Need a price increase letter to customers due to inflation (or any reason)?

Check out our example price increase letter and template along with why it makes sense to raise your prices.

Key Takeaways

- Write your price increase letter in 4 easy steps (with examples).

- Get a sample price increase letter to customers (with downloadable template)

- There are a number of reasons to raise your prices

- Increasing your prices can increase sales

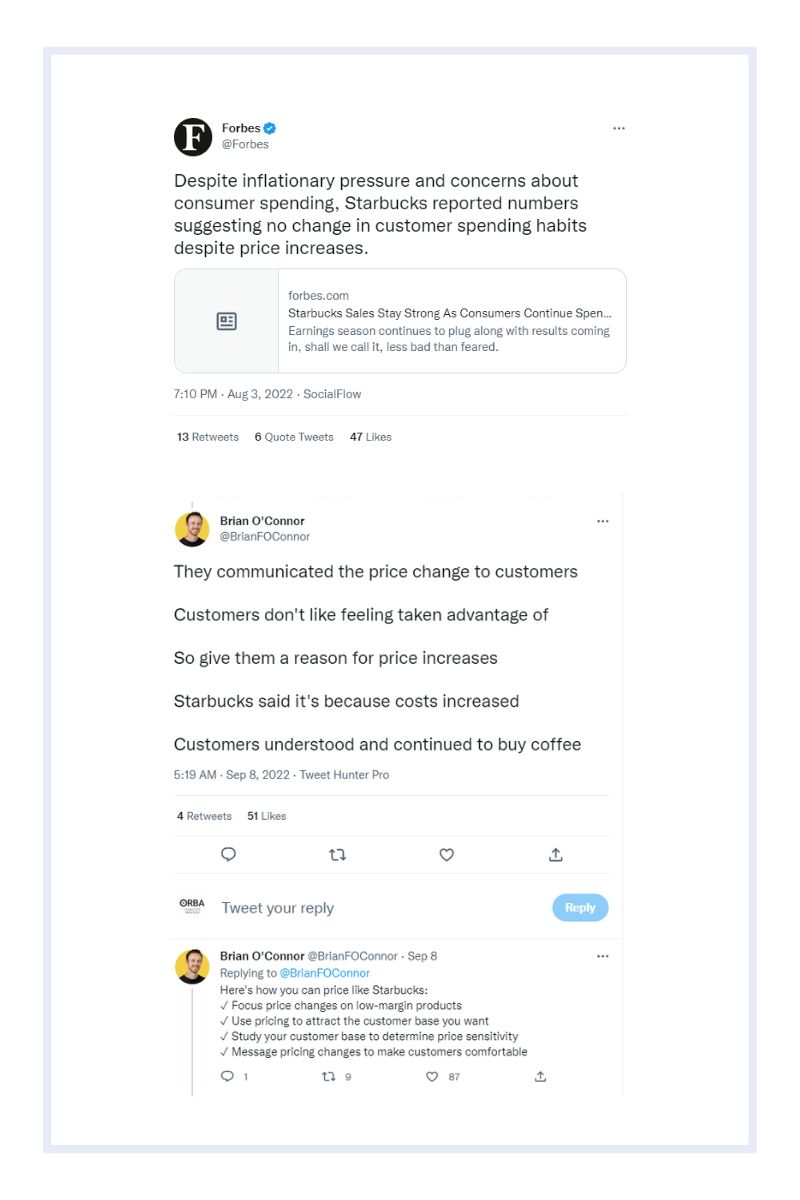

Between Q4 2021 and Q1 2022, Starbucks raised their prices not once, but twice! Of course, they took grief for it from some customers. When asked about their price increase, Starbucks cited inflation and staffing issues were to blame. They further explained that they needed to balance their business needs while still offering value to their customers. What they did not do, was apologize for it!

But what happens when your price increase is poorly-received?

