Forecasting. Surprisingly overlooked, hugely strategic.

This may come as a surprise. Our target market companies are making anywhere up to $25+ million in revenue per year yet a lot of them still don’t forecast. It’s one of the reasons we can offer something unique to our clients. We see their financials as part of a bigger picture: their success. That can mean different things to different companies- some are planning on diversifying or shifting business models, some are wanting to scale and some are looking to exit. And all need the forecasting to do it successfully.

What’s covered in this blog:

- Why do you need to forecast?

- How cash flow forecasting helps in decision making.

- Create a budget/forecast.

- How to build a cash flow forecast.

- Reviewing a budget/forecast.

- Changing a budget/forecast.

Why is cash flow forecasting important for business owners?

According to U.S. Bureau of Labor Statistics, over 20% of small businesses fail in their first year and about half survive after five years. Of those that fail, 29% report failing because they ran out of cash.

Over 20% of small businesses fail in their first year and about half survive after five years. Of those, one-third report failing because they ran out of cash. Be like the other 71% and use cash flow forecasting.

Source: U.S. Bureau of Labor Statistics

If you’ve been apart of a budgeting roundtable with me, you’re familiar with my race car analogy- think of your business like a race car. If you’re only looking in the rear-view mirror (a.k.a. using backward looking financials) you’re not likely going to win any races, or in this case you’re more likely to end up in that 29% of businesses who fail because they ran out of cash. Ultimately forecasting is about taking a proactive approach to your business:

- It’s how you monitor and manage cash flow.

- You can spot both opportunities and risks.

- It provides the chance to plan for both supply and demand needs.

- Understanding when and how a new hire might affect cash flow.

- It’s essential in introducing a new service or product.

How cash flow forecasting helps in decision making.

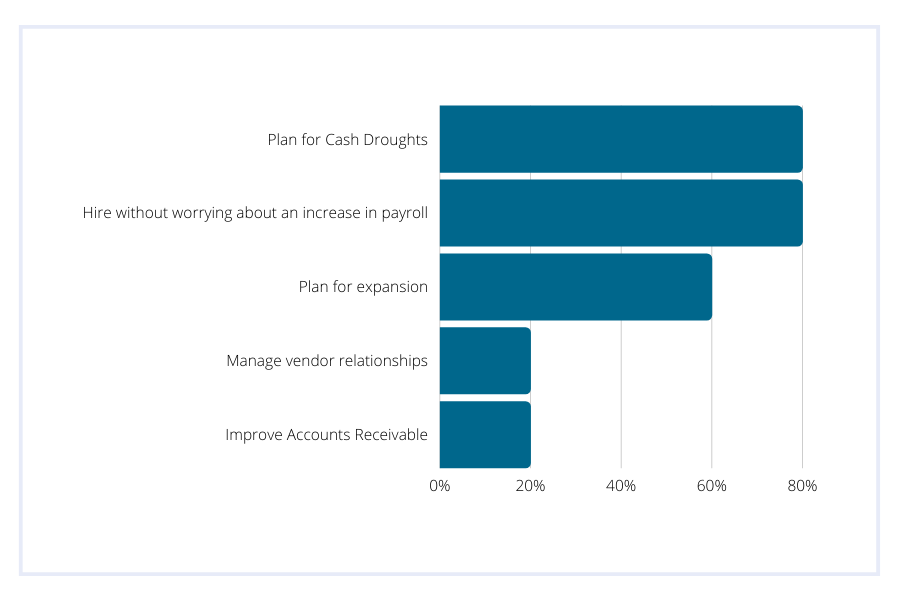

We polled our readers, and the top two reasons business owners performed regular cash flow forecasting: to prepare for cash flow droughts and to hire without worrying about how that might affect their cash.

How do I forecast for my business?

Budgeting and forecasting should go hand in hand. A budget is what you create one time for the year and you never change it. It’s your stake in the ground. Your forecast is driven by your budget; without it, you wouldn’t be able to accurately forecast.

Create your budget/forecast.

Just the process of creating a budget and a regular forecast holds incredible value.

It forces your team to sit down and think about what is in the pipeline for your company. Going through the budgeting process provides a deliberate time to strategize without getting sidetracked by the daily undertakings. It gives your team the space to really think about how you’re going to hit the targets you set.

Those goals are great but only if you have a tangible strategy in place for how you plan to achieve them, e.g. here’s how we plan to hit x number of customers by this date. You’re likely going to be wrong, but it’s not about having a perfect forecast, it’s about creating valuable conversation.

Begin by discussing your key assumptions based on the cash flow you expect then nail down your costs and drivers. Be clear about the purpose of the forecast and how it will be used.

Best Practices for Creating a Financial Forecast:

- Include all departments.

- Use top-down goals with bottom-up drivers.

- Be detailed about the line items that matter.

