Revenue leakage is when a company experiences a loss in income from expected revenue. Much like a leaky pipe, money that should have been earned drips away.

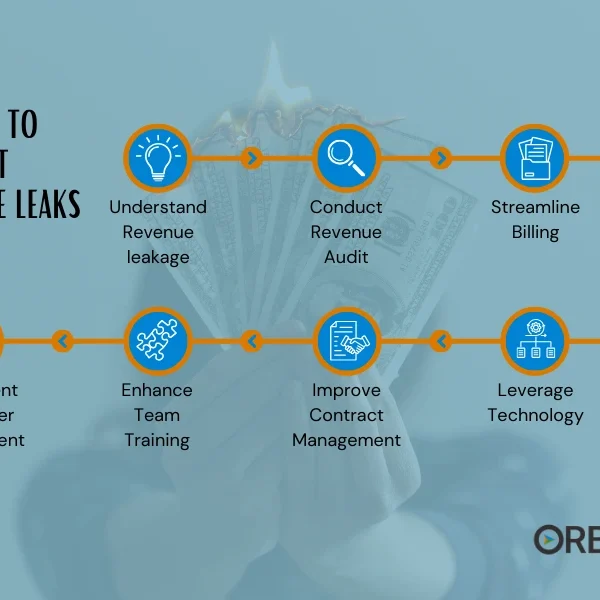

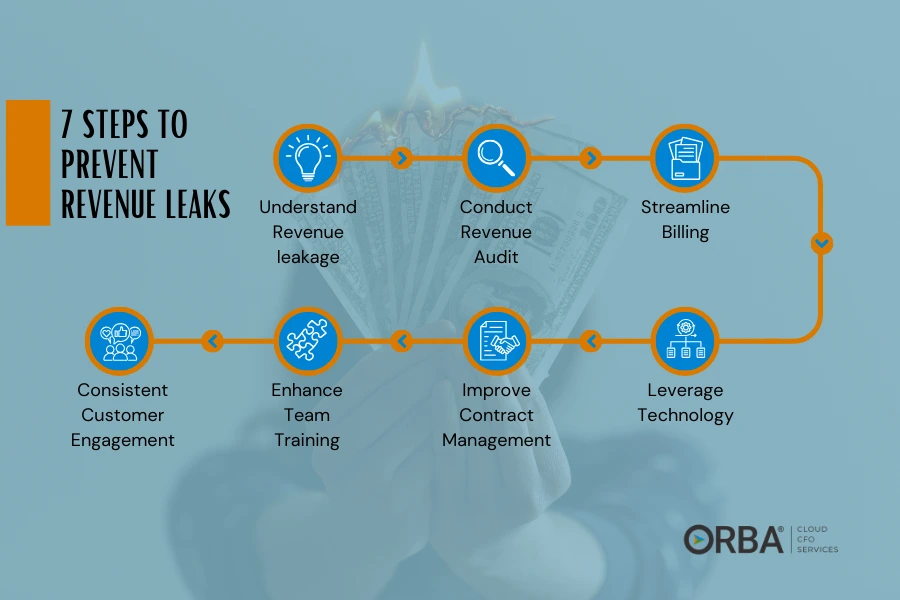

7 Steps to Prevent Revenue Leakage

Don’t let hidden financial mistakes cost you thousands. Let’s fix it.

1). Understanding Revenue Leakage

Many business owners underestimate how much revenue slips through these leaks:

Inaccurate financial data

Problems like poor accounting which can lead to gaps in pricing.

Failure to charge for certain fees or services.

Underbilling or pricing errors

Inefficiencies in accounts payable process or accounts receivable cycles.

Supply chain disruptions which can directly impact customers.

By fixing those leaks, you may find untapped profitability. If you’re not tracking and adjusting, you’re leaving money on the table.

2). Conducting a Revenue Audit

The key aspects of a revenue audit include

- Purpose: To make sure your revenue reporting aligns with standard accounting principles and your company’s policies. Think of it as a health check for your financials.

- Focus: Digging into transactions, contracts, and supporting documents to confirm that your reported revenue is accurate and complete—no fluff, no shortcuts.

- Process: Auditors review sales records, contracts, invoices, and payment details to verify that revenue is recognized at the right time and for the right amount. It’s all about timing and precision.

- Importance: Nail your revenue recognition, and you’re not just ensuring spotless financial statements—you’re also building trust with investors. Integrity matters.

- Potential Outcomes: A revenue audit might uncover discrepancies or errors in how revenue is recognized. Translation? Potential adjustments to your financial statements or deeper dives into the issues.

Say your company ships products to customers. A revenue audit would check if you’re recognizing that revenue when the goods are shipped (as you should) and not before or after. Auditors would also scrutinize customer contracts to ensure payment terms match your revenue recognition practices.

Client case example:

After running a revenue & profit audit, we uncovered $15,000 in annual profit leaks. Our client was:

1. Losing money on an inefficient AP process.

2. Spending on tools she didn’t even use.

3. Not charging a customer enough that was draining their profits.

The worst part? She had no idea.

By automating these processes using NetSuite and using updated financial data to focus on their best customers, we were able to increase their YoY revenue.