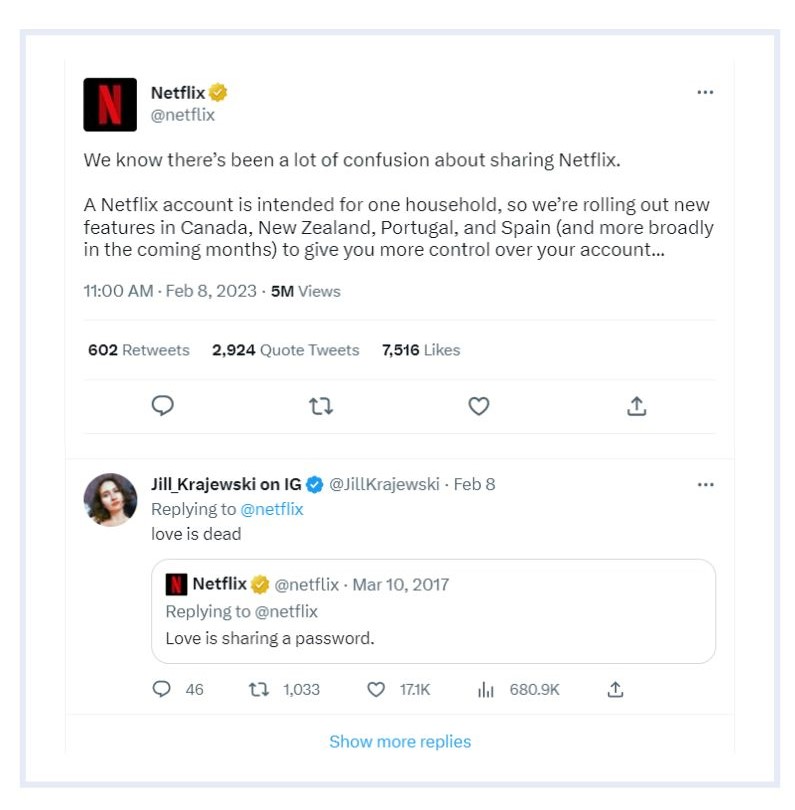

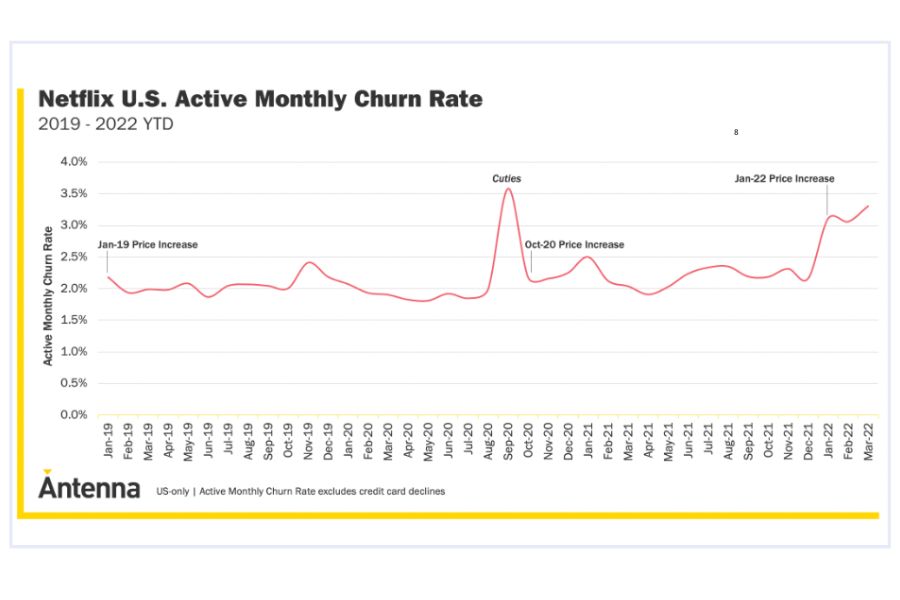

Despite increased competition from new streaming services, Netflix was the only major service to increase their prices in 2022. Then they lost more than 1 million subscribers. Up until recently, Netflix has been able to clearly show its growth narrative to investors, but as customer growth slows, it comes as no surprise that they will be raising the price of subscription. More recently Netflix has begun charging more for password sharing. It’s likely an effort to shift its Rule of 40 levers. Moving from an emphasis on revenue growth to instead extracting profit.

