AR Automation: How NetSuite can improve your cash flow

AR automation is step one to improve your accounts receivable (AR) process. Because AR is considered to be assets converted to cash, optimizing your AR

Thank you, your application has been submitted successfully. We’ll be in touch shortly. In the meantime, check out our latest blogs…

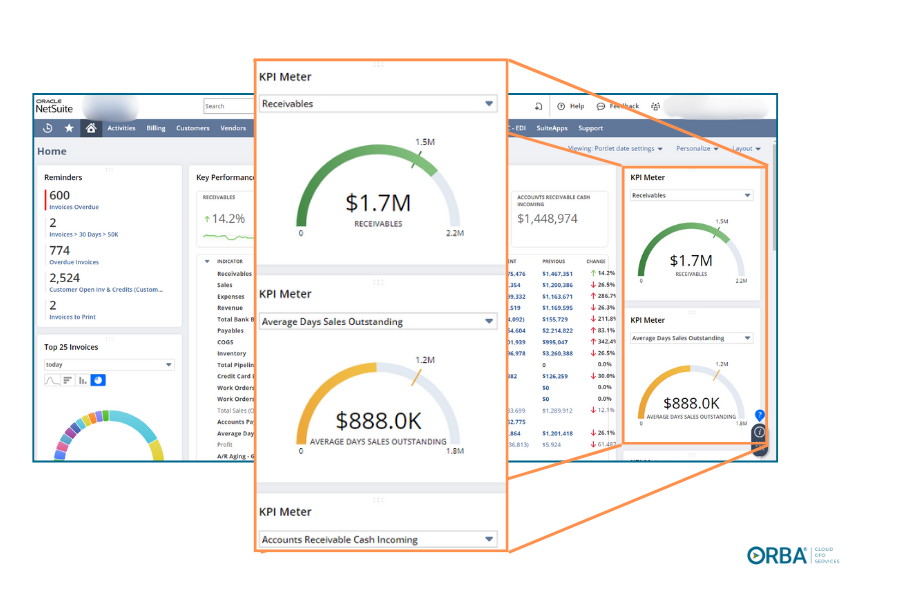

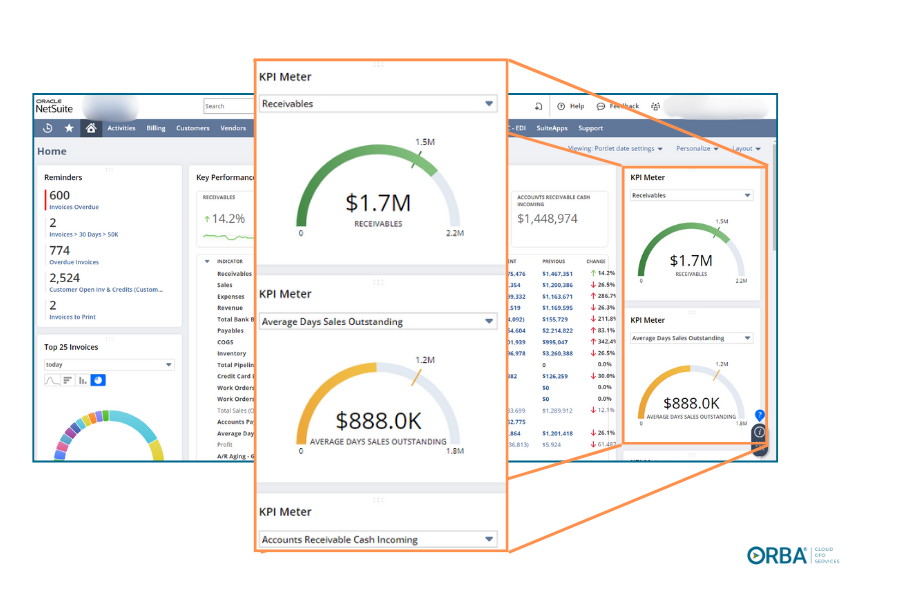

AR automation is step one to improve your accounts receivable (AR) process. Because AR is considered to be assets converted to cash, optimizing your AR

