Don’t yet have an expense policy? Don’t worry, you’re not alone. Many businesses and startups overlook this item at the beginning. Initially, it may seem unnecessary because there are not a lot of travel and expenses incurred and, if there are, they are mostly incurred by a select few people. An expense policy should include: 1). A standard budget and procedure, 2). A schedule 3). Qualified Expenses 4). A method for reporting.

However, as your business grows, you will notice more of your staff are either requesting reimbursements or you are having to add more employee credit cards to your account. Worse, you may begin to be concerned that your employees are over-spending on certain expenses. This not only instills a lack of trust in your staff but also makes it difficult to budget. That is when it is time to rein in the spending and begin drafting your expense policy.

Why Create an Expense Policy?

A good expense policy offers many benefits.

- It will help with training and provide an established process for new employees.

- A good policy reduces confusion about what kind of expensing and spending is acceptable.

- Expense policies help mitigate operational risk of expense fraud.

- And, a big benefit from an accounting perspective: an expense policy will help with budgeting and forecasting.

Are you sold yet? Follow these four steps to create an expense policy:

4 Tips to Create an Expense Policy

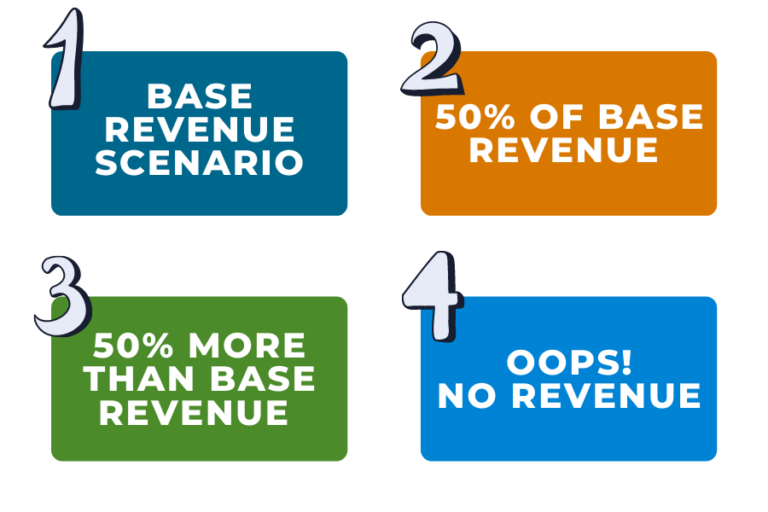

1). Determine a Standard Budget and Procedure

First, as the employer, decide on the spending budget and what can be expensed. This is not to say just pull numbers out of thin air. Discuss with your team, and look at your historical expenses to create a reasonable, yet fiscally responsible budget. Make sure that budget is standardized across staff. Next, decide on which of those expenses will be paid directly through the company and which ones will be paid for by the employee up front to later be reimbursed. For example, many companies will arrange travel and accommodation on behalf of the employee and then offer a per diem for expenses incurred while traveling.

2). Include a Schedule

Something to consider in this process are the IRS requirements for an expense policy:

With these requirements from the IRS in mind, you will want to include a schedule for claiming expenses. This should include how quickly an expense should be claimed by your employee and also how quickly after claiming the expense the employee should expect reimbursement from your company.

3). Create a List of Qualified Expenses

You may wish to include a list of what are allowable or qualified expenses:

- Travel (plane, car, taxi, rental car, gas, hotel and accommodation): Consider whether economy only or plus and first-class travel should be included. Are luxury hotels okay, or do you want your employees to be staying in budget options like extended-stay hotels or AirBnB’s?

- Meals: Is this a per diem, or a set amount per breakfast, lunch and dinner? Is there a different budget if the meal is for client dinners versus travel dinners?

- Entertainment: Consider if your employees will need tickets to sporting events or golf outings to host clients. Will you provide a per diem for entertainment while they are traveling for business? Perhaps “Entertainment” is an expense that always needs manager approval in advance.

- Supplies: Does your company ever require an employee to pick up supplies on the fly for a company event? Or, is this something that should always be approved in advance?

- Subcontractors: If you employ subcontractors who are likely to incur expenses, it is even more of a reason to have a clear expense policy prepared. Are there additional expense items that are only relevant to your contractors?

