Is the Labor Market Finally Stabilizing? What Business Owners Need to Know

If you’ve been navigating the ups and downs of hiring, payroll, and employee retention over the past few years, you’re not alone. Since the COVID-19 pandemic, employers have faced a rollercoaster of labor market disruptions—ranging from talent shortages and wage inflation to high turnover and volatile productivity trends.

But there’s some good news on the horizon: the U.S. labor market is showing signs of stabilization. For business owners, especially those seeking to control costs and improve operational efficiency through outsourced accounting and financial strategy, understanding where the labor market is headed is essential for smarter planning and sustainable growth.

Key Signals the Labor Market Is Stabilizing

Several data points suggest we’re entering a more predictable phase in the labor economy—albeit one that still requires careful navigation:

1. Voluntary Turnover Is Declining

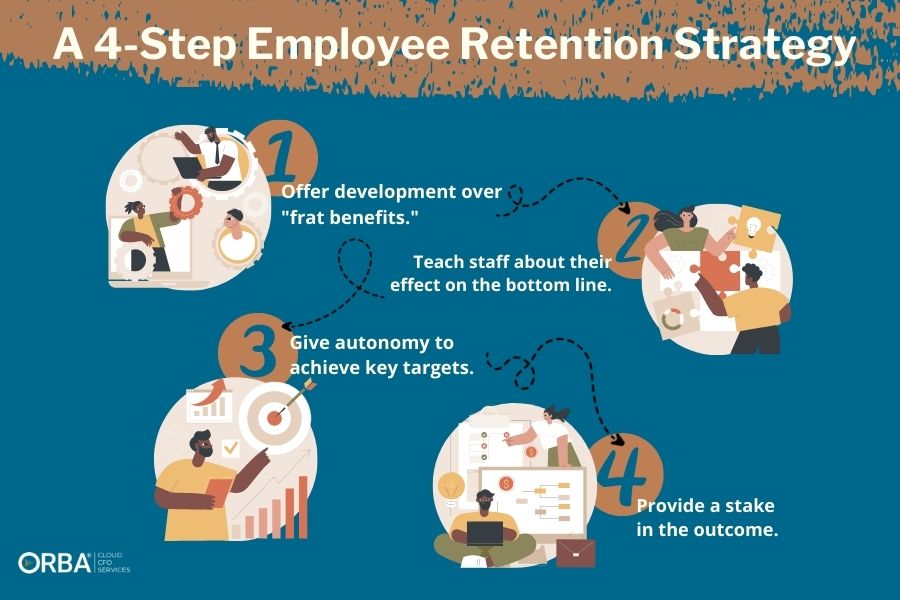

The “quits rate”—a strong indicator of worker confidence—has dropped from its 2022 high of 3.0% to 2.0% in early 2025. At the same time, job openings have declined by more than 4 million from their peak. This means fewer people are leaving jobs for better offers, and businesses may find it easier to retain talent without being forced into costly bidding wars.

2. Switching Jobs Doesn’t Pay Off Like It Used To

In a notable shift, early 2025 wage data shows that employees who stay in their current roles are now seeing slightly higher wage growth than those who switch jobs. This reverses the trend we saw during the Great Resignation and signals a cooling in the job-hopping premium, giving employers more room to negotiate reasonable raises and maintain payroll stability.

3. Macroeconomic Uncertainty Is Tempering Pay Raises

Geopolitical risks, fluctuating interest rates, inflation concerns, and tariff-related tensions are making business leaders more cautious about locking into aggressive long-term compensation packages. Many are prioritizing financial agility—a strategy that aligns well with the benefits of outsourcing accounting functions to firms that provide flexible, data-driven support.

4. Technology Is Easing Labor Pressures

Generative AI and automation tools are starting to reduce labor demands in certain roles, especially in administrative, financial, and analytical functions. While not eliminating jobs outright, this trend is helping some organizations reduce reliance on additional headcount and avoid costly wage escalations.

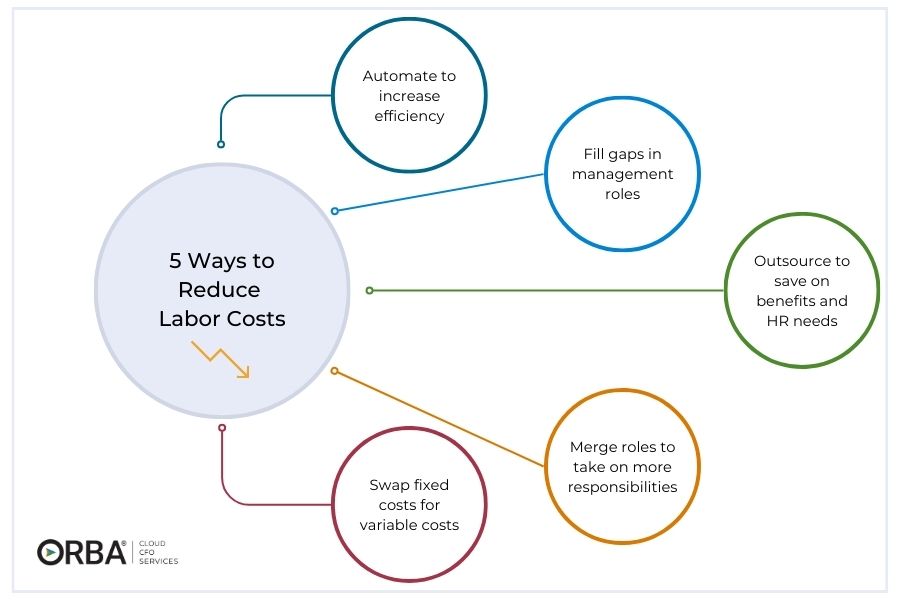

Related Read: 5 Tips to Reduce Labor Costs

Demographic Shifts That Will Reshape the Talent Landscape

While economic indicators point to short-term stabilization, long-term labor trends are being shaped by powerful demographic forces:

- Accelerated Baby Boomer Retirements: Millions of experienced professionals are exiting the workforce—and they’re not coming back. This mass retirement is the largest sustained workforce departure in U.S. history.

