How much do outsourced accounting services cost and other answers to your questions about fractional CFO services

Guide to Outsourced Accounting Cost & Benefits

Is it time to scale up your finance team or switch accountants? In this guide, we break down the pros, cons and the costs of outsourced accounting services.

Quick Links

- Pros of outsourced accounting services

- Cons of outsourced accounting services

- Outsourced accounting services cost & pricing comparison

- How do outsourced accounting services work?

- 17 questions to ask an outsourced accounting service

What do outsourced accounting services cost?

Typical outsourced accounting services cost vary wildly, $500 to $5,000+ per month, depending on the services included in the offerings. We advise against cost being your main determining factor. I know what you’re thinking. An accounting firm that’s suggesting I disregard cost?? Instead, think of how much you are getting for the investment and ensure the firm you pick is experienced in your field. ORBA Cloud CFO offers outsourced accounting services in a wide range of fields from: Cannabis accounting, ecommerce accounting, NetSuite accounting & more!

We offer 3 pricing packages at ORBA Cloud CFO services:

- Base Package: $2,000 per month

- Includes a dedicated team, monthly financial reporting & improved financial insight

- Core Package: $3,500 per month

- Includes all base package offerings + weekly check-ins with our team, payroll services, bill pay & general ledger/chart of accounts coding

- Core + Outsourced CFO Package: starting at $5,000 per month

- Includes everything in the Core package + CFO KPIs & metric analysis, budgets, cash flow forecasts and more!

- Core NetSuite Accounting Package: starting at $4,500 per month

- Includes everything in the Core package + NetSuite licensing and dashboard customizations. Learn more about our NetSuite pricing.

While many companies express concern at the costs, the benefits of a fractional CFO make up for it and in the end, you will see that on your bottom line. Learn more about what’s included in our outsourced accounting pricing.

ORBA Cloud CFO is helping us really understand our cash flow. We’ve set a big revenue goal this year, and we want to make sure that we are on track to meet that. Understanding… our profitability across our different service offerings has been paramount to how we can grow the business.”