- Exceptions: Are there exceptions you can include right away in your policy?

- Exemptions: Are there expenses that should never be expensed?

4). Consider the Best Methods for Reporting

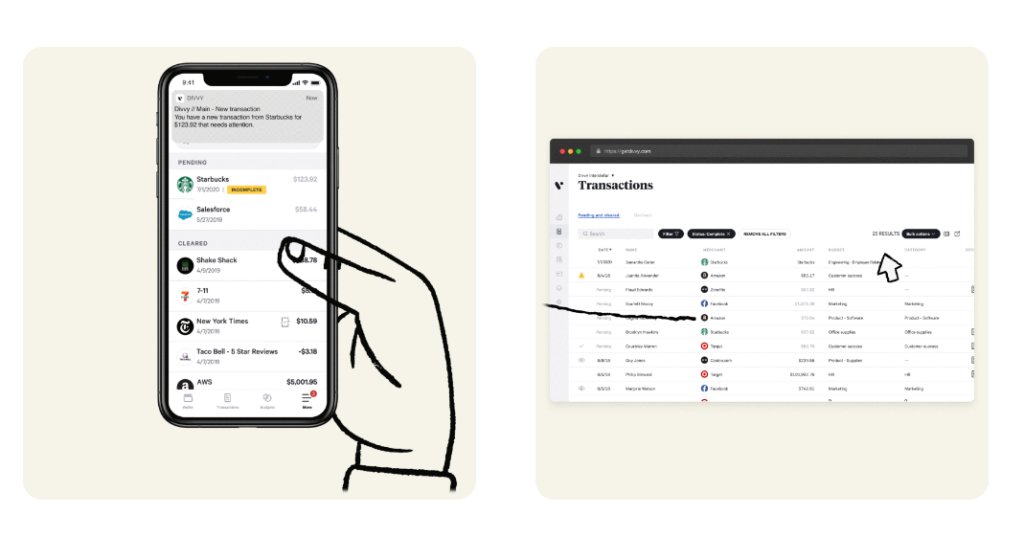

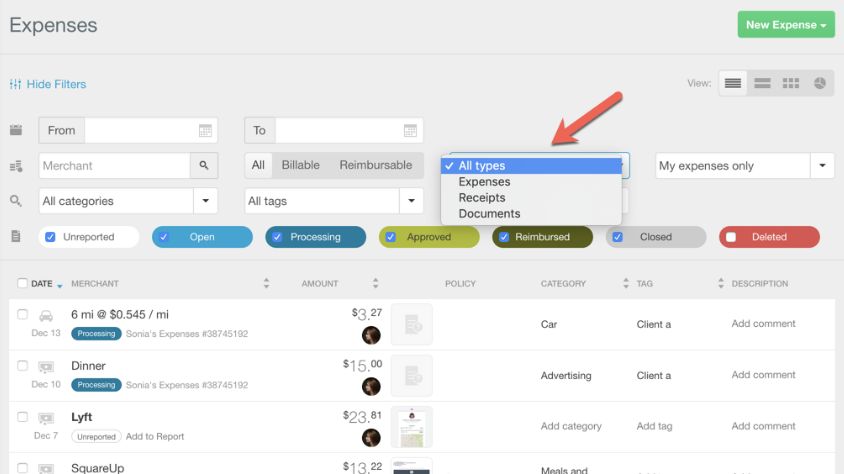

Once the details of the policy have been ironed out, it is time to consider reporting. There are templates you can find online like this one from MS Word, but in this day and age of cloud accounting, there are also plenty of reporting tools you can consider. We recommend our outsourced controller service clients automate expenses using either Expensify or Divvy.

Some of the benefits of these are:

- A streamlined reporting process to track and submit receipts online or through an app;

- Employees can report on the fly, which is more efficient and reduces the likelihood of losing receipts;

- It provides an easy way for you to track expense spending;

- If you enable public reporting within your company it may encourage employees to actually spend less;

- It reduces paperwork, which is good for efficiency and good for the environment; and

- Some of these apps will sync with your accounting/payroll software to streamline your process even further.

The initial time you put in to build a good expense policy will pay off later on, saving your business both time and money. That’s a win-win in our books!

Need help developing your internal controls? Get in touch to see how ORBA Cloud CFO can help!