Have you hired a NetSuite accountant? You’ve just invested tens of thousands of dollars into the best ERP out there: NetSuite. And yet, you still can’t manage to get the consolidated reporting you were hoping for. This is a scenario we hear all the time from new NetSuite accounting clients.

Here are 3 reasons you should hire a NetSuite accountant.

1). A better ROI on the NetSuite ERP

Making the switch to NetSuite is no joke. It’s a costly venture and the last thing you want is to experience an ERP implementation failure. You may already know the benefits of ERP systems but NetSuite accountants work consistently in the ERP and can quickly identify how to maximize your sizeable investment. Additionally, they can recommend how to set it up to work the best for your business. That way you know you will pay off that investment sooner. There is also a good chance that any NetSuite partner will be able to find cost-savings by knowing the ins and outs of NetSuite.

Client case study: a client hired our NetSuite accounting services who was under-using NetSuite. As their new NetSuite accountant, we quickly identified a number of ways we could optimize their use and carved out $35,000 in labor savings the first year with an additional $60,000 in labor savings each year after that. That’s a big chunk of any SMB’s budget.

“NetSuite’s complexity means that many business owners may need to consider hiring a consultant to help them navigate the software and make full use of its capabilities. That said, the steep learning curve belies extremely powerful tools and capabilities that you simply won’t get with cheap alternatives.”

Chad Brooks, Business.com

2). Reporting that is customized to your business and industry

NetSuite is a robust system that offers a ton of options and integrations to small-to-midsize businesses across the world. So many options, that for a new user it can quickly become overwhelming. A NetSuite accountant can recommend which integrated tools make the most sense for you. Further, they can set up the right kind of reporting to capture the metrics most relevant for your growth. For example, SKU analysis by 3PL facilities, landed cost or sales channel profitability.

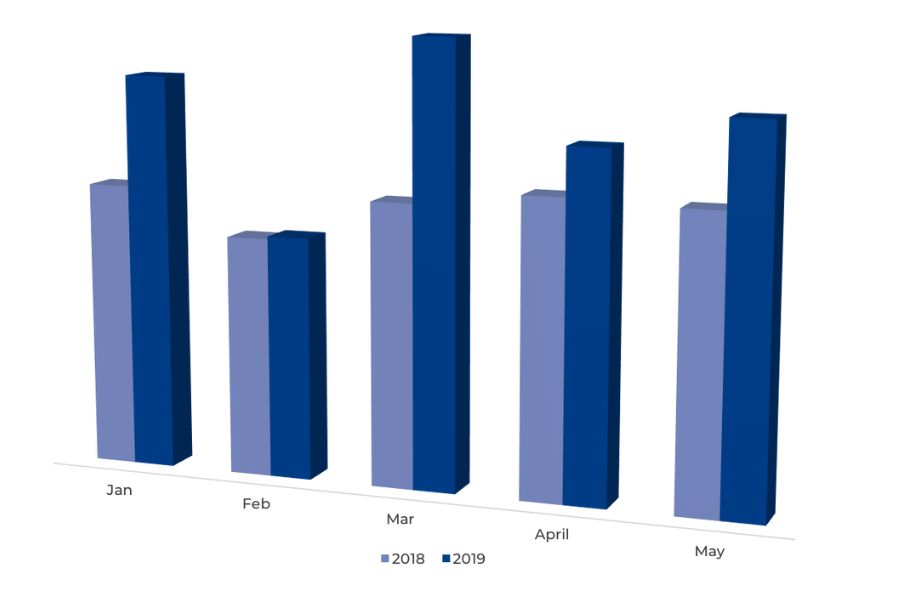

Case Study: Young Nails YoY revenue grows by 29% with streamlined NetSuite data

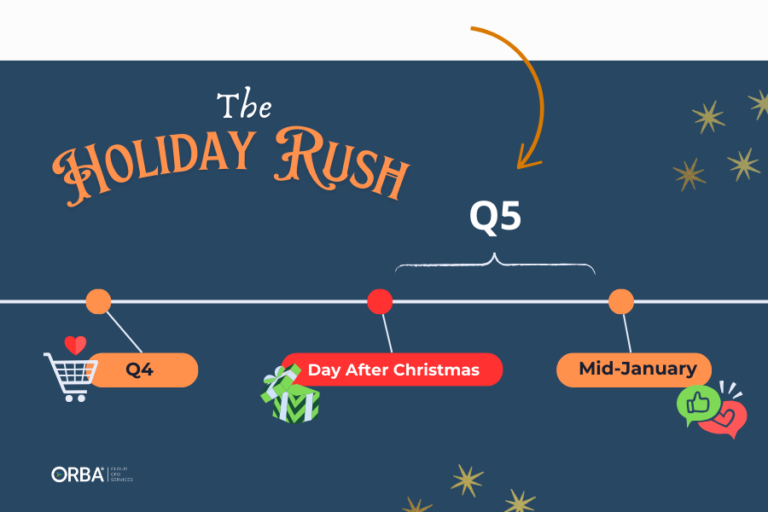

Even companies that have a solid grasp on how much money they make per item sold might not drill down to margin variances across sales channels. Not only are wholesale prices different from consumer prices, but the cost of goods sold and other expenses can also vary. For example, your marketing expenses are likely higher for D2C than wholesale. Even more unexpected is when your reporting uncovers a sales channel that you thought was profitable but was, in fact, eating into your bottom line with its hidden landed cost. And if your company partners with large retailers, tools that plugin to your supply chain management to reduce the EDI workload are a must. For Young Nails, hiring a NetSuite accountant from ORBA Cloud CFO meant a 29% increase in revenue YoY.

“Knowing that our [finances] are getting done better than ever is a big deal. “Now data is accessible. To drive growth- especially for our marketing efforts- having data is not an option, it’s an absolute necessity.”

Habib Salo, Young Nails

3). Your time is better spent growing your business

You could try to implement NetSuite yourself. Your team could try to customize the reports you hope to get. But isn’t your and your team’s time better spent focusing on your core operations? An accountant is meant to be a strategic financial advisor that can offer guidance. A NetSuite accountant is meant to be the same. Using the improved reporting a NetSuite accounting service offers can improve your ROI, reporting and integration to get you the most bang for your buck.

Client case study: one NetSuite client of ours was investing too much time (and ultimately money) on one retailer. With proper inventory accounting and tracking landed costs, it highlighted customers with specific fulfillment requirements that were driving up costs. Given the retailer’s well-known brand identity, the margins for that sales channel were lower than they realized plus it was eating up their time to keep that customer happy. By dropping them and concentrating on higher margin channels they increased their net profit and were able to focus their time on new opportunities.

Related Read: NetSuite vs. QuickBooks Comparison

What services can you expect from a NetSuite accountant?

Not all NetSuite accounting services are the same, but some you should expect are:

- Controller-level financial reporting

- Implementation guidance or clean-up

- Transaction accounting for AP, AR and monthly reconciliations

- Automate routine accounting processes in NetSuite

- Month-end close

- Demand planning setup

- Revenue recognition

- Profitability analysis

- Financial planning

- Work with third-party service providers (Celigo, FarApp, BigCommerce, SPSCommerce, RF-SMART, etc.)

- Work with audit and tax accountants

- Secure financial transactions

The Bottom Line

Switching to NetSuite is not a decision to take lightly. But, if you do decide it’s time for your business to make the jump to that ERP, hiring a NetSuite accountant is the number one way to get the most out of your investment.