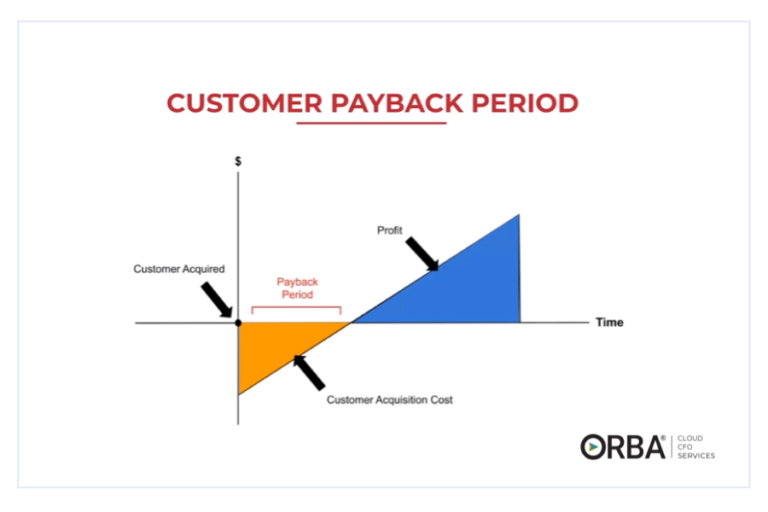

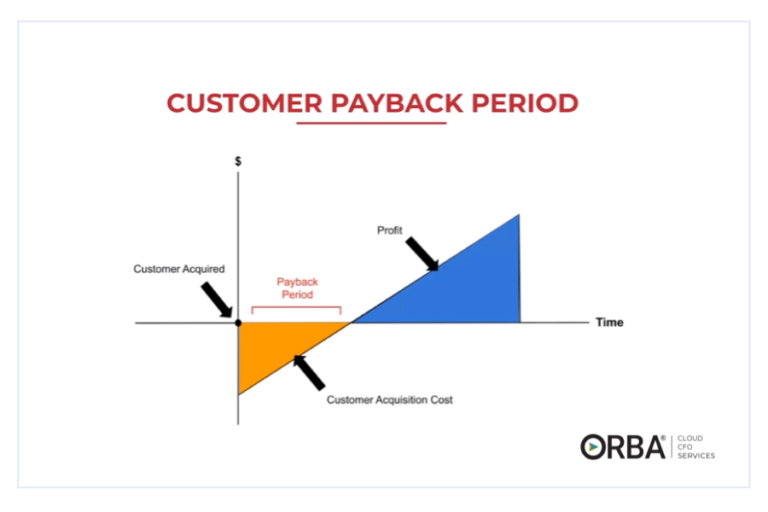

How to Calculate Payback Period

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon). Your Payback Period (PBP) is the length of

Many scaling businesses fail because they don’t put enough emphasis on the Payback Period (which we’ll get to soon). Your Payback Period (PBP) is the length of

Why should you care about your debt-to-equity ratio? Investors care about your liquidity (asset health) and solvency (debt health), and as a business owner, you should too. In financial metrics, that means tracking your current and quick ratio and your debt-to-equity ratio respectively. On the simplest terms, debt is what you owe, equity is what you own. Includes a debt-to-equity ratio calculator and infographic.

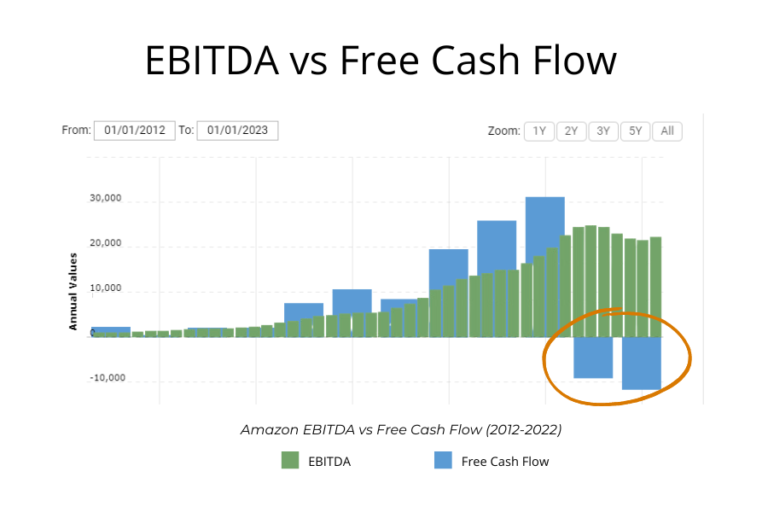

In this EBITDA guide, we’ll unravel what EBITDA is, why it’s a useful measure of business performance, how it compares to net income, free cash flow and the EBITDA pitfalls to avoid. Plus, we’ve included an EBITDA calculator to jumpstart your financial analysis today.

A common question we get asked: what does a fractional CFO do? So, you’re in need of some financial guidance but don’t want to break

We will cover inventory accounting best practices, including inventory tracking, and the key inventory accounting concepts you should know. Given ongoing supply chain troubles, skyrocketing

Congratulations, you have managed to persuade a customer to purchase your product or service. In fact, you have managed to repeat this action over and over again. But, do you know the true cost to acquiring those customers and have you figured out how to improve that cost?

Are you ready for forward-thinking financials? Book your free consultation today.