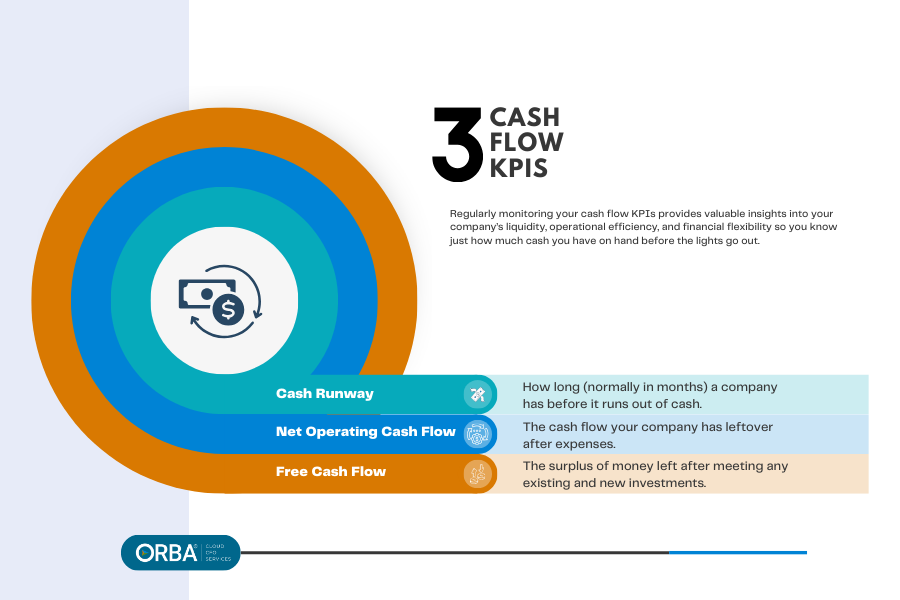

The secret to cash flow awesomeness? Cash flow analysis. Imagine walking into a store without really knowing whether your card would be declined. Cue the

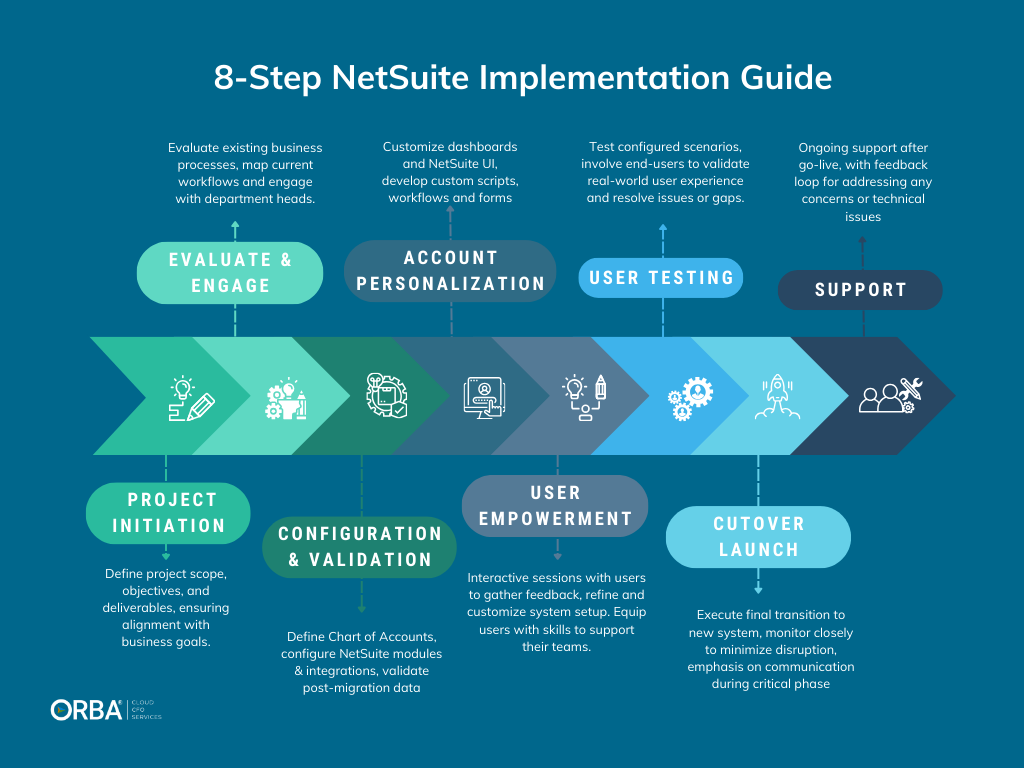

If you’re planning a NetSuite implementation, we suggest using these eight steps to avoid ERP implementation failure. ERP implementations are often wrought with missteps and

