When pricing your product, do lower costs to lower prices, but do not forget to overlook value.

From freemium to premium and tiered to flat-rate there are a number of things to consider. First, find your optimal pricing strategy and then consider the appropriate pricing model. Once you’ve nailed those down, follow our do’s and don’ts of pricing your product to ensure you’ve optimized your price.

How to Set Your Prices

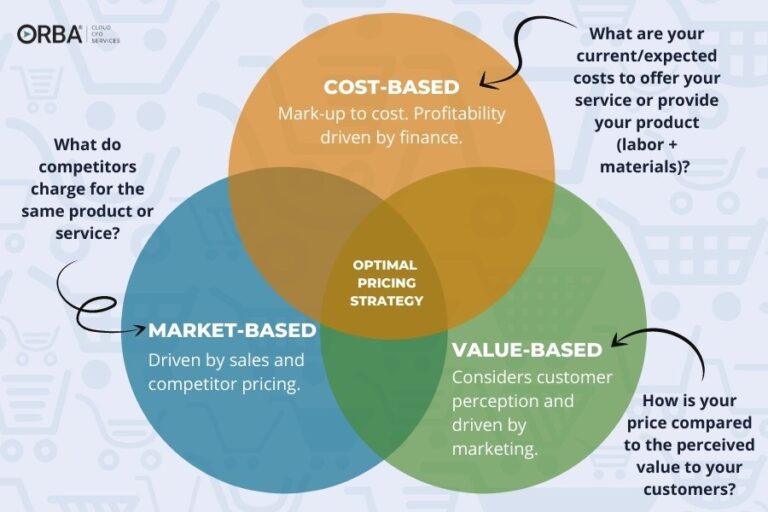

To find the ideal price-point, plan to include your finance, sales and marketing teams. By including each of these departments you’re ensuring actionable steps from the bottom up.

The 3 key approaches to price a product:

Cost-based approach: look at your current/expected costs to offer your service or provide your product (labor + materials) and mark it up by a certain %. Driven by your finance team. (Hey there, that’s us!)

Market-based approach: what do competitors charge for the same thing? Driven by your sales team.

Value-based approach: how is your price compared to the perceived value to your customers? Driven by your marketing team.

Cloud CFO Tip: 80% of your effort should be spent on revenue and key variable costs. The best pricing strategies maximize profit and revenue.

6 Factors to Consider When Choosing a Pricing Model

- The Value Metric: Will you charge by user or by feature?

- Time: A more complex model often means more time and resources that you will have to account for within the price you set.

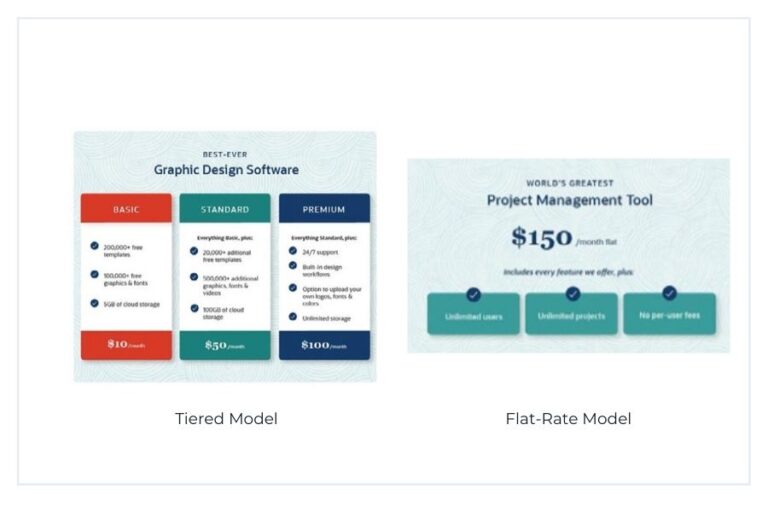

- Product: If you can upsell your product or service easily, you might want to consider a tiered model with add-ons over a flat-rate model. Depending on what you sell, marrying two models in a hybrid pricepoint may offer the best of both worlds. For example, a fixed-rate monthly rate with overage options.

- Customer Base: What is your customer persona and how do they like paying? Do your research.

- Competitors: Can you fill a gap that is not currently met by competitors?

- Financials: At the very least your pricing model needs to cover both fixed and variable costs.

From freemium to premium, you have to decide what is right for your company, your product and what fits industry standards. And let’s be honest, if we’re digging into everything there is to be said about pricing strategy then this should be an ebook not simply a blog. But, there are a few things that are universal, no matter which pricing scheme you choose.

