Your company has grown and it is now time to scale up your financial team. But which do you hire first, a CFO or a controller?

Truthfully, the finance department is not always the first thing business owners think to scale as their company grows. More often than not, business owners come to this realization once they have seen a big jump in revenue and suddenly realize that some more strategic financial planning is in order. So which one should you hire? A CFO or a Controller?

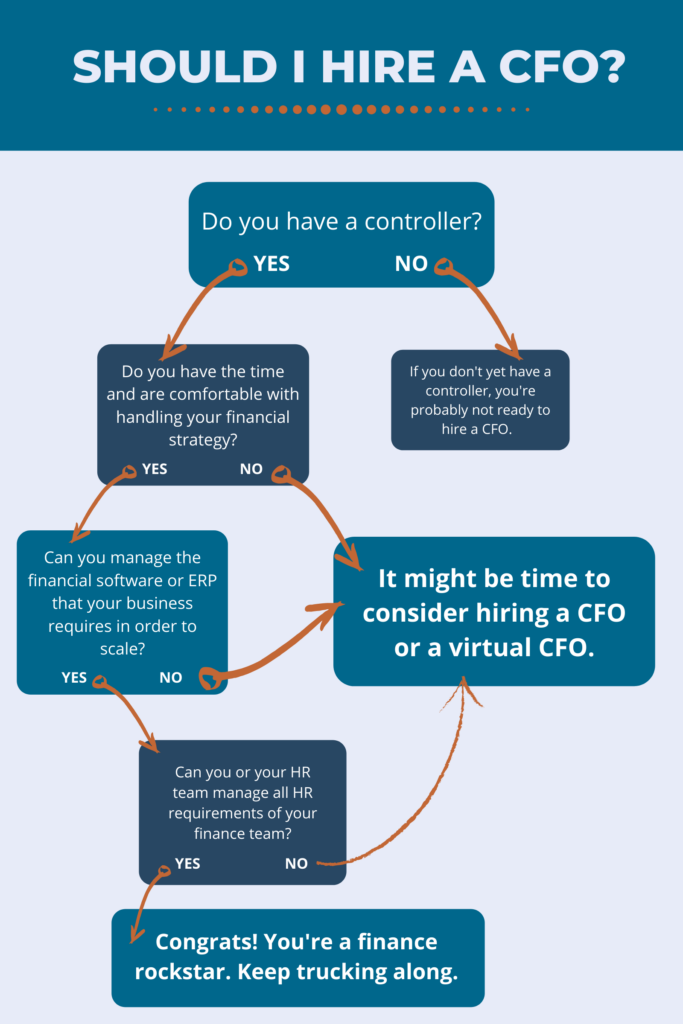

Simply put, if you don’t yet have a controller on your team, you don’t need a CFO. But let’s dig a little deeper.

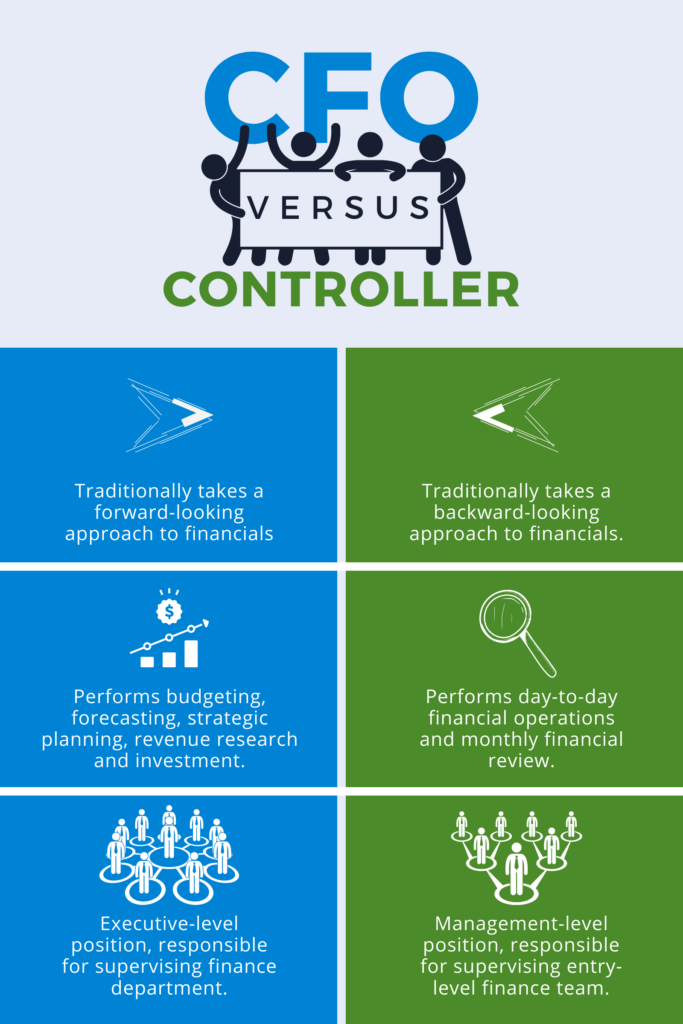

CFO vs Controller: What’s the Difference?

What is a Chief Financial Officer (CFO)?

The Chief Financial Officer (CFO) is your executive-level staff, often reporting directly to the CEO. The CFO position performs strategic analyses and is responsible for planning your financial future.

According to salary.com, the median salary for a CFO in 2022 was reported to be $420,300 in the United States.