- Declining Birth Rates: For over a decade, U.S. birth rates have been below the level needed to replace the current workforce, shrinking the talent pipeline and putting pressure on future hiring efforts.

- Immigration Volatility: Immigration has historically helped offset domestic labor shortages. However, political and regulatory uncertainty continues to limit its ability to fill the gap consistently.

Together, these trends suggest that talent scarcity will become a structural issue, not just a temporary challenge. Business owners will need to plan accordingly—especially when it comes to compensation, workforce planning, and operational efficiency.

Forecasting Wage Growth: What to Expect

Based on current trends, most economists anticipate average annual wage growth of around 4.0% through 2032. That’s higher than the pre-COVID average but well below the rapid increases seen during the labor market’s post-pandemic overheating.

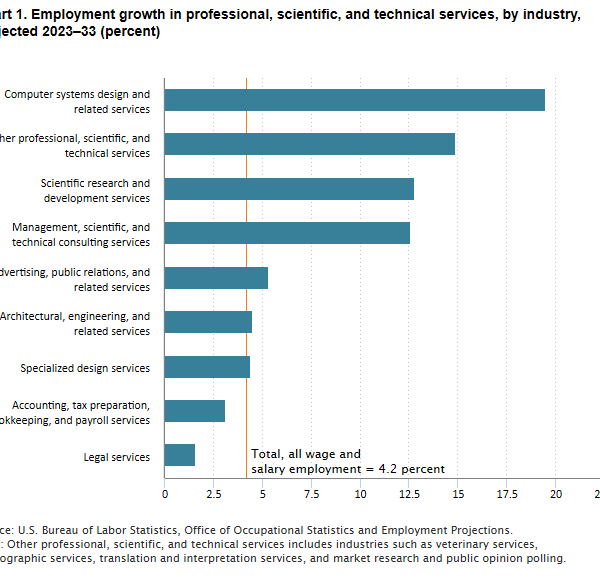

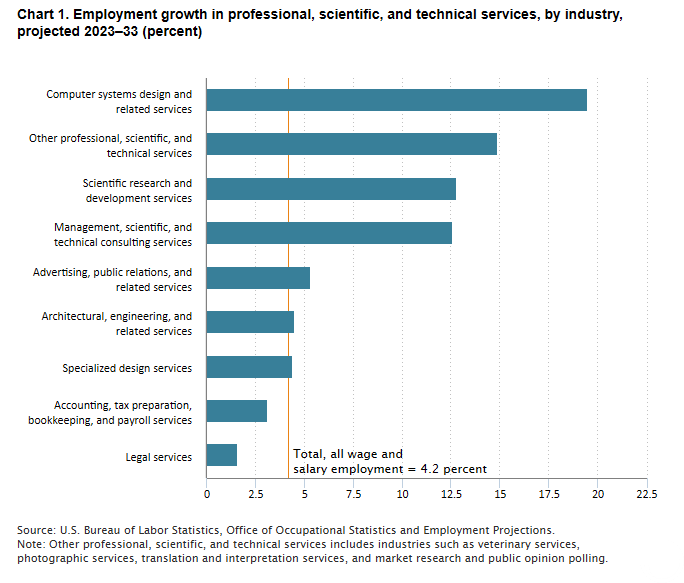

However, this average masks considerable variation by industry and role:

- High-demand sectors like professional services, sciences, and IT may continue to see wage pressures of up to 10.5% over the next decade.

- Commoditized roles in admin support, clerical work, and customer service may experience slower wage growth, closer to 2–3%.

For business owners, this variability means that compensation strategy must be industry-specific, data-informed, and regularly revisited to ensure competitiveness and fiscal responsibility.

Why Compensation Strategy Should Be a Core Part of Your Financial Planning

Rather than chasing the market or making reactive pay decisions, you can take control with a forward-looking compensation strategy.

An outsourced CFO or accounting partner can help you:

- Benchmark current compensation across roles and regions

- Build salary bands aligned with long-term business goals

- Model wage growth scenarios based on labor forecasts

- Integrate workforce planning with broader budgeting and cash flow management

- Improve retention by aligning pay with performance, value, and market expectations

How ORBA Cloud CFO Can Help

At ORBA Cloud CFO, we specialize in helping business owners optimize labor costs while improving financial clarity. From real-time payroll insights and budgeting to strategic compensation planning, we support your organization with tools, data, and expert guidance.

Let’s work together to build a workforce strategy that’s competitive, compliant, and financially sustainable—now and in the years ahead.

📩 Schedule a consultation today to learn how outsourced accounting and CFO services can streamline your back office and help you navigate a rapidly evolving labor market with confidence.