Lindsay Wilson, Ink Factory

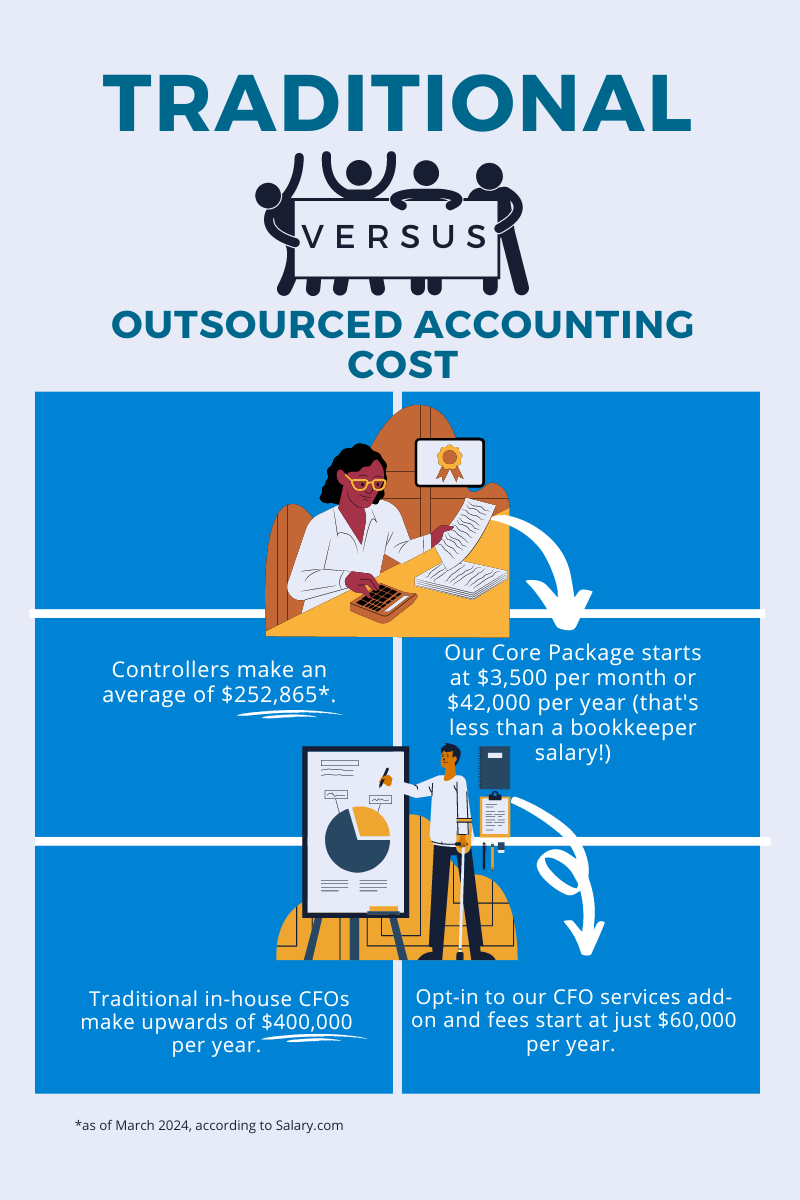

The infographic below is a quick guide to break down what outsourced accounting services cost compared to a traditional in-house finance team.

For the mid-market company, the pros outweigh any cons with notable savings when you compare the cost of an outsourced accounting service to hiring in-house accountants.

Common outsourced accounting tasks

Some of the outsourced accounting tasks you can expect from a well-reputed service include:

- Accounts Payable & Receivable

- Journal Entries and Chart of Accounts oversight

- Payroll execution

- Monthly reconciliations and month end close

- Monthly financial reporting

- Controller review

- Financial planning and analysis

- Budgeting and cash flow forecasting

- Audit review and prep

What are the pros of outsourced accounting services?

Here are 10 benefits to outsourced accounting services:

1). 360-degree accounting

Depending on the outsourced accounting firm, they can offer accounting services to meet your stage of growth, from outsourced bookkeeping to CFO-level strategy.

