When and Why You Need a Virtual CFO and Accounting Team

As Entrepreneur recently pointed out, there are certain things a growing business should not “skimp out” on, a primary one being who you have looking after your finances. Number one on their list of three alternatives to hiring a full-time CFO? Fractional CFO Services!

What signs should you look for to know it is time to outsource your accounting?

4 Signs it’s Time to Outsource Your Accounting

1). Your Finances are Growing More Complex

When first starting out, many entrepreneurs aim to look after their books themselves or hire a cheap bookkeeper. It saves money and gives you control and knowledge over your finances. But once your business adds a new location, more services, and more employees, your finances all of a sudden appear a lot more daunting. The last thing you want to do is leave them in the hands of someone inexperienced. Or worse, ignore your books leaving them to gather dust because you’re intimidated or don’t know where to start. Hint: start with our outsourced bookkeeping services and go from there!

Related read: Think you’ve outgrown QuickBooks? Read this checklist to know for sure.

2). You’re updating Your Strategic Plan.

When you reach a growth stage where it’s time to strategize the next steps, you’re better off calling in the experts, like a fractional CFO. Perhaps you’re evaluating lending options or planning to reinvest for growth. Regardless of the reasoning for your new strategic plan, you want to ensure your cash flow forecasts and historical financials are accurate and tell an attractive story to your stakeholders.

3). You’re Looking for Value.

Let’s preface this by saying value does not equal cheap. Most outsourced accounting firms aren’t offering discount pricing for their services. A successful entrepreneur knows the value in efficiency. And what better way to be efficient than to outsource. Take something off your plate and hand it to the people who do it every day and night (yeah, we love accounting so much we dream about it!) A good outsourced accounting team has standardized processes that they follow so you don’t have to manage them. Besides, don’t you have 1,000 other things you could (er…should) be doing?

4). Your Company is Modern, Thinks Outside the Box, and is Environmentally Conscious.

Ok, so this might be three signs lumped into one, but ultimately, this is what an outsourced accounting team can offer you outside the obvious financial reports, bookkeeping and payroll management:

- A modern approach to accounting that reflects the methodology you employ within your own company by using business-specific KPIs to help you scale profitably.

- A team that uses innovative, technological solutions to enhance their services and thereby your finances. It’s unrealistic to expect an in-house team to keep up with technological advancements so instead use outsourced accounting services to leverage tech on your behalf.

- A paper-saving blessing in this, “let’s all save the planet together,” world. We do this by utilizing the latest cloud-based software that is just, dare we say, awesome.

To learn more about our virtual accounting services, get in touch today.

What’s the cost of an outsourced CFO?

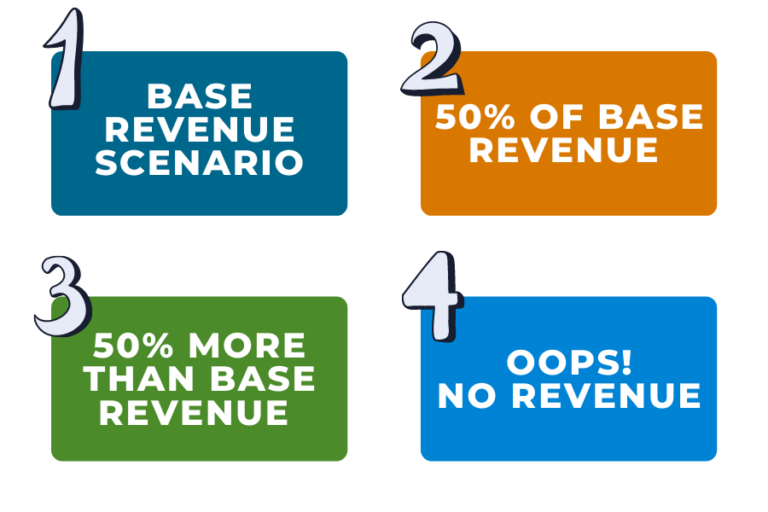

According to Salary.com the average annual salary of a CFO in the United States is, $393,412. Our packages start from just $500 per month.

Learn more about our pricing tiers, standard packages and the cost of our Awesome CFO add-on. We can save you time and money. We are the Entrepreneur’s CFO.