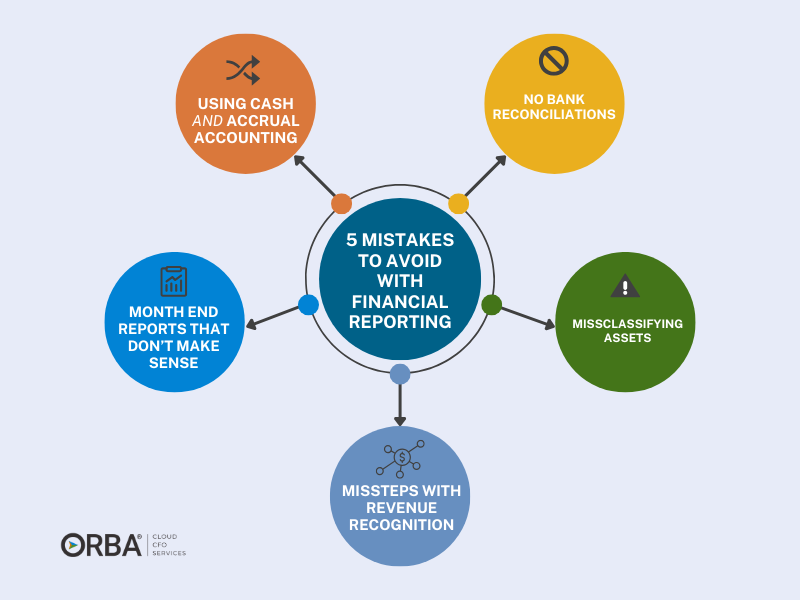

Financial Reporting Mistakes: 5 Red Flags to Look For

Even the most seasoned businesses will run into some financial reporting mistakes that can jeopardize their financial health and decision-making. From inconsistent data to fragmented reporting systems, these challenges can hinder growth, compliance, and strategic planning. In this article, we’ll explore some of the most common financial reporting red flags and the fix to maintain long-term success. Financial Reporting Mistake #1: A “mix” of cash and accrual accounting Many businesses