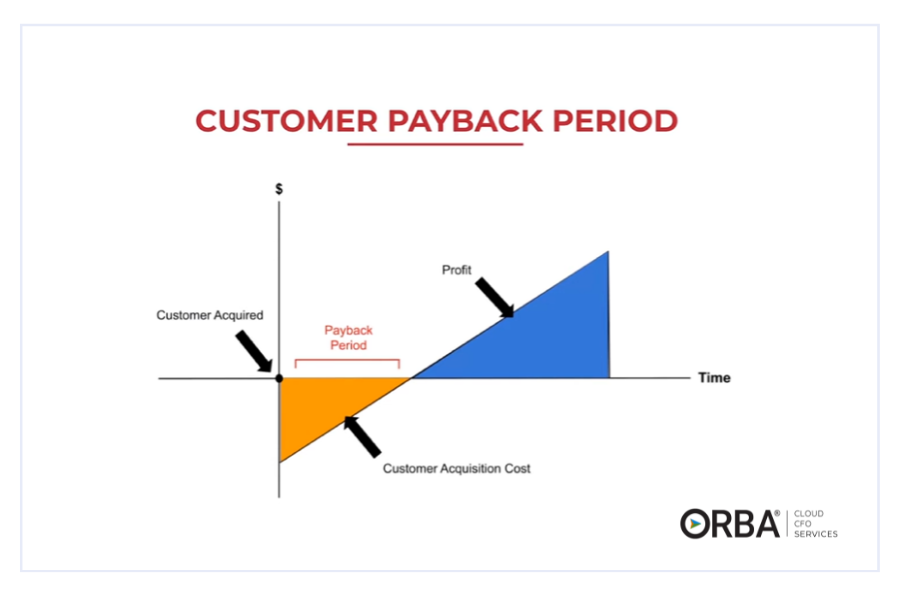

Here’s a two-minute breakdown of payback period for you:

Financial Metrics for Growing Companies.

“All companies should be gross margin positive.”— Mark Suster, Partner at Upfront Ventures

Meaning what? A quick reminder of what “gross margin positive” actually means. As Fortune recently pointed out, gross margin positive is different than “net margin positive,” which includes corporate costs like marketing and R&D.

There may be times when you are not net profitable because you’re focused on scaling, which will be seen in your operating margin. Your gross profit is your revenue minus cost of goods sold (COGS)

Gross Profit = Revenue – (COGS)

Basically, if you’re not gross margin positive early on, then you need to seriously examine why. In fact, if you’re gross margin negative, then you’ll LOSE more money the more you grow! But if growing yourself broke is the goal, then by all means go for it!

3 Common Mistakes with Financial Metrics

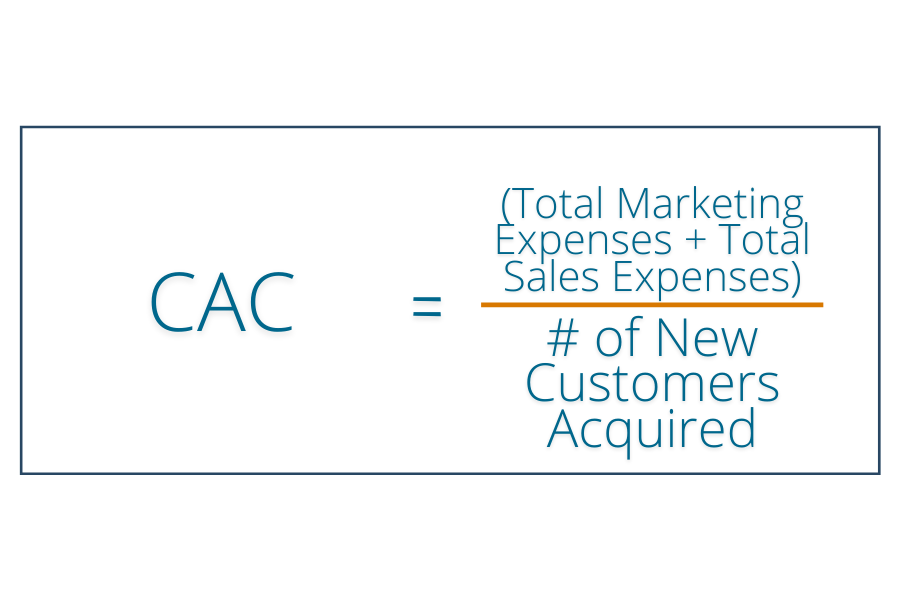

1). Not using your complete Customer Acquisition Cost (CAC) to get that ever popular Lifetime Value (LTV)/CAC number.

While paid advertising may be obvious, it’s important to remember not to omit things like PR, Free Trial support and hosting, etc.

2). Getting LTV confused with meaning it’s OK to lose money on acquiring customers.

Some companies that are scaling can be overly optimistic. Figure out your churn rate to get an accurate LTV. Read more about churn rates here.

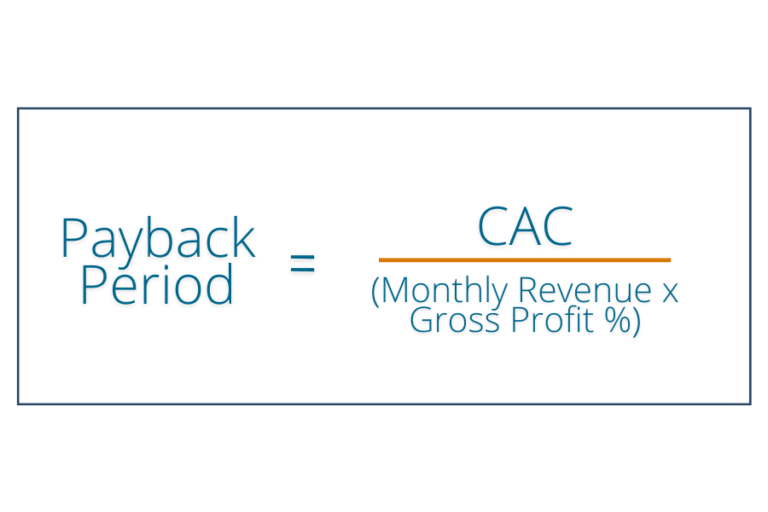

3). And here’s the big one: Forgetting to take into account the importance of the Payback Period (PBP).

Your payback period tells you how long it takes for a customer to be earning you profit.

If you don’t have the capital to fund losses, your PBP should be short. A good PBP is 12 months or less, but it’s ideal to be less than six months if you’re in hyper-growth mode (greater than 50 percent revenue growth per year).

Learn more about how tracking the right KPIs with our outsourced CFO services can help your business grow.