Running a small business comes with countless challenges—but financial missteps can be the most costly. Many business owners don’t have the time or background to manage complex financial decisions, leading to missed opportunities or serious cash flow issues.

Here are the top five financial mistakes we see—and how a Fractional CFO can help prevent them:

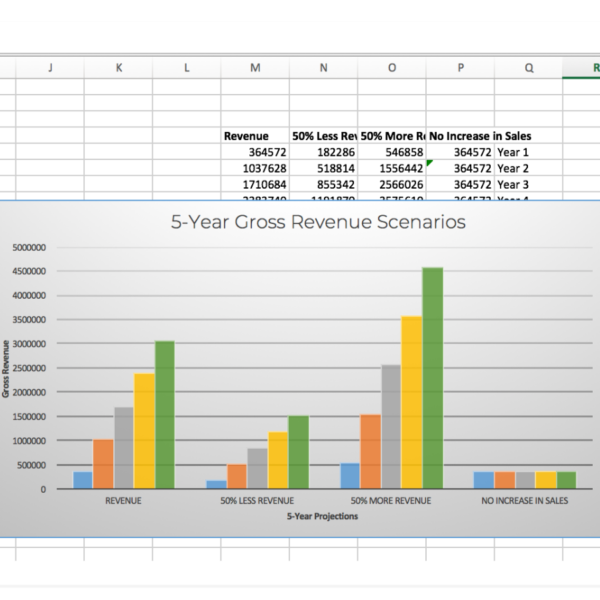

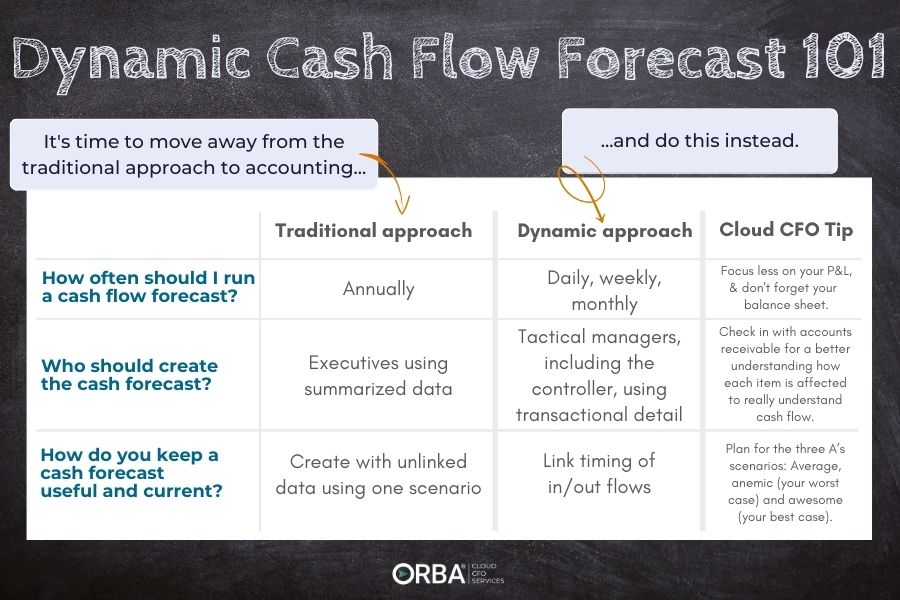

1. Neglecting Cash Flow Forecasting

The Mistake:

Many small businesses focus on profits without tracking when cash comes in and out. This can lead to late payroll, unpaid vendors, or missed growth opportunities.

38% of businesses fail due to exhausting their cash reserves or the inability to secure additional capital. This points to the essential role of financial management in the survival and growth of startups and young companies.

The Fix:

