QuickBooks Online: A solution for property management?

Property management firms have special accounting software needs. But, what happens if your company isn’t quite big enough to merit specialized accounting software that comes with a big HR investment and an even heftier price tag? Our recommendation for firms in this gray area is to use QuickBooks Online for property management.

If you opt to use QBO for property management, it’s important to keep your company’s P&L separate from the properties you manage. You will need to run necessary reports for the owner of the properties. With QBO it is possible to do both in one file if you map certain fields in certain ways.

How to use QuickBooks Online for Property Management

1). Set up each property or unit you manage as a customer.

By doing this, you can set expenses as billable and charge them back to the property owner. You can easily pull a P&L report and filter by property or unit on a monthly, seasonal or YTD basis as needed.

2). Use location to note the different property locations.

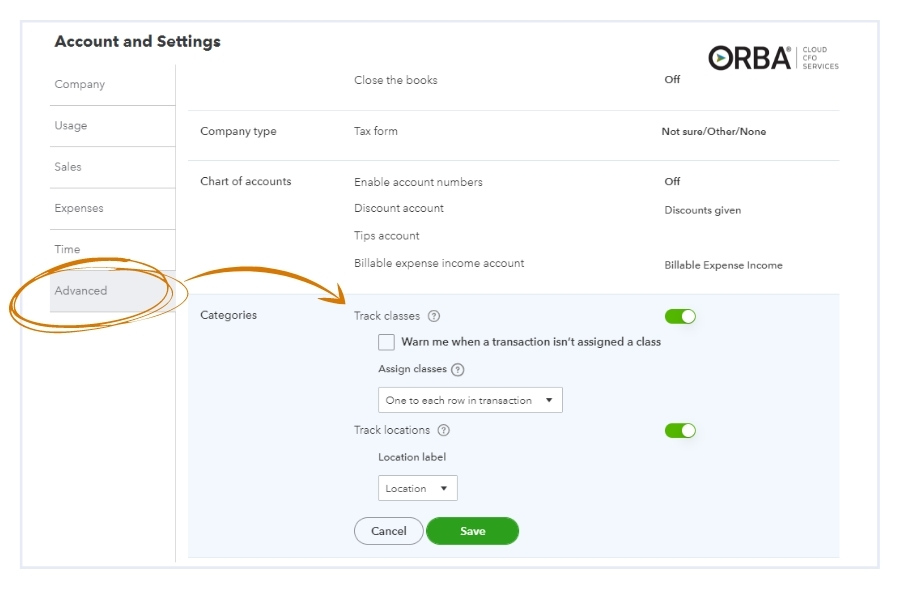

Set this up from the start when you create your QBO file. You can then run reports by unit and location. This is essential to the property owners if they have more than one unit or property. To turn on location tracking go to: Settings Gear Icon > Account & Settings > Advanced. You can also choose the label for location (e.g., business, property etc.).

3). Use class to highlight different types of service offerings.

Any operation or service necessary for a property can be categorized using the class field in QBO. This categorization is key to successful property management reporting. For example:

- run a P&L and know which service is generating the most income

- differentiate your COGS for each service or property

- examine margins by class or customer and spot leading costs across each property you’re managing

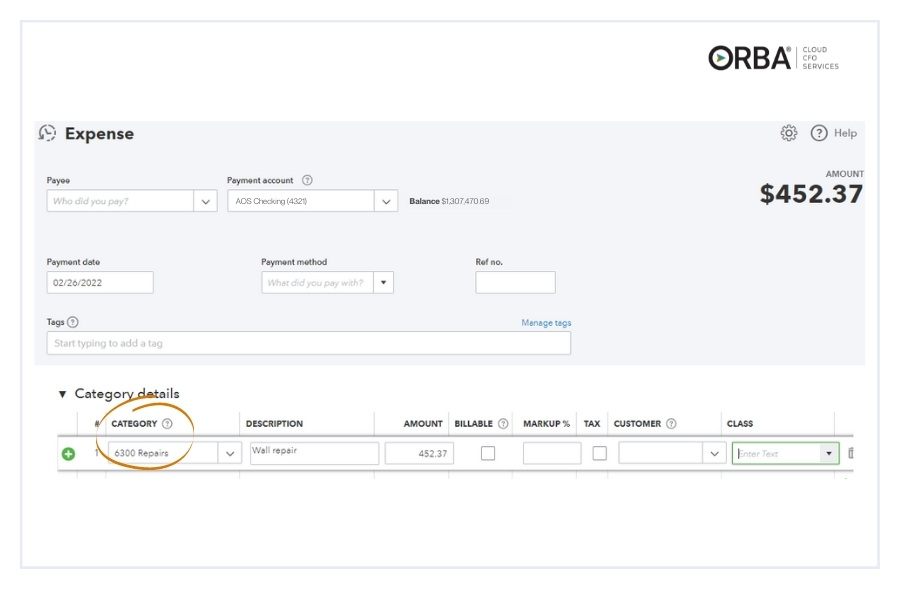

4). Use category to code your expenses and income to accounts.

