If you’re reading this, chances are you’ve got a few things on your plate right now. It’s likely that you’re feeling overwhelmed or even confused by your finances. Perhaps you’re growing faster than you anticipated and are worried that growth is not sustainable. But, you’re not entirely convinced that you need a full-time CFO. Here’s how to know if it’s time to hire a virtual CFO:

What’s covered in this blog?

- 3 signs it’s time to hire a virtual CFO

- What does a virtual CFO do?

- How much does a virtual CFO cost?

What does a virtual CFO do?

A virtual CFO is an experienced financial expert, outside of your own company, who provides fiscal & operational guidance. The role has a variety of titles (Virtual CFO, Outsourced CFO & Fractional CFO) but each provides the same solution; complete financial guidance at the fraction of a full-time CFO salary. Our virtual CFOs look after:

- Budget planning

- Budget variance analysis

- Financial reporting (income statements/P&L, balance sheets and cash flow statements)

- Financial forecasts and projections

- Debt planning

- Cost management

- KPI tracking and analysis

- Financial planning and strategy

- Exit strategies

If you opt to hire a virtual CFO they should adapt to your business needs without the full-time commitment of another executive. But a virtual CFO should not simply be an accountant. A good virtual CFO should be a strategic partner enlisted to help smooth business operations and protect your assets, so you can grow in a sustainable, profitable way.

How to Know if You Need to Hire a Virtual CFO

Here are some common things that clients are looking for when they want to hire a virtual CFO:

- better financial insight

- getting their books caught up

- regular and accurate reporting

- bookkeeping and accounting management

- financial planning and analysis

- KPI tracking and reporting

- accounting technology oversight

Many entrepreneurs know this is what they want. But aren’t sure when the right time is to make the jump and hire a CFO. Here’s what I tell many small to mid-size businesses: you need about 10% strategic insight and 90% execution. Before you hire in-house and find yourself paying a salary over $300K, check first to see if your needs would be met by hiring a fractional CFO. Here are 3 signs it’s time to hire a virtual CFO:

1). Time is elusive but you know cash is king.

Time is money. And as the CEO or COO, you don’t have time to learn how to put your financial reports to work. This is when you should bring in an expert to look after all your finances. In fact, a good virtual CFO should be able to provide financial strategy, projections, modeling and investor reports. Additionally you can expect even a fractional CFO to make accounting processes more efficient. When you hire a virtual CFO it frees up your time to focus on operations or business development.

Quick Time-Saving Tip:

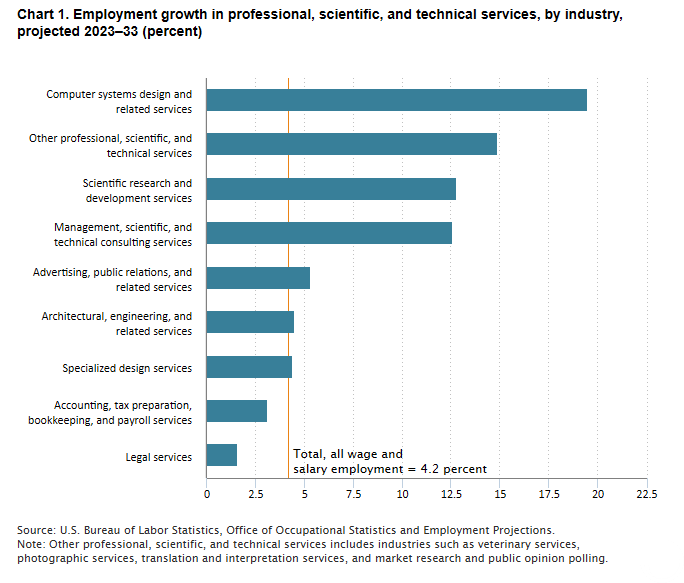

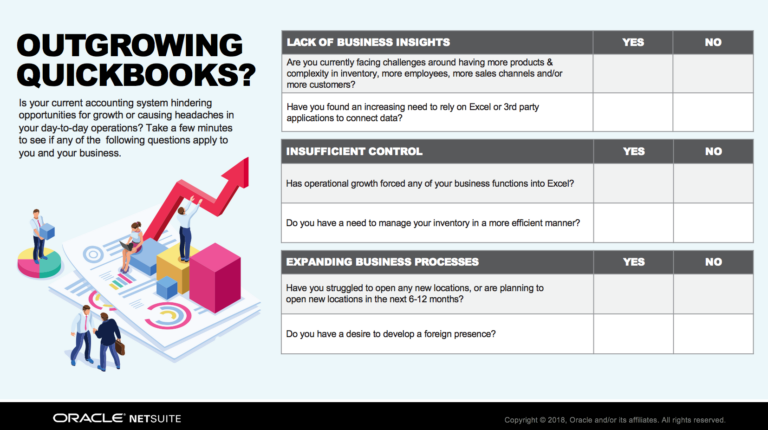

Move your accounting to the cloud for anytime, anywhere access. Many cloud solutions and ERPs like NetSuite also have a phone app that lets you see real-time dashboards. Learn more about the difference between NetSuite vs QuickBooks.