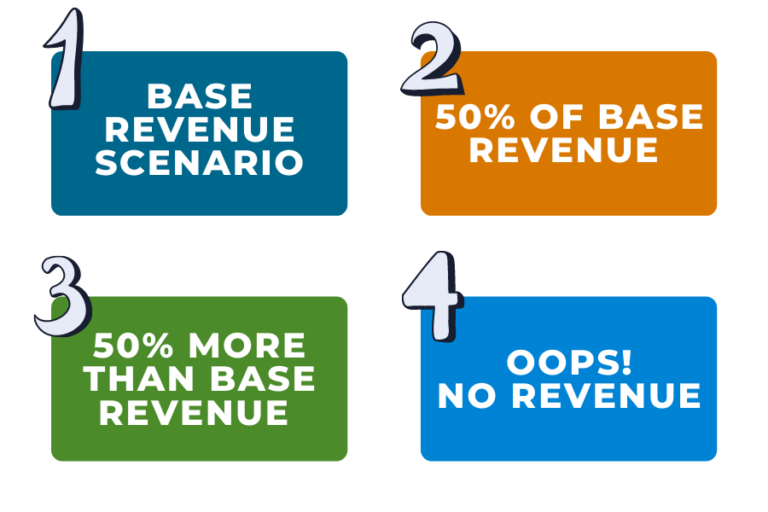

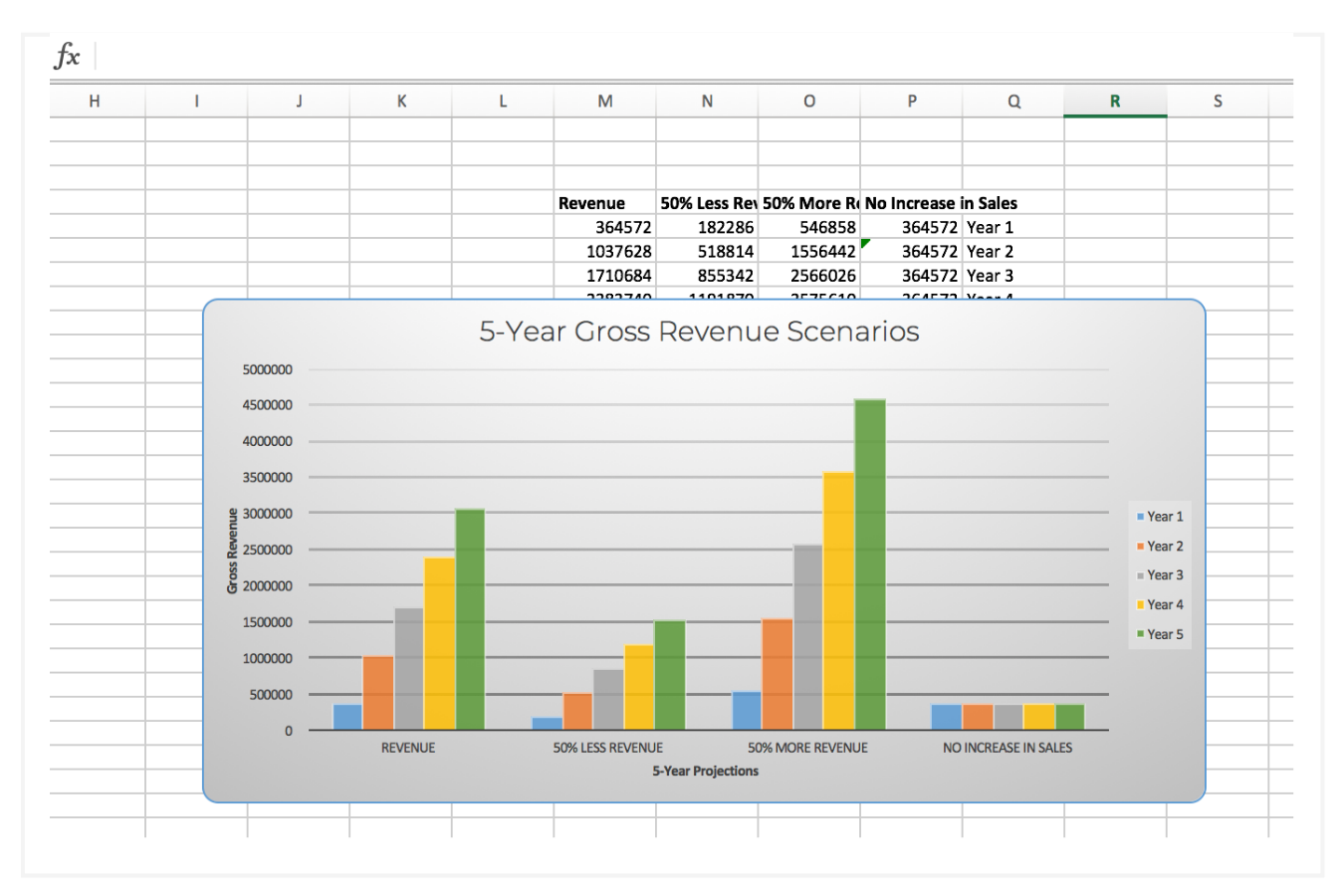

A Fractional CFO builds dynamic cash flow models, stress-tests them, and helps forecast upcoming liquidity needs. This gives business owners the clarity to plan for both expected and unexpected financial scenarios.

