, having data and being able to group information quickly and efficiently is super important

Habib Salo, Young Nails

2). Forecast your true inventory demand

We recently wrote an entire blog post specifically on how to build a better inventory forecast, but the gist of is as follows:

Run your forecasts more often

Increased frequency leads to nimbler inventory management. You will want to be using some automation in order to access forecasts more frequently.

Forecast for different scenarios

When running inventory forecasts remember to use historical data but also include any emerging trends seen in your various sales channels or with your competitors. Then run multiple scenarios so you’re not caught off guard by a sudden dip in revenue.

Forecast by SKU, channel and location

By slicing your data by SKU, sales channels, and locations you can get more accurate forecasts that allow you to base decision-making on reliable data and therefore optimize inventory costs.

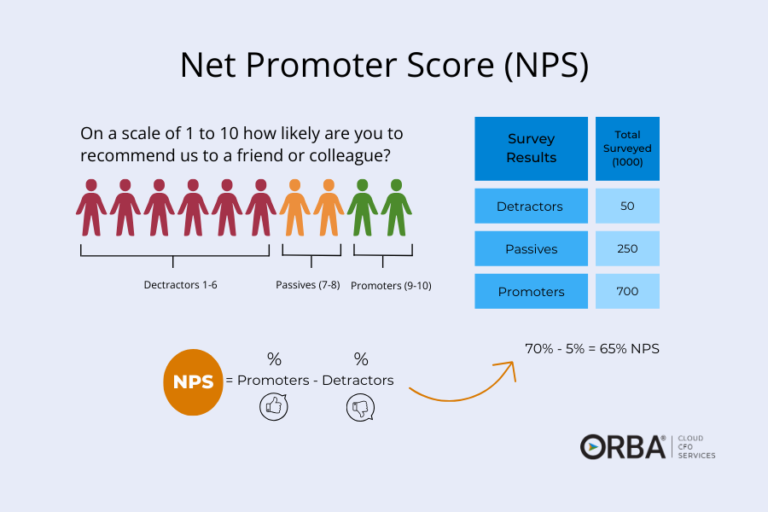

Track your Inventory KPIs

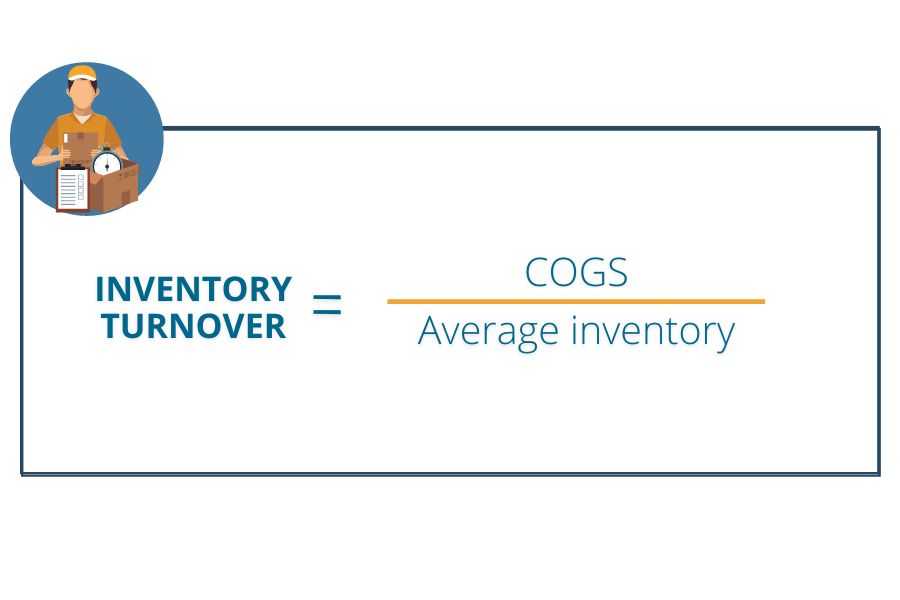