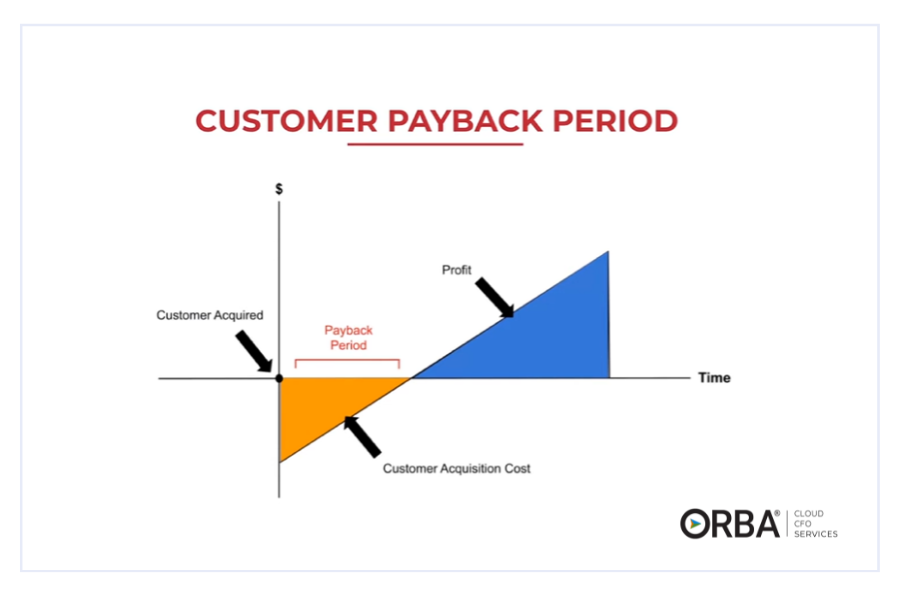

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon). Your Payback Period (PBP) is the length of

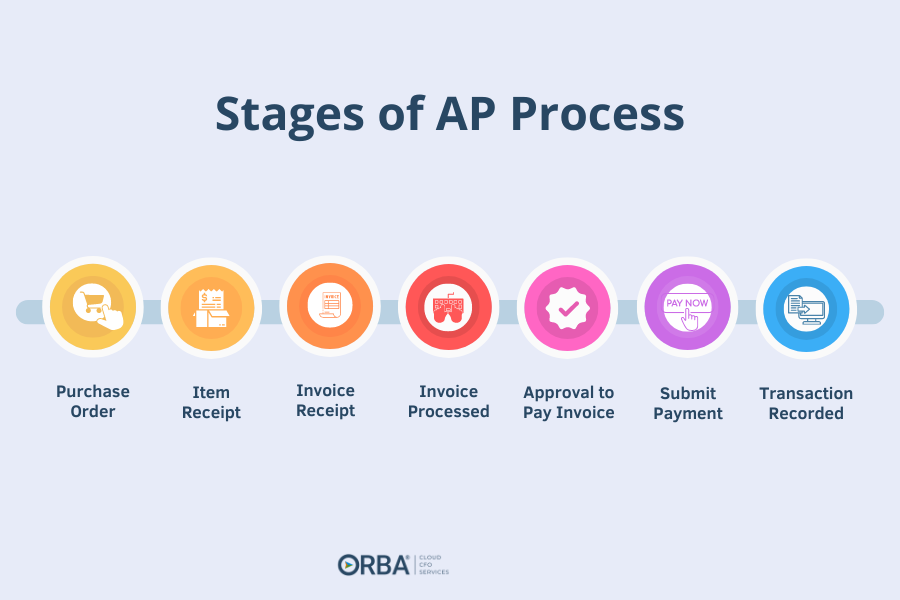

You know what’s not awesome? An outdated, time-consuming AP process. You know what is awesome?

An efficient Accounts Payable (AP) process that saves your staff time and your business money.

Not only does a dialed AP process make sure your bills are paid on time; it strengthens your connections with vendors, and keeps you in line with regulations, but it also forms the foundation for financial stability and growth.

The benefits of outsourcing staff far outweigh the risks of handing over a piece of your business. With almost 9 million job openings in the

© 2023 | All rights reserved. Ostrow Reisin Berk & Abrams, Ltd.

Are you ready for forward-thinking financials? Book your free consultation today.