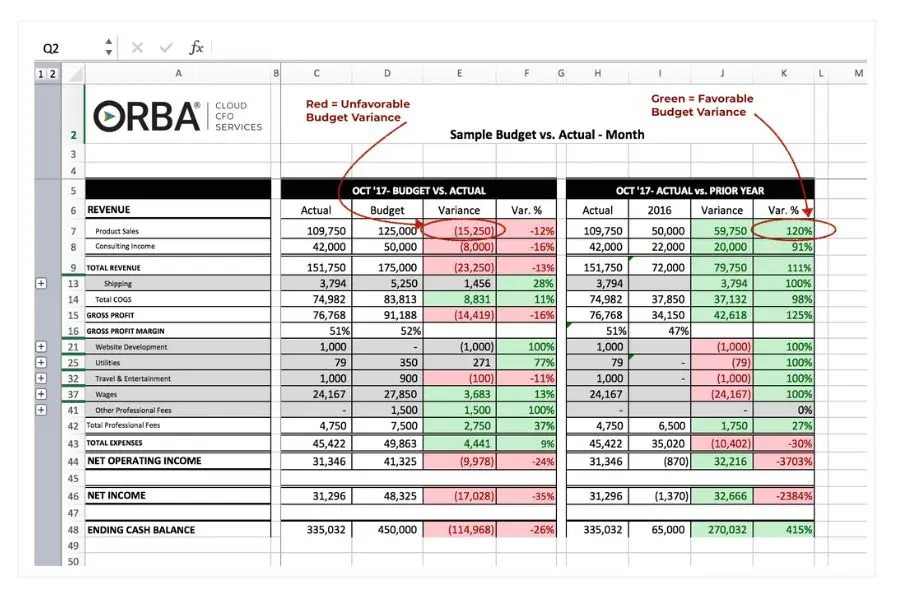

2. Not Setting or Following a Budget

The Mistake:

You’d be surprised at how many companies come to us with this financial mistake. Without a structured budget, spending often exceeds targets, and business decisions become reactive rather than strategic.

The Fix:

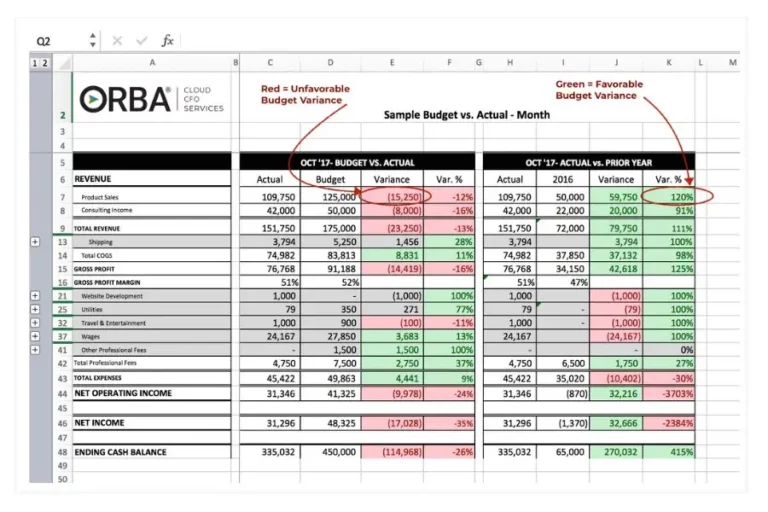

Fractional CFOs design and implement budgets aligned with your business goals. They also hold teams accountable, monitor budget variances and adjust plans as market conditions shift, keeping your business agile and financially disciplined.