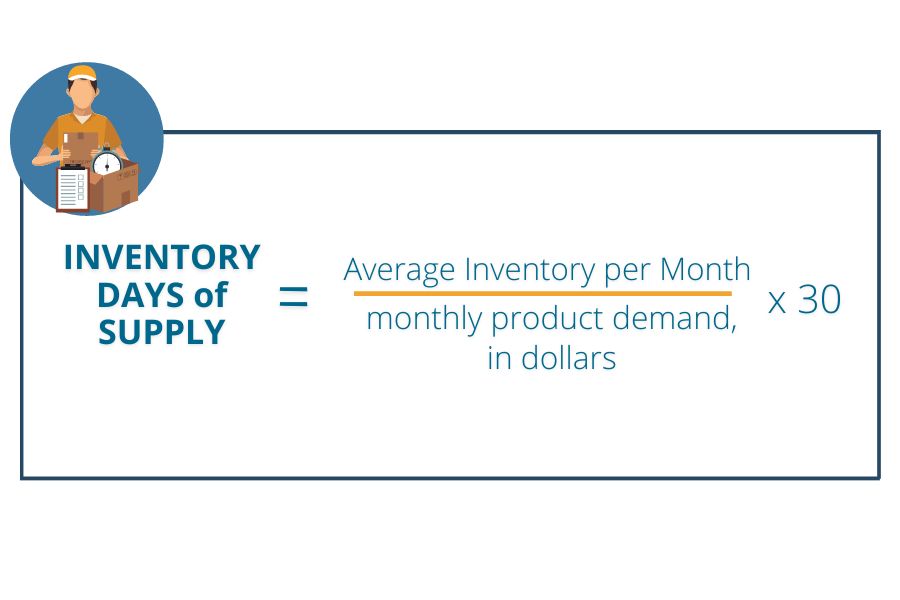

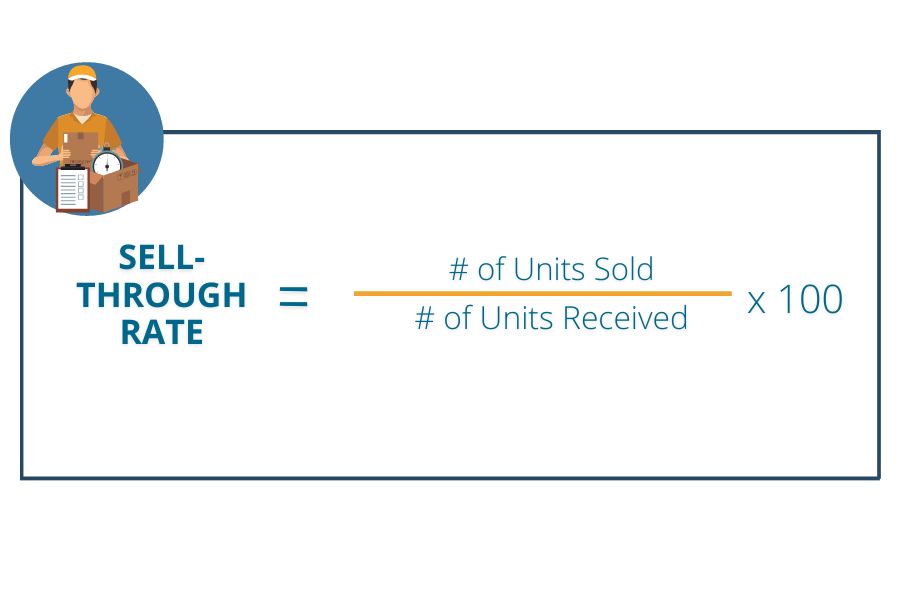

There are a number of supply chain KPIs you want to track to attain your par level. For example, with NetSuite Inventory Management it becomes easier to calculate GMROI, Inventory Turnover, Sell-Through Rate, and your Inventory Days of Supply.

Tracking KPIs like Gross Margin Return on Investment (GMROI), pronounced “Jim-Roy,” you gain better insight into your best performing stock and your slowest-selling inventory. This can reduce inventory cost by helping you know where to direct your attention in times with less revenue. We discuss the GMROI formula in more detail in another post, but the Cliff notes version is this: increase your GMROI, decrease your inventory costs.

Tracking these inventory KPIs means you can meet customer demand while decreasing the chances of stockout. With better forecasting, you can prevent a lot of dead stock, but might not eliminate it completely.

3). Sell off dead stock to reduce inventory cost

Dead stock. It even sounds like it’s weighing you down.

