What is a fractional CFO?

A fractional CFO (also referred to as an outsourced CFO) is a financial partner to to drive growth when there is an opportunity and to help weather a recession if you see a downturn. The top 3 benefits of a fractional CFO in a recession are: 1). strategic financial reporting 2). financial planning for the economic climate and 3). lowering your HR concerns.

With the turbulent markets we’ve seen since 2020, plus the lasting effects of the Great Resignation, it’s no wonder the interest in fractional CFOs has risen. Add in a looming recession and most business owners want to know they have are backed by a knowledgeable financial partner.

Fractional CFOs offer financial guidance

Fractional CFOs bring a playbook of best practices to businesses facing recession. These strategies are based on cross-industry experience they gather from working with a number of companies facing similar obstacles.

Some of the questions that you may find yourself asking:

- “How should the company structure a fundraising round? Do we want to offer equity or take on debt? Can we bootstrap?”

- “What kind of capital structure is best for our company going forward?”

- “What are the trends suggesting is next for data automation? Should we be allocating resources to invest in new technology?”

- “What three KPIs will define that we successfully navigated a recession?”

- “Is now the time to exit?”

- When should you cut back on operating expenses?

- What if the recession lasts longer than forecasted? What key drivers are triggers for a shift in spending?

- When should you dip into your line of credit to protect it?

You want a CFO service to be able to answer these. Ultimately your CFO should be able to paint a financial narrative of your business.

Benefits of a fractional CFO in a recession (or anytime, really)

The #1 benefit we hear from clients who use our fractional CFO services is that they gain a strategic partner who both allows them to focus on core operations and offers insight into profitability. It makes even more sense to lean on the experts in times of economic uncertainty. Here are the top 3 benefits of a fractional CFO in a recession:

1). Fractional CFOs offer financial analysis based on your market position

A fractional CFO will analyze your financial position including your:

- Financial strengths and weaknesses

- Market position, brand value, and pricing

- Profit margins

- Break-even point and cash runway

- Overhead obligations and operating costs

- Gaps in reporting and profitability

- Liquidity and solvency

- Capital structure and financing

- Working capital cycle

An outsourced CFO will then make recommendations tailored to your business and market position. For example, a consumer product company with large volume and small margins might benefit from customer profitability analysis. They might shift their focus to the higher margin customers to increase cash flow and sell off stale inventory to reduce carrying costs. Additionally, a fractional CFO might tighten up and automate accounts receivable processes to improve working capital. As the focus shifts from top-line growth to bottom-line stability, the multitude of benefits from automating AR and AP can really pay off.

On the other hand, a SaaS company might need to increase prices for inflation to retain staff and adequate customer service. Then, to avoid customer churn and a long sales cycle to acquire new customers, they might offer more value to long-term clients ahead of the price hike.

Regardless of your business model, fractional CFOs will try to optimize operations at their current size — and be prepared to scale again when opportunity arises.

2). Fractional CFOs offer financial planning based on the economic climate.

Whether the economy is in recession or growing, best practices for financial planning should include:

- Financial projections with anemic, average and awesome scenarios.

- Collaborative budgeting with managers to ensure alignment and to link incentives with key drivers.

- Routine monthly or, when needed, weekly financial planning meetings with a fractional CFO.

- Monthly budget variance analysis of actual results vs. forecast

In this Fortune magazine article, our client, Ink Factory notes that now their outsourced CFO meets with her once a week to check in on the financial forecasting. “Kim is helping us really understand our cash flow,” Lindsay Wilson says. “We’ve set a big revenue goal this year, and we want to make sure that we are on track to meet that.”

[ORBA Cloud CFO is] helping us really understand our cash flow. We’ve set a big revenue goal this year, and we want to make sure that we are on track to meet that.”

