A common question for growing companies who are considering outsourced accounting is: “What is the difference between bookkeeping and accounting?”

Bookkeeping looks after the day-to-day transactions and financial operations of a business or nonprofit. Accounting involves reviewing the accounting records and reports. This is an ongoing process to analyze and consult on overall business operations and financial health.

So in a nutshell, bookkeeping is monitoring your books on a transactional basis while accounting involves more reporting and advice based on those reports.

Bookkeeping and accounting tasks

Bookkeeping tasks may include:

- Entering expenses and income into accounting software;

- Reconciling bank and credit card accounts;

- Paying vendors;

- Maintaining records; and

- Flagging discrepancies.

Accounting tasks may include:

- Financial reporting (e.g., balance sheet, income statement, statement of cash flows);

- Financial analysis;

- Financial consultation;

- Database management; and

- Staff management.

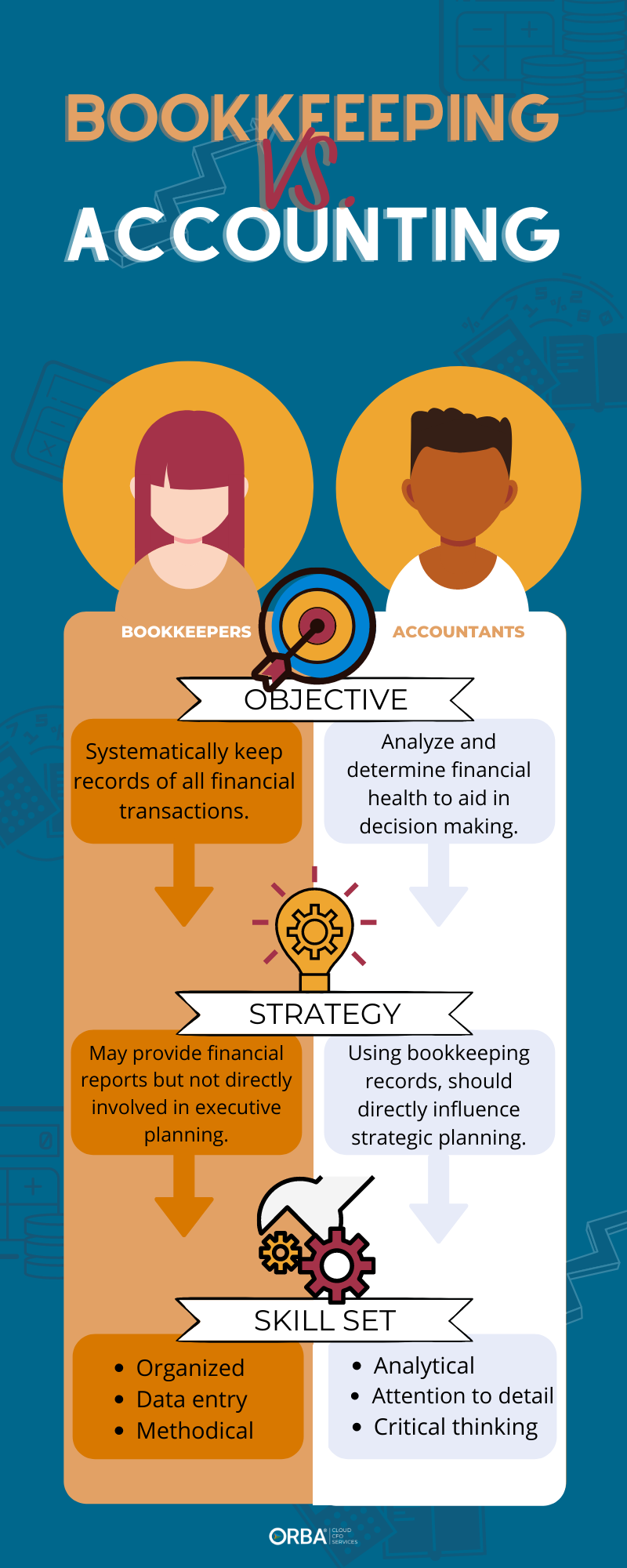

Difference between bookkeeping and accounting:

| Bookkeeping | Accounting | |

|---|---|---|

| Objective | Systematically keep records of all financial transactions. | Analyze and determine financial health to aid in decision making. |

| Strategic Planning | May provide financial reports but not directly involved in executive planning. | Using the records from bookkeeping, an accountant’s reports should directly influence strategic planning. |

| Skill Sets | -Organized -Data entry -Methodical | -Analytical -Attention to detail within a bigger picture -Critical thinking |

| Types | Single entry or dual entry | Cash or accrual, tax, audit |

| Organizational Hierarchy | Bookkeeper: Typically an entry-level finance position, reporting to a controller or accountant. | Accountant/Controller: Typically a management-level position, reporting to an executive like the CFO or COO. |

Pros and Cons of the Modern-Day Accountant: Is the bookkeeper becoming irrelevant?

In shifting landscapes, bookkeeping and accounting are beginning to overlap in function and role. With more remote work we’ve seen more cloud bookkeeping tools offer financial reporting. And accountants “perform,” or at least oversee, more day-to-day operations with the automation of accounting.

Pros

- More efficient;

- Less overhead; and

- Less human error.

Cons

- Decreased opportunity for discussion and analysis; and

- With one person taking care of both roles there’s less time for strategic planning. Action items like avoiding losses, gaining profit, reducing debt and maximizing cash can be more easily missed. That’s why many companies see the benefit in outsourced accounting services. You get the best of both worlds.

Related Read: 5 Benefits of Outsourcing Bookkeeping Services

What does an outsourced bookkeeper do?

Tasks usually included in outsourced bookkeeping:

- Managing all financial transactions in the accounting software/database;

- Processing payroll;

- Managing accounts payable and pays bills;

- Managing accounts receivable and tracks outstanding invoices;

- Performing bank and credit card reconciliations;

- Checking for inaccuracies; and

- Assisting in financial reporting.

Related Read: 3 Signs It’s Time to Hire an Outsourced Bookkeeper

What does an outsourced controller do?

For our purposes, we’ll list the tasks an outsourced controller performs. Tax and audit accountants have another very specific list of duties.

- Completes financial reporting;

- Ensures the accuracy of financial statements, like your income statement and balance sheet;

- Completes trial balance reconciliation;

- Performs monthly review of company profitability and performance;

- Assists in building budgets;

- Develops and improves internal controls;

- Provides custom financial reports;

- Reviews debt and equity ratios for debt planning;

- Collaborates with external auditors, tax accountants or other financial parties as needed; and

- Supervises bookkeeping practices.

When should you hire an accountant for your business?

Your business might benefit from an outsourced accountant if:

- your staff are short on time and you need more insight from your finances.

- you want to increase profitability or reduce debt.

- you struggle to understand exactly how your finances are affecting your operations, or vice versa.

In these instances, an outsourced controller can help.

Related Read: How do I know if I need to hire a CFO vs. a Controller?

How much does it cost to hire a bookkeeper versus an accountant?

The average salary of a bookkeeper is $44,365, according to Salary.com. The salary of an accounting manager often falls in the range of $55,000-$90,000 per year, while the average controller salary is closer to $200,000+. These accounting fees can vary a lot depending on the nature of the work performed. So how much do outsourced accounting services cost? When you use our outsourced accounting services, you pay a fixed monthly rate that fits within your budget, starting from $1000 per month. Learn more about our outsourced accounting pricing.

Related Read: Our Ultimate Guide to Outsourced Accounting Services Cost and Questions

Still not clear on the difference between bookkeeping and accounting? Get in touch and we can help decipher exactly what kind of virtual accounting services your business needs.