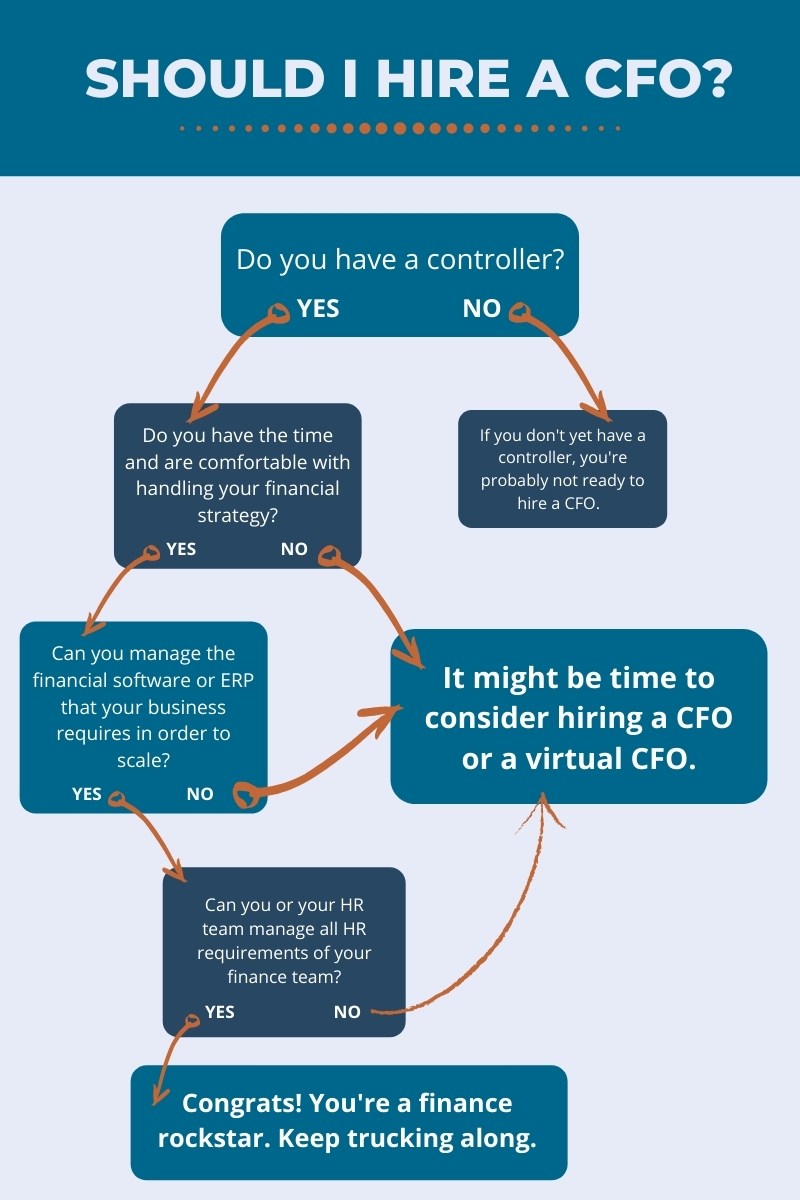

2). CFO strategy for less

Understand where you stand and where you need to go. The cross-industry experience will bring an array of expertise and relevant strategy to your business. In my experience, for companies in the $5-$50 million in revenue range, what they really need is about 10% strategic insight and 90% execution. If you don’t have the finance team to roll-up their sleeves and look after the day-to-day needs, you’re not ready for an in-house CFO. Instead, you might benefit from an outsourced CFO.

3). Savings

Even with the monthly outsourced accounting cost, our clients see savings equivalent to the cost of one full-time employee plus an additional 20-30%. Plus with our business partners our clients can see additional savings in software and accounting ERPs like NetSuite. Investing in corporate finance team training also maximizes these savings, enabling teams to leverage NetSuite’s features effectively for streamlined financial operations.

4). Easy onboarding

Established firms should have a seamless onboarding process for transitioning to their services because if they have a decent client roster they will have done this a few times.

5). Reduce your HR headache

No more worrying about hiring for your financial back office or the growing accountant shortage. We manage your financials and our team. Add to that, the lasting effects of the Great Resignation, and it’s not an ideal hiring market to bring on an in-house accountant.

Related Read: 5 Ways Outsourced Accounting for Small Business Can Help with the Accountants Shortage

6). Improved financial reporting

Established systems in place to provide accurate and reliable financial reporting.

7). Automation & Partnership Discounts

Outsourced accounting services often have partnerships with vendors to automate and improve your accounting cycle at a savings which is typically passed on to you. This increases the workflow efficiency while further decreasing your costs.

8). Risk management

With an established firm you can (and should!) expect a certain amount of risk management and security. This becomes especially important for those industries like nonprofit accounting services or cannabis bookkeeping & accounting services who require specific record-keeping in preparation of tax time each year.

9). Avoid common pitfalls

Having someone (aka an outsourced accountant) who’s gone through a few rounds with many other businesses can help you avoid common pitfalls that you might otherwise miss.

10). Save time

With an expert team looking after your books, you can focus on what matters most to you in your business whether it’s product development or connecting with customers.

Are there cons to outsourced accounting services?

1). Infrequent Communication

You know that saying out of sight out of mind? If you don’t find the right firm, communication with an outsourced accounting team may not be as regular as you’d like. That’s why at ORBA Cloud CFO we ensure our dedicated team is consistently meeting with you to relay findings. We pride ourselves on being a very proactive managed accounting service, so we typically find our newer clients surprised by how responsive we are. Have a question about your books? Contact your associate and we’ll be in touch within 24 hours.