Lindsay Wilson, COO Ink Factory

3). Address your HR concerns with fractional CFO services

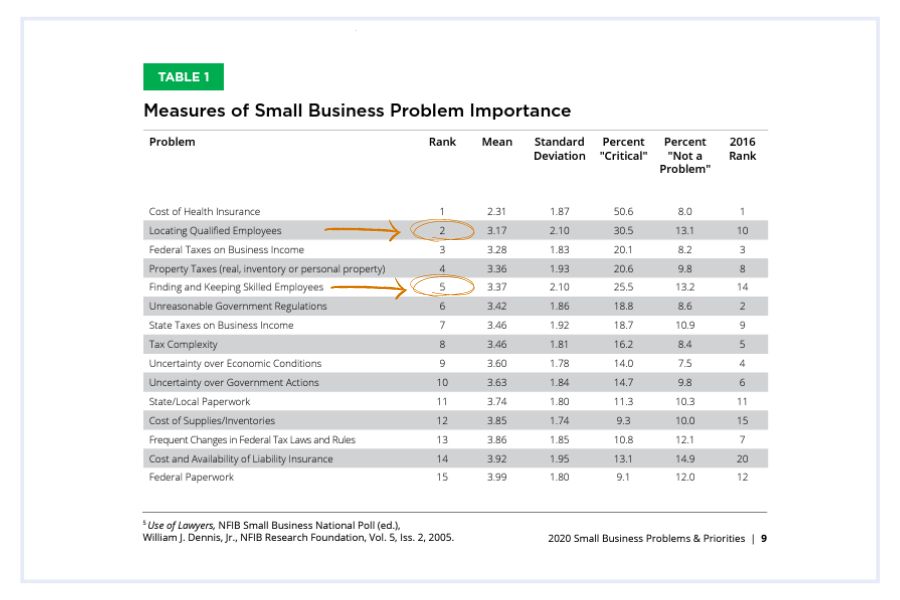

If it’s not a recession that’s keeping you up it might be the lasting effects of the Great Resignation. According to the NFIB, finding qualified employees and keeping them are the top 2 and top 5 concerns facing small businesses. Removing the need for a months-long hiring process, a fractional CFO reduces your HR strain while also reducing your salary costs.

Given the volatility of the past several years, it’s not surprising that CFOs need to pair proactiveness with flexibility in decision-making. And a fractional CFO can offer the nimble strategic advice an SMB is looking for, without the executive salary. For example, our core package + CFO add-on starts at just $5,000 per month.

Are we really headed into recession?

Some of the warning signs of recession include:

- record high inflation

- record high fuel prices

- material costs rising sharply

- consumers feeling the brunt of inflation

- decreasing sales

- real estate slowing

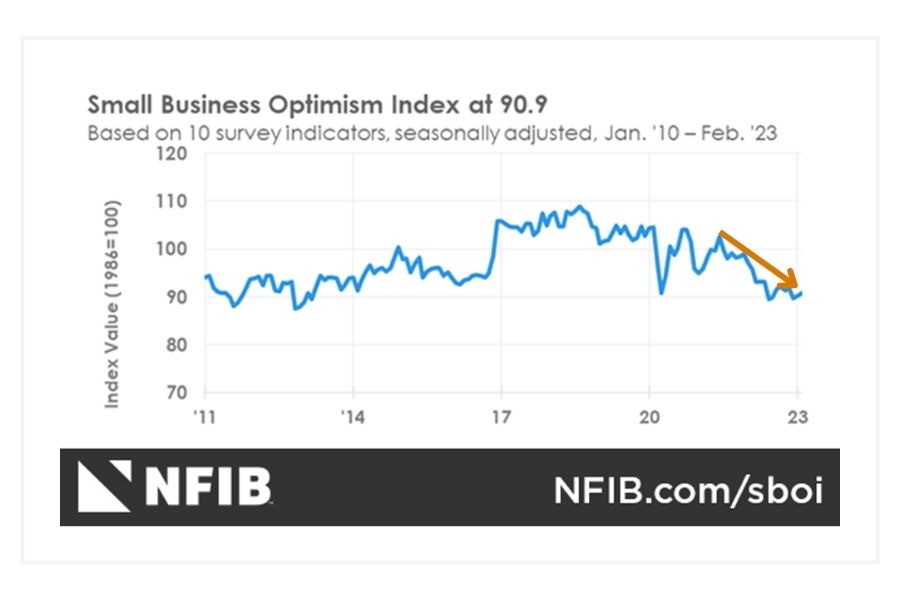

You could argue that at least five of those six indices are currently accurate. Plus, the small business optimism index continues to trend downward, which is one indicator that a 2023 recession may still be on the horizon.

Historically, we know that companies that prepared for past recessions came through okay, and a percentage of them even flourished.

Businesses that grow during recessions:

- Have a market position that allows them to play offense in a recession

- Have a diverse and resilient supply chain

- Have multi-year contracts

- Have a strategic financial partner who can offer sound guidance in a recession

Asking some of the same questions we listed above? Worried about what a recession might mean for your business? Get the peace of mind you need with our fractional CFO services. Contact us today to talk to an expert.