How did this price increase land? One user phrased it perfectly: referencing a past tweet from Netflix themselves, “Love is sharing a password,” the user simply replied, “love is dead.” Ouch.

Netflix has stated that they will sometimes “ask [customers] to pay a little bit more to keep that virtuous cycle of investment and value creation going.” But once again, their communication fell flat. We first wrote about this in 2020! Two years later and they still haven’t learned a lesson. With inflation and increasing competition, Netflix could work a little harder to reduce customer churn. To start with, they might consider a better price increase letter.

Related Read: Pricing in a Pandemic: Aim for flexibility over lifetime value.

Price hikes are always a delicate business decision to make. You don’t want to raise your prices too high and scare your consumers or clients off, but you want to, as Starbucks puts it, address your business needs. Your loyal customers will understand if they value your product. So what did Netflix do wrong?

How to write a price increase letter (Without apologizing).

1). Pick Your Timing Wisely

Begin with the path of least resistance. Pick a time to raise your prices that matches your business’ seasonal cycles, or stage of growth you are in. Then, give advance notice. Don’t spring the price increase on your clients for the next billing cycle. Even if you’re not selling a service, it still bodes well to give some warning. We’d suggest 60-90 days ideally. Not 30, as is the Netflix M.O. Arm your sales and marketing teams with enough time to prepare for the change in price.

2). Explain Why You Are Raising Your Prices

As we saw with Starbucks, most reasonable customers will understand why you’re raising your prices if you’re transparent as to why. If raising your prices brings growth to your business, explain how this will benefit your consumer. Demonstrate to your customers what you have brought to the table so far and how you will benefit them in the future. For example, our cost is derived from 2 things: more work and higher labor costs. So I split out the two causes to support an 11% overall increase (6% increase in salaries, plus 5% increase in work load). Our outsourced accounting services work with you to justify rising prices in a manner the consumer can understand. Some examples of how you could use this in a price increase letter:

Example: “We know that one reason our clients using our services see increased revenue is because they get reliable and accurate financials and then can make better decisions for their business.”

Example: “Your success is our success! Our customers saw a 30% increase in conversions last year. We’re increasing our rates so we can offer packages that include the tools our customers need most.”

3). Offer Value

Here’s where Netflix went wrong. Plan to showcase your value to your consumers so they are more focused on what you’re offering than the price of the product or service you are selling. Do this before raising your prices.

As we saw above, Netflix attempted, but failed brutally, at this in 2020 and 2022 with many customers questioning the value of the product and whether it was in line with the price increase. While Netflix has had a historically low churn rate, with more price hikes, it’s been increasing.

Let’s just say something didn’t land with their messaging to customers. They might have tried writing a new price increase letter rather than recycling the same one from their last price hike for starters. And suggesting that they needed to increase the prices to then deliver more value is like charging for the cart without the horse.

Regardless, Netflix did not apologize for raising prices and you don’t have to either.

“Price is what you pay, value is what you buy.”

Grant Cardone

To define your value proposition, consider both your specialty and the customer experience you offer. This means first understanding your marketplace. Once you do, you will be able to determine a way to offer even more value to your customers. This will instill confidence in your services or product regardless of an increase in cost to the consumer.

Example: “Raising our rates will allow us to focus more closely on the work we do together [hire more people] to support your business. This means better turn-around times and more availability.“

Example: “This small increase means we can upgrade our servers, hire new talent (P.S. we’re hiring!) and bring more tools to help your business grow.”