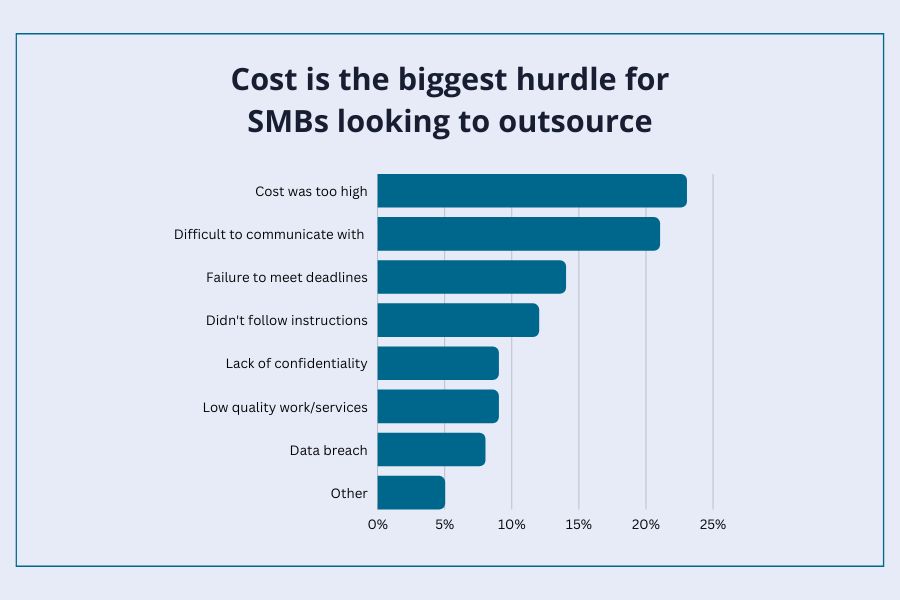

Upcity’s 2022 poll of 600 US and Canada-based small businesses found that 23% of small businesses consider high costs the biggest challenge in working with an outsourced team. Other challenges were more interpersonal — 21% said outsourced teams were difficult to communicate with,

2). Giving Up Control

You have to hand over part of your business to an external party. Easier said than done for some. We get it! That’s why you can decide how involved you are. We make onboarding easy and accessible during the entire process until you feel comfortable and confident stepping back from your finances.

3). Time & Location

Not all outsourced accounting services are U.S.-based but we are! Your dedicated US based team will be available during normal business hours and avoid those awkward time of day cross-ocean calls.

4). Paying Today to Save Tomorrow

The savings outsourced accounting services can free up your budget but only after initially constraining it.

Depending on your needs you may have to spend more for a service than you thought. Or you may end up paying for a service that you won’t use if everything is bundled into one fee. But, usually it is still cheaper than hiring an in-house accounting team. For example, in 2023 these were the average salaries according to Salary.com:

- Bookkeepers make an average of $43,618;

- Controllers make an average of $249,498;

- And CFOs make between $329,100 and $557,200

Related Read: To find more strategic financial insight from your outsourced accounting service then be sure to include some of the tips we’ve included on hiring the right CFO vs. controller.

How do outsourced accounting services work?

