How to Calculate Payback Period

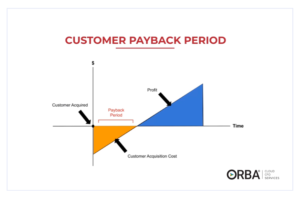

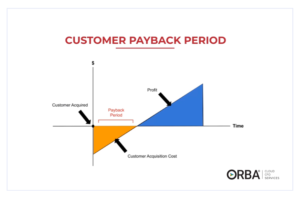

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon). Your Payback Period (PBP) is the length of

Thank you for signing up for our Cloud CFO newsletter. You should be receiving your first edition jam-packed with tips shortly. In the meantime, check out our latest blogs…

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon). Your Payback Period (PBP) is the length of

You know what’s not awesome? An outdated, time-consuming AP process. You know what is awesome?

An efficient Accounts Payable (AP) process that saves your staff time and your business money.

Not only does a dialed AP process make sure your bills are paid on time; it strengthens your connections with vendors, and keeps you in line with regulations, but it also forms the foundation for financial stability and growth.

The benefits of outsourcing staff far outweigh the risks of handing over a piece of your business. With almost 9 million job openings in the

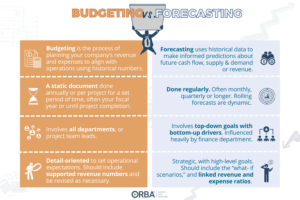

A quick guide to all things budgeting and forecasting, the difference between the two, how to create a budget, tips to improve forecasting, and more.

When you’re trying to improve cash flow or working capital a great place to begin is by improving your accounts receivable (AR) cycle. Six ways to improve your accounts receivable are…

Why should you care about your debt-to-equity ratio? Investors care about your liquidity (asset health) and solvency (debt health), and as a business owner, you should too. In financial metrics, that means tracking your current and quick ratio and your debt-to-equity ratio respectively. On the simplest terms, debt is what you owe, equity is what you own. Includes a debt-to-equity ratio calculator and infographic.

Are you ready for forward-thinking financials? Book your free consultation today.