3). Streamline Billing Processes

Traditional standalone billing solutions create operational silos. Meanwhile billing errors can lead to revenue leakage.

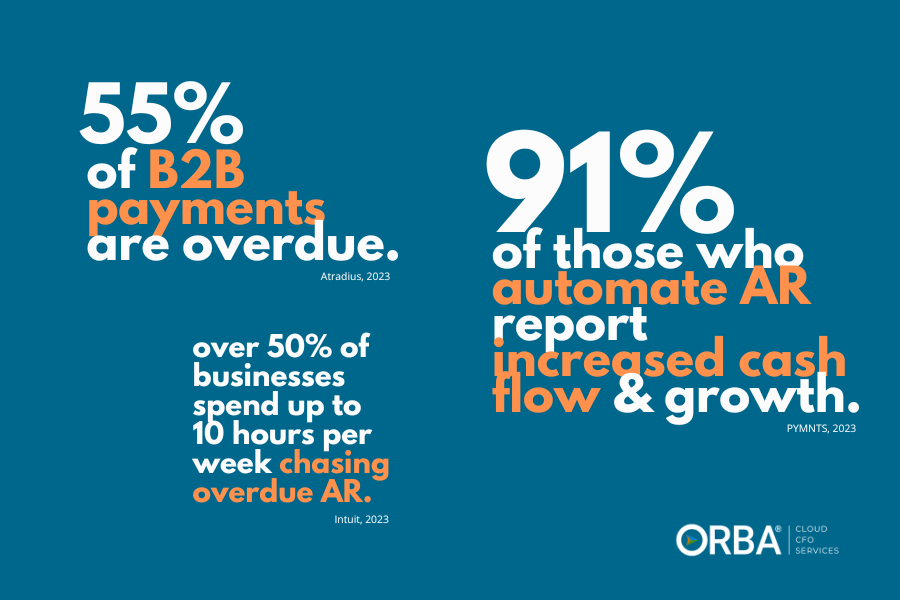

Reasons to clean up your accounts receivable (AR) :

1️⃣

Your Accounts Receivable (AR) balance is an asset that can be converted to cash.

2️⃣

The higher your AR balance = the less cash you have.

3️⃣

The longer your balance remains unpaid, the greater the risk of unpaid debt.

Look to AR automation to tear down the silos and reduce errors.

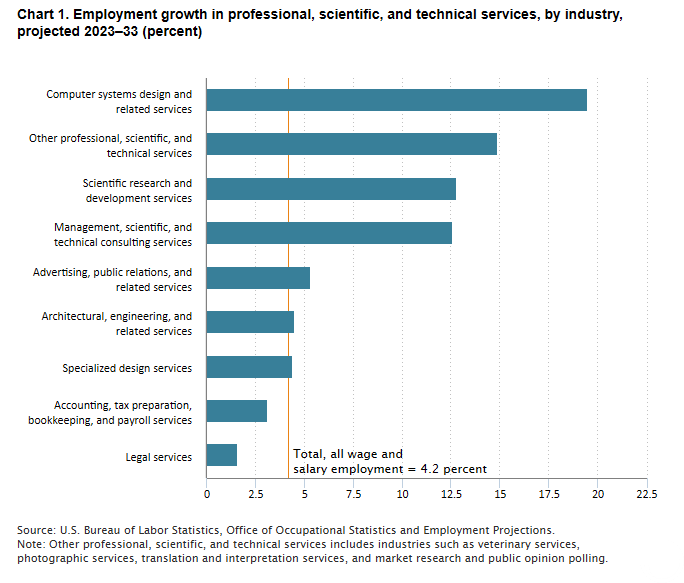

4). Leveraging Technology and Automation

As noted in #3 automation is a great way to reduce manual error, plus, by integrating systems you increase efficiency. Remember, time = money. And fixing or reviewing things that could have been automated is a sure-fire way to see revenue leakage.

Client case example: when we recommended one of our clients switch to NetSuite, we implemented the ERP in under 3 months and reduced monthly close time by 67%. The results? Warehouse operations were streamlined. Their revenue increased by a whopping 120%!

An added bonus of adding a cloud-based system: curbing the time your IT team spends on patching servers and installing and troubleshooting software.

