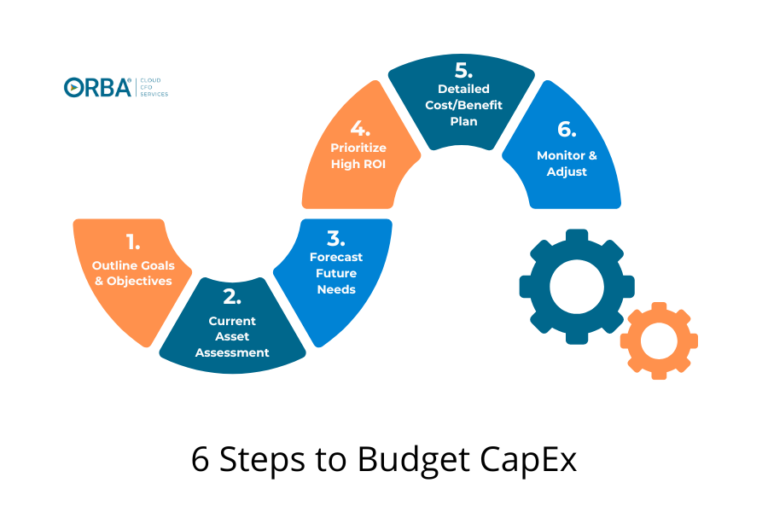

Budget Process Steps: A Guide for Small Businesses

Taking the correct budget process steps play a crucial role in the success and growth of small businesses. It allows entrepreneurs and business owners to gain financial stability, make informed decisions, and set and track their financial goals. And yet, many small businesses still don’t have a budget.

How To Forecast & Prepare For Inflation

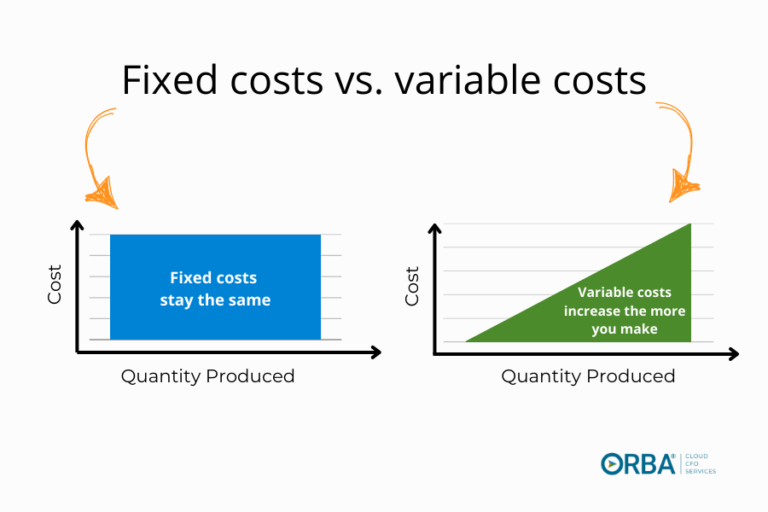

With inflation soaring to 8.6% in May, every business owner, no matter the industry, should update forecasts with the assumption of higher costs.

There are two things that you can do as a business owner to prepare for inflation and protect your profit. The first thing is to monitor costs and secure your prices from suppliers, either over the short-term or long-term. The second thing is to raise your prices.

7 Tips to Build a Better Inventory Forecast

Why should a retail or ecommerce business strive for better inventory forecasting and management to increase profits? Simply put, poor demand forecasting = higher carrying costs.

Why Business Owners Need to Know How to Forecast

Forecasting. Surprisingly overlooked, hugely strategic. This may come as a surprise. Our target market companies are making anywhere up to $25+ million in revenue per