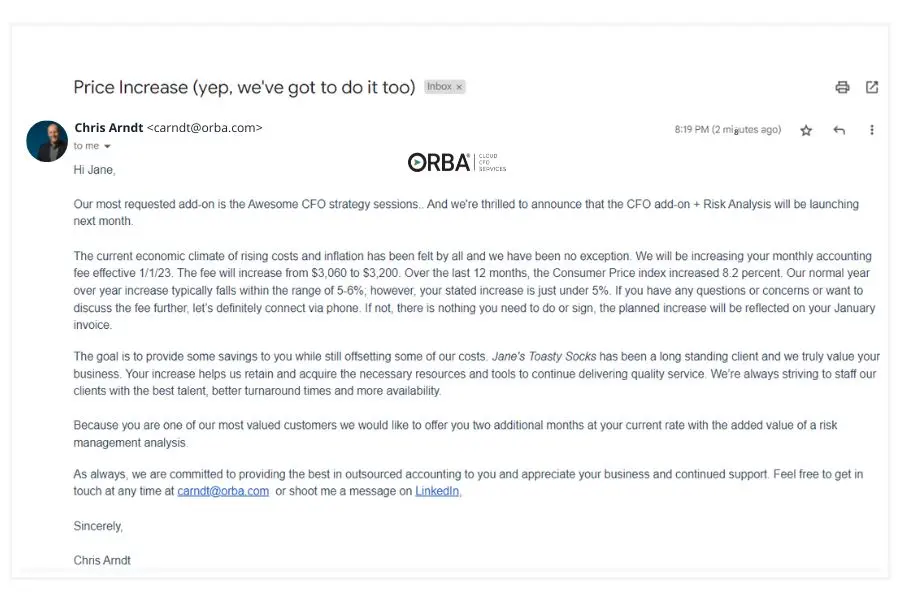

4). Reward Loyalty

One way to increase your prices without losing customers is to reward your most loyal ones in the process. If you sell a service you might offer one additional month at the current rate. Call it a legacy rate. You might offer a bonus complimentary strategy session for your clients. Or a pre-sale where existing customers can get 10% off the new annual cost or total price of the product. These kind of offers are more likely to increase customer stickiness, reducing churn. Plus, while it may take some investment up front, if it means that client sticks with you to increase ltv (lifetime value) and that outweighs the cost up front.

Example: “As one of our most loyal customers, we want to give you the first two months of any plan at your current rate.”

Example: “Because you’re one of our most loyal customers, we want to offer you this discount code LOYAL15, for 15% off your next order.”

Sample price increase letter to customers.

Price Increase Letter Template

Use the letter template below to inform customers of a price increase, or click here to get a copy of our price increase letter template:

Hi [Customer],

[Explain the value-add] Our most-requested [add-on, feature, product expansion] is ___________. And we’re thrilled to announce that [new product expansion/feature] will be launching next month. [Ideally in advance of price increase].

[Give notice] I wanted to let you know that there will be a _______% increase in price of [product or service] , effective [date, ideally 90 days out].

This increase ensures we can continue to provide the very best products and services for our customers. This means better turn-around times, more availability, and more focus on your business. [or: Faster shipping, better customer service and more new exciting offers to come!]

[Insert appreciation of loyalty] Because you are one of our most valued customers, we would like to offer you an additional month at the current rate but with [the added value of one of our strategy sessions, or, with a sneak peek of the new feature/product___________].

As always, we are committed to providing quality [products and service] to you and appreciate your business and continued support. Feel free to get in touch anytime at ______________ [email or social media messaging account]

Sincerely,

[Name]

4 Reasons to Increase your Prices

Why even bother to increase your prices if you risk losing customers? There are, of course, a number of reasons to raise your prices. Here are the top 4 we’ve seen:

1). Attract the right customers

First, it’s a matter of attracting the right clientele; you don’t want customers that are only willing to pay bottom-barrel prices. That only reflects poorly on your product. We talk more about identifying your market position in this post on how to define your value proposition.

2). Supply & demand

Second, you should always be taking into account your supply and demand. If you’re really busy or can’t keep up with product demand, it’s likely time to consider raising your prices. Grow, baby, grow, right?! If you’re employing any of our favorite analytics for growth (LTV, PBP, funnel velocity), our outsourced CFO services would be able to tell you when you’ve outgrown your price.

3). Provide more value to retained customers

Increasing your margins allows you to provide even better services or product to your customers that understand the value of it. And those who don’t? Customers that don’t are typically the ones that take up more time and investment and in the end cut into your margins even more.