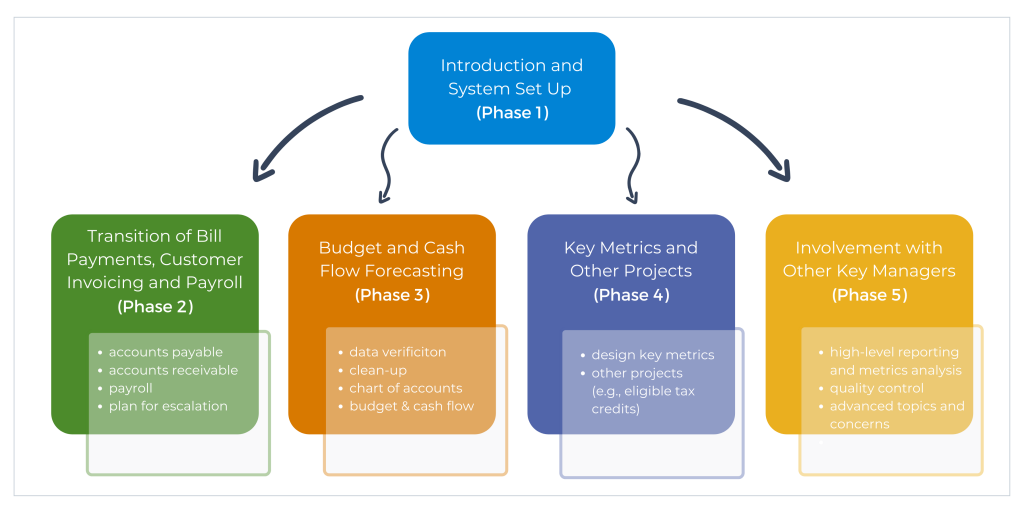

What does the onboarding process look like for outsourced accounting services?

The first step in starting outsourced accounting services with ORBA Cloud CFO is the onboarding process:

- Phase 1: Kickoff meeting

- Phase 2: Transition of weekly accounting and bookkeeping items

- Phase 3: Month-end accounting items (business knowledge share, monthly reporting and chart of accounts)

- Phase 4: Advanced services (key metrics and special projects)

We typically begin executing phase two by the end of the first week and the onboarding process is normally completed in five to six weeks.

If you need to clean up your books, we’ll take a look at the size of the project and provide and estimate on completion time along with cost.

How do ongoing outsourced accounting services work?

Once you complete the onboarding process, and any clean-up you requested, we begin our ongoing accounting services. This includes weekly check-ins with an associate as required. And you can expect monthly meetings for financial reporting of your income statement, balance sheet and statement of cash flows with both an associate and a manager.

We pride ourselves on being a very proactive managed accounting service, so we typically find our newer clients surprised by how responsive we are. Have a question about your books? Contact your associate and we’ll be in touch within 24 hours.

Our responsibilities include:

- weekly bookkeeping tasks like accounts payable, accounts receivable and payroll

- monthly controller tasks like financial and investor reporting

- strategic insight if you opted into our outsourced CFO services

- answering your accounting-related questions

- looking after your books!

Your responsibilities include:

- providing us access to any of the company systems or tools you use

- showing up for the monthly meetings with any questions you may have

- running your business!

What type of businesses should use outsourced accounting services?

We have clients from all walks of business and business model. Some of the industries we serve include:

- Cannabis Bookkeeping & Accounting

- eCommerce Accounting

- NetSuite Accounting

- Nonprofit Accounting

- Real Estate Accounting

- Accounting for Tech Companies

17 questions to ask when hiring an outsourced accounting service:

IS time for you to outsource your accounting? Here are a few questions to ask your outsourced accounting candidate:

- How long are your contracts?

- Do you bill hourly, monthly or on retainer?

- Are your staff all based in the United States?

- How do you communicate with clients and how often?

- How much time do you need from me or company representatives each month?

- Will I always work with the same team member?

- How do I get documents to and from your firm?

- How often can I expect to see financial reports?

- What does it cost to clean up my books if our company is behind?

- What are the costs if we have a specific accounting project we would like to tackle later on?

- Do you offer advisory services like CFO and tax?

- What do you know about my industry and business model?

- Can you provide a reference from a related company?

- What kind of approach do you take to debt?

- Will you be able to identify my key drivers of growth?

- What kind of systems or tools do you use to report on operations?

- If I have multiple entities can you provide consolidated reporting?

By using this guide you can determine the right budget and find the best outsourced accounting service for your company. Get in touch to learn more about our outsourced accounting services cost and how we can fit within your budget.