Budget Planning: Ask these 3 Questions and It suddenly Seems Easier

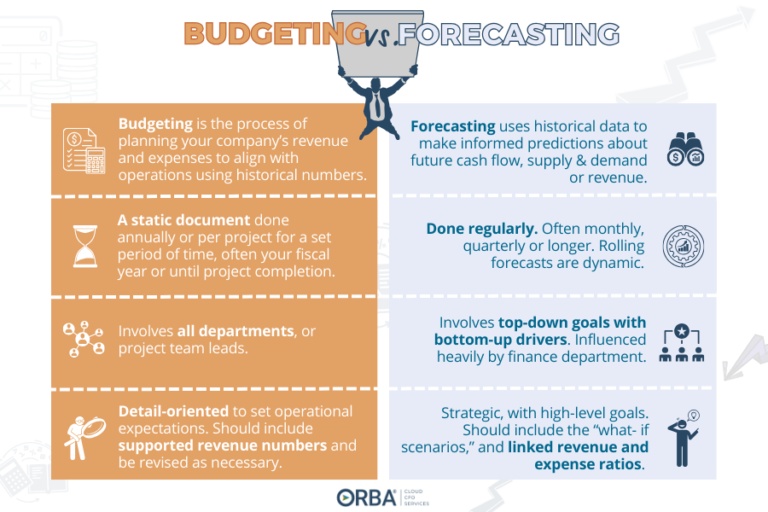

It’s budget-planning time. After a year that may very well have derailed your budget, and despite how begrudgingly you might enter this process, now is the time to plan next year’s budget. Digging deeper into the essential questions from budgeting and forecasting for high growth companies is a great place to start.

The Cash Forecast is Dead. 5 examples of why a dynamic cash flow forecast is better.

“The cash forecast is dead. Planning cycles have shifted from long-term to short-term and the financial operations we’ve run our companies on have dramatically changed.”

How to adjust your budget in a recession.

Running a business in the face of a looming recession is a daunting task. It may be a time-intensive process, but the investment now will help you navigate the uncertainty ahead. Here is how to adjust your budget in a recession.

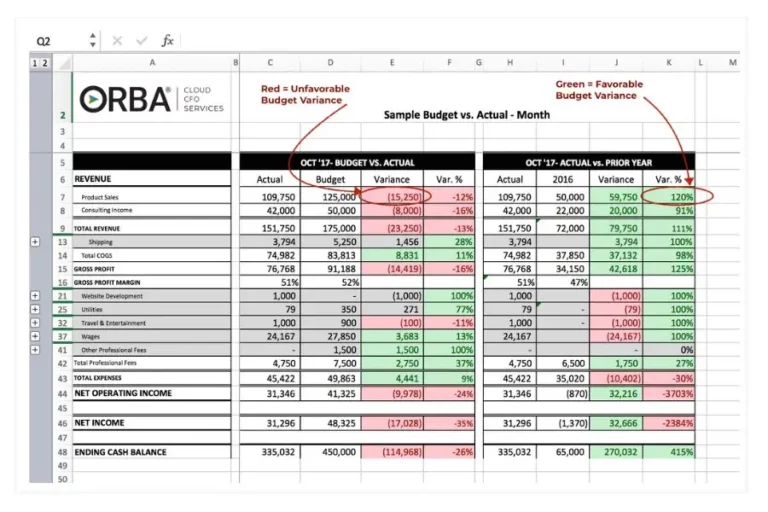

How Detailed Does My Business Budget Need to Be?

I feel pretty safe saying that most, if not all, entrepreneurs know they need a business budget. Where business owners often get hung up is on just how comprehensive that budget needs to be. We, at Red Granite and ORBA, frequently get asked this exact question by clients: “How detailed does my business budget need to be?” And it’s another one of those “it depends,” kind of answers.

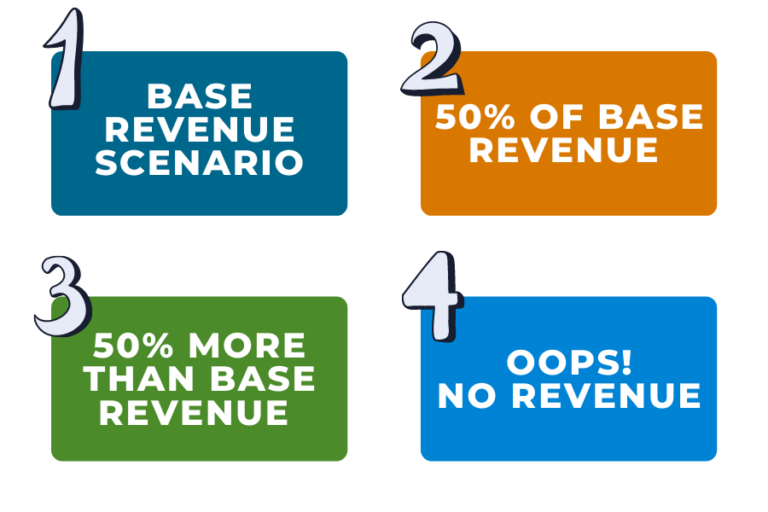

Budgeting and Forecasting for High Growth Companies

From best practices, to forecasting, to budgets gone bad, we recently hosted a roundtable discussion on budgeting and forecasting for high growth companies at The Junto Institute in Chicago, IL. One of the key takeaways from this discussion were the essential questions to ask for each stage in building a budget.