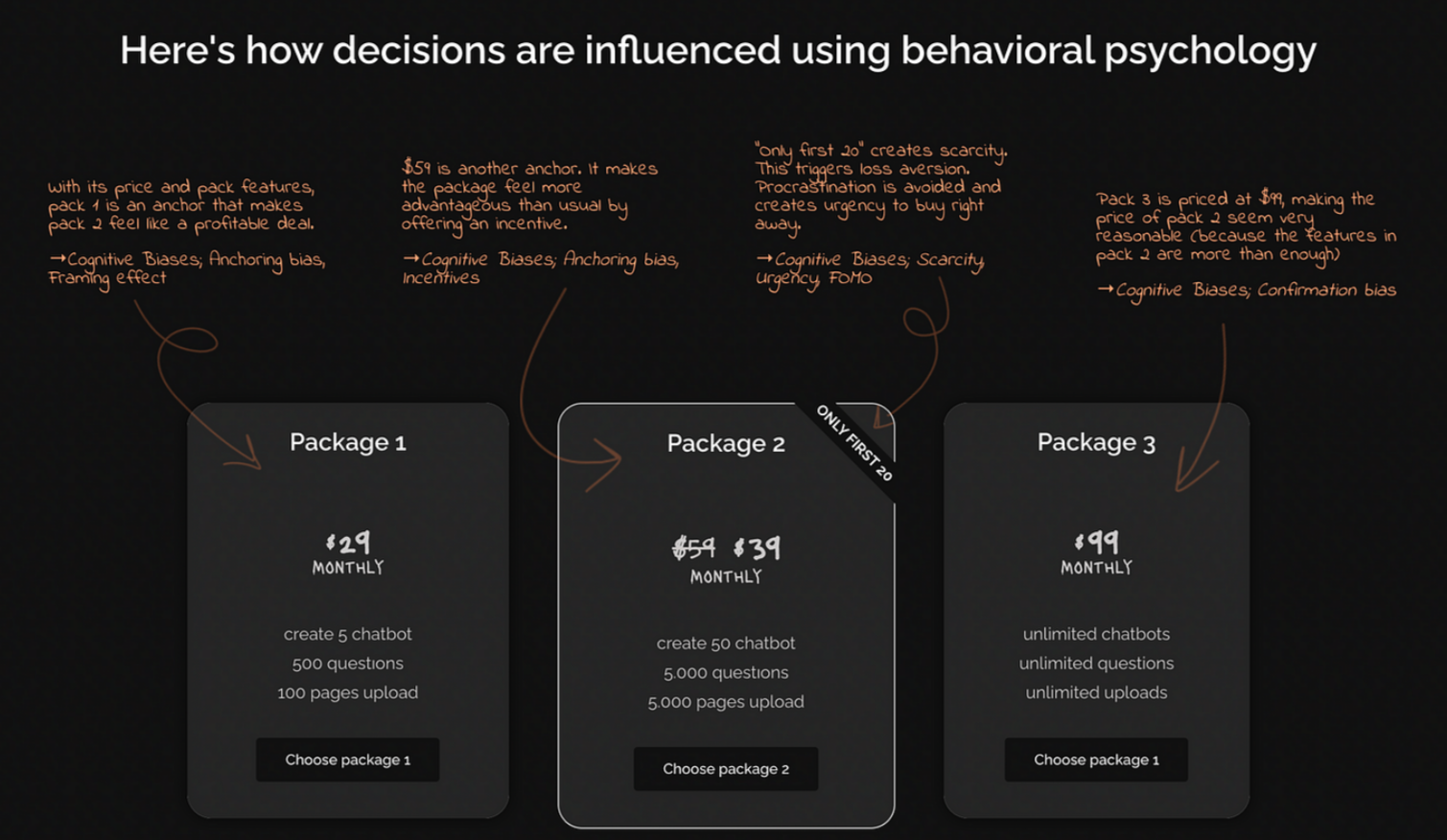

Here’s a great example:

You can read more details in his article, but what Sanlav is pointing out here is to:

- Use Package 1 as an anchor for cognitive bias

- The regular price of Package 2 acts as anchor number two

- The “Only first 20” banner creates demand for a seemingly scarce deal, 100% aimed at all you suffering from FOMO

- Package 3 is priced higher which helps Package 2 seem very reasonable hitting that confirmation bias