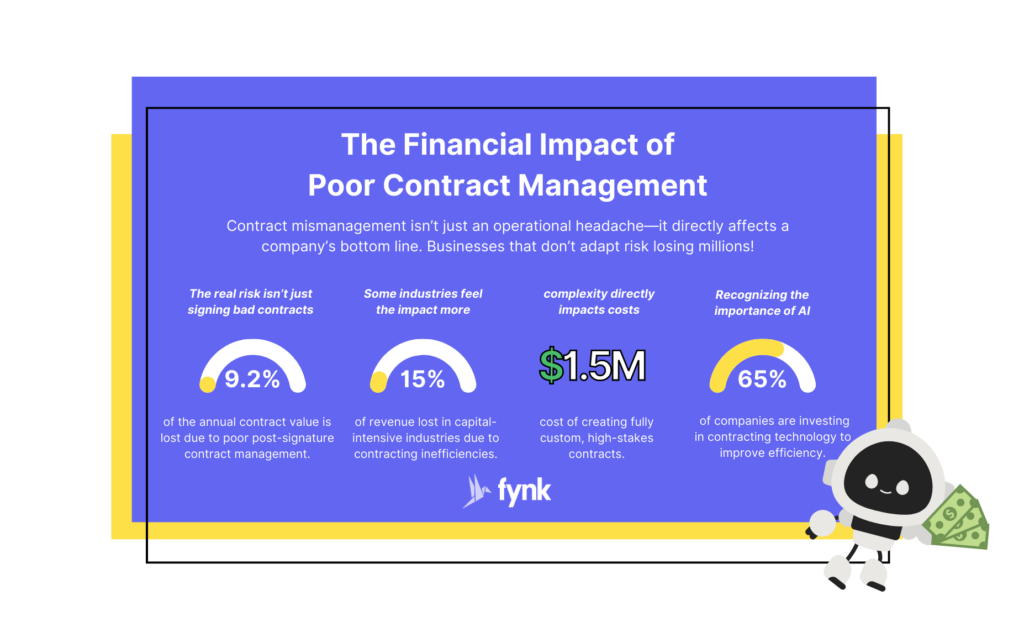

5). Improving Contract Management

Reviewing and renegotiating contracts regularly as well as paying attention to missed or incorrect charges.

6). Enhancing Team Training and Awareness

There are three things we see as paramount to getting your team on board to prevent revenue leakage:

- Educating staff on revenue management best practices.

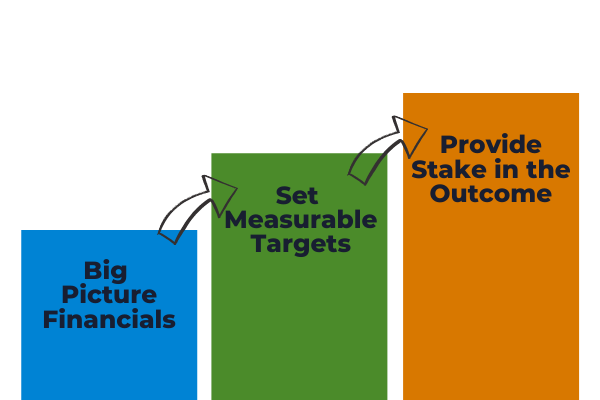

- Building a culture of accountability: give big picture financials > set measurable targets > provide a stake in the outcome

- Regular review of processes and policies.

7). Consistent Customer Engagement

One of the trendiest ways to address revenue leakage has got to be digging into your customer experience (CX): Things like:

- Proactively addressing customer concerns to avoid disputes.

- Ensuring timely communication of updates and changes in billing or price increases.

- Building trust to reduce instances of non-payment.

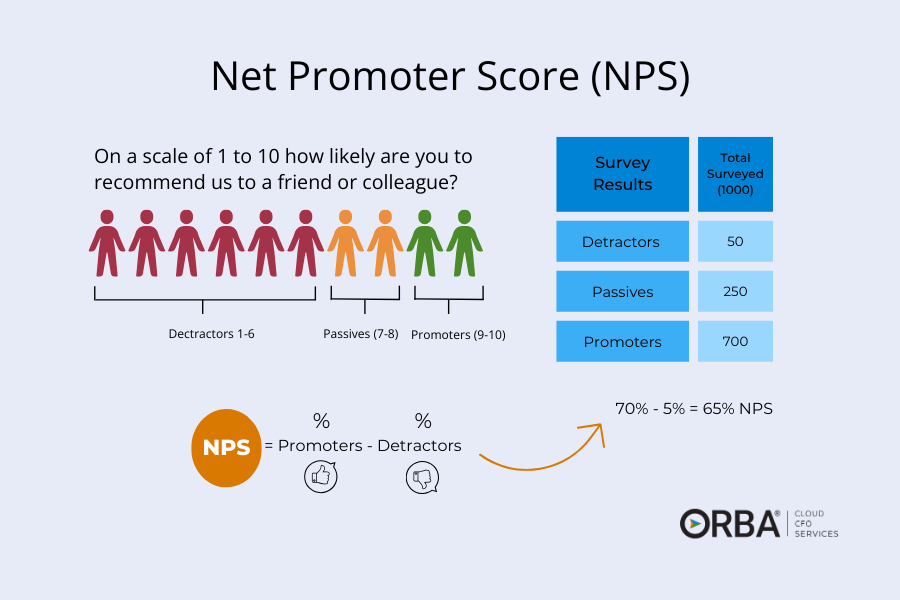

- Tracking and reporting your customer success KPIs.

And finally, when you’re selling your product or service to customers are your departments aligned? Marketing is highlighting features, but sales is selling outcomes. Clear messaging is important to keep those customers in our funnel.

The Bottom Line

Addressing revenue leakage requires a proactive approach using clear policies, ongoing monitoring, and the integration of advanced technological solutions. By fostering a culture of accountability, consistently engaging with customers, and implementing robust systems, you can effectively mitigate risks and protect your bottom line. Get in touch to help address your revenue leakage today.