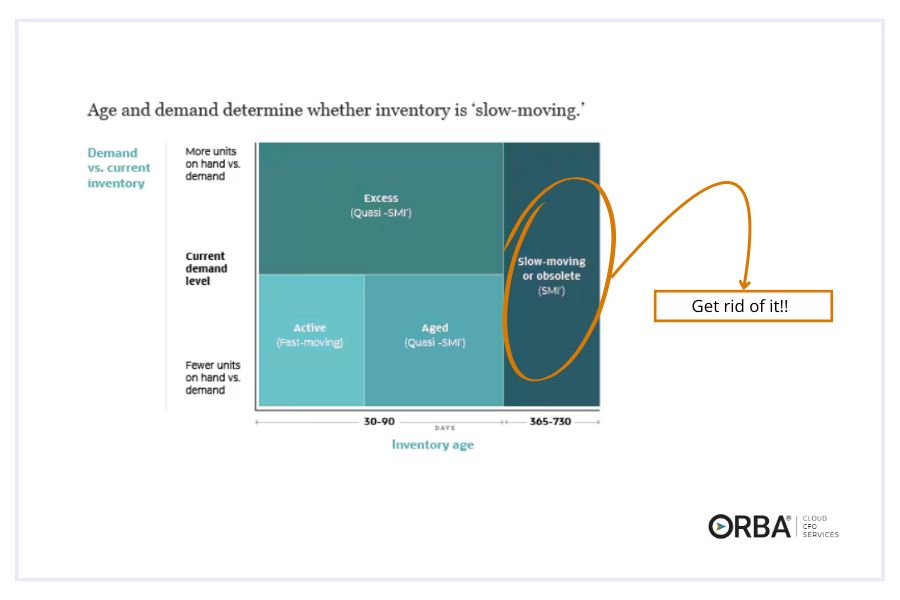

Dead stock, or dead inventory, is simply a drain on your profits. Holding onto dead stock, also referred to as SLOB (slow-moving and obsolete), can cost a whopping 20-30% more than the inventory cost per unit! How does SLOB inventory or dead stock increase costs:

Why is dead stock bad for business?

- It impacts cash flow

- The more cash you have tied up in inventory, the less you have for other operating costs

- It increases carrying costs

- Ties up valuable warehouse space

- more money sunk into equipment rental to move dead inventory in warehouse

- Increases inventory management costs (like employee wages)

- Increases insurance

Inventory can become dead stock for a variety of reasons: you ordered too much product, they were damaged, or were perishable and expired. The most preventable one, of course, is ordering too much product. Say an office supplies company has 100 toner cartridges they can’t sell. Each toner is valued at $150. That’s $15,000 in anticipated revenue they’ve now lost. Additionally the company is likely paying anywhere from 15-30% of that value on carrying costs.

Carrying costs are the total costs a business pays for holding inventory in stock. Examples of carrying costs include: warehouse & storage fees, insurance, and employee costs.

So, how can selling off dead stock reduce inventory cost? Sell off dead stock to reduce inventory cost or lower inventory carrying costs

4 ways to sell off dead stock to reduce inventory costs

1). Free gift with minimum purchase: While this will still hit your bottom line, it will clear up your shelves and if you set a minimum, say $100 or more, then you minimize the revenue loss. Clearing shelves reduces storage costs or frees up room for your higher-selling items.

2). Sell dead stock at a discount: Probably the most straightforward way of selling dead stock, using a discount or promotion may cut into your profit margin, but it will increase cash flow and make room for better selling inventory.

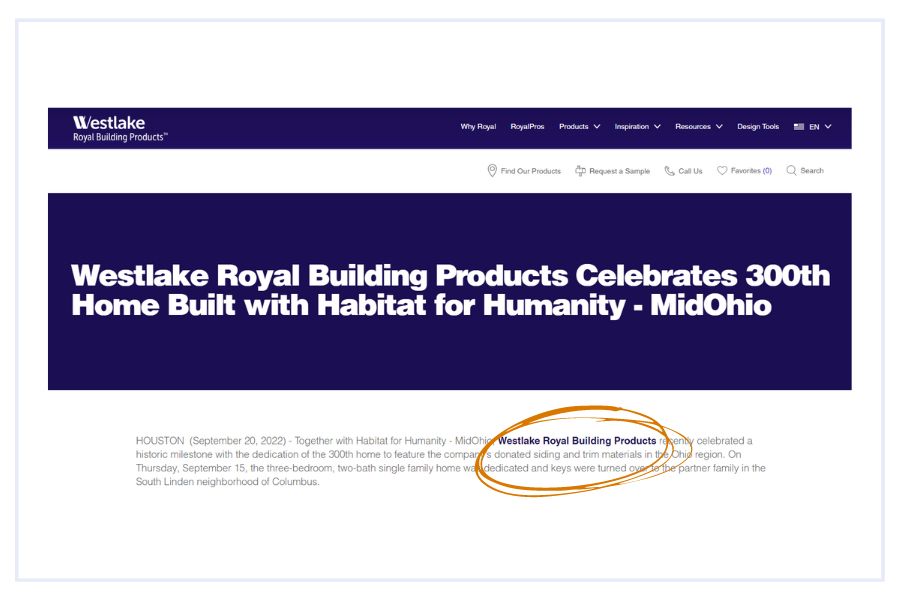

3). Donate dead stock: While this won’t help with lost revenue, it has three obvious benefits: you can help your community, you may be able to claim tax deductions and it can help your brand image. More consumers are paying attention to companies that engage in corporate social responsibility. Check with your tax advisor to determine if you’re eligible for any deductions from in-kind donations. Plus, once again you’re moving that inventory off your shelves reducing all of your carrying costs on a product that isn’t bringing in revenue.