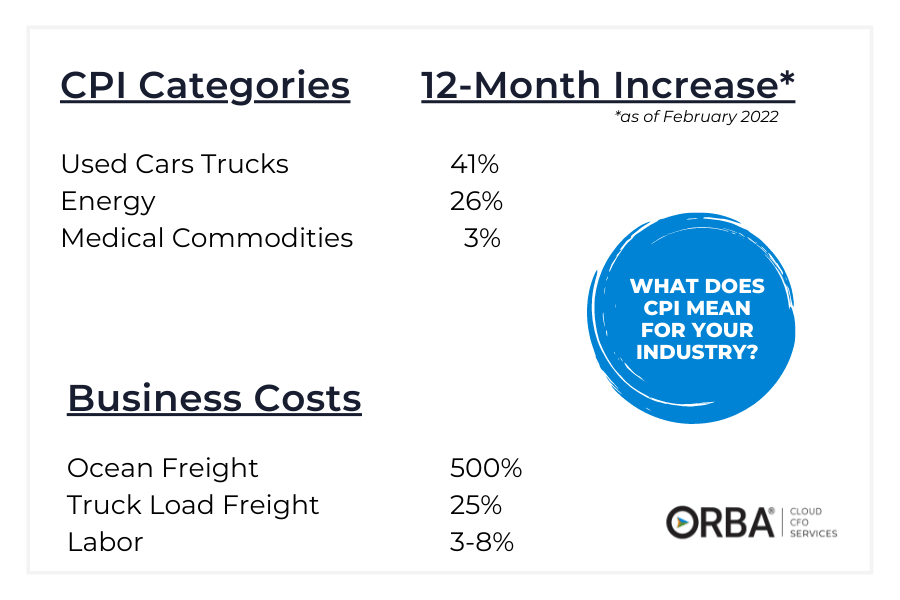

4). Profitability (or inflation)

Lastly, a price hike is occasionally mandatory for general cost of living increases or operating expenses. Especially when facing increasing costs due to inflation. It’s also worth pointing out that you can shift the value and price of your product without changing the actual costs to make it. (But harder to do in the midst of soaring energy prices). Increasing your profitability should always be an end-goal. Plus if you’re trying to prepare for current inflation and looking at the CPI, my only question is why wouldn’t you raise your prices?

Related Read: How to Prepare Your Business for Inflation (aka Raising Your Prices Because Everyone Else Has)

Raising your prices to increase your sales.

Let’s pretend you are a coffee shop that does $1 million per year in sales at your store. Your average consumer spends $4 on your java jolt, which means you had 250,000 customers walk through your door last year ($1 million / $4 each). Your goal is a 5% increase in sales for next year (a $50,000 increase in sales).

You have two main options to achieve this goal:

1). Get More Customers in the Door

If you take this approach, you need to somehow get an additional 12,500 customers in the door ($50,000/$4 each). That’s about 34 extra customers every day. Not an easy feat for a store that has a stabilized traffic pattern of customers.

2). Alternatively, You Can Raise Your Prices

With this approach, instead of charging everyone $4.00, you would charge them $4.20 (a 5% increase). And then you wouldn’t need any additional customers to achieve your goal! Instead of focusing on finding more customers, you can focus on making your current customers even happier and bringing them back more frequently. This increases the value of your product, which your best customers will truly appreciate.