2). QuickBooks doesn’t offer the custom reporting you need.

When you need a real person to give sound financial advice about things like pricing strategies, inventory turnover, or equity and debt health, it is time to hire a virtual CFO. They might work remotely, but they are real people looking after your books. For example, QuickBooks can’t tell you when to scale at the appropriate time or offer consolidated reporting for companies with multiple entities.

You need monthly reports that measure and identify key growth drivers to support your business plan as a whole. Once a company has outgrown QuickBooks, it simply will not provide you with the in-depth financial information you need. A virtual CFO is your on-demand answer.

Quick Financial Analysis Tip

For a better financial breakdown, use cohort analysis whenever possible so you can isolate the main drivers behind an improving key performance indicator (KPI).

3). Cash is Exactly What it Sounds Like…Cash, Right?

If only it were that straightforward. Cash is not simply the money your business makes. Depending on whether you are operating in the black or red, your free cash flow could either be an enticing carrot or a warning sign for investors. If you’re consistently running into cash flow issues or you don’t know what to do with any surplus of cash, it’s pretty clear it’s time to hire an expert, aka a virtual CFO. Or, if your business is not profitable, a virtual CFO will monitor your cash flow, help manage your assets, implement a strict accounts receivable cycle and mitigate your risks with internal controls.

Quick Cash Management Tip

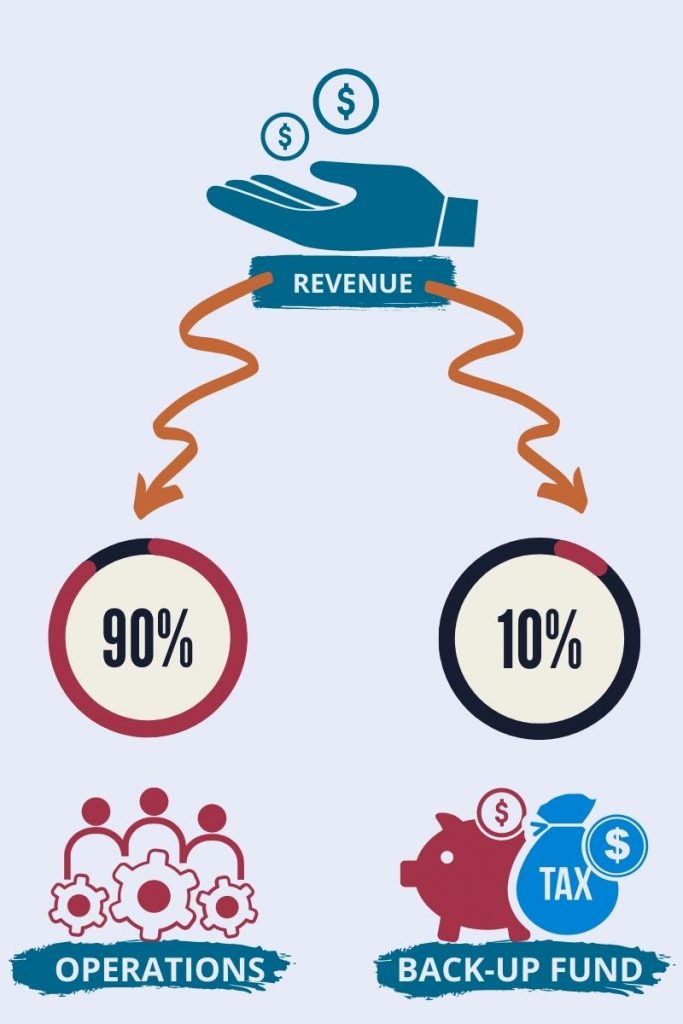

Take a small portion, 10%, of your monthly revenue and set it aside. Take the majority, or other 90%, and sit down with your virtual CFO to draft a budget for how that revenue is spent on operational costs. With the 10% that you are accruing, you have a nice back-up fund for things like taxes, paying off debt or simply growing it as savings for future reinvestment.

You want to save money on an in-house CFO.

Speaking of 90/10, I’m going to refer back to my earlier statement about what most businesses need which is 90% execution and 10% strategy. I’m referring to companies in the $5-$50 million in revenue range. If you go out and hire an in-house CFO but don’t have the processes in place to run the day-to-day accounting needs then you are, quite simply, wasting a C-suite salary.

Related Read: For tips on how to hire the right virtual CFO, check out CFO vs. Controller: Which one should you hire?

How much does it cost to hire a virtual CFO?

Hiring an in-house CFO salary could easily cost you over $315,000, according to salary.com. Hiring a virtual CFO on the other hand can save you money compared to hiring a full-time CFO. Learn more about our outsourced accounting pricing: and the standard fractional CFO rates designed to fit within many budgets, starting at $4,000 per month.

Ready to add a strategic partner to guide your sustainable growth? Click here to book your free consultation today.