4). Bundle your dead stock with faster-selling inventories: Pair a hot item with a stagnant product to clear inventory space and decrease your inventory holding costs. This technique has the added bonus of upselling your other items. Like all tactics to empty dead stock shelves, your profit margins will take a hit. To recover as much revenue as possible, bundle dead stock with highly popular items that are likely to sell anyway. Let’s look at an example.

Bundling dead stock example

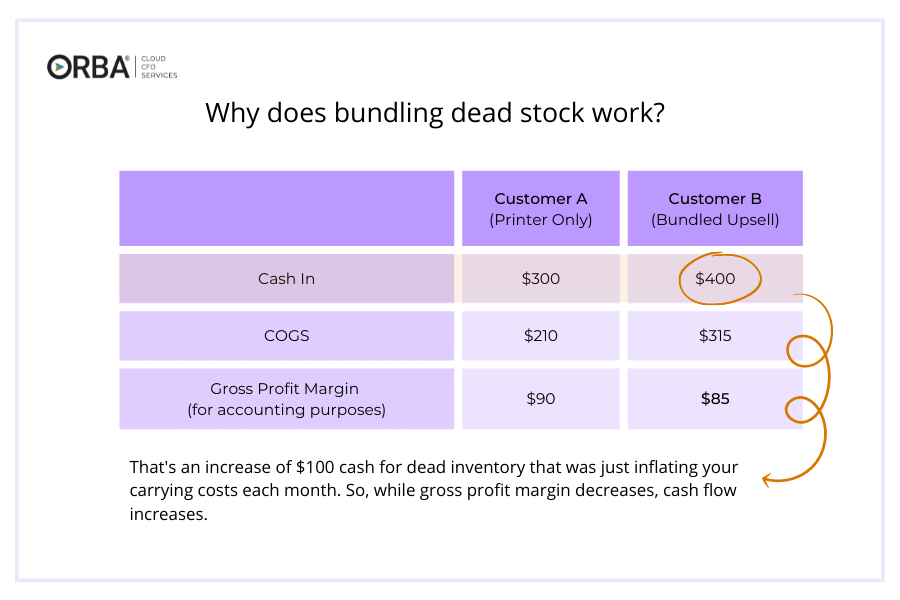

Say Awesome Office Supply is selling printers and toner cartridges. For the ease of this example, let’s also say Awesome Office Supply sells both for a 30% profit margin on average. They list their printers for $300 and their toner cartridges for $150 for a profit of $90 and $45 respectively.

But, with paperwork needs decreasing, Awesome Office Supply realizes the toner’s sell-through rate is abysmal. They over-ordered toner and it’s become dead stock taking up valuable inventory space at multiple warehouses.

Cloud CFO Tip: bundle related items to further upsell other products.

Now, if Awesome Office Supply offers a Printer + Toner Special for $400, overall, the company’s gross profit margin takes a hit of $15. But cash in increases by $100. So while profit margin decreases, cash flow increases.

Cloud CFO Tip: Worrying about gross profit margin on dead inventory is futile as you’ve already paid for that dead inventory. It’s a sunk cost. Don’t let your accountants say this is a bad thing because it hurts gross profit margin. Instead focus on increasing cash flow and at least getting an extra $100 for that old dead stock toner that’s collecting dust (and increasing carrying costs!).

You might even entice Customer A to purchase toner as well with a bundled deal. Maybe Customer B and Customer A specifically chose Awesome Office Supply to purchase from because they were offering a bundle. So, to reduce inventory costs, bundling your dead stock can make a lot of sense and come with a few sneaky benefits. Even if your profit margin is taking a hit, you might actually be driving more revenue.

The Bottom Line

CFOs are more frequently looking to reduce inventory costs to protect cash flow. This starts with leveraging inventory data to get better forecasting. Inventory management is essential for a company to have the money it needs when it needs it. And every CFO should want to predict demand to avoid overbuying. Remember, inventory is “money” tied up on your shelves. Items that don’t generate income are missed opportunities. Clear out that dead stock to increase cash flow.

Need help reducing inventory costs? Contact us to learn how our outsourced CFO services can help!