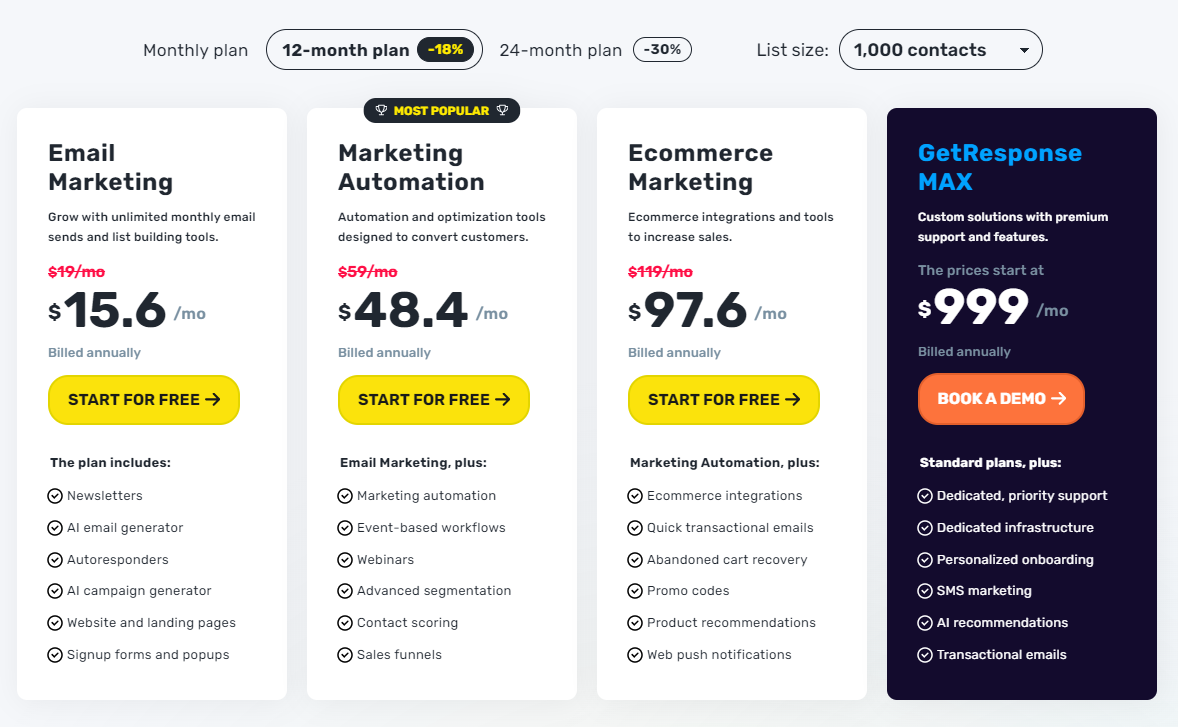

Run through this example below and see if you can find the anchors for cognitive bias, FOMO (or bandwagon effect) and confirmation bias:

The Do’s.

When pricing your product, do:

Make Sure Your Price Covers All Costs

This may seem like a “duh” statement, but all too often, we see clients that do not account for all costs when determining the appropriate price for their product. This means both fixed and variable costs. Think about staffing, marketing and overhead, not just material costs. Know the appropriate markup to meet your profit margin goal. Our outsourced controller services offers financial reporting to better understand your full costs.

Lower Costs to Lower Prices

Remember that the best way to offer lower prices is by lowering your costs. As you become a more efficient machine, you can look to lower your prices, if that seems appropriate for your market.

Consider Raising Your Prices

Sometimes it is absolutely appropriate to raise your prices. In fact, in order to prepare your business for inflation there has never been a better time. William McEwen, author, PhD in Communication and a Global Practice Leader at The Gallup Organization points out, ” if you can be the company that doesn’t raise prices, that would seem to be a competitive advantage, but it might knock the hell out of your ability to compete in other ways.”

Related Read: How to write a price increase letter (with examples)

Perform Market Research

Do you have a 500 percent profit margin when most of your industry peers are offering 300 percent? This is crucial research to do ahead of time and to review periodically to ensure you are competitive in your market. Don’t forget to also review prices when there is any inflation or recession in the economy or if you are entering a new market.

Related Read: Pricing in a Pandemic: Flexibility Over Lifetime Value

The Don’ts.

When pricing your product, don’t:

Ignore Your Cash Flow

Your necessary optimal cash flow should be paramount in determining what your price point will be. Because, as our outsourced CFO services would suggest, your free cash flow is the number one metric to impress investors.

Forget to Review Your Prices Periodically

Make sure you are meeting your financial goals. Occasionally, it may be time for a price increase. If you have a surplus of inventory, then maybe it is time to offer a sale. Do market research again. Some questions to consider.

- What are your competitors offering?

- How often do your competitors offer sales?

- Has the demand for your product increased or decreased?

- Are your customers making money from your product?

- Have your target demographics altered in any way?

- Does it make a difference what pricing model you choose?

Overlook Value

Define your value proposition and ensure it’s tied to your financial strategy. If your product is comparable to your industry peers, then it makes sense to price your product similarly. But maybe your product offers more value than the competition. If that is the case, your price should reflect that.

For more help choosing a pricing model or tracking your costs, contact us to learn more about our custom outsourced accounting services.