- Link your expenses to revenue and know your growth ratios, e.g. hire one person for every four new clients.

- Bridge your daily operations to your long-term financial goals, e.g. digital cost-per-action, daily prospect touches by your sales team, customer usage frequency etc.

How to Build Your Cash Flow Forecast

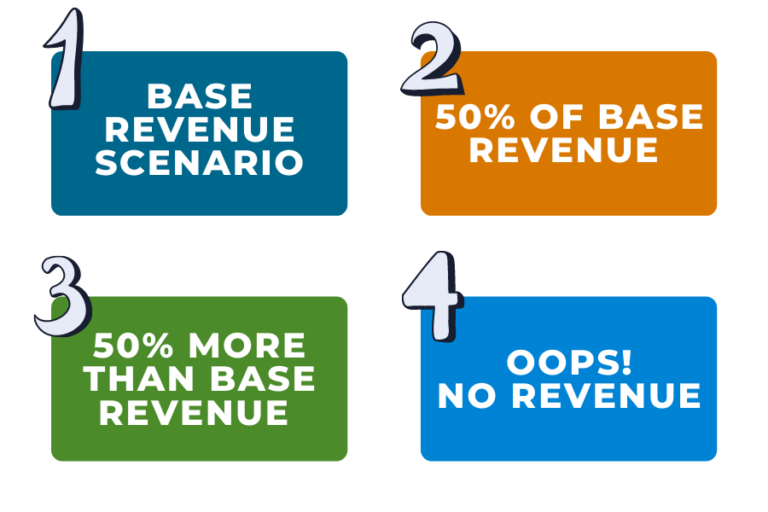

Forecasting should be a combination of accrual and cash-based predictions, based on where your company stands as of the prior month-end close. Follow these steps to build your cash flow forecast:

1. Add cash inflows:

Historical sales numbers are a good place to start, but only tell part of the story. Outline a realistic sales pattern and tie any delays to your forecast for income.

Predict when your current A/R accounts will pay their invoices and build those into the “A/R Collections” line. But don’t confuse cash with revenue. It is helpful to show your projected revenue for each month, but make sure that your ending cash balance formula does NOT include the total revenue (because it already includes the cash collections total).

2. Add cash outflows:

Tie your cash outflows to your forecast for expenses.

3. Add factors that change the movement/timing of cash:

As a rule, you should go through every line item of your balance sheet and think through whether it has an impact on cash. It’s important to understand how different liability and asset accounts vary and will impact overall cash flow.

Examples of assets and liabilities and their effect on cash flow forecast:

Asset example 1: Say you prepay for an annual liability insurance policy, and you make an adjusting entry to expense a portion of this policy each month, show the same number as your adjusting entry as a positive number each month.

In this scenario, the sum of the line should tie out to the balance of the prepaid expenses as of the end of the current month.

Asset example 2: If you have a rental deposit that is partially credited to your account in the month of lease renewal, show the amount being credited as a positive number in the month it will be credited.

In this scenario, the sum of the line should tie to whatever your ending balance will be on your balance sheet by the date of the end of your forecast.

Liability example 1: If you have accrued expenses that will be paid out during the term of your forecast, show the amount of the payout as a negative number in the month(s) during which it will be paid.

In this scenario, the sum of the line should tie out to the balance of the accrued expenses as of the end of the current month.

Liability example 2: Say you collect tuition deposits at the beginning of the year and have to pay these back as students complete their program, show a negative number for each payback in the project month of the payout to students.

In this scenario, the sum of the line should tie out to the balance of the refundable tuition deposits liability balance as of the end of the current month.

4. Accounts Payable:

- Map out when you anticipate outstanding bills being paid.

- Bill payments should be shown as a negative number.

- The sum of your A/P Payback line + your A/P detail total should = 0 if this is built properly (assuming all bills will be paid before the end of your forecast).

5. Line of Credit:

- Draws from a business line of credit (LOC) into a checking account should be recorded as positive numbers (cash in).

- Payback of the LOC should be recorded as negative number (cash out).

6. Depreciation and/or Capital Expenditures

- Tie each forecasted month to your actual forecast for these items. This should be a positive number.

7. Net Profit

- Include your revenue to expenses (net operating income) on this report for reference and to help tie it to the statement of cash flows.

Ending Cash Balance = Starting cash balance + cash in – cash out + sum of change in net assets.

Remember, it’s helpful to review projected revenue, but make sure that your projected ending cash balance does not include the projected revenue. If both are included, cash will be getting double counted.

Reviewing your forecast.

Stripping away all the jargon, your forecast is essentially taking your budget multiple times a year (monthly, quarterly etc.) and updating it. The faster your company is growing the more often you’re forced to update it. Again, each time this happens your team should sit down together and think about the future of your business, its growth and how to plan for it. The goal of reviewing your forecast is to create strategic conversation.