Related Read: What is an outsourced CFO and what do they do?

What are CFO responsibilities?

Some examples of tasks that are performed by CFOs include:

- Budgeting: Building forward-looking budgets whether they are dynamic budgets or zero-based. Once you hire a CFO, the arduous task of budgeting typically falls under their job description.

- Projections, Planning and Forecasts: All forward-looking financials, like projections and cash forecasts, are usually the CFO’s responsibility. They should be a strategic financial partner for your company with a finger on the pulse of the business. A CFO should assist in knowing when the time is right to scale, grow, or reinvest.

- Performance Management, Strategy and Investing: Besides forward-thinking financial planning, the CFO often oversees streamlining financial processes. A good CFO will know how to uncover financial insight from data and run analytics to identify the key drivers on which your company should be focusing. Your CFO should also research new revenue streams. In addition to cash flow, raising capital is central to the CFO’s role. The CFO is responsible for the financial health of the company.

- Leadership: A CFO manages all finance personnel. Once you are spending more time managing your financial personnel than garnering insight from them, it’s time to hire a CFO.

Related Read: Why Business Owners Need to Know How to Forecast?

What is a financial controller?

The Controller is your reviewer of all financial and monthly reporting. The focus of the controller is generally on more historical financials.

According to salary.com, in 2022, the median salary for a controller was $240,082 in the United States.

Related Read: What is an outsourced controller and what do they do?

What are controller responsibilities?

Some examples of tasks a controller perform include:

- Financial Operations: The controller approves day-to-day financial operations and ensures that they have been executed accurately. A controller develops and maintains internal financial controls.

- Financial Review: Creating and reviewing recurring and monthly financial reports. For example, the statement of cash flows, balance sheet, and profit and loss statement.

- Leadership: A controller supervises the accounting team and reports directly to the CFO (if you have one).

Should I Hire a CFO or a Controller?

A quick way to rule out hiring a CFO is this: If you do not already have a controller, you do not need a CFO. Do you have time to handle CFO responsibilities, including managing any financial software or ERP you need? Can you or your HR team look after the hiring of your finance department? Are you competent enough to understand and improve your company’s health? If yes, then skip ahead to hiring a controller.

Should I hire a CFO?

If you do already have a controller and your finance needs are becoming more sophisticated, it may be time to search for a CFO.

A few things to keep in mind when hiring a CFO:

- With rising inflation rates our planning cycles have shifted from long-term to short-term. Finance teams need to work at a faster pace than ever before to tackle problems as they arise and prepare for inflation. Better yet, your finance teams should make a shift from reactive to proactive.

- A CFO should be prepared to build flexible or zero-based budgets as we move deeper into 2022, with some continued level of unpredictability.

- Additionally, a CFO should understand how the cash flow forecast has changed in this new environment. A dynamic cash flow forecast with linked data holds much more value than a traditional approach to forecasting using just one scenario. Ideally the CFO should know your revenue and expense ratios and plan for different scenarios: average, anemic (worst case) and awesome (best case).

- Ask your CFO candidate if they have a handle on top-down approaches or ideas for a model that can tie line items from your budget and P&L to operations.

- Instead of raising more questions with historical financials, a strategic financial partner like a CFO should drive discussion around budget variance analysis, outstanding and recurring questions, and retarget data and KPIs to matter. Or in other words, identify key drivers of growth.

- Finally, you want a CFO that understands your industry and business model. If you have ecommerce accounting needs, they should be tracking and reporting on supply chain kpis. The faster your new CFO can hit the ground running, the sooner your company will see results.

Watch: The Cash Forecast is Dead. 5 Examples of Why a Dynamic Cash Flow Forecast is Better.

Do I need a controller or a CFO?

If you don’t yet have a controller on staff, then this is the place to start. Forget about the CFO vs controller question and hiring a CFO for now. Hiring the right controller will be a great step forward to better understand your finances.

Tips for hiring a controller:

- Your controller should have a good handle on your industry and market position. The last thing you want is to feel like you are having to always explain how your business works.

- Pay special attention to your controller’s approach to problems. While a controller does typically focus on historical financials, if the candidate you are considering is only focused on pinching the bottom line, then by default, you can expect they will struggle to see the big picture. A great example is how our controller services helped Logical Media Group get accurate reporting for their gross profit margin.

- Ask the controller candidate what kind of approach they take to debt. It says a lot about how they think about finances and whether they have the ability to think outside the box.

Related Read: 8 Signs It’s Time to Switch Accountants

Follow the above guidelines to know when the time is right to hire a CFO or if instead you should hire a controller.

Are Cloud CFO Services Right for You?

Still not sure which one is right for you? Our Cloud CFO Services offer the best of both worlds:

- Our managers provide fractional controller services with the support of our outsourced bookkeeping services for your day-to-day accounting needs.

- Because our team works with a number of business models, we can offer diversified expertise that you will not normally find in a controller.

- Plus, you will have access to our CFO strategy check-ups a few times a year.

We believe this is just the right amount to fuel your growth. Many of our clients need about 10% strategy and 90% execution. Our awesome CFO service add-on offers custom accounting at a price that fits within many budgets. No short-cuts or cookie-cutter solutions.

How Much Does a Virtual CFO cost?

We save our clients both time and money. A virtual CFO can replace at least one full-time employee with additional savings in the finance department of up to 30%. See our outsourced accounting pricing tiers to learn more about our base packages starting at $1000 per month.

Get in touch to learn more about how we can take care of your controller and CFO needs.