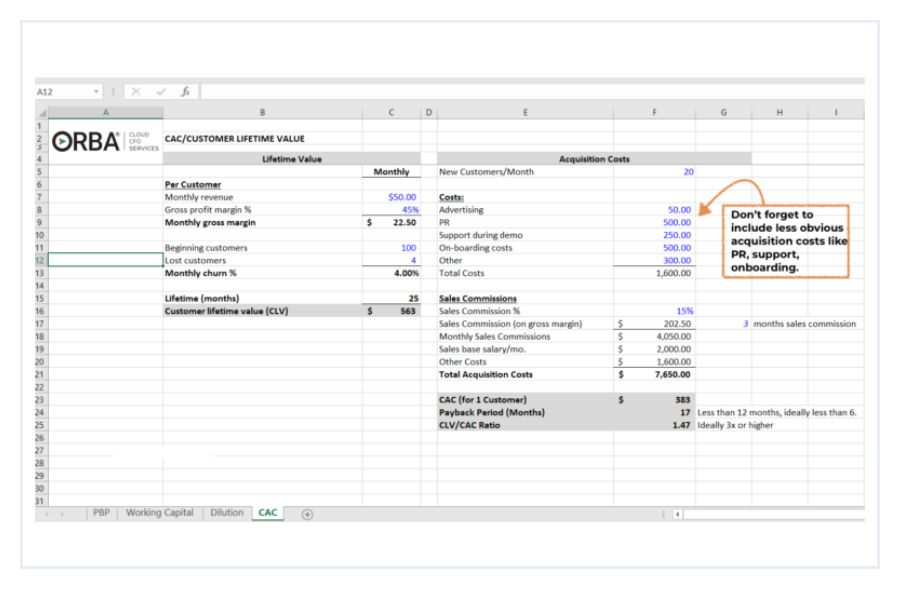

3. Overlooking Unit Economics and Cost Structure

The Mistake:

Businesses often don’t fully understand the true cost of acquiring and servicing a customer, leading to unprofitable growth. Unit economics is key here.

The Fix:

A Fractional CFO analyzes your cost structure, product margins, and customer acquisition costs to determine what’s profitable—and what’s not. This lets you double down on what works and fix what doesn’t.

Related Read: Unit Economics— Officially Underhyped.

4. Failing to Prepare for Financing or Fundraising

The Mistake:

Business owners sometimes approach lenders or investors without clean financials or a compelling financial narrative.

The Fix:

A Fractional CFO preps your financial statements, forecasts, and investor decks. They speak the language of banks and investors, helping you secure funding or apply for a business line of credit on better terms—and with less stress.

5. Wearing Too Many Hats

The Mistake:

Founders and CEOs often try to handle financial strategy themselves, spreading themselves too thin and making avoidable errors.

The Fix:

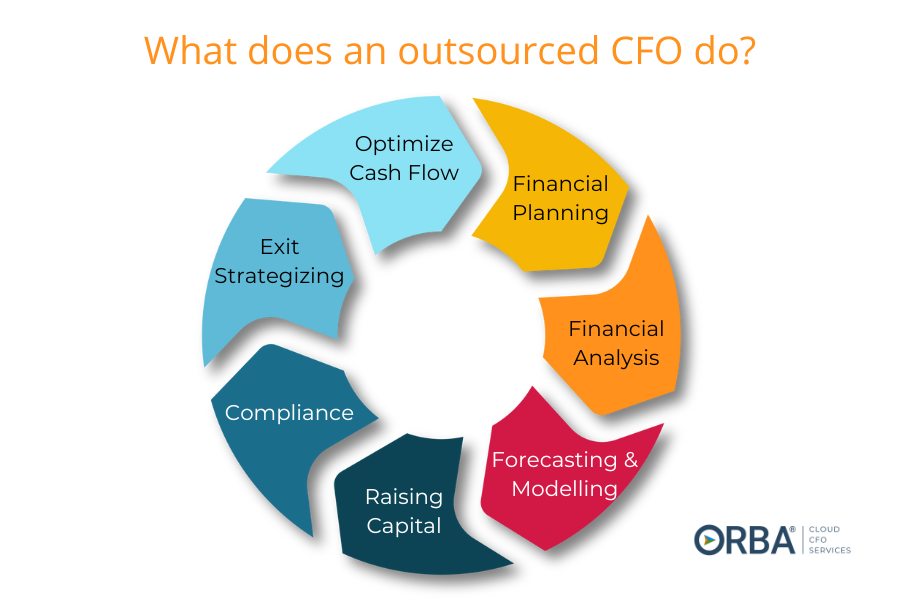

Hiring a full-time CFO may be too expensive—but a Fractional CFO gives you executive-level financial leadership without the full-time cost. You stay focused on growing your business, while your CFO handles the numbers.

The Bottom Line

A fractional CFO isn’t just for fixing problems—it’s about building smarter systems, planning for growth, and sleeping better at night knowing your finances are in expert hands.

👉 Learn more about our Fractional CFO Services