Price Increase Examples

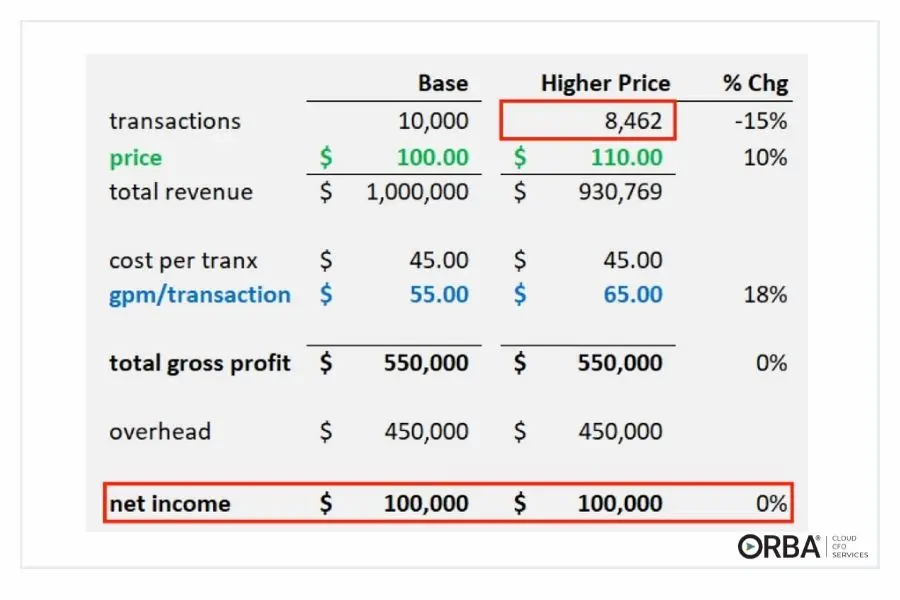

Finally, we like numbers, so let us throw some at you.

In this example, raising prices by 10%, allows you to lose 15% of your transactions and still have the same gross profit dollars. A 10% increase in price translates to an 18% increase in gross margin. The lower your % gross margin, the more customers you can afford to lose with a price increase and still maintain your gross profit.

If our starting margin was only $25 (25%) in this example, a 10% price increase would allow you to lose 29% of customers and still break even!

Related Read: How to Use the Break-Even Sales Formula

Who are the first to leave when prices go up? The customers that don’t realize your true value (buh-bye). Lots of low quality and low margin customers is a prime spot to raise prices with lower risk. Plus, maintaining or increasing your margins can let you provide even better services or product to your customers that stay.

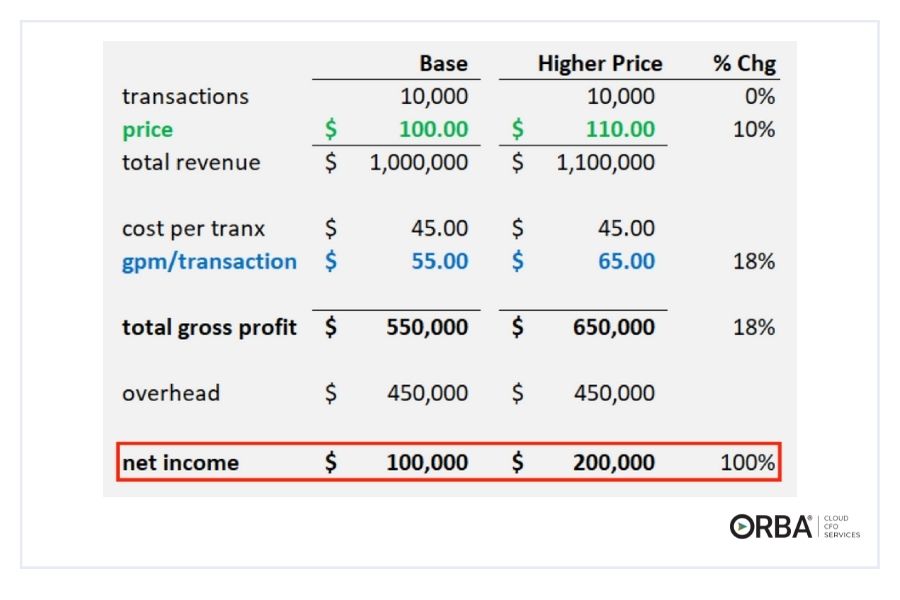

Now what if you raise prices and your customers stay? A 10% increase leads to the 18% gross margin increase, and a 100% increase in net profit!

Finally, remember that those customers who kick up a fuss over small percentage increases might not be your best customer if they end up being more work than they’re worth.

So… go ahead, raise those prices, no apologies necessary.

Need help breaking down the right margins to raise your prices? Get in touch to see how we can help.