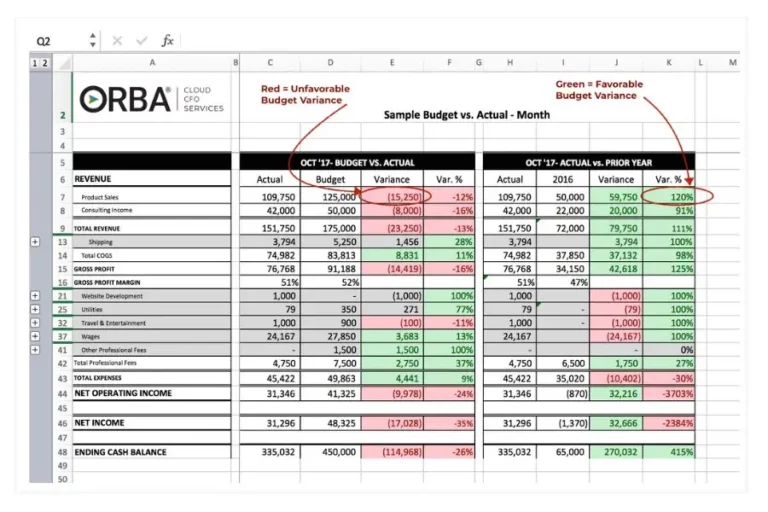

If you look only at the P&L on the left, it looks pretty good with a 10% increase in net operating income. But, if you compare it to your stake in the ground- the budget- all of a sudden you see this business spent the same amount on personnel and ended up with half the amount of income they expected. They spent more on product than budgeted, then cut down on personnel just to show a profit. That is the exact opposite of positioning yourself to grow.

Some inaccuracy in forecasting is expected but if you’re way off it forces you to ask questions, e.g. why aren’t we hitting the revenue goals we set? Do we need to shorten sales cycles, raise or lower prices, automate tasks etc.? This review process forces dialogue with your marketing or sales teams and various other departments. Decide as a company what size budget variance you are comfortable with and then set category-specific targets.

Related Read: Financial Projections: 3 Mistakes You’re Making and How to Fix Them

Changing your budget/forecast.

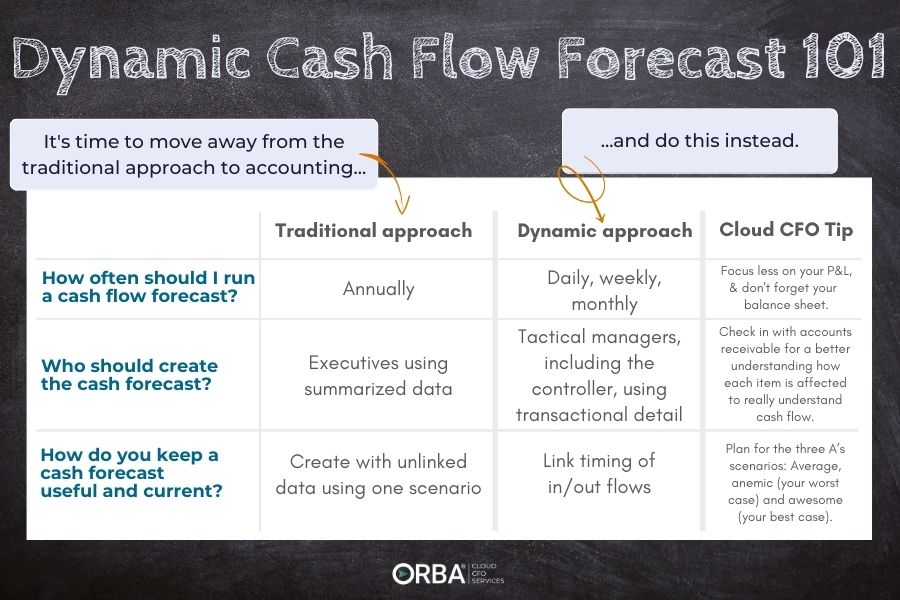

By reviewing your forecast and monitoring operational KPIs you can adjust if you run into any of these common cash flow problems. Compare actuals to budget and forecast to budget, then revise assumptions or tighten up operations as needed. These days dynamic cash flow forecasts allow high-growth businesses to maintain a more nimble approach from month-to-month.

The point of your forecast is to drive a forward-looking approach and drive change through daily or weekly review. But it needs to be a tangible, daily goal, e.g. the sales team should call 50 people each day. If you’re only using monthly financials then you will always have a lag in response.

Here’s the bottom line: a lot of companies don’t forecast. But those who do are automatically putting themselves in a better position to grow. Don’t have time to create your own forecasts? You need a CFO.

Our outsourced CFO services can offer just the right amount of CFO strategy without the executive salary. Learn more about our pricing tiers.