Categories can be set up by account name to classify the different expenses and property management services you offer. Simply select them from the drop-down menu when you record a transaction in QBO.

Account categories can be set up in two ways: Go to Settings Gear Icon > Your Company > Chart of Accounts > Click New. Or you can add categories right from the Expense window.

5). Record income and expenses either manually, syncing with a cloud accounting app or a combination of both.

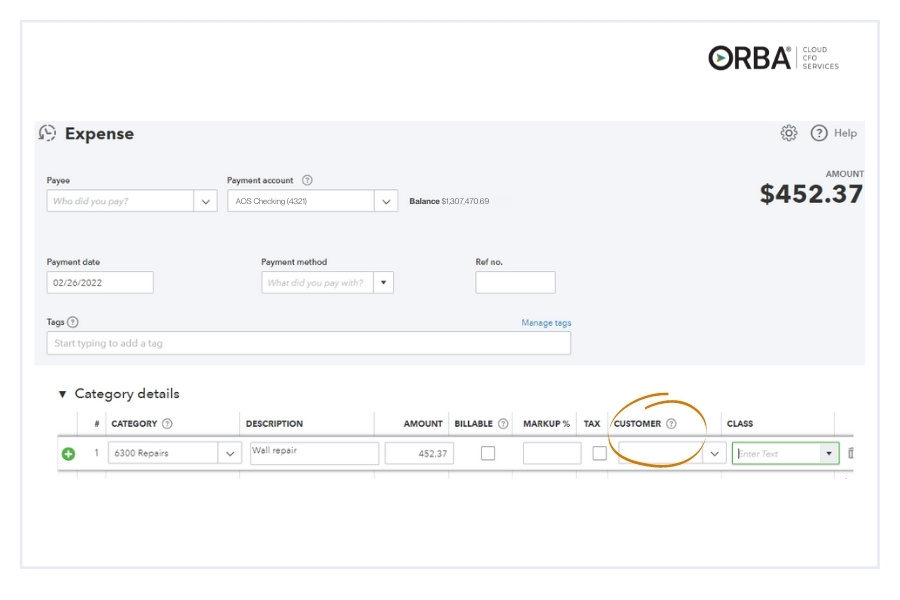

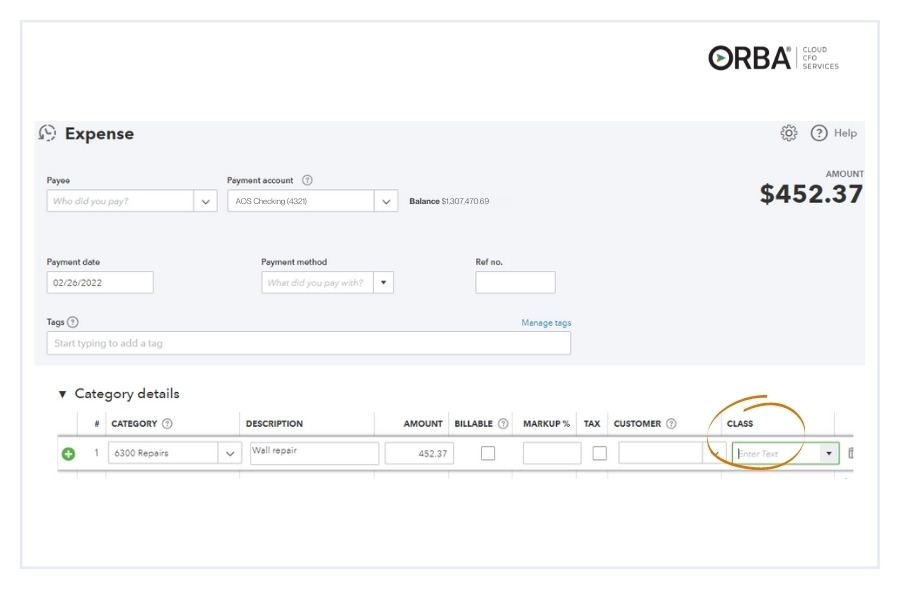

Generally, using QBO for property management, you record transactions using the same method you would for any business with a couple of additional helpful steps.

- Select the class to indicate which service it relates to.

- If it’s an expense for any of the properties or units you manage (as opposed to your own business expense), mark it as billable.

- Next, select the appropriate property or unit from the customer drop-down menu.

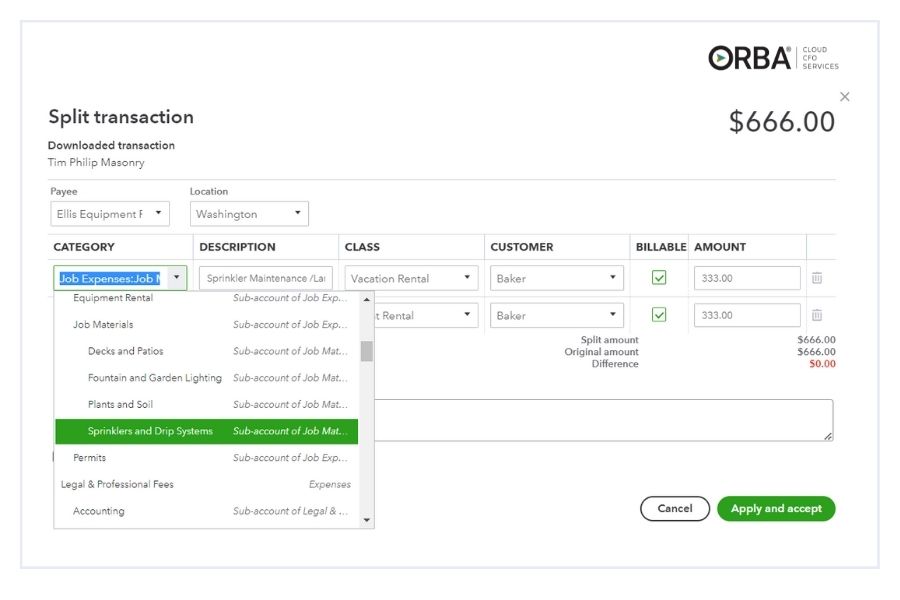

6). Use the split function for multi-service vendors.

When entering expenses, use the split function to record an invoice that includes two different types of services, such as cleaning and waste removal. To do this, you must access the transaction from within Banking menu and edit the transaction using the split button.

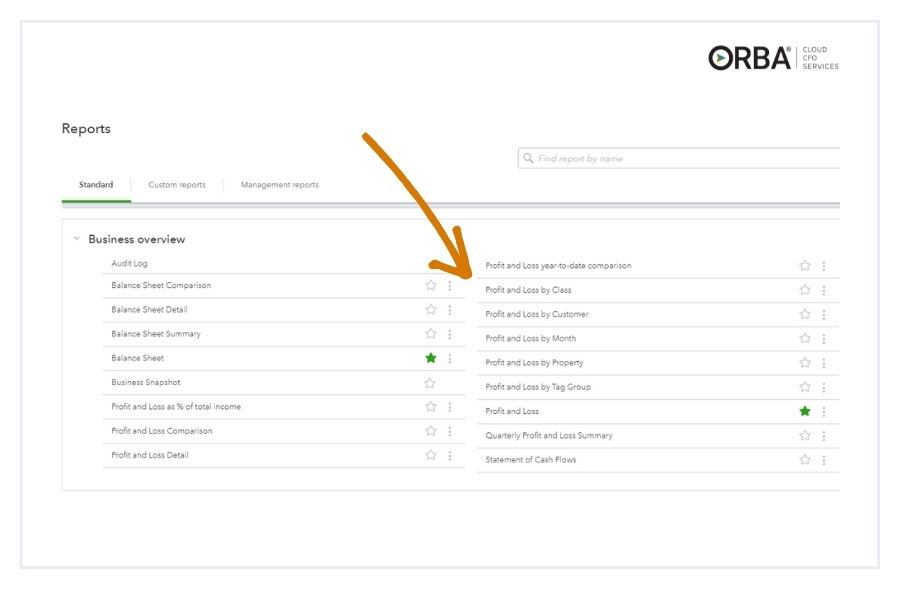

7). Run reports as needed.

Now that you have set up your QBO file for property management, you can run reports as needed (P&L, balance sheets, etc.) by class, customer and location. This will help greatly with any reporting you are required to provide to the property owners.

The Bottom Line

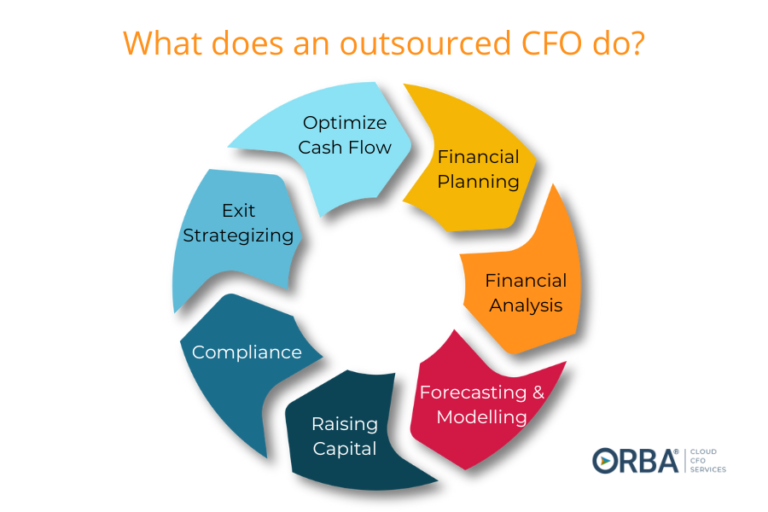

QBO can’t always meet all the accounting needs for property management. But, if you sync it with other cloud accounting apps like Bill.com for invoices, Divvy for expenses and Gusto for payroll, it can operate as a fairly robust system for small to mid-size property management companies.

Next time you run into issues setting up QuickBooks Online for your property management company contact us to learn how our team of Cloud CFO professionals